Should we laugh or cry?

Should we laugh or cry?

After dropping 100 points (2.7%) after lunch, the Shanghai Composite jammed up 175 points (5%) into the close and, combined with the pre-market pump that gave them a good open, resulted in a 3.4% gain on the day that NO ONE in the MSM seems to think is in the least bit strange.

Yesterday I said: "Everything you used to laugh about regarding Russia's Pravda and Izvestia is EXACTLY what is now happening to the US media except, rather than government control – it's controlled by corporations, who determine what information YOU will be given each day." and Hanno on Seeking Alpha asked me what I meant by "YOU" and I said I mean non-PSW Members (the target audience for the morning post, the rest of our day is private) because "WE" at PSW learn to be very critical of the Mainstream Corporate Media. As one of our Members said recently:

Subscribing to Phil’s site is like the Matrix – taking the red pill:

"You take the blue pill – the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill – you stay in Wonderland and I show you how deep the rabbit-hole goes."You start to become educated at a different level – and the main stream media has diverged to such a degree that a normal conversation with friends that only casually follow the market is no longer possible. They’re still taking the blue pill – the banks, the fed, the govt. – all have put them to sleep.

It's a very appropriate conversation for what is to be a blue pill day, when the Fed is scheduled to release their statement (2pm) in which they will change a dozen words from the last statement and the Media will act like another tablet has been delivered from Mount Siniai when really (as is very apparent in the minutes) it's just a room full of Economorons trying their best not to be publicly wrong and putting out the vaguest crap they can possible think of to excuse their actions.

It's a very appropriate conversation for what is to be a blue pill day, when the Fed is scheduled to release their statement (2pm) in which they will change a dozen words from the last statement and the Media will act like another tablet has been delivered from Mount Siniai when really (as is very apparent in the minutes) it's just a room full of Economorons trying their best not to be publicly wrong and putting out the vaguest crap they can possible think of to excuse their actions.

Of course the Fed will not raise rates today, nor are they likely to at the next meeting (Sept 17th) but October (28th) is still in play and that's their last chance this year because there is no November meeting and Dec (16th) is impossible as the Fed doesn't want to ruin Christmas or there may be another crucifixion before Easter!

We had a bit of a rally yesterday (the exact 1% bounce I said we'd have yesterday morning, for those of you keeping score) but this morning, in our Live Member Chat Room at 7:35 am, I put out a note to our Members to short the Futures at Dow (/YM) 17,600, S&P (/ES) 2,100, Nasdaq (/NQ) 4,575 and Russell (/TF) 1,230 because we don't see how the Fed will be able to avoid tightening in October, despite the very shaky conditions in Asia.

When I was interviewed earlier in the week, I said that the Fed would most likely stay the course (same as last statement) except put a bit more emphasis on watching out for overseas conditions but, 48 hours later, it occurs to me that the Fed can't say they are worried about the Asian markets because that statement alone could be enough to tank the Asian markets. Without that couching language, investors are likely to get nervous because October 28th is just around the corner.

When I was interviewed earlier in the week, I said that the Fed would most likely stay the course (same as last statement) except put a bit more emphasis on watching out for overseas conditions but, 48 hours later, it occurs to me that the Fed can't say they are worried about the Asian markets because that statement alone could be enough to tank the Asian markets. Without that couching language, investors are likely to get nervous because October 28th is just around the corner.

We had our FREE Live Futures Trading Workshop yesterday (1-3pm – replay will be here when available) and I'm happy to say that our demonstration trades made $185 in 90 minutes for our happy participants. The Workshop was a follow-up to the weekend post titled "Using Stock Futures to Hedge Against Market Corrections" and that is exactly what those index levels I just mentioned are for!

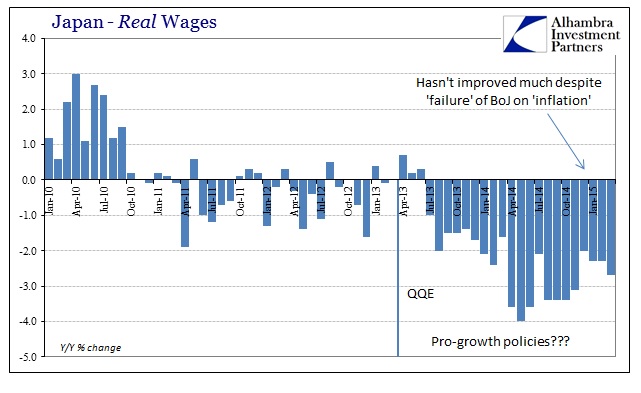

Japan is a major destination for Chinese exports and, this morning, June Retail Sales were reported to be down 0.8% from May and the commentary from Misuho Securities summed it up nicely: "Consumers are hitting the brakes and I don’t think the economy is getting any upward momentum at all. I don’t see a strong, sustainable catalyst for growth. Exports are fragile, capital investment is limited.” Th-th-th-that's all for Q2 in Japan, folks – it's a BUST and Japan's Q2 GDP is going to show CONTRACTION, possibly severe contraction in the World's 3rd largest economy.

Japan is a major destination for Chinese exports and, this morning, June Retail Sales were reported to be down 0.8% from May and the commentary from Misuho Securities summed it up nicely: "Consumers are hitting the brakes and I don’t think the economy is getting any upward momentum at all. I don’t see a strong, sustainable catalyst for growth. Exports are fragile, capital investment is limited.” Th-th-th-that's all for Q2 in Japan, folks – it's a BUST and Japan's Q2 GDP is going to show CONTRACTION, possibly severe contraction in the World's 3rd largest economy.

A record 62 percent of Japanese households described their livelihoods as “hard” last year, a health ministry survey on incomes showed earlier this month. Just file this under one of the many things you have no idea of if you get your information from US Corporate Media, who only know one tune (and you KNOW what that is).

Japan's in a recession? Gosh, you would think that would rate a mention somewhere but no more than China's market jammed up 5% by mysterious forces into what would have been a disastrous close that dropped the Shanghai more than 10% for the week. Nope, all you will hear is a very uncritical 3.4% gain as the Shanghai "recovers" – AWESOME!

Japan's in a recession? Gosh, you would think that would rate a mention somewhere but no more than China's market jammed up 5% by mysterious forces into what would have been a disastrous close that dropped the Shanghai more than 10% for the week. Nope, all you will hear is a very uncritical 3.4% gain as the Shanghai "recovers" – AWESOME!

Ford (F) says auto sales in China are likley to decline for the first time in 17 years (1998), Komatsu saw Chinese demand drop by 50% in the first quarter, BEFORE the crash with Hitachi Construction Machinery reporting similar results and Kobe Steel is also reporting an 84% decline in construction machinery.

“Demand in China is deteriorating further as the country’s large-size infrastructure investment remains stagnant,” Naoto Umehara, executive vice president of Kobe Steel, told reporters Tuesday in Tokyo. “We have yet to see any sign of a recovery.”

We are long-term short China, playing the ultra-short ETF (FXP) and shorting the ultra-long ETF (CHAU) but we've covered with a short-term long position on (FXI) because we expected these kinds of shenanigans from China. We also shorted the Japan ETF (EWJ), as we also expected the repercussions of the Chinese RECESSION (yes, I said it!) would spill over to the land of the rising sun.

Now we'll see what the Fed has to say at 2pm.