How is this a GDP that's growing by 7% a year?

How is this a GDP that's growing by 7% a year?

That's the -10% line we're testing on China's Industrial Profits, which is the worst decline since the Government has been releasing the data (2011). “Companies are facing enormous operational pressures,” said Liu Xuezhi, a macroeconomic analyst at Bank of Communications Co. in Shanghai. “The momentum of growth is weak, and the downward pressure on the economy is relatively large.”

I know the conventional wisdom is that, if we pretend China is not having a crisis for long enough, the crisis will go away but this is rapidly spilling over to other Asian economies and is now affecting Europe too. This is like when everyone in your family but you catches the flu and you just KNOW you're going to get it – the only question is when. Coal mining profits in China, for example, are down 64.9% from last year so either they have converted 60% of their economy to renewables in 12 months or their economy is slowing considerably.

Keep in mind this is AFTER 5 interest rate cuts in the past year along with reduced reserve-requirements for the banks AND currency devaluations. As noted by Asia Analytics:

Keep in mind this is AFTER 5 interest rate cuts in the past year along with reduced reserve-requirements for the banks AND currency devaluations. As noted by Asia Analytics:

"The Chinese central bank can drop the price of money all it wants and shovel ever more cash into the banking system, but the problems facing the Chinese corporate world are more about the lack of customers than the lack of credit, more about insolvency than illiquidity."

This is happening on our planet folks – not off in some distant galaxy! It amazes me how little concern people seem to have about what's going on in China – as if we learned nothing at all 7 years ago – not even to be a little bit cautious. Well, I'm not going to try to convince you – I put up "Hedging for Disaster – NOW Are You Ready to Listen?" and the rest is up to you. I can only tell you what's going to happen in the markets and how to profit from it – that's the extent of my powers.

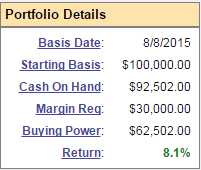

Speaking of powers – despite the sell off and my gloomy outlook, we did find 3 new plays for our Option Opportunities Portfolio on Friday, looking to lock in another $5,000 worth of gains (our goal is to make $5,000 each month in a $100,000 portfolio). Just because a market is generally bad, doesn't mean you can't find nice bargains if you know where to look. We did go long-term though – as we expect a very rough ride ahead and, of course, we have our hedges in place already – so well-balanced.

Speaking of powers – despite the sell off and my gloomy outlook, we did find 3 new plays for our Option Opportunities Portfolio on Friday, looking to lock in another $5,000 worth of gains (our goal is to make $5,000 each month in a $100,000 portfolio). Just because a market is generally bad, doesn't mean you can't find nice bargains if you know where to look. We did go long-term though – as we expect a very rough ride ahead and, of course, we have our hedges in place already – so well-balanced.

As you can see, we are 92% in CASH!!! and that's the way we like it in all of our Member portfolios because it's a very dangerous market out there and we need to stay flexible. It doesn't mean there's nothing to trade – in fact this morning silver (/SI Futures) came down to $14.60, where we like it long ($14.50 is our actual long line but we'll take $14.60 to get started). We teach Futures Trading Techniques in our Live Weekly Webinars and back on July 25th, I published "Using Stock Futures to Hedge Against Market Corrections" where our Futures shorts were:

- Dow (/YM) 18,000, now 16,085 – up $9,575 per contract (+200% on margin)

- S&P (/ES) 2,120, now 1,903 – up $10,850 per contract (+250% on margin)

- Nasdaq (/NQ) 4,675, now 4,177 – up $9,960 per contract (+200% on margin)

- Russell (/TF) 1,260, now 1,110 – up $15,000 per contract (+375% on margin)

This stuff is not complicated folks! It's a quick and easy way to protect your portfolio when the market turns and I STRONGLY suggest you learn how to use the futures, not to gamble, but to help balance your portfolio positions when the market turns against you. These are just the free samples, we put up trade ideas like these every day but you have to want to learn to BALANCE your portfolio – constantly looking for the next great pick isn't going to do it for you…

Of course, in our Member Chat Room, we took the money and ran on that 8/24 dip (lower than we are now) flipped bullish and then bearish again at the strong bounce lines. The strong bounce lines were determined by our fabulous 5% Rule™ back on 8/25 and we had predicted:

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

As you can see from the above Russell chart and this Dow chart, we totally nailed the move and, of course, going long at the bottom and short again at the strong bounce line was way more profitable than simply sticking with the shorts – although that didn't work out too badly either, so you're welcome for the freebies…

This morning, we're testing 1,900 on the S&P Futures (/ES) and we're below 16,200 on the Dow and more red indicators are BAD – keep that in mind, especially if you are not well-hedged or in cash (we're both). It's going to be an exciting week with the quarter ending on Wednesday and Yellen speaking at 2pm that day in a last-ditch attempt to dress the windows. In case that doesn't work, we have 5 other Fed speakers on Friday and 4 more scattered over the week – each one capable of sending the markets up or down 1% with a single word – scary!

Last week we told you how each report would do on Monday morning (why wait when it's obvious?) but this week it's all about the Fed speakers and Friday's Non-Farm Payroll Report, which is expected to hold the line at 200,000 jobs added in September after a disappointing 173,000 in August. Unfortunately, we have to wait until 8:30 on Friday for that result so, between now and then, PLEASE:

Be careful out there!