Financial Markets and Economy

The U.S. Economy's Top Speed Has Probably Been Overestimated for Years (Bloomberg)

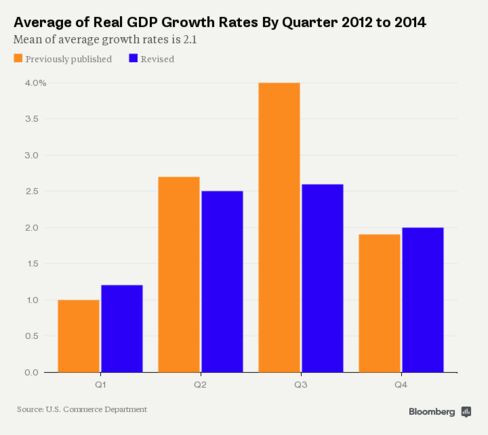

Revisions to the U.S. gross domestic product since 2011 reinforce the shift to a slower era of economic growth and underscore the difficulties the Federal Reserve faces in gauging just when to inch interest rates away from the zero-lower bound.

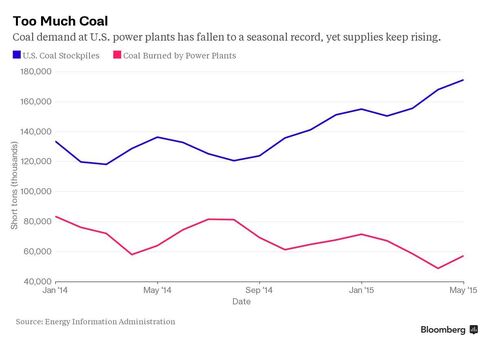

Alpha Bankruptcy Plan Shows Mines Must Die for Others to Live (Bloomberg)

As coal king Alpha Natural Resources Inc. prepares for bankruptcy, an uncomfortable reality is setting in across the hills of Appalachia and the open pits of Wyoming: More mines are going to have to die for the rest to survive.

Alpha Natural, the biggest U.S. producer of metallurgical coal, is discussing a plan with creditors that would shut mines as part of its bankruptcy proceedings, three people with direct knowledge of the situation said Thursday, asking not to be named because the discussions are private.

Asia shares edge up, wary of China volatility (Business Insider)

Asia shares edge up, wary of China volatility (Business Insider)

Asian shares inched higher on Friday but were on track for a weekly loss, while the dollar edged away from highs scaled after U.S. GDP data reinforced expectations that the Federal Reserve is on track to raise interest rates this year.

Investors kept a wary eye on China, where stocks dropped on Thursday after state media reported that banks were investigating their equities exposure in the wake of the recent dramatic rout there.

Brazil's Economy Slides Into Depression, And Now Olympians Will Be Swimming In Feces (Zero Hedge)

Brazil's Economy Slides Into Depression, And Now Olympians Will Be Swimming In Feces (Zero Hedge)

Back on December 29 of last year, we explained how under the burden of its soaring current account deficit, and its its first primary fiscal deficit since 1998, not to mention numerous corruption scandals and a dysfunctional monetary policy, the Brazilian economy "just imploded." We also noted the main reason for the Latin American collapse: Brazil had for the past decade become China's favorite source of commodities, and now that China suddenly no longer needed commodities, the Brazilian economy went into freefall.

Slower wage growth seen in second quarter (Market Watch)

One of the most closely watched measures of wage inflation likely cooled a bit after a strong first quarter, economists predicted. Analysts said equity investors might cheer as there is concern wage gains might put an end to the six-year bull market.

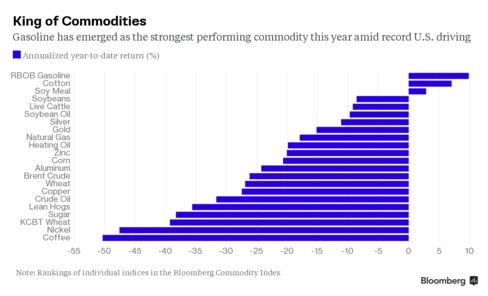

Refiners Herald the Return of King Gasoline in the U.S. (Bloomberg)

After years of trying to reduce gasoline production in favor of diesel, U.S. refiners are once again relying on America’s favorite motor fuel to drive profits.

Hedge fund Elliott eyes fresh market turbulence (Business Insider)

Hedge fund Elliott eyes fresh market turbulence (Business Insider)

Paul Singer's $27 billion hedge fund Elliott Associates is worried about Europe's prospects and is bracing for fresh market turbulence.

In a letter to investors dated July 23 and seen by Reuters on Thursday, the New York-based firm told clients that it has returned 2.8 percent in its Elliott Associates, L.P. and 2.2 percent in its Elliott International Limited.

Chinese Stocks Extend Yesterday's Plunge Despite Regulators "Asking" Insurers To Stop "Net Sales" (Zero Hedge)

Following last night's afternoon session plungefest (with ChiNext's biggest drop in a month), as it appeared the government experimented with 'free' markets briefly, regulators have "asked" insurance companies to be "net sellers" of stocks going forward.

Venezuela's currency woes are costing American companies a ton of money (Business Insider)

Venezuela's currency woes are costing American companies a ton of money (Business Insider)

Venezuela's currency woes cut nearly $3 billion in profit at U.S. blue-chip companies during the second quarter and prompted Procter & Gamble Co to remove its operations in the South American country from its consolidated financial reports.

More so-called deconsolidation moves and exits from Venezuela are likely to happen during the second half of the year as U.S. corporations grow increasingly frustrated with Venezuela's sinking Bolivar currency, according to analysts and U.S. regulatory filings.

U.S. company struggles in Venezuela are stark reminder of emerging market risk (Market Watch)

U.S. company struggles in Venezuela are stark reminder of emerging market risk (Market Watch)

U.S. companies are writing off their Venezuelan assets amid a currency crisis in the South American country, a stark reminder that as some developing markets have found firmer footing in recent years, others remain perilous for investors.

Procter & Gamble Co. PG, -4.01% is the latest on that list. The consumer-products giant said earlier Thursday it took a $2.1 billion charge in the second quarter related to its Venezuelan operations, and reported results that were below market expectations.

Uncowed Treasury Buyers Can't Get Enough Even as Fed Hike Looms (Bloomberg)

Not even the Federal Reserve's plans to raise interest rates this year were enough of a deterrence to keep investors away from Treasury debt auctions this week.

Elizabeth Warren’s Crusade to Separate Investment and Commercial Banks (NY Times)

Elizabeth Warren’s Crusade to Separate Investment and Commercial Banks (NY Times)

For reasons that are mystifying, the idea of separating investment banks from commercial banks — once the law of the land for more than 60 years — is again the rage among certain politicians.

The leading political proponent of this idea has been Senator Elizabeth Warren of Massachusetts, a former Harvard Law School professor who should know better. In 2013, she joined with a bipartisan group of her fellow senators, including John McCain, Maria Cantwell and Angus King, to introduce what she called the 21st Century Glass-Steagall Act – an homage to the original law passed 80 years earlier. It was created, she hoped, to make the financial system safer.

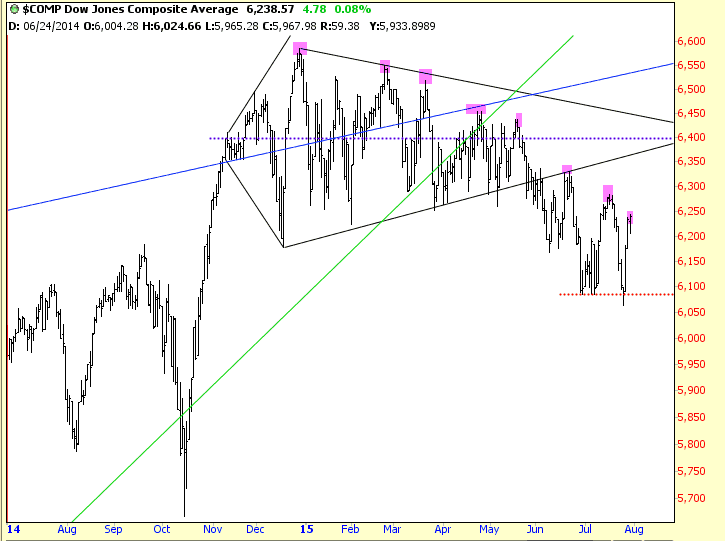

Whole Foods’ stock is teetering on the edge of a scary technical cliff (Market Watch)

Whole Foods Market Inc. may not have as much time as it hopes to repair its image, because the natural-foods grocer’s stock has reached the edge of a technical cliff, that warns of a potentially massive selloff.

China is trying to save its market with failed policies (CNN)

China is trying to save its market with failed policies (CNN)

If financial history repeats itself, it won't be good for China.

China's stock market is in a meltdown. The main Shanghai Index has fallen about 30% since its peak on June 12. The Chinese government is freaking out, and it's responding like a frightened momma bear, unleashing numerous efforts to stop the plunge.

Oil execs think lower prices are here to stay (Business Insider)

Oil execs think lower prices are here to stay (Business Insider)

The leaders of BP appear to have joined their counterparts at Royal Dutch Shell in concluding that oil prices will stay low for longer than anyone had previously expected.

BP’s outlook springs from the second-quarter beating it reported July 28. The British energy major reported a loss replacement cost, or a loss in net income, of $6.27 billion, a far cry from the $3.18 billion profit it recorded in the same period of 2014.

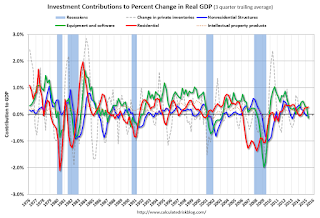

Q2 GDP: Investment (Calculated Risk)

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

How Cheap OiI is Fueling a Surge In New Factories (Bloomberg)

How Cheap OiI is Fueling a Surge In New Factories (Bloomberg)

America's energy rebirth is the gift that keeps on giving for the economy. But this year, it's more about construction than drilling holes in the ground.

While the collapse in oil and gas prices since the middle of last year caused energy companies to slash investment in oil wells, Thursday's report on second-quarter GDP showed an interesting dynamic taking shape — investment in factories has been running full bore.

'Housing Bubble 2' has bloomed into full magnificence (Business Insider)

The current housing boom has Dallas solidly in its grip. As in many cities around the US, prices are soaring, buyers are going nuts, sellers run the show, realtors are laughing all the way to the bank, and the media are having a field day. Nationwide, the median price of existing homes, at $236,400, as the National Association of Realtors sees it, is now 2.7% higher than it was even in July 2006, the insane peak of the crazy housing bubble that blew up with such spectacular results.

Puerto Rico Back in the Hot Seat (Morning Star)

The commonwealth of Puerto Rico and the municipal-bond mutual fund market were thrust back in the headlines in recent weeks as Gov. Alejandro Garcia Padilla warned that the U.S. territory couldn't pay its $72 billion of debt. In this article, we'll provide context around the announcement, review which mutual funds own significant amounts of Puerto Rico bonds, and discuss what investors can expect moving forward.

Another Day, Another V-Shaped Manic-Melt-Up Recovery In Stocks (To Unchanged) (Zero Hedge)

After 3 days of magical buying on no volume after heavy volume dumps, this seemed appropriate… "if you don't buy the dip, then you are a f##king idiot"

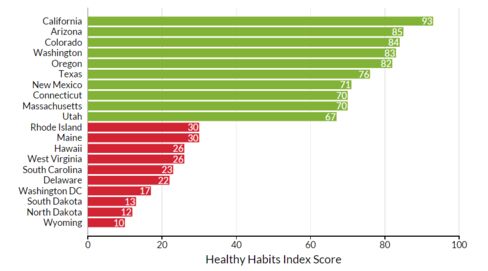

Do Fitter Economic States Produce Healthier Residents? (Bloomberg)

Which state has the healthiest lifestyle? MyFitnessPal and MapMyFitness—two popular smartphone apps that help the health-conscious tabulate their energy in and energy out—used data collected from their users across the country to rank the states (plus D.C. and Puerto Rico) from best to worst. It may not come as a surprise: California clocked in at the healthiest, with most other western states also making the top 10. The least healthy included Washington, D.C,. both Dakotas, and in last place, Wyoming.

Get ready for the biggest month of US economic data in years (Business Insider)

Ahead of Thursday's Q2 GDP report, Michelle Meyer at Bank of America Merrill Lynch said the US economy was facing a "moment of truth."

But that was just a sideshow.

.jpg)

Twist Those Dirty Bags! (Slope of Hope)

Greetings from Whole Foods Market in Palo Alto. There are times when I simply have to get away from my home office, since even I have limits as to how many hours I want to stay in the same place. I come to Whole Foods often enough to notice that a fair number of insane people come here. I divide them into (a) insane people without money and (b) insane people with money.

Jobless claims move up a bit from four-decade low (Market Watch)

Jobless claims move up a bit from four-decade low (Market Watch)

The number of people who applied for U.S. unemployment benefits in the seven days ended July 25 stayed near the lowest level in decades, indicating the labor market is still on the upswing.

New applications for U.S. unemployment benefits rose by 12,000 to 267,000 in the seven days ended July 25, the Labor Department said. The rise was less than expected. Economists polled by MarketWatch had forecast claims to increase to 275,000.

Oil Market Embraces Lower-for-Longer Price View as Futures Sink (Bloomberg)

Oil Market Embraces Lower-for-Longer Price View as Futures Sink (Bloomberg)

The global oil surplus increasingly looks like a problem that’ll take years rather than months to solve — and the market is pricing that in.

U.S. crude futures for delivery in five years have broken below levels seen during the financial crisis. With leading OPEC members pumping at a record, supplies from elsewhere holding up and Iran close to reviving exports, the market is signaling the glut will persist.

China is looking to this type of energy to power its future (Business Insider)

China is looking to this type of energy to power its future (Business Insider)

The disaster at Japan’s Fukushima Daiichi nuclear power plant in 2011 has prompted world leaders to slow or even suspend reliance on that source of energy. That’s left an open field for China to become one of the world’s top producers of nuclear power.

As the traditional leaders in nuclear power have stagnated since the accident, in the same period China has added 10 new reactors capable of more than 10 gigawatts of generating capacity, according to the U.S. Energy Information Administration (EIA).

U.S. economy didn’t grow as fast as we were told from 2012 to 2014 (Market Watch)

The U.S. economy grew somewhat more slowly from 2012 to 2014 than previously estimated, according to a new government approach to gross domestic product that addresses flaws in how the report is produced.

"Why Commodities Defaults Could Spread", UBS Explains (Zero Hedge)

UBS has been keen to warn investors about just how perilous the situation in high yield has become – which works out nicely, because we’ve been saying precisely the same thing ever since it became readily apparent that between investors’ hunt for yield and energy producers’ desire to take advantage of low rates and forgiving capital markets in order to stay solvent, the market was setting up for a spectacular implosion.

Politics

Wall Street’s ‘quick-buck’ strategy isn’t so bad, Hillary (Market Watch)

Wall Street’s ‘quick-buck’ strategy isn’t so bad, Hillary (Market Watch)

Hillary Clinton just hit Wall Street right where it counts: its self-regard. In a policy speech, she essentially said that every prevailing assumption Wall Street has about how to conduct business pushes the world economy toward ruin.

Seriously, Hillary, next time tell us how you really feel.

Wall Street, of course, earns its standing as a sitting target for bombast and ridicule. In our culture and economy, Wall Street is an inscrutable force. Anyone who says otherwise is talking gibberish.

Donald Trump's Soaring Popularity "Is The Country's Collective Middle Finger To Washington" (Macro-Allocation)

Donald Trump's Soaring Popularity "Is The Country's Collective Middle Finger To Washington" (Macro-Allocation)

Donald Trump’s ascendance as the early GOP front-runner is symbolic of a greater global trend: growing pushback against institutional political and economic power.

To many centrist politicians and mainstream political observers, Donald Trump is a boastful, insensitive egomaniac spouting populist rhetoric. Whether such a characterization is true is not worthy of debate, which may explain why the rantings of enraged career political pundits have no impact on Mr. Trump’s popularity among Republican voters in Iowa, New Hampshire, and across America. It seems no amount of ink or air time spent tarring and feathering Trump’s reputation sticks; in fact it seems to help Teflon Don in the polls, where he leads a crowded field of career politicians.

Technology

Bio-inspired robots jump on water (Eurek Alert!)

Bio-inspired robots jump on water (Eurek Alert!)

By studying how water striders jump on water, Je-Sung Koh and colleagues have created a robot that can successfully launch itself from the surface of water. As the team watched the water strider jump on water surfaces using high-speed cameras, they noticed that the long legs accelerate gradually, so that the water surface doesn't retreat too quickly and lose contact with the legs.

Health and Life Sciences

How to become a T follicular helper cell (Eurek Alert!)

How to become a T follicular helper cell (Eurek Alert!)

(La Jolla Institute for Allergy and Immunology) Follicular helper Tcells (TFH cells), a rare type of immune cell that is essential for inducing a strong and lasting antibody response to viruses and other microbes, have garnered intense interest in recent years but the molecular signals that drive their differentiation had remained unclear. Now, a team of researchers at the La Jolla Institute for Allergy and Immunology has identified a pair of master regulators that control the fate of TFH cells.

FibroGen's anemia drug, not yet approved, is a hit among cheating cyclists (Fierece Biotech)

As The New York Times reports, FibroGen's drug can't be cleared for therapeutic use until the FDA weighs in on its safety and efficacy, but its chemical active ingredient, FG-4592, can be legally purchased for research purposes from suppliers around the world. Such companies require written confirmation that what they sell is for lab tests only, and they ship only to universities, but these precautions are apparently not enough to stem abuse.

The drug, developed as roxadustat by FibroGen and partner AstraZeneca ($AZN), is designed to mediate the transcription factors that control the amount of oxygen in cells, thereby spurring the body to naturally generate more red blood cells and thus battle the underlying cause of anemia.

Life on the Home Planet

North America’s salamanders threatened by bloody skin disease (The Verge)

North America’s salamanders threatened by bloody skin disease (The Verge)

A gruesome and deadly skin disease threatens to wreak havoc among North America’s salamanders, researchers warn in a study published in Science today. The Asian fungus that causes the disease — called Bsal — has already reached Europe, wiping out 96 percent of fire salamanders in the Netherlands. Now, researchers have determined that the fungus will spread like wildfire if it reaches North America, and they’re calling for an immediate ban on all salamander imports.

Californians Cut Water Use By 27% During the Hottest June On Record (Gizmodo)

Californians Cut Water Use By 27% During the Hottest June On Record (Gizmodo)

Looks like all that #droughtshaming worked. Last month, California’s urban water use dropped more than the 25% reduction ordered by Governor Jerry Brown—the state cut water use by 27.3%, in fact. We did it!

Well, not all of us. According to the Wall Street Journal, some cities still missed the mark. Earlier this year the state water board set goals for different communities based on current water use for the 405 municipal districts.