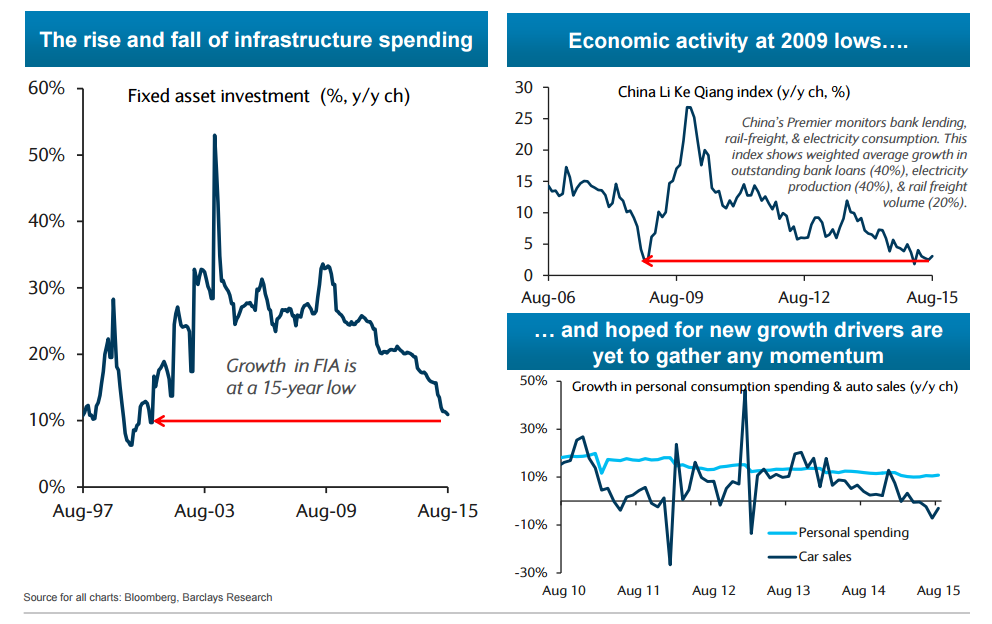

I'm not talking about China.

I'm not talking about China.

We did that already in our Live Member Chat Room and you can follow this link to find out all about what's going on over there. China is still conducting their Plenary Meeting this week and we'll get the details of their next 5-year plan by the week's end – no point in speculating but, on the whole, we're expecting disappointment as the reality hits investors that you can't fix a $10Tn economy while simultaneously pretending it doesn't need fixing.

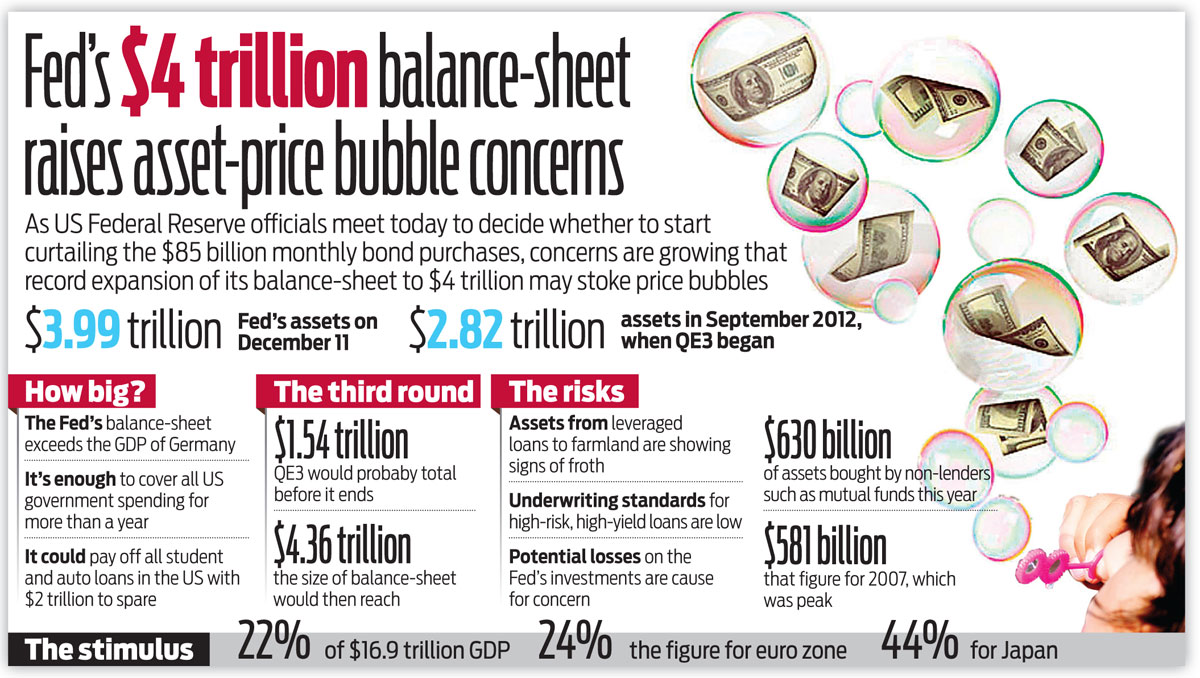

You'll hear a lot of people telling you how much Europe's PMI has improved (Asia's was terrible!) in October but, in reality, it still sucks compared to 2011 and, keep in mind, this is the Global Economy WITH over $3Tn in stimulus from China, Europe, the US and Asia – what would it look like without these massive inflows of FREE MONEY?

There are a lot of moving parts to the Global economy and it's easy to forget the context, especially when we're in year 6 of QE programs, which means there are hundreds of thousands of traders who began their careers post-crash who have never known any other kind of economy. Sure, 5% of the Global GDP is always used to prop up the equity markets and force down bond rates each year. It's bound to continue another 5 years. After all, what can possibly go wrong?

We get our own PMI report this morning at 9:45 followed by ISM at 10. Tomorrow we'll have Economic Confidence (8:30) and Factory Orders (10:00) and then, on Wednesday, Fed speak begins with Brainard at 5:30, Harker (8:45), Yellen (9:45), Dudley (2:30) and hawkish Fisher (6pm) gets the last word of the day. Seems like they are afraid of something on Wednesday – probably it's Mortgage Applications at 7am or maybe they are trying to get ahead of Thursday's Productivity Report (8:30) or Friday's Non-Farm Payrolls (8:30).

Whatever it is, it's something as we have Harker again on Thurs (8:30) and Dudley again (8:30), Fisher again (9:10), Evans (10:40), Tarullo (12:45) and Lockhart (1:30) plus Bullard (7:30) and Brainard (4:15) on Friday. That is, by far, the most Fed speakers (13) scheduled in a single week all year and that usually happens on weeks when the market is going to get some very bad news.

Those totals are from last year, they're up close to $5Tn now! That's my big issue with the Global economy – even if it LOOKS better – so what? A pool with a leak in it will LOOK find if you keep pumping in more water than leaks out but then your efforts to hide the leak don't fix the problem and may make things worse as more and more water pours out of the whole and it gets wider and wider until the rate of water flowing out exceeds your ability to pump water back in and you end up much worse off than you were before. That pretty much sums up the efforts to "fix" the Global Economy since 2008.

This is a FAKE recovery! You can swim in the pool and enjoy the cool water (and the free money) but don't let that fool you into tying up your investment capital betting on the long-term health and stability of the pool – that would be a huge mistake! As demonstrated by our new Options Opportunity Portfolio (up 18.3% in just 3 months), we don't need to commit a lot of capital to make great returns – we can just keep betting on MORE FREE MONEY – until it finally runs out.

This is a FAKE recovery! You can swim in the pool and enjoy the cool water (and the free money) but don't let that fool you into tying up your investment capital betting on the long-term health and stability of the pool – that would be a huge mistake! As demonstrated by our new Options Opportunity Portfolio (up 18.3% in just 3 months), we don't need to commit a lot of capital to make great returns – we can just keep betting on MORE FREE MONEY – until it finally runs out.

Staying "Cashy and Cautious" keeps us nimble and able to get out of the pool long before we get sucked down the drain when (and if) our Central Banksters finally run out of water to fill the pool with. Warren Buffett is famous for saying: "Only when the tide goes out do you discover who's been swimming naked" and the same is true for what is likely to happen when all this free money stops flowing into the markets – and things can get ugly very, very quickly when that happens.

We've already seen what happened when the ECB stopped propping up Greece – even for a brief period of time – why would it be different if the BOJ or PBOC stop propping up their own economies? Japan and China's rates of stimulus are DOUBLE what our own Fed and the ECB are doing and we're all doing SOMETHING and that's why SLIGHT EXPANSION in SOME manufacturing reports is extremely disappointing at this stage in our QE decade.

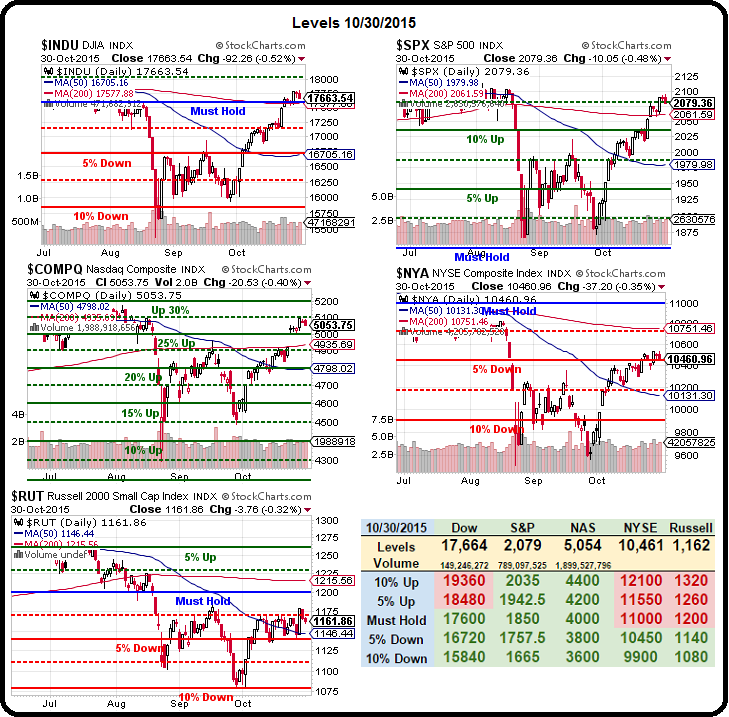

This is the final week of big earnings and they slow to a relative trickle after this. We'll be looking for fun earnings plays over the next few weeks but, more importantly, we'll be looking to see whether or not the Nasdaq can hold that 5,000 line and whether or not the NYSE and the Russell can manage to get to their Must Hold lines and confirm a proper rally. Don't hold your breath…