This is turning into a tragedy:

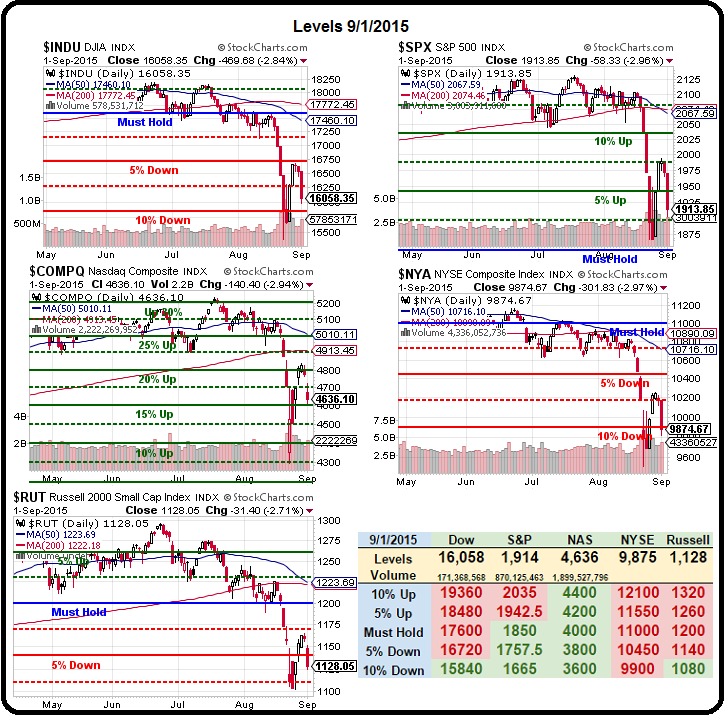

We really don't wan to see 1,850 back in play on the S&P after failing to hold our strong bounce line at 1,950 in yesterday's collapse and we're sitting just above our weak bounce line at 1,900, which better be very strong support or down we go again (see yesterday's post for our bounce lines).

Fortunately, tomorrow is parade day in China and we got a huge prop job to lift the Shanghai composite 5% from the open to close down just 0.2%, making it all ready for a big gain tomorrow back over 3,200 – just in time for Chairman Xi to tell us how great everything is and how well the economy is going in his big speech. That speech is scheduled for 10 am in China, so I'd say betting in the China markets to open up tomorrow is what you would call A SURE THING!

Fortunately, tomorrow is parade day in China and we got a huge prop job to lift the Shanghai composite 5% from the open to close down just 0.2%, making it all ready for a big gain tomorrow back over 3,200 – just in time for Chairman Xi to tell us how great everything is and how well the economy is going in his big speech. That speech is scheduled for 10 am in China, so I'd say betting in the China markets to open up tomorrow is what you would call A SURE THING!

What happens after the parade is anyone's guess but our own Prop Masters are hard at work after yesterday's little tragedy, where our US indexes gave up 2.5% into the close. From an intra-day perspective, our fabulous 5% Rule™ tells us to expect a 0.5% weak bounce into today's open but we're certainly not even a little impressed until we see a 1% gain this morning – then we might consider a bullish bet on the bounce.

Fortunately, we were ahead of the curve and I warned you in Monday's post ("China's $200Bn Manipulation Not Enough – Now What?") that China didn't have the firepower to prevent additional selling but our key play was shorting the overpriced Nasdaq with the following hedge using the very volatile ultra-short ETF (SQQQ):

- Buying 10 SQQQ October $22 calls for $4.20 ($4,200)

- Selling 10 SQQQ October $28 calls for $1.90 ($1,900)

As you can see, SQQQ gained 9% yesterday alone and is up 11.5% from Monday's $24.78 open, so you don't have to play the options to make great money on our calls BUT (and I like big buts), if you did follow our options hedge, you'll be pleased to know the Oct $22 calls are now $6.40 ($6,400) and the short Oct $28 calls are $3.60 ($3,600) for net $2,800, up 21.7% from our net $2,300 entry and on track for the full $6,000, which would be a 160% gain to offset a small (so far) decline in the Nasdaq.

When we are hedging against market uncertainty, we practice something called layering, in which we add a series of hedges over time to supplement the major hedges in our portfolio. For example, in our 5% Portfolio yesterday, we added a hedge using TZA yesterday morning, right before it crashed!

As we were expecting an immediate drop in the Russell, which would lead to a pop in that ultra-short ETF (TZA) and our trade idea was shorter-term using:

- Buying 20 TZA Sept $11 calls at $1.49 ($2,980)

- Selling 20 TZA Sept $13 calls at 0.70 ($1,400)

That spread was net $1,580 and closed at $2,140 for a nice $560 gain on the day, which is 35% in 4 hours – not a bad way to make a living. But this wasn't a bet, it was a hedge because we have a LONG position on the Dow (DIA) from last week's drop that was 100% in the money that we wanted to protect.

Today, if a 1% rise in our indexes holds, we'll be flipping the TZA trade bullish by selling the Sept $11 calls (now $1.92) and leaving the short $13 calls. This is how we can make minor adjustments to our short-term portfolios that can shift us more bullish at a moment's notice. The cool thing is, we cash out the winning portion of the position and suddenly the losing side (the $13 calls are 0.85) becomes the whole position that we can make $1,400 on!

Another way to navigate the tricky markets is using the Futures and yesterday, in our Live Trading Webinar (replay available here), I called for a long on the Nikkei Futures (/NKD) at 17,800 – after a 10% drop on the day and, lo and behold, it ran almost all the way to the strong bounce line at 18,600, stopping at 18,400 and up 600 points (and $3,000 per contract!) before settling down right around the weak bounce line at 18,200 – exactly as expected by the 5% Rule™!

We're long on the Nikkei (/NKD) over the 18,200 line today (with very tight stops below), expecting another attempt at 18,600 for a potential $2,000 per contract gain and we already took a long on Gasoline Futures (/RB) at $1.40 in this morning's Live Member Chat Room as we expect at least a 2.5% bounce ($1.435) into inventories (10:30) but, after that, we could go either way, so stay tuned!

There's no excuse for the markets not to be bouncy today as we had great Productivity numbers (+3.3%) with lower Unit Labor Costs (-1.4%) which means the few humans who still have jobs are working harder and getting paid less for it – a huge win for our Corporate Masters! The good times should last until we get disappointed by Factory Orders at 10:00 am where, for some reason, a 1% increase is expected but that's not what we saw in the regional Fed reports. At 2pm we get the Beige Book and that may be a bit disappointing too.

Now, back to work!