I'm still the only one expecting this.

I'm still the only one expecting this.

The markets are near record highs, China has a 6.9% GDP (our less than exciting GDP report comes out tomorrow), Europe has settled down, the currency markets are calm and investors are back to being complacent. What better time than today for the Fed to raise rates?

Remember, the Fed was going to raise rates in July, but they put it off to September and, in that meeting, they said:

After assessing the outlook for economic activity, the labor market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labor underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting. They agreed that developments over the intermeeting period had not materially altered the Committee's economic outlook. Nevertheless, in part because of the risks to the outlook for economic activity and inflation, the Committee decided that it was prudent to wait for additional information confirming that the economic outlook had not deteriorated and bolstering members' confidence that inflation would gradually move up toward 2 percent over the medium term.

That meeting was held on September 17th and the S&P 500 was at 1,950, having just recovered from the August crash. The Fed's non-move did not have the desired effect and the market dropped right back to the lows after their announcement that the economy wasn't quite strong enough to handle a rate hike.

That meeting was held on September 17th and the S&P 500 was at 1,950, having just recovered from the August crash. The Fed's non-move did not have the desired effect and the market dropped right back to the lows after their announcement that the economy wasn't quite strong enough to handle a rate hike.

Now we're 5% higher than we were and the Fed is essentially damned if they do or damned if they don't hike rates (which is why we're short the indexes up here) and they do NEED to hike rates – that's very clear from reading the minutes. So why wouldn't they hike rates today, when the conditions are favorable and the markets can stand a small hit? Who knows where we'll be on Dec 16th (next meeting) or Jan 27th?

Aside from this being perfect timing to hike the rates – the Fed also has their credibility to consider. Over and over again they have said they would begin to raise rates in 2015 and this is the second to last meeting of 2015. There's not much point of having an open Fed if they are going to lie to us in their communications, right?

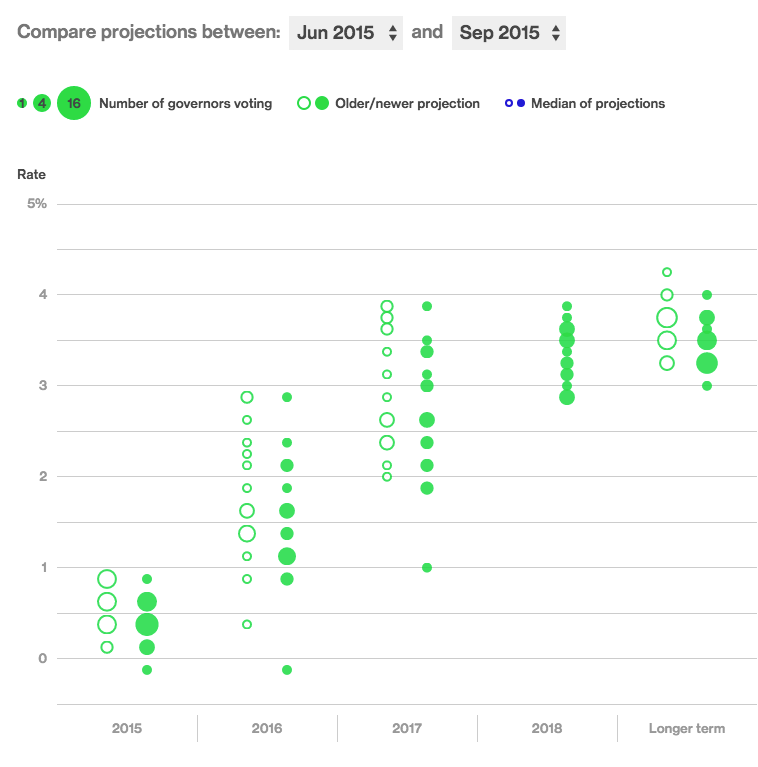

As you can see from this Bloomberg chart for the Fed's own rate expectations (per their statements), rates next year should be no less than 1%. Currently they are 0.25% and the Fed has 8 meetings next year so again, if not now, then the Fed will have to hike pretty much every other meeting next year to stay on track and that wouldn't give them room to skip a hike – just because the markets were down or the Global situation was worrisome.

As you can see from this Bloomberg chart for the Fed's own rate expectations (per their statements), rates next year should be no less than 1%. Currently they are 0.25% and the Fed has 8 meetings next year so again, if not now, then the Fed will have to hike pretty much every other meeting next year to stay on track and that wouldn't give them room to skip a hike – just because the markets were down or the Global situation was worrisome.

The Fed NEEDS to normalize rates and if you know you NEED to get to 2% in two years – do you skip a perfectly good opportunity to add 0.25% when you can?

Anyway, that's why I still think they will, or at least should, raise rates today. I am completely and utterly alone in this opinion so even I will be surprised if I am right and, needless to say, other than shorting indexes that are overbought anyway, we're not making any bets on the outcome but we do remain, of course, "Cashy and Cautious" into the Fed today and our GDP report tomorrow. Next week, after the dust clears, we'll be ready to start deploying some of our sideline cash.

.jpg) One thing we'll be doing with our cash is expanding our Apple (AAPL) position as they had great earnings last night. I already Tweeted out my notes on AAPL from last nights Member Chat so no need to re-hash it here and we can certainly afford to be patient as AAPL is well below our $140 target for the end of next year.

One thing we'll be doing with our cash is expanding our Apple (AAPL) position as they had great earnings last night. I already Tweeted out my notes on AAPL from last nights Member Chat so no need to re-hash it here and we can certainly afford to be patient as AAPL is well below our $140 target for the end of next year.

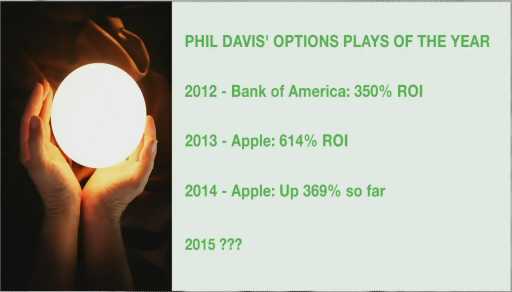

We did officially mark IBM (IBM) as our trade of the year for 2016 (AAPL was 2015 – you're welcome) and I can't tell you what our IBM trade is (non-Members have to wait for my televised announcement) but I can tell you that yesterday's dip to $137 was a GIFT thanks to another SEC investigation into their accounting of certain revenues. While an SEC investigation may sound scary to you or me – it's not very scary to a $135Bn company with 380,000 employees – some of whom are accounts and lawyers who are well-prepared to handle an SEC inquiry.

Two years ago, the SEC opened an investigation into IBM’s cloud computing revenue recognition. It was dropped a year later with no enforcement action by the SEC. These investigations happen all the time and knocking 5.8% off IBMs price yesterday ($8Bn) was an over-reaction, to say the least! IBM, for their part, announced they would spend another $4Bn of their cash pile to buy back about 3% of their own stock and, at these prices – that's a great idea:

That consistent dividend growth (now $5.20 per share) make IBM one of the best long-term stocks to hold. Clearly a person who paid $30/share back in 1996 to capture a 1% dividend who now gets $5.20 (17.3%) back each year against his now $140 stock (+366%) knows what I'm talking about. Sure, 1996 was 20 years ago – who wants to think that far back or, even worse, that far forward? This is the problem with modern investors, they have no real intentions of investing at all.

I'd put it in perspective that a man who bought $60,000 worth of IBM (2,000 shares) in 1996 and simply held onto it would have collected $31.08 back in dividends so far and this year would be collecting another $10,400 while his net free stock could be cashed out for $276,000. And that's doing it passively – we teach you how to do it with options and triple those returns!

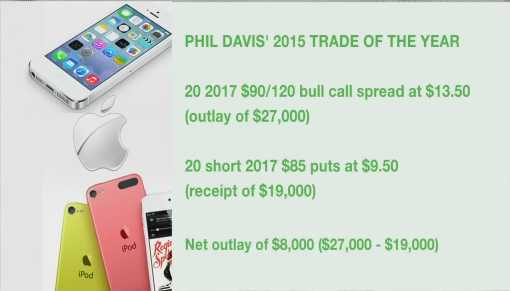

Take our Apple trade, for example, last year's trade of the year was rolled out for the public on my 12/17/14 appearance on BNN and, at that time, we adjusted it for new viewers as shown on in this screen grab from that show.

Take our Apple trade, for example, last year's trade of the year was rolled out for the public on my 12/17/14 appearance on BNN and, at that time, we adjusted it for new viewers as shown on in this screen grab from that show.

Apple will, of course, be higher this morning but, as of yesterday's close, the net on that trade was $25,160 – up a fantastic 214% against the $8,000 cash outlay and well on track to our full $60,000 (up 650%) in Jan 2017. We had a detailed reveiw of this strategy back in January, if you are interested. Notice the trick to our trades of the year is to pick a 2-year play that is very likely to make 500% without setting a very high target for the stock. Our actual projection for AAPL in Jan 2017 is $140 – so $120 was a conservative estimate we could be comfortable making a big trade out of.

The coolest thing about that trade is that AAPL was at $109.41 on Dec 17th and now it's only at $114.55 (yesterday's close) yet STILL we managed a 214% gain using our options for leverage. That's why I can say with GREAT CONFIDENCE that we can easily teach you to triple the returns of a dividend stock like IBM over time using CONSERVATIVE option strategies (like we do in our Long-Term Portfolio).

Even going from scratch today, a net $25,160 investment in that spread will still return $60,000 (+138%) if AAPL manages to hold $120 through next year. As of that same show, last Jan, our prior televised Trade of the Year picks had all been huge winners – even though the TV audience got the picks miles behind our PSW Members.

Even going from scratch today, a net $25,160 investment in that spread will still return $60,000 (+138%) if AAPL manages to hold $120 through next year. As of that same show, last Jan, our prior televised Trade of the Year picks had all been huge winners – even though the TV audience got the picks miles behind our PSW Members.

So there you have our IBM pick on the same day we picked it. We'll keep track of it and I'll reveal my options spread for IBM in the coming months and perhaps, like AAPL, you'll still be able to jump in after it's up 214% because it still has another 138% to go. That's still worth playing, don't you think?