"Woah, we're half way there

Woah, livin' on a prayer

Take my hand, we'll make it I swear

Woah, livin' on a prayer" – Bon Jovi

That's right folks, we're halfway there!

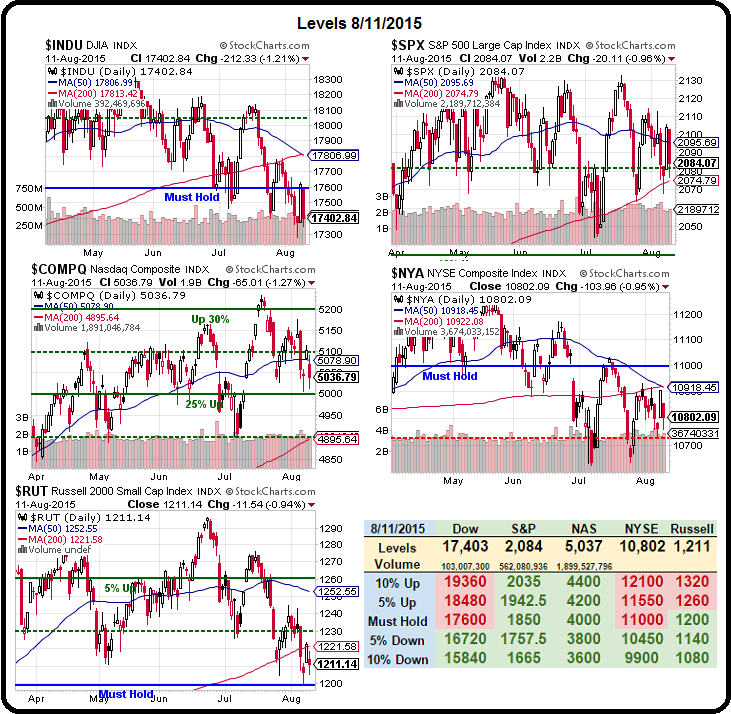

Halfway to our predicted 5% pullback on the S&P to 2,035 (our 10% line) and hopefully NOT halfway to our 5% line at 1,942.50 as that would probably lead to 10% corrections for the NYSE, Dow, Russell and Nasdaq as well. I don't want to get too technical for fear of this article being rejected by SA editors so I'll just refer you to our Twitter feed, where we sent out bounce lines and Futures trade ideas earlier this morning from our Live Member Chat Room.

I guess I can tell you about how well our Japan ETF (EWJ) short is doing as it was featured as our 2nd trade idea for our 5% (Monthly) Portfolio, which is a Seeking Alpha Premium Research product that we just launched this week. We nailed the entry on 10 Sept $14 puts at 0.90 ($900) and already yesterday they popped to $1.10 for a $200 gain (22%) in two days – already paying two months of the $99 subscription fee on just one two-day trade!

Not only that but, as a bonus for our 5% Portfolio Subscribers (and, of course, our PSW Members), we laid out our trading strategy for conviction shorting the Nikkei (/NKD) Monday afternoon (3:05 pm, EST) as follows:

- 1x short at 20,900

- 1x short at 20,950 (avg 20,925 – stop out of 1 even)

- 2x short at 20,995 (avg 20,960 – stop out of 2 even)

As you can see we NAILED IT for our subscribers and, at $5 per point, per contract, those /NKD Futures shorts were up $3,500 PER CONTRACT when /NKD hit 20,200 this morning – not bad for 48 hours' work, right? Even better were the trade ideas we posted on July 25th under "Using Stock Futures to Hedge Against Market Corrections" which was, unfortunately, rejected by Seeking Alpha's editors because:

(1) We usually avoid these "how-to" instructional pieces, (2) we're looking for long-term investment ideas, not necessarily short-term trading strategies, (3) parts of the submission come across as rather promotional.

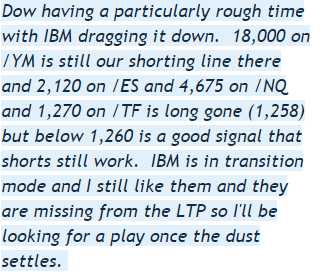

I understand that but our Long-Term Investment Strategy includes protecting yourself against short-term market corrections – a strategy I did not realize was so radical that it couldn't be discussed in polite company. As you can see, we clearly laid out the levels at which we would go short again and, a week later (7/31), the Dow was at 17,700 but the S&P was at 2,120 and the Nasdaq topped out at 4,625 and Russell managed 1,240 so our only re-play was the S&P.

I understand that but our Long-Term Investment Strategy includes protecting yourself against short-term market corrections – a strategy I did not realize was so radical that it couldn't be discussed in polite company. As you can see, we clearly laid out the levels at which we would go short again and, a week later (7/31), the Dow was at 17,700 but the S&P was at 2,120 and the Nasdaq topped out at 4,625 and Russell managed 1,240 so our only re-play was the S&P.

Now back at 2,055 this morning, those S&P Futures gained $3,250 per contract – and that's a nice hedge! Unfortunately Friday, July 31st's article: "Final Friday for Bull Run – Dow Death Cross Dead Ahead" was also rejected at Seeking Alpha for the following reason:

Thanks very much. This article is rather heavy on technical analysis, and parts of it read as something of a rant.

I respect the criticism but I will tell the editor that he should try condensing the pre-market action down to a couple of pages of summary ahead of the bell without sometimes ranting a bit. My opening line two weeks ago, at the very top of the market, was "Look out below!" – continuing:

"With the Dow Jones Industrial Average having spent the past week below the 200 day moving average, the 50-day moving average has been pulled down and is now almost certain to cross below the 200 dma during the month of August in what Technical Analysts call a "Death Cross" and no, it isn't better than it sounds…

"The Dow has gotten back over our Strong Bounce line at 17,700 for the week (see Tuesday's predictions), so we'll cut it some slack for now but yesterday we got a little more bearish in our Short-Term Portfolio, taking advantage of a cheap roll to improve our SQQQ position. We also had another chance to short the Russell Futures (/TF) at our 1,230 target, so we took that but we also took $500 per contract and ran this morning as it's Friday, and Friday's are dangerous days to trade the Futures.

"As for the S&P, well the song remains the same on that index as we endure yet another prop job to take us back to our shorting spot at 2,130 (was 2,120 but moved up in May). Notice that there has been a much easier time using our system to short at the top than trying to guess where the bottoms are to go long (we don't like to go long when we're macro-bearish)."

We had charts supporting all this, of course but I fear if I include them here it will be considered "too technical" and you won't see this either. Even now, I'm wondering if they will publish this but I think the readers should be able to tell the editors what content they consider worth reading and not vice versa. I did rant at the end of that post – I was talking about how robots and automation were destroying the buying power of the working class and how that's a bad thing. The funny thing is that, in five years, these editors will all be replaced by robots too!

We had charts supporting all this, of course but I fear if I include them here it will be considered "too technical" and you won't see this either. Even now, I'm wondering if they will publish this but I think the readers should be able to tell the editors what content they consider worth reading and not vice versa. I did rant at the end of that post – I was talking about how robots and automation were destroying the buying power of the working class and how that's a bad thing. The funny thing is that, in five years, these editors will all be replaced by robots too!

I'm not a TA guy at all. I'm a true Fundamentalist who thinks TA is just some BS voodoo that placates the masses the same way the village witch doctor would soothe the villagers by making up some story to explain things AFTER the comet was sighted. The problem is, so many people follow TA that it's become a self-fulfilling prophesy, so we HAVE to factor it in as one of the market fundamentals we follow.

Anyway, back to EWJ and Japan: This morning we should add another dime and we'll have to consider stopping out ahead of our $1.35 goal (+50%) as it came so soon we're worried it might reverse. Japan is, of course, suffering along with China as both countries are in a bit of an undeclared recession and now China has dropped their currency a bit, cutting into Japan's trade advantage.

We also took a long play on oil in our 5% Portfolio because, as Jeff Gundlach notes, "If oil goes to $40 a barrel, something is very, VERY wrong with the World, not just the economy. The geopolitical consequences could be — to put it bluntly — terrifying." Now, I know I say stuff like that all the time but I'm a big fan of hyperbole – it's much scarier coming from Gundlach!

Oil at these prices is destablizing for many Governments that depend on oil sales. Brazil, Venezuela and Russia have economies that are falling off a cliff and even Canada is on the ropes and who knows what's going on in the OPEC nations. The funny thing is that Iraq, which is now pumping over 4M barrels of oil a day (up from 500,000 during the Bush wars) considers every single dollar to be profits, as does Iran, who are ramping their production up to record levels.

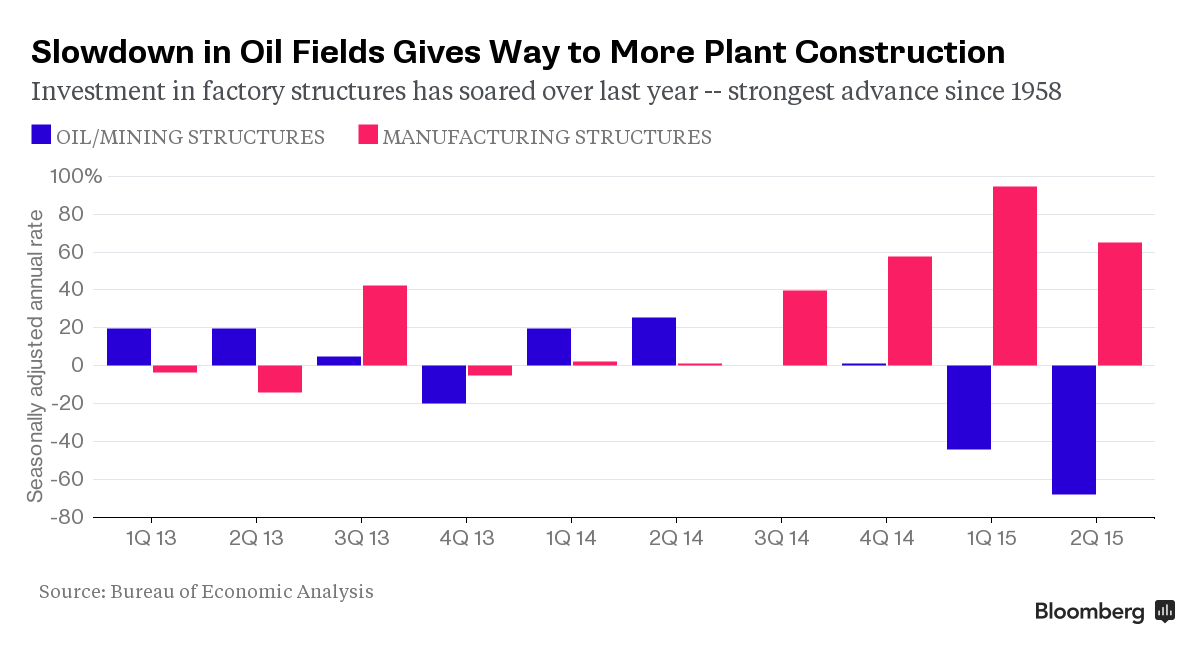

That is keeping the markets flooded with oil yet demand remains in the doldrums, for now. Over time, major decisions will be made (like opening factories) that will create long-term demand for oil and things will normalize – but don't expect it to come back very quickly as there is still a massive surplus of oil that will take a long time to draw down.

As you can see from this chart, oil is and has been cheap, so more factories are getting built but less oil wells are being drilled so the surplus sows the seeds of the eventual shortage to follow. The problem is that these cycles take YEARS to play out – and the average investor has the attention span of a fruit fly on twitter. That's why our trade idea for USO in the 5% Portfolio has an April option set-up. If all goes well, that trade will make us 10% a month for the next 8 months and those are the kind of time-frames we like to play!

Meanwhile, we love our short-term Futures plays – even if the editors do not…