100%

Those are the odds that Draghi will provide more stimulus in Europe this Thursday based on the recent speeches he's been making. That means, most likely, that it will be a "sell on the news" even at the rumor has already been bought – sending the DAX up 500 points (5%) in 5 days.

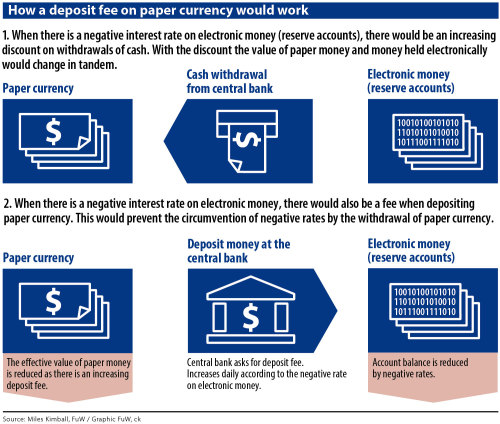

The ECB Deposit Rate has already been at -0.1% since June and is expected to go down to -0.3-0.4%, which is an actual penalty for banks who wish to store their cash with the ECB, rather than lending it out to the Private Sector. While this will, of course, be a boost for the Private Sector, keep in mind that the banks who have looked at their books and analyzed their prospects have to be FORCED to lend these businesses money.

As with many of our economic "solutions" since the 2008 crisis – this one simply masks one problem (businesses are not worth lending to) with another (forcing banks to make bad loans again) and now we can stagger forward for another few years until our banks need bailing out because they have too many bad loans – again.

The evidence from the eurozone, Switzerland and Scandinavia is mixed. The worst-case scenarios of cash-hoarding and broad-based asset bubbles, due to plowing money into investments such as real estate, haven’t materialized. But despite the negative rates, Switzerland’s central bank, which sees the franc’s exchange rate against the euro as key, still has a stronger currency than it would like. In the ECB’s case, any transmission to private-sector lending has been modest at best.

Still, ECB officials are convinced that negative rates and large-scale asset purchases are a powerful combo to boost activity and prices by increasing the incentive to lend to households and businesses rather than accepting tiny or negative returns on government bonds or deposits at the central bank.

Meanwhile, let's pretend the real economy matters and talk about Black Friday, Cyber Monday and the Holiday Shopping Outlook – just for fun!

Of course our Corporate Media, after a word from our sponsors, is happy to tell you that on-line shopping is up 14% this year so far but what they often fail to mention is that on-line shopping is only 10% of all Retail Sales ($320Bn out of over $3Tn) and that this year Thanksgiving Day is included in the holiday totals, which is not fair as most retailers are closed on Thanksgiving.

Of course our Corporate Media, after a word from our sponsors, is happy to tell you that on-line shopping is up 14% this year so far but what they often fail to mention is that on-line shopping is only 10% of all Retail Sales ($320Bn out of over $3Tn) and that this year Thanksgiving Day is included in the holiday totals, which is not fair as most retailers are closed on Thanksgiving.

According to ShopperTrak, in fact, Black Friday overall sales (on-line and retail) are down 10% from last year, but possibly because more people shopped on-line at Thanksgiving rather than waiting to go to the malls the next day. “Shoppers are researching products ahead of time, targeting their store visits, and arriving in store with the intention of making a purchase,” Kevin Kearns of ShopperTrak said.

WAY too much emphasis is being put on cyber sales, mostly because they are still delivering impressive double-digit growth numbers while brick-and-mortar retail sales are dying on the vine. That much is obvious to anyone who went to a mall this weekend and didn't see half the crowds they were expecting. There's far less impulse-buying in cyberspace and I notice with my teenagers as well that they tend to go to the mall already knowing exactly what they are going to buy:

The people who run retail don't understand this and the people reporting on retail and analyzing retail don't understand this either because it's not the way they were raised and it's not the way they shop. Unfortunately, retailers can't afford to wait a generation to begin making changes to accommodate the changing consumers.

As I pointed out to our Members earlier this morning, low interest rates are allowing Corporations to cover up a lot of faults while M&A and buyback activity (also made possible by low borrowing costs) make things seem like they are going much better than they actually are – for now.

At some point, however, companies are going to have to put up or shut up and, so far, with 98% of the S&P reporting their Q3 earnings, it looks like earnings for the S&P 500 are down $8.21 per share this year while Russell earnings are off $4.79 per shares. The last 3 times this metric fell that far into negative territory on the S&P 500 were Q1 1990, Q1 2001, and Q4 2007, coinciding with the start of each of the last three high yield default cycles.

As I mention often, we're not foolish enough to be bearish on the market – that's unrealistic while the Central Banks are flooding us with free money. We are, however, "Cashy and Cautious" and likely to remain so through the holidays and I'm still searching for some underlying Fundamental good news that will make me change my mind.

No luck so far…