As noted yesterday, the DAX is in trouble.

As noted yesterday, the DAX is in trouble.

It's no surprise to us then that, this morning, Germany's ZEW Economic Sentiment Indicator fell more than 50% in 30 days, from 25 to 12.1 – almost down to last October's lows, when the DAX itself was below 9,000 (10% lower). Yet another reason we are thrilled to be mainly in cash as we wait for Thursday's Fed decision.

"The weakening economic development in emerging markets dampens the economic outlook for Germany’s export-oriented economy. While economic growth in the second quarter was largely driven by external demand, it is becoming less likely that exports will stimulate growth in the near future," says ZEW President Professor Clemens Fuest.

As you can see from today's chart, the DAX sold off sharply at the open (3am) but was miraculously saved a bit after 5am as Maria Cannata of Italy's debt agency (doesn't matter who) was quoted saying that the ECB's QE program might be extended. Rumors like this are a regular occurrence and even Draghi himself will make a doveish statement if he thinks the markets might slip because, after all, what else would we want our Central Banksters to do other than talk up the markets?

All this nonsense is doing is confirming to the bears that 10,200 is becoming the new top of the DAX channel and that will more likely embolden them for a run back to 10,000 at which point 10,200 will become the weak bounce line and, next time that fails, we may have a faster drop that breaks through 10,000 and indicates a more serious correction (see yesterday's chart).

Meanwhile, over in Shanghai, it's no surprise that we're re-testing that 3,000 line as there simply isn't enough money in China to keep propping up this nonsense. As the Government there is beginning to realize, every Dollar they put into the market is immediately being withdrawn by traders who are better Capitalists than they are and know when to cash in their chips.

Meanwhile, over in Shanghai, it's no surprise that we're re-testing that 3,000 line as there simply isn't enough money in China to keep propping up this nonsense. As the Government there is beginning to realize, every Dollar they put into the market is immediately being withdrawn by traders who are better Capitalists than they are and know when to cash in their chips.

Speaking of cash, here's a nice article where Cambria Investment's Mebane Faber explains why they agree with my cash call for their clients:

If you're a buy-and-hold investor, long-term time horizon, ignore what I'm getting ready to say for a little bit, but if you're a tactical person who's concerned about drawdowns and losses, the bad news looking at the U.S. stock market, we look at in two ways. The first is the trend, right, so we've done historical studies not only on U.S. stocks but [on] foreign stocks, REITs, commodities, currencies, bonds, just about everything, and when markets are up-trending, that's when you want to be in. It's simple. Use something like a 200-day moving average, we used a 10 month moving average when we published this paper back in 2006. But what it shows is that when the market is downtrending and you move to the safety of cash or, say, 10-year bonds, you avoid a lot of the volatility. You avoid a lot of the big drawdowns, meaning the peak-to-trough loss in markets. … Until right now, for the first time in a really long time we've had this incredible six-year run, U.S. stocks are finally below trend, and we've told a lot of people for the trend following side, it's a good time to move to the safety of cash or bonds.

I don't think bonds are as safe as cash. In fact, the bond ETF (TLT) probably still makes a good short at $121.58 because there are still too many people buying 20-year notes for 2.65% who think it's a good idea to lend the US Government money at that rate. First of all – have you seen who's running for President? One of those idiots could be in power just one year from now! Second – twenty years is a REALLY long time to believe inflation will stay at record lows…

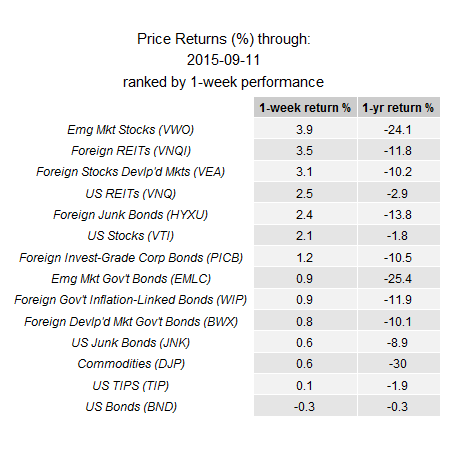

Unfortunately, there isn't anywhere to put your money. If there were, I wouldn't have called for CASH!!! but CASH!!! is the only asset class that isn't down this year – the ONLY one! Emerging market bonds are down a whopping 25.4% in the first 9 months of 2015 and you want to give our government your money to hold for 20 years? The way wages are going in the US, we'll be an emerging market long before then!

Unfortunately, there isn't anywhere to put your money. If there were, I wouldn't have called for CASH!!! but CASH!!! is the only asset class that isn't down this year – the ONLY one! Emerging market bonds are down a whopping 25.4% in the first 9 months of 2015 and you want to give our government your money to hold for 20 years? The way wages are going in the US, we'll be an emerging market long before then!

The Vangaurd REIT ETF (VNQ) may be down 2.9% but at least they pay a 4.1% dividend. In our Long-Term Portfolio, we still have positions in Northstar Realty (NRF), who pay an 11.5% dividend (just paid us 0.40 on 8/13, in fact) as well as Armour Residential (ARR), who pay 18.9% (0.33 MONTHLY) and Chimera Investments (CIM), who pay 13.8% with the next one due (0.48) on 10/30. That's not bad on a $14 stock.

So I'm not a big fan of REIT ETFs as we prefer to cherry-pick the ones we like best. While those REIT returns may seem very impressive, we can enhance them further with some stupid options tricks like:

- Buy 1,000 shares of ARR at $19.87 ($19,870)

- Sell 10 April $20 calls for $1.15 ($1,150 credit)

- Sell 10 April $17 puts for $1.10 ($1,100 credit)

That nets you into 1,000 shares for $17,620 and we expect to collect a 0.33 monthly dividend (usually mid-month) which would be 7 x 0.33 = $2.31 ($2,310) between now and April. So, if we are called away at $20 in April, we end up with $22,310 back on our $17,620 outlay or 26.6% in 7 months – that's not too shabby for a boring play!

ARR has been hit hard since it did a 1:8 stock split on Aug 3rd but it's more likely investors taking the opportunity to sell some of their holdings, now that they have 8x more shares. Rate concerns have been hitting the whole REIT sector but ARR is heavily hedged and we'll find out on next earnings (10/30ish) whether or not they can sustain this ridiculous dividend but I'm good with half of 18.9% as a long-term investment, so I think it's a good time to take a chance. Plus – it's a great stock to own on Talk Like a Pirate Day (Sept 19th)!

Again, we're 80-90% in cash so these are relatively small pokes at things we like and are willing to buy more of if they get cheaper. Those are the only kinds of stocks we have left in our portfolios. We're having a Webinar at 1pm (EST) today where we'll be reviewing our positions but it's Members Only, of course.

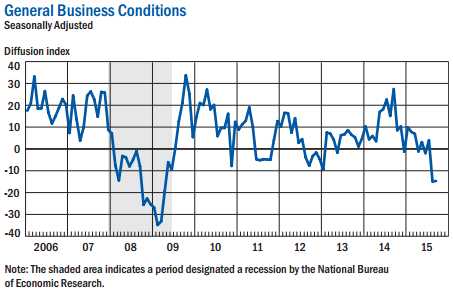

If this chart doesn't make you understand why we're in cash, I don't know what will. This is today's Empire State Manufacturing Index at -14.7, which is 15.2 below the estimates of leading economorons (yet still they ask their opinion every month) and 15.3 below the prior reading of +0.6. I guess I better mention that the last time this happened was 2008 – just before the last major stock market collapse but go ahead and listen to the market apologists who tell you to stay the course.

If this chart doesn't make you understand why we're in cash, I don't know what will. This is today's Empire State Manufacturing Index at -14.7, which is 15.2 below the estimates of leading economorons (yet still they ask their opinion every month) and 15.3 below the prior reading of +0.6. I guess I better mention that the last time this happened was 2008 – just before the last major stock market collapse but go ahead and listen to the market apologists who tell you to stay the course.

We get Philly Fed on Thursday along with the Fed statement that afternoon (2pm) but we'll be watching from the sidelines, thank you. Retail Sales for August were up an anemic 0.2% vs. 0.3% expected and 0.7% in July – also not good but weighed down by lower gas prices, so call it even overall, even though the ex-Auto number was a huge miss at 0.1% (economorons strike again). How professional economists fail to take into account a 10% drop in gasoline prices is beyond my understanding…

I can tell you right now, looking over the Retail Report, that Durable goods next Thursday will be lower than August's 2.2% and, as you can see from the chart, that number is already in big trouble so why on Earth would we want to be positioned bullishly into this sort of data?

I can tell you right now, looking over the Retail Report, that Durable goods next Thursday will be lower than August's 2.2% and, as you can see from the chart, that number is already in big trouble so why on Earth would we want to be positioned bullishly into this sort of data?

Yet, even as I write this, the markets are going UP because the Empire Manufacturing data and Retail Sales data are so bad that they're GOOD (and now add Industrial Production to the FAIL pile). Good because an economic disaster a day keeps the Fed at bay and this market is all about the FREE MONEY and nothing about actually making money through the sale of goods and services.

And really, when you think about it – why bother? Why go through the headache of making a product and employing all those people and selling it and trying to avoid taxes when you can simply borrow money from the Fed for 0.25% and lend it out for 3.5% or just stick it in a 2.6% 20-year bond and make 10x on your interest for 20 years? A 2.35% spread may not sound that sexy to you but it's $23.5M for each Billion you borrow and there are plenty of ways to leverage it (Interactive Brokers will give you 5:1) to turn that into a very nice return!

And really, when you think about it – why bother? Why go through the headache of making a product and employing all those people and selling it and trying to avoid taxes when you can simply borrow money from the Fed for 0.25% and lend it out for 3.5% or just stick it in a 2.6% 20-year bond and make 10x on your interest for 20 years? A 2.35% spread may not sound that sexy to you but it's $23.5M for each Billion you borrow and there are plenty of ways to leverage it (Interactive Brokers will give you 5:1) to turn that into a very nice return!

We'd love to get on the "bad news is good news" bandwagon and buy stocks based on the premise that the Fed will support the markets forever – but we can't, because we're not idiots.