Wow, what a rally!

Wow, what a rally!

Yeah, yeah – go markets, BUYBUYBUY!!! OK, now that we have that out of our system, how about we take a deep breath and try to get real? This week has been the best week for the markets since late February and that's nice BUT, in early March, we gave back 50% of the gains.

While we are bound to respect the technicals over our strong bounce lines – we are very happy to remain mainly in cash ahead of the earnings reports.

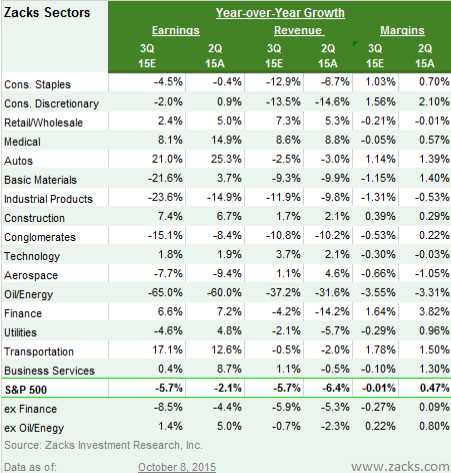

As you can see from this Zacks chart – and as I noted on Benzinga Radio the other day, Q3 earnings are going to suck. Alcoa (AA) kicked things off with a bomb last night and the economic hits are just going to keep on coming as companies around the World report on the damage that's been caused by our anemic Global economy.

You don't have to take my word for it – just ask Nobel prize-winning economist, Joe Stiglitz:

As I said on Benzinga the other morning, how can earnings be good? Oil will be a disaster, of course (7% of the S&P), Banking is having trouble with low rates squeezing lending margins and M&A slowing down considerably (16% of the S&P) and Retail (16%) is sputtering, Manufacturing orders are the worst we've seen since the last crash and Materials (2.5%) were in a death spiral until this week (and the banks lend to these guys too).

Expectations/Market Prices simply haven't come down enough to reflect that – certainly not after this week's rally. Is this market really priced for two big, negative quarters?

Expectations/Market Prices simply haven't come down enough to reflect that – certainly not after this week's rally. Is this market really priced for two big, negative quarters?

The Energy drag notwithstanding, there is not much growth elsewhere either, with earnings growth for half of the 16 Zacks sectors expected to be in the negative for the quarter. The strong U.S. dollar and China-centric global growth questions are some of the key issues that will figure prominently in the earnings reports and management’s outlook for the last quarter of the year. Current estimates for the fourth quarter already show negative growth for the quarter, which will likely fall further in the coming days as companies update their outlook on the earnings calls.

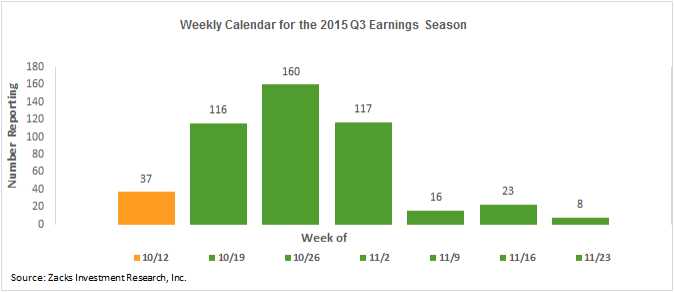

We have just 37 S&P earnings reports next week but they'll include some heavy-weights like JNJ, CBSH, WFC, NFLX, USB, AMD, HON, GE, GWW and FHN. While that's going on, we have PPI and Retail Sales on Wednesday along with the Fed's Beige Book (will be awful) on Thursday it will be time for CPI, Empire Manufacturing (can it get any worse?) and the bound to be awful September Industrial Production Report on Friday. After that, things really get interesting, with 116 S&P earnings reports the week of the 19th and 160 the week of the 26th:

Have I mentioned how nice it is to be in CASH!!! in a market like this? Well, if not – then CASH!!!! Holy cow, did we learn nothing from 8/24? On Aug 17th the S&P was at 2,100 – not 2,000 and one week later we were at 1,850 – that's down 12% in 7 days and, since then (and another try at 1,850 on 9/29), we've bounced back to 2,013 as of yesterday's close.

That's up 8.8% and very impressive but we spiked up to 2,020 in Mid-September and our foray over 2,000 lasted all of a few hours and, so far, the S&P has been over 2,000 for 90 market minutes – we'll see how today's session goes before we begin passing out cigars!

That's up 8.8% and very impressive but we spiked up to 2,020 in Mid-September and our foray over 2,000 lasted all of a few hours and, so far, the S&P has been over 2,000 for 90 market minutes – we'll see how today's session goes before we begin passing out cigars!

Yes, now that we're over the 50 dma and the 2,000 mark, we'll have to stop shorting and maybe we'll need to find a couple of longs to balance out the so far, so wrong short positions we've been taking to lock in the gains in our portfolios. As noted yesterday, our Options Opportunities Portfolio closed it's second month up 16.8% – a ridiculous amount of money to make in 60 days. When you make quick gains like that you either cash them out or protect them – so far, we're protecting.

We added 3 bearish plays this week (NFLX, FXI and USO) and we pressed our SQQQ hedge and, so far, none of them are working but the overall portfolio is still up 9% for the week because we had plenty of longs at just the right time – now we're just locking in our profits. Our Long-Term Portfolio is where we have the bulk of our positions and they are all bullish and, this week, those untouched positions are up 14.2% from last weekend's review. What else can we do but add a lot of shorts to lock in those gains?

The biggest mistake investors make is GREED. When they make good money, they don't cash out because they think they are going to miss something – not realizing that the thing they will miss is the inevitable reversion to the mean. Especially coming into such an uncertain earnings season as this one – I cannot stress enough the wisdom of cashing out at least some of your winners or, in the very least, taking 25-35% of your profits and plowing them into some hedges. See:

The biggest mistake investors make is GREED. When they make good money, they don't cash out because they think they are going to miss something – not realizing that the thing they will miss is the inevitable reversion to the mean. Especially coming into such an uncertain earnings season as this one – I cannot stress enough the wisdom of cashing out at least some of your winners or, in the very least, taking 25-35% of your profits and plowing them into some hedges. See:

- Hedging For Disaster: 3 Ways To Save Your Assets In a Market Collapse

- Hedging For Disaster – Now, Are You Ready To Listen?

- Using Stock Futures To Hedge Against Market Correction

Have a great weekend,

– Phil