And up we go again!

And up we go again!

After failing the 16,000 line early yesterday, the Dow has now come back 450 points (2.8%) thanks to Janet Yellen's bullish outlook in yesterday's "do-over" speech at Amherst. “The message from Yellen yesterday was that it’s not that bad, and we’re still going to hike,” said Allan von Mehren, chief analyst at Danske Bank A/S in Copenhagen. “That was what the market needed to hear.”

Of course, this was no surprise at PSW as I had already said to our Members Tuesday Morning (7:56) in our Live Chat Room: "Interesting timing (Yellen's 5pm Thurs speech) knowing Durable Goods are out that day. She's scheduled for 5pm, so maybe a market-booster into the week's end. "

In fact, in our Options Opportunities Portfolio, we called the top in gold as it topped $1,155 and cashed out the trade we discussed in yesterday morning's post, getting $6.95 for our long Gold ETF (GLD) Oct $104 calls and buying back the short $108 calls for $3.40 for net $3.55 ($3,550), which was up a very nice 62% ($1,360) in just two weeks. That's why we call it the OPPORTUNITY portfolio!

By the way, this is the last 5 days to sign up at our introductory rate. As of October 1st, rates go back to the normal $199 a months but you can still lock in the very low annual introductory rate of $792 between now and then – we just made almost double that on a single trade!

In fact, just yesterday morning, when I was telling you how great that trade was, it was only at $3,000, so we added another $550 (18.3%) in a single session! Options are certainly a tool you want to have in your trading tool belt. Sure, anyone could have seen that GLD would bounce off $105 and go back to test $110 and you could have made 5% playing the stock. But you would have had to have bought 710 shares of stock for $74,550 to make the same $3,550 we made by investing just $2,190 in 10 option contracts.

Our risk was no greater than a stock-holders. In fact, the most we could possibly lose was our $2,190 while a stock player risks the whole $74,550. Meanwhile, we still had $72,360 left to play with! Don't let people scare you away from options trading – when used properly (and most people don't), you can use them to LOWER your risk and INCREASE your returns because you can Be the House – NOT the Gambler.

Our risk was no greater than a stock-holders. In fact, the most we could possibly lose was our $2,190 while a stock player risks the whole $74,550. Meanwhile, we still had $72,360 left to play with! Don't let people scare you away from options trading – when used properly (and most people don't), you can use them to LOWER your risk and INCREASE your returns because you can Be the House – NOT the Gambler.

Notice this risk period puts options right on top of the pyramid, and they are right. 80% of all option contracts expire worthless so BUYING them is a tremendous risk. What we teach our Members at PSW is how to SELL options to all the gamblers out there.

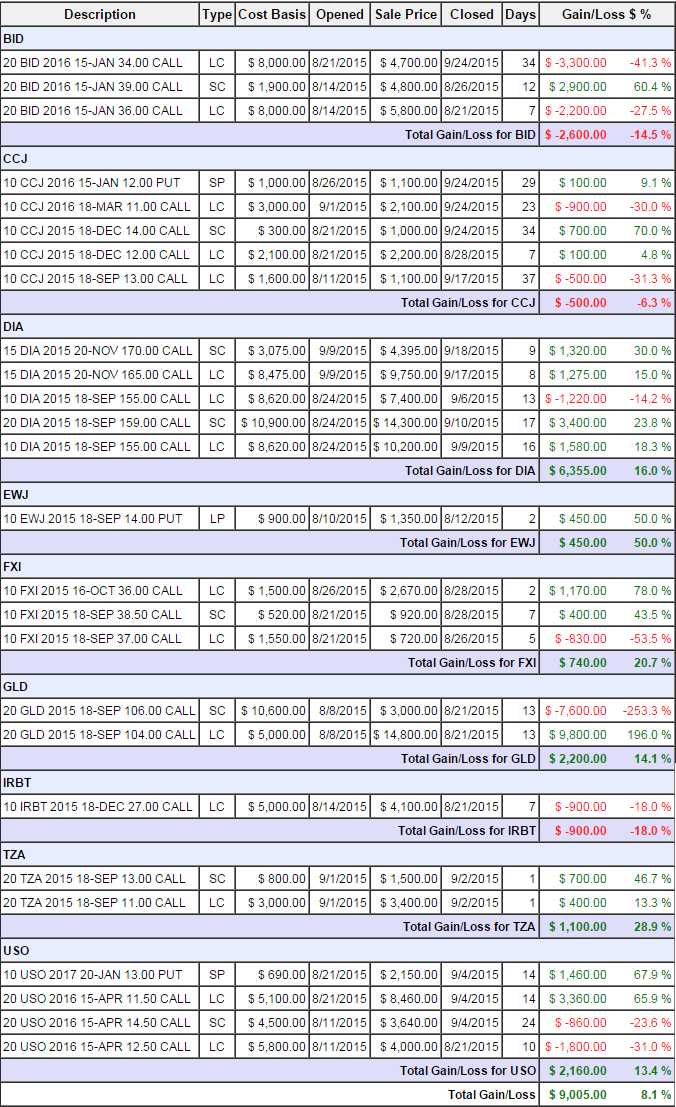

If 80% of the options contracts expire worthless and we SELL option contracts to other people – won't we then get an 80% success rate? YES, that's exactly what happens. In fact, you can see that happening right here in the performance of the closed positions from our Options Opportunity Portfolio, with $9,005 in gains on a $100,000 Portfolio in just 7 weeks (initiated Aug 8th):

As you can see, we have closed 26 contracts and 17 of them were winners (65%) but only 2 short contracts (<10%), where we sold premium, were losers! So why don't we only sell short contracts? Well there's a lot of margin costs when you do it that way, as well as open-ended risk that isn't suitable for most investors so we hedge our short sales with long buys and net the difference as profits – very simple!

While 26 contracts in 7 weeks seems like a lot, it's only 9 actual positions – most of the time we're actually pretty bored! The portfolio is generally bullish, as we expected the market to bounce today and was off the highs but well on track for our 5% monthly profit goal.

Here's a few concrete examples of how you can LOWER your risk while SELLING premium to suckers who think they are going to beat the market using stock options.

Apple (AAPL) is our Stock of the Year and the new iPhones are out this weekend but $115 is a lot of money to spend on a stock. Don't you wish you had bought Apple for $80 when you had the chance? Well, thanks to options you still can! You can sell the AAPL 2018 $90 puts for $11 and each contract obligates you to buy 100 shares of Apple stock for $90 ($9,000) but you collect $11 per share ($1,100) up front in exchange for your promise to buy the stock at $90 and that means your net is just $79, which is $36 below today's $115 price (31% off).

You will probably never get to actually own AAPL for net $79 but, if AAPL stays over $90 into the Jan, 2018 expiration, you will simply keep the $1,100 – for doing nothing but promising to buy Apple for a 31% discount today.

IBM is another blue-chip that's cheap at the moment. That stock is trading at $144 but again, you can promise to buy it for $105 and collect $7.20 for selling the 2018 $105 puts and that makes your net just $97.80, which is 32% off IBM's current price.

Notice both IBM and AAPL are low in their trading channels – that makes them even more attractive because, not only are the stocks on sale, but the premiums on the short puts are higher – as more people fear the stock will fall and seek to protect themselves. How much better off would your portfolio be if you ONLY bought stocks when they were 30% off? That is the cornerstone to our main, Long-Term Portfolio strategy, but it comes into play in our Option Opportunities Portfolio as well.

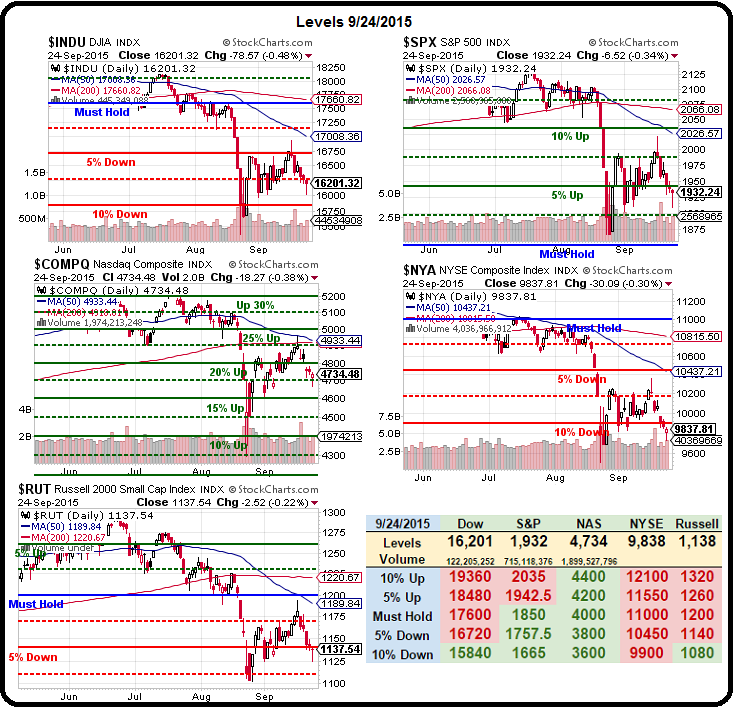

Market-wise, we'll accept Yellen's little gift today but we're still skeptical, especially with the Government shut-down (Part 2) looming next week. As I noted yesterday – we're right in the range (our Must Hold lines) that we expected to be on our Big Chart at this part of 2015, so we're not looking for a big rally back – just a sort of dribble into the year's end around these levels (sorry Santa).

Have a great weekend,

– Phil