Financial Markets and Economy

Why U.S. Efforts to Cut Off Islamic State’s Funds Have Failed (Bloomberg)

Why U.S. Efforts to Cut Off Islamic State’s Funds Have Failed (Bloomberg)

Weeks before the attacks that killed 129 people in Paris, U.S. warplanes resumed sorties above Syria and Iraq, targeting anew oil fields and other parts of a vast petroleum infrastructure that fuels—and funds—Islamic State, one of the richest terrorist armies the world has known.

Fed pushes back as Congress eyes its billions (Politico)

Even as members of Congress are slamming the Federal Reserve for being too political with its monetary policy, they are plotting to use the central bank as a government piggy bank.

Congress is aiming to take billions out of the Fed's accounts to help pay for a new highway and transit bill, but the Fed is balking, registering “strong concerns about using the resources of the Federal Reserve to finance fiscal spending.”

Glencore Buy Calls Are Highest in Two Years After Stock's Plunge (Bloomberg)

Glencore Plc, the commodity trader and miner that’s lost two-thirds of its value this year, may be on the cusp of a rebound if analyst recommendations to investors are any guide.

A major symbol of the financial crisis is back on the market (Business Insider)

It's been a good week for reminiscing about the 2008 global financial crisis.

Volkswagen cutting investments, to present US engine fixes (Yahoo! Finance)

Volkswagen cutting investments, to present US engine fixes (Yahoo! Finance)

Volkswagen will cut its spending by 1 billion euros ($1.07 billion) next year and "strictly prioritize" investments as it shores up its finances to deal with its emissions-rigging scandal, CEO Michael Mueller said Friday after a board meeting.

Oerlikon Surges as Vacuum Unit Sale to Atlas Beats Expectations (Bloomberg)

OC Oerlikon Corp AG shares gained the most in more than 2 1/2 years after the Swiss industrial equipment maker agreed to sell its vacuum business to Sweden’s Atlas Copco AB for more than some analysts had expected.

Finally — some data on whether crowdfunding is a good investment or not (Business Insider)

Finally — some data on whether crowdfunding is a good investment or not (Business Insider)

Crowdfunding has been exploding in popularity for both investors and companies in Britain over the last two years.

But we haven't had much concrete data on whether it's a good investment or not.

Global shares march on as alarm bells ring for metals (Yahoo! Finance)

World shares headed for their best week in over a month on Friday, though alarm bells over global growth were ringing in metals markets as copper hoovered at its lowest level since 2009 and nickel since 2003.

Charting the Markets: One Week On, French Equities Defy Terror (Bloomberg)

Europe's worst terror attack in more than a decade hasn't deterred equity investors this week, with France's CAC 40 Index rising as much as 2.5 percent. Fewer than 10 stocks have fallen, among them Accor, Europe's biggest hotel operator, which dropped 4.7 percent on Monday on concern about tourist flows.

Asian shares hang on to gains, commodities battered (Business Insider)

Asian shares hang on to gains, commodities battered (Business Insider)

Asian shares looked set to hold on to this week's gains, while the dollar took a breather on Friday after stepping back from seven-month highs as investors grappled with the prospects of higher U.S. borrowing costs and slower global economic growth.

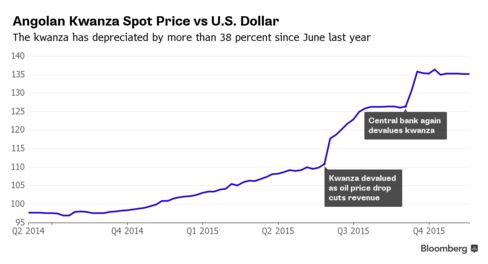

Angolans Desperate for Forex Seek Euros as Dollar Supply Cut Off (Bloomberg)

Some Angolan banks running low on dollars are offering customers euro notes and other foreign currencies after a distributor said it could no longer supply U.S. cash.

A tiny part of Square's business could make it a Wall Street darling (Business Insider)

A tiny part of Square's business could make it a Wall Street darling (Business Insider)

Square finished a bumpy ride to the public markets on Thursday, losing half of its value in its IPO pricing and then popping 45% on its first day of trading.

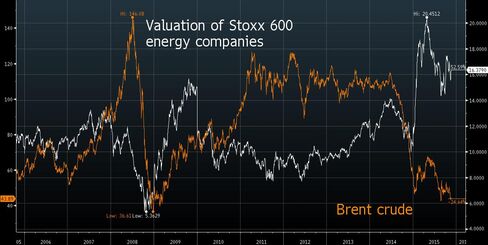

Falling Oil Prices Aren't Deterring European Energy Stock Bulls (Bloomberg)

The cost-cutting campaign among European energy companies is paying off: Investors are buying up their shares even as oil prices drop.

What Is Driving the Price of Gold? (Jesse's Cafe Americain)

This is a reprint without changes or updates from a posting on this site on 18 January 2008.

China Restarts IPO Process for 10 Companies as Stocks Stabilize (Bloomberg)

China’s securities regulator gave the green light to initial public offerings by 10 companies as a five-month freeze on new share sales ends.

The key to squeezing a 10% gain out of the S&P 500 next year (Market Watch)

The key to squeezing a 10% gain out of the S&P 500 next year (Market Watch)

Thanksgiving next week, then soon it’ll be Christmas and bye-bye 2015. And what are investors likely to get for their troubles this year? If the market can keep it together, maybe a 1% gain for the S&P 500. That’s something that will keep this bull market going — on fumes.

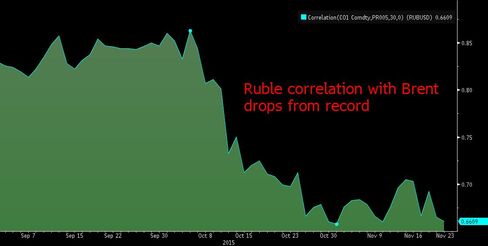

Ruble Rally Fails to Entice Citigroup, Morgan Stanley Eyeing Oil (Bloomberg)

Beware the rally in the ruble.

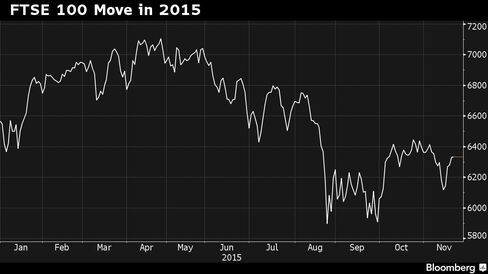

U.K. Stocks Little Changed With FTSE 100 Poised for Weekly Gain (Bloomberg)

U.K. stocks were little changed, after four days of gains, as miners climbed and Barclays Plc declined.

Dollar holds steady, but weakness sticks (Business Insider)

Dollar holds steady, but weakness sticks (Business Insider)

The U.S. dollar was nearly unchanged against the yen and the euro during Asia trade Friday, as investors refrained from taking strong positions amid a lack of fresh incentives.

The dollar USDJPY, -0.05% was at ¥122.75 after briefly hitting as high as ¥123.06 in morning trade. That compared with ¥122.86 late Thursday in New York.

U.S. Index Futures Rise With S&P 500 Poised for Best Week in Six (Bloomberg)

U.S. stock-index futures advanced, with the Standard & Poor’s 500 Index heading for its biggest weekly gain since October.

The Fed’s Dollar Distraction (Prohect Syndicate)

The Fed has delayed increasing interest rates, because policymakers expect that dollar appreciation, by lowering import prices, will undermine their ability to meet their 2% inflation target. But while it is true that some global developments, such as falling commodity prices, push down US inflation, dollar appreciation does not.

Australian stocks log their best week in a month (Market Watch)

Australian stocks log their best week in a month (Market Watch)

Shares in Australia logged their best week in over a month Friday, while investors elsewhere in the region gradually adjusted to the prospect of higher U.S. interest rates.

As Biggest Hedge Funds Stumble, One Currency Manager Gains 21% (Bloomberg)

In a year when the worlds biggest hedge funds are suffering losses and closures, one asset manager is trouncing rivals by betting on currencies — without taking a view on their direction.

Politics

Terror crisis exposes shallowness of U.S. politics (Market Watch)

Terror crisis exposes shallowness of U.S. politics (Market Watch)

“Silly season” and “clown car” hardly seem to do justice to the level of political discourse in this country. It is much worse than these harmless epithets suggest.

Japan Considers Sending Navy to Support U.S. in South China Sea (Bloomberg)

Japan Considers Sending Navy to Support U.S. in South China Sea (Bloomberg)

Japanese Prime Minister Shinzo Abe told President Barack Obama hell consider sending the countrys maritime forces to assist U.S. operations in the South China Sea.

The comments in a bilateral meeting Thursday on the sidelines of an Asia-Pacific Economic Cooperation summit in Manila came after the U.S. sparked an angry reaction from China last month by sailing a warship close to an artificial island in waters that China views as its own territory.

Technology

An Inside Look at the Integrative Future of Virtual Reality with Bublcam (PSFK)

An Inside Look at the Integrative Future of Virtual Reality with Bublcam (PSFK)

As the future of virtual reality quickly climbs the slope of enlightenment, new players are jumping on the chance to leverage the technology in the name of innovation. With the rise of smartphones over the years prompting news sites to expand to video, VR is the next frontier in engaging users and providing an immersive experience.

Health and Life Sciences

Sleep Cycle Changes May Affect Your Health (Medicine Net)

Sleep Cycle Changes May Affect Your Health (Medicine Net)

Waking early on workdays and sleeping in on days off may not be as restful as you think: a new study suggests that when routine sleep habits are disrupted, your risk for diabetes and heart disease rises.

The study included 447 men and women, aged 30 to 54, who worked at least 25 hours a week outside the home.

Should Clinicians Prescribe Opioids To Patients At Hospital Discharge? (Forbes)

Should Clinicians Prescribe Opioids To Patients At Hospital Discharge? (Forbes)

Patients without a recent history of opioid use are at a higher risk of chronically using prescription painkillers if prescribers provide the drugs to them when being discharged from the hospital, a new study suggests.

University of Colorado Anschutz Medical Campus researchers reviewed nearly 7,000 patients who were prescribed opioids when discharged from the hospital.

Life on the Home Planet

Gunmen Take 170 Hostages at Radisson Blu Hotel in Mali (Bloomberg)

Gunmen Take 170 Hostages at Radisson Blu Hotel in Mali (Bloomberg)

U.S. and French military forces entered the Radisson Blu Hotel in the Malian capital of Bamako where gunmen took 170 hostages.

Past earthquakes can make landslides more likely (Futurity)

Places that have experienced strong earthquakes in the past may be more likely to produce landslides if a second earthquake strikes, a new study finds.

These new insights could have important implications for disaster management and could help experts identify areas that may be susceptible to future landslides.