First of all – let's talk jobs.

First of all – let's talk jobs.

The markets managed to end the week on a high note as a huge beat on the headline Non-Farm Payroll number stunned us all with 271,000 jobs added in October. In our morning post on Friday, I noted we were skeptical and would be shorting into the weekend in our Live Member Chat Room and we did – fortunately.

As it turns out, upon closer examination, pretty much all of those additional jobs were part-time jobs and, in fact, people in the prime working age group (25-54) LOST 35,000 jobs in October. What seems to have happened is that full time jobs were replaced with part time jobs for retirees. Multiple job holders increased by 109,000 in October, an indication that people who lost full time jobs had to take two or more part time jobs in order to make ends meet.

Also, 94.5M people dropped out of the work force, giving us the lowest labor-force participation rate since the recession of the 1970s. If you want to know the story in just one chart – here's what's been happening in our economy since 2007 as the servant class increases dramatically while middle-class jobs disappear permanently:

Again, if you are in the Top 1%, congratulations – this is what "winning" looks like. After all, we NEED more servants. We need them more than we need our 20th car because silverware doesn't polish itself and each kid should have their own Nanny and why should we pay one person a lot of money to do a job when we can pay two people a little money instead? When we pay two people part-time, neither gets benefits and neither one feels like they have any leverage over us – saving us lots of money down the road!

When I go to Chilie's, there's one waitress running around serving 5 or 6 tables and I have to wait for food which costs about $25 per person by the time I get my check and pay the tip. When I go to Nobu, my waiter has perhaps 3 other tables but also support staff and I can barely put my napkin down without it being folded for me.

Nobu costs $125 per person (if you don't drink) and doesn't employ 5x more people or use 5x more food – just like my $90,000 Range Rover employs the same amount of people as a $30,000 Jeep Wrangler to build. This is why "trickle down" doesn't work – when the rich spend money, we don't create more jobs – we consume the same amounts as anyone else, just a better quality.

Nobu costs $125 per person (if you don't drink) and doesn't employ 5x more people or use 5x more food – just like my $90,000 Range Rover employs the same amount of people as a $30,000 Jeep Wrangler to build. This is why "trickle down" doesn't work – when the rich spend money, we don't create more jobs – we consume the same amounts as anyone else, just a better quality.

So we don't need more manufacturing employees – just more servants and that's why the Service Sector is doing well but, overall, there is no improvement in wages for the bottom 90% – even as more "jobs" become available. Here's a chart that illustrates what's wrong with the mix of jobs we're creating. Also note that Mining and Logging have fizzled out and are now actually in decline (thanks to commodities bust caused by not enough broad demand for materials).

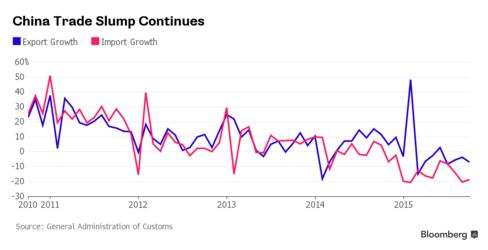

Without construction and mining, there's almost no high-end job growth outside of tech and most of the jobs added last month were Retail and Health Care – no surprise at all given our ever-widening wealth gap. That's why China's Trade Exports dropped ANOTHER 6.9% in October while weaker demand for coal, iron and other commodities from declining heavy industries helped push imports down 18.8%.

This is yet another strong indicator of the slowing Global Economy, despite the FAKE!!! GDP headline numbers. In fact, Nils Anderson, CEO of Maersk (the World's biggest shipping line) believes GDP forecasts are greatly exaggerated and unlikely to improve, prompting the company to cut 12% of it's workforce. Maersk Line said it will cut as many as 4,000 jobs, scale back capacity and delay investments to cope with a weaker container market.

This is yet another strong indicator of the slowing Global Economy, despite the FAKE!!! GDP headline numbers. In fact, Nils Anderson, CEO of Maersk (the World's biggest shipping line) believes GDP forecasts are greatly exaggerated and unlikely to improve, prompting the company to cut 12% of it's workforce. Maersk Line said it will cut as many as 4,000 jobs, scale back capacity and delay investments to cope with a weaker container market.

Again I will say, if the S&P were around 1,850 and the other indexes about 10% lower – I would not be so bearish-sounding. I simply think that pressing our all-time highs against all these headwinds is foolish – especially heading into a very uncertain holiday period. At the moment, a lot of people are staying in the market because they don't want to miss a "Santa Claus Rally" yet staying invested makes you so much less flexible and we prefer to stay "Cashy and Cautious" and take advantage of opportunities as they come.

For instance, in Friday's morning post, we detailed the following earnings play on Shake Shack (SHAK) from our previous day's Live Member Chat:

SHACK/StJ – That's a tempting short. You can sell 5 Nov $52.50 calls for $2.25 ($1,125) and buy 5 March $52.50 ($5.40)/57.50 ($3.70) bull call spreads for $1.70 ($850) and, if they miss, you get $275 + whatever is left on the long spread or, if they pop, you are protected up to over $57.50 with your $275 net credit plus the spread value.

Since SHAK was popping higher at the open, that trade was still doable Friday morning but they sold off into the close (as we expected) and the short $52.50 calls ended the day at $1.10 ($550) while the spread stayed at $1.72 ($860) for net $310 + the $275 credit is $585 profit (212%) in less than 24 hours on that earnings play (but we'll make more as we ride it out). Very simple stuff – in and out and back to CASH!!!

We'll be making more trades like that in our 5% (Monthly) Portfolio, which you can sign up for HERE. We are, in fact, up 15.5% at the end of our 3rd month and averaging 2 new trade ideas every week. Usually, these are not ones we share in our morning post, of course!

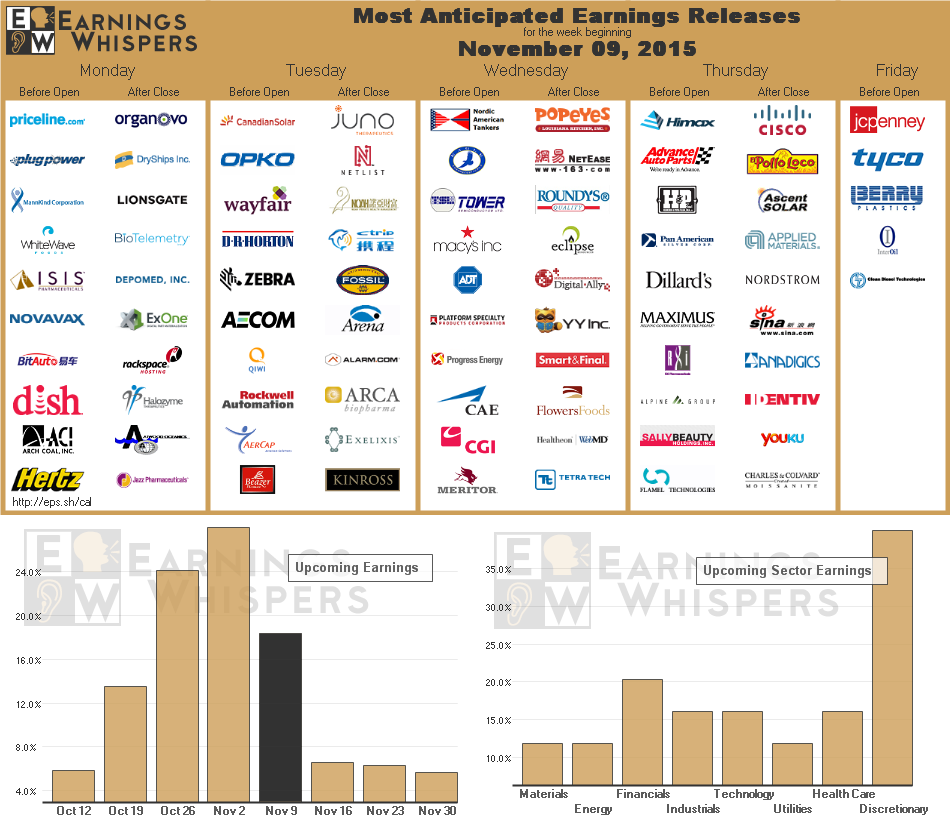

This is our favorite time of year over at PSW because we've now seen enough earnings reports where we have a good, Fundamental basis for guessing how the laggers are going to behave and the next three weeks are even better as there's less overall noise into Thanksgiving. A lot of Consumer Discretionary stocks will be reporting and that will give us a preview of Holiday Shopping Season.

Have a fun week,

– Phil