Oh this is so ridiculous!

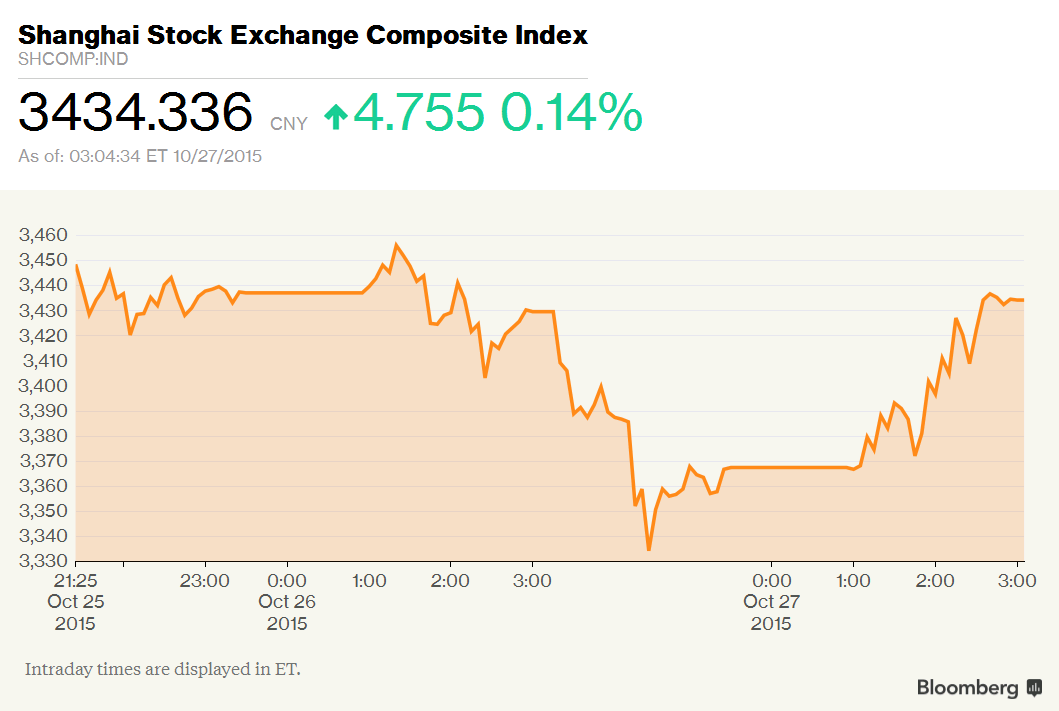

After opening down 200 points (1%) the PBOC boosted the Chinese markets with yet another announcement of easing monetary policy. This time the PBOC cut borrowing cost on reverse REPOs:

The PBOC reduced its one-year lending rate to 4.35 percent from 4.6 percent effective Saturday, while the one-year deposit rate was cut to 1.5 percent from 1.75 percent. Reserve requirements for all banks were lowered by 50 basis points, with an extra 50 basis-point reduction for some.

"Now that the deposit rate is entirely liberalized, the market is more focused on the rates in open-market operations," said Cici Wang, an analyst at Citic Securities Co. in Beijing who expects the seven-day repo rate to fall to about 2.2 percent. "Deflationary pressure became more marked this year.”

CLEARLY the PBOC is terrified of another market correction and will do ANYTHING to support it – even look like idiots as they add more stimulus measures the next market day after they announced another fresh batch. This is not economic policy – this is micro-managing the markets and you don't micro-manage things you aren't very concerned about, do you?

CLEARLY the PBOC is terrified of another market correction and will do ANYTHING to support it – even look like idiots as they add more stimulus measures the next market day after they announced another fresh batch. This is not economic policy – this is micro-managing the markets and you don't micro-manage things you aren't very concerned about, do you?

Keep in mind, in the big picture, the Shanghai is still down 35% from 5,200 just a few months ago, so whether it goes up or down 1% in a single session should not be something China's Central Bank should be fussing with, yet they are TERRIFIED of any sign of weakness. And well they should be – 40% off or more from the highs is NOT where you want to finish your year and China certainly doesn't want the market collapse to mar their 13th Plenary Session this week.

Indeed, just like in the US, everything is AWESOME in China – at least according to the state-controlled media (theirs, not ours – well, ours too). In fact, China had more bad news today as September Industrial Profits were down 0.1% from last year, no recovery at all after last month's 8.8% decline. Fortunately, this stuff doesn't seem to affect their GDP – as all!

Our own numbers are coming in poorly as well (and we get our GDP Report Card on Thursday). This morning, we have Durable Goods coming in at -1.2% but -2% ex-Defense but "only" down 0.4% ex-Transportation, which is nice, but Transportation was driving our recovery. Even worse, last month's terrible -2.3% has been revised to a more terrible -3%, which is the pattern they use to soften the blow each month – revising it long after people have already reacted.

Look at those durable goods levels since 2010 and think of the way the Dow and S&P have climbed since then – more than doubling over the same period and yet, just like in China – we accept the numbers and dutifully put our money into the market casino – as if we don't clearly see how rigged and ridiculous the game has become. As I said to our Members this morning in our Live Chat Room:

Look at those durable goods levels since 2010 and think of the way the Dow and S&P have climbed since then – more than doubling over the same period and yet, just like in China – we accept the numbers and dutifully put our money into the market casino – as if we don't clearly see how rigged and ridiculous the game has become. As I said to our Members this morning in our Live Chat Room:

Sorry to be such a stick in the mud with the CASH!!! thing but this is a crap market to trade – about the worst since 2007/8 and I very much regret not being more of a stick in the mud back then. People would ask what I thought of trades and I would tell them the best way to trade their overpriced stocks rather than just telling them not to trade and I saw a lot of people get caught with their pants down when the market crashed. I just don't want to sit by and watch that happen again.

It's not like we don't have ANY trades but the trades are just fewer and farther between and I'm trying to keep as much cash as possible on the sidelines so IF the market crashes, THEN we can BUYBUYBUY. Meanwhile, there's plenty of ways to amuse ourselves and, next week, we should have enough data from early reporters to make educated guesses on upcoming earnings.

How can you look at charts like this and not believe things may not be as good as we are being told? This is how our economy is doing WITH constant Central Bankster interventions – what will happen when they stop? Well, don't worry, clearly they can't stop. Our Fed may raise rates this week or December but we're talking 0.5% to 0.75% and that's still free money. If they don't raise rates, the banks will start charging you to keep your money there – and that will force more money into the markets. As I mentioned last week, there are several major countries where this is already happening.

Certainly something still needs to be done if we're going to have a positive year. A look at our performance to date has the Dow down 1%, S&P up 0.73%, Russell Down 3.85% and the Nasdaq, thanks to Friday's excitement, is up 9.3% for the year.

Most alarming, of course, is the accelerating decline in the energy sector and earnings have not been kind to that group so far. Low oil and gasoline prices have allowed Consumer Discretionary to lead us higher and the Tech sector is actually 4 companies (AMZN, AAPL, GOOG, MSFT) and the rest are pretty much along for the ride. Remember, Apple alone is 15% of the Nasdaq and AAPL stock (our Stock of the Year) has earnings this evening that will move the index one way or the other.

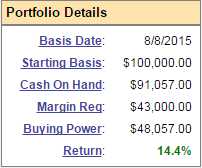

As noted above, we've moved our Member Portfolios to neutral as we wait for AAPL earnings, the Fed decision (tomorrow), GDP (Thurs) and China's 5-year plan (Monday?) as well as this week and next week's earnings, after which over 60% of the S&P will have reported and we can have fun playing with those that come in during November.

As noted above, we've moved our Member Portfolios to neutral as we wait for AAPL earnings, the Fed decision (tomorrow), GDP (Thurs) and China's 5-year plan (Monday?) as well as this week and next week's earnings, after which over 60% of the S&P will have reported and we can have fun playing with those that come in during November.

Here you can see that our Options Opportunity Portfolio (which you can sign up for HERE) has dropped off a bit since our last review but still well on track for our goal of 5% average monthly gains. We haven't made many trades recently as we stay mainly in cash and very well-balanced. That's what we mean by "Cashy and Cautious" – it doesn't pay to take chances in a choppy market – especially when you're not sure if you are able to trust the economic data – and we certainly don't!

Be careful out there!