Are we still falling for this crap?

Are we still falling for this crap?

Apparently, all the GOP candidates believe that, a joke made by Will Rogers in the Great Depression that "money was all appropriated for the top in hopes that it would trickle down to the needy" (pg 184) What Will Rogers actually said, in context, was:

They (Republicans) didn't start thinking of the old common fellow till just as they started out on the election tour. The money was all appropriated for the top in the hopes that it would trickle down to the needy. Mr. Hoover was an engineer. He knew that water trickled down. Put it uphill and let it go and it will reach the dryest little spot. But he didn't know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night anyhow. But it will at least have passed through the poor fellow’s hands. They saved the big banks but the little ones went up the flue

Sound familiar? That's pretty much the same game plan they ran during the S&L crisis under Bush the 1st and again in the more recent crisis under Bush the 2nd and now Bush the wants-to-be-3rd is telling us how his brother did a pretty good job while he was in office – as if none of us were there to witness the truth! But this article isn't about whether or not Americans are stupid enough to elect another Bush while we're still cleaning up the last one's mess.

This is about whether or not Americans are stupid enough to let ANY candidate bullshit them with what Bush I originally called "Voodoo Economics" before joining team Reagan and embracing the WORST ECONOMIC POLICY EVER! Someone really needs to explain to these complicit journalists, who haven't checked a fact since the Carter Administration, that IT WAS A JOKE – "trickle down" was a derogatory term to describe the obvious supply-side disaster of Hoover, Reagan and the Bushes – it wasn't supposed to become the Republican religion!

This chart from the St. Louis Federal Reserve illustrates what has happened since the mid-70s as Wages (red) have fallen 7% as a percentage of GDP while Corporate Profits have grown 7%. So, I guess I'm wrong – trickle down works perfectly: When you suck the money away from the workers, it trickles right down to the Corporate balance sheets!

Of course 7% is 14% of the 50% each of them had to start with, but let's not nit-pick because 7% is horrific enough without doing proper math. The worst thing, of course, it that it took 25 years to go from 50% to 47% (2000) for wages but only 15 more years to get to 42% and there's no sign at all of this trend slowing down – quite the opposite, in fact.

So much so that the negative wage growth "enjoyed" by the bottom 90% consumers has become a drag around the economy of not just America, but for all of the OECD countries practicing these disastrous "top down" economic fixes. As I mentioned on Wednesday, though there are short-term benefits for the Top 1% and the investing class – the perks of Free Federal Money are short-lived and only manage to hide the deteriorating business conditions that caused the printing presses to be fired up in the first place.

What the Top 1% fail to realize is that their customers – the people upon whom their businesses depend, are going deeper into debt and, even those Top 1% businesess that cater to the Top 10% (like mine), who are relatively well off, begin to suffer because our Top 10% clients have lower-tier customers who are at the end of their own economic ropes.

What the Top 1% fail to realize is that their customers – the people upon whom their businesses depend, are going deeper into debt and, even those Top 1% businesess that cater to the Top 10% (like mine), who are relatively well off, begin to suffer because our Top 10% clients have lower-tier customers who are at the end of their own economic ropes.

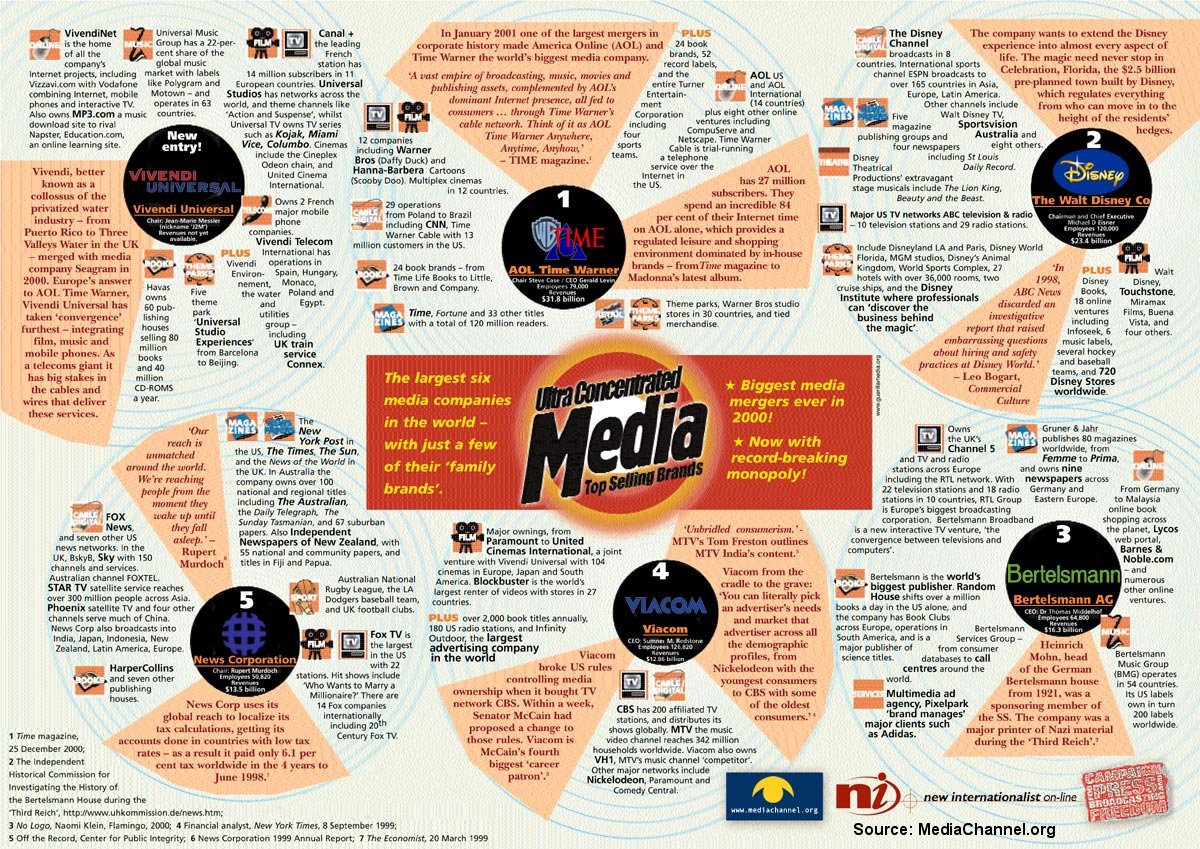

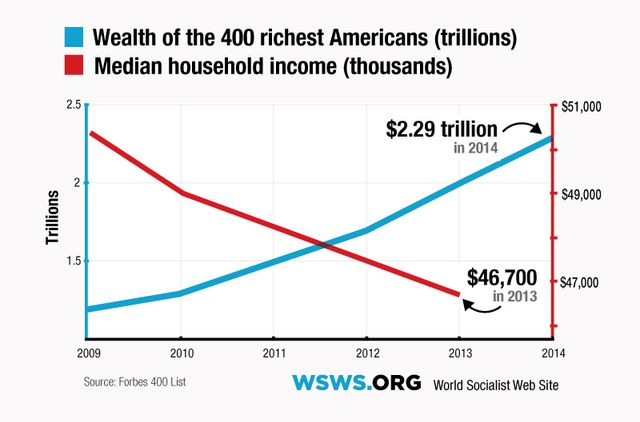

Unless we allow money to flow into the hands of our customers – how are they going to keep being our customers? This is where the whole supply-side theory really falls apart, when you fail to supply anything to the people at the bottom – the people who still drive 70% of the US economy, then there's no sales in our registers and no profits on our bottom lines. Of course, for the people at the very top, none of that matters, because their wealth is not bound by national boarders. Look at the astounding growth of wealth amount some of the Forbes 400 in just 20 years:

By the way, on that Billionaire chart above – those aren't even the 36 richest, just a set of the Forbes 400 – $1Bn doesn't even make the list anymore. So, if we keep going at this pace – just those 36 guys will turn $300Bn into $5Tn in the next 30 years. That means in EACH subsequent year, they will remove $156Bn from the American Pie under the current tax policies. That's $1,000 per year from EVERY SINGLE working American going to just these 36 people. When you do that math on the whole 400 – it costs the American Worker about $5,000 a year in that completely unequal distribution of profits I talked about in Wednesday's post.

THAT is the Republican platform and THAT is what I'm very firmly against. This country barely survived the last 30 years but that's NOTHING compared to what's in store for us if we keep heading down this path. This growth is EXPONENTIAL and we're not even talking about the 500 richest Corporations and what they've accumulated over this time period – this is just a snapshot of some of their owners.

This Monopoly example is very apropos, this is the game we'll all be playing if we let this continue. Well not all – I know people on the other side of this board and congrats for that, but the rest of you are mainly deluding yourselves if you think you're going to win this game.

This Monopoly example is very apropos, this is the game we'll all be playing if we let this continue. Well not all – I know people on the other side of this board and congrats for that, but the rest of you are mainly deluding yourselves if you think you're going to win this game.

Those of us in the bottom of the Top 1% know how hard it is to make further headway – it didn't used to be like that but the game is closing out and the winners are the winners and they are not keen on sharing and, in fact, they want more – so they are only going to take it from each other (hard) or us (easier) or the people below us (piece of cake).

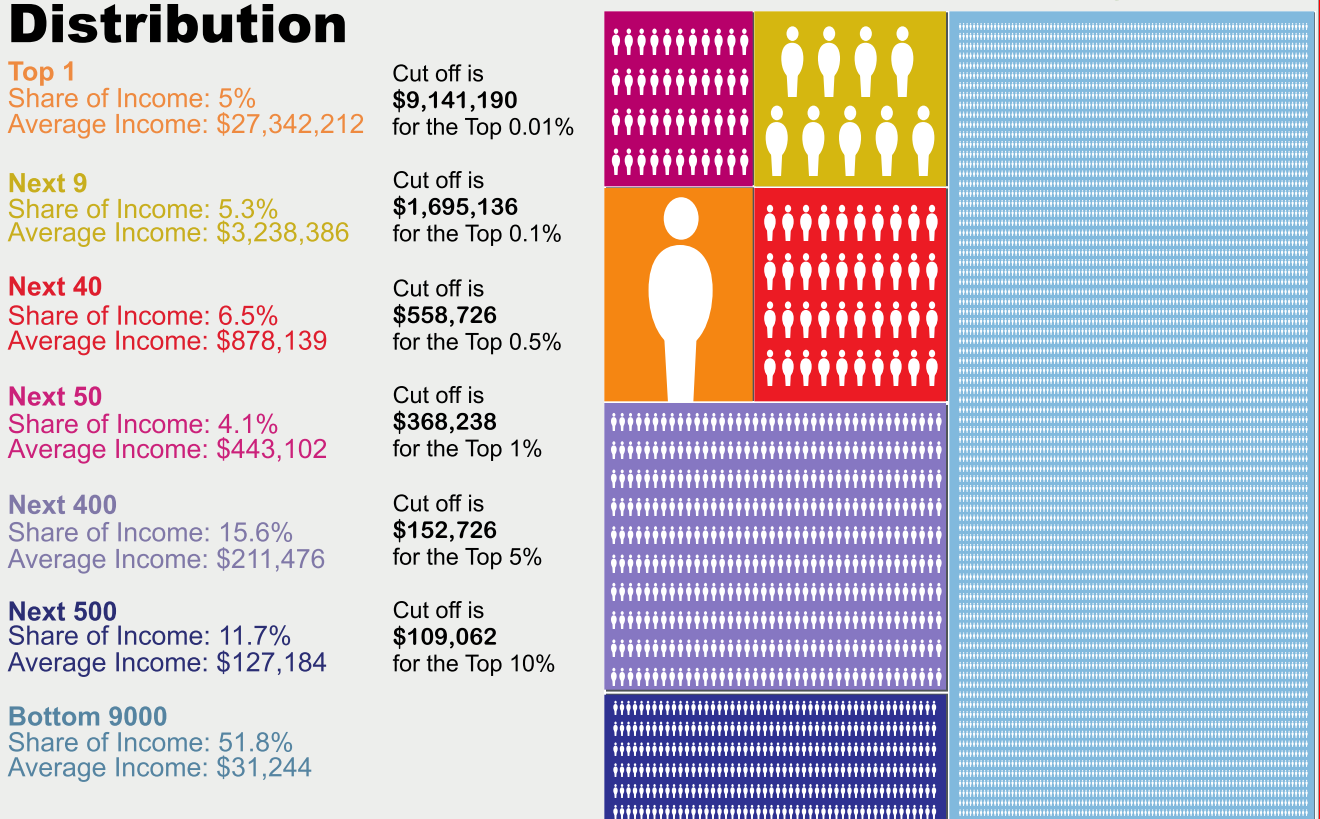

As long as those of us in the top 10% keep getting crumbs, we're happy enough to play along because the crumbs from a $150Bn annual transfer of wealth to the top 400 can be maybe $30Bn divided by 1,500,000 of us top 1% workers is another $20K a year falling in our pockets, so we're "doing better" but even within the top 1% there's a really wide margin. The bottom half of the top 1% earn $368,000 a year while the top 1/10th of the top 1% make $1.7M a year but, as you can see – all of us appreciate another $20K or our share of it – so we mostly shut up about this insane system and enjoy our crumbs.

But the beast we are feeding in the top 0.0000027% (the top 400 out of 150M workers) gets bigger and hungrier each year. They want their wealth to grow too so, even when they have $5Tn, they want to make 10% (clearly they never want to lose, right) an that means they'll need $500Bn a year contributed by the rest of us to be content (and keep in mind they are currently averaging 50% a year so this is VERY CONSERVATIVE) and that means 150M bottom 99.9999973% workers will have to send $3,333 each up to the top each year. And that's only if "THEY" are content with 10% growth and again, we're not counting corporations. Clearly the bottom 80% don't have $3,333 to give, so who do you think they'll turn to next for their tribute?

That's why, over the next 20 years, those crumbs we get will get smaller and smaller and eventually reverse and we (in the top 1%) will scramble and eventually turn on each other as we fight over our ever-smaller slice of the pie. That's the Future we're creating for our children – right here, right now – and THAT is why I don't like the GOP or their programs or their phony representatives who are clearly nothing but puppets for the 400. They WILL destroy this country and they WILL sell your children and your grandchildren into economic slavery.

That's why, over the next 20 years, those crumbs we get will get smaller and smaller and eventually reverse and we (in the top 1%) will scramble and eventually turn on each other as we fight over our ever-smaller slice of the pie. That's the Future we're creating for our children – right here, right now – and THAT is why I don't like the GOP or their programs or their phony representatives who are clearly nothing but puppets for the 400. They WILL destroy this country and they WILL sell your children and your grandchildren into economic slavery.

The time to stop them is now – in 20 years it will be far too late. Maybe it's already too late but I'd like to at least try… Meanwhile, the Top 1% are trying too:

GOP passes massive tax break for millionaires, billionaires …

The House voted Thursday to repeal the estate tax, a longtime priority of Republicans that also spurred Democratic charges that the GOP is in the pockets of the rich. […]The White House has threatened to veto the measure, and the bill does not appear to have the 60 votes necessary to break a Democratic filibuster and get through the Senate.The final tally was 240 to 179, with nearly every GOP lawmaker voting for it and nearly every Democrat voting against it.When describing Republican tax proposals, it’s not uncommon to talk about policies thatdisproportionately benefit the very wealthy. GOP proponents will say a bill benefits all taxpayers, but they’ll brush past the fact that the rich benefit most. This, however, is altogether different – today’s bill, called the “Death Tax Repeal Act,” quite literally benefits multi-millionaires and billionaires exclusively.It’s not an exaggeration to say House Republicans, en masse, voted for a $269 billion giveaway to the top 0.2%. Under the plan, GOP lawmakers, who occasionally pretend to care about “fiscal responsibility,” would simply add the entire $269 billion cost to the deficit, leaving future generations to pay for a massive tax break for the hyper-wealthy.Even by contemporary GOP standards, today’s vote is pretty obscene. At a time of rising economic inequality, House Republicans have prioritized a bill to make economic inequality worse on purpose. At a time in which much of Congress wants to make the deficit smaller, House Republicans have prioritized a bill to make the deficit much larger.At a time when prosperity is concentrated too heavily at the very top, House Republicans have prioritized a bill to deliver enormous benefits to multi-millionaires and billionaires – and no one else.Asked to defend this, Republican leaders – the same leaders who balk at all requests for public investment, saying the nation is too “broke” to fund domestic priorities – say it’s only “fair” to approve a $269 billion giveaway to the hyper-wealthy.It’s like Lewis Carroll and Charles Dickens got together to write a novel, and Congress’ majority wants Americans to live in it.

Grouped By Vote Position

YEAs —54 Alexander (R-TN)

Ayotte (R-NH)

Barrasso (R-WY)

Blunt (R-MO)

Boozman (R-AR)

Burr (R-NC)

Capito (R-WV)

Cassidy (R-LA)

Coats (R-IN)

Cochran (R-MS)

Corker (R-TN)

Cornyn (R-TX)

Cotton (R-AR)

Crapo (R-ID)

Cruz (R-TX)

Daines (R-MT)

Enzi (R-WY)

Ernst (R-IA)Fischer (R-NE)

Flake (R-AZ)

Gardner (R-CO)

Graham (R-SC)

Grassley (R-IA)

Hatch (R-UT)

Heller (R-NV)

Hoeven (R-ND)

Inhofe (R-OK)

Isakson (R-GA)

Johnson (R-WI)

Kirk (R-IL)

Lankford (R-OK)

Lee (R-UT)

Manchin (D-WV)

McCain (R-AZ)

McConnell (R-KY)

Moran (R-KS)Murkowski (R-AK)

Paul (R-KY)

Perdue (R-GA)

Portman (R-OH)

Risch (R-ID)

Roberts (R-KS)

Rounds (R-SD)

Rubio (R-FL)

Sasse (R-NE)

Scott (R-SC)

Sessions (R-AL)

Shelby (R-AL)

Sullivan (R-AK)

Thune (R-SD)

Tillis (R-NC)

Toomey (R-PA)

Vitter (R-LA)

Wicker (R-MS)

NAYs —46 Baldwin (D-WI)

Bennet (D-CO)

Blumenthal (D-CT)

Booker (D-NJ)

Boxer (D-CA)

Brown (D-OH)

Cantwell (D-WA)

Cardin (D-MD)

Carper (D-DE)

Casey (D-PA)

Collins (R-ME)

Coons (D-DE)

Donnelly (D-IN)

Durbin (D-IL)

Feinstein (D-CA)

Franken (D-MN)Gillibrand (D-NY)

Heinrich (D-NM)

Heitkamp (D-ND)

Hirono (D-HI)

Kaine (D-VA)

King (I-ME)

Klobuchar (D-MN)

Leahy (D-VT)

Markey (D-MA)

McCaskill (D-MO)

Menendez (D-NJ)

Merkley (D-OR)

Mikulski (D-MD)

Murphy (D-CT)

Murray (D-WA)

Nelson (D-FL)Peters (D-MI)

Reed (D-RI)

Reid (D-NV)

Sanders (I-VT)

Schatz (D-HI)

Schumer (D-NY)

Shaheen (D-NH)

Stabenow (D-MI)

Tester (D-MT)

Udall (D-NM)

Warner (D-VA)

Warren (D-MA)

Whitehouse (D-RI)

Wyden (D-OR)

All together the 400 wealthiest Americans are worth a staggering $2.29 trillion, up $270 billion from a year ago. That’s about the same as the gross domestic product of Brazil, a country of 200 million people. The average net worth of list members is $5.7 billion, $700 million more than last year and a record high. An impressive 303 of the 400 saw the value of their fortunes rise compared to a year ago. Only 36 people from last year’s list had lower net worths this year.

Where do you think this money comes from? That one really cracks me up when people talk about a "growing pie" when we MEASURE the GDP and the money supply and everything else and it sure isn't growing 10% a year!

Where do you think this money comes from? That one really cracks me up when people talk about a "growing pie" when we MEASURE the GDP and the money supply and everything else and it sure isn't growing 10% a year!