$225 TRILLION!

$225 TRILLION!

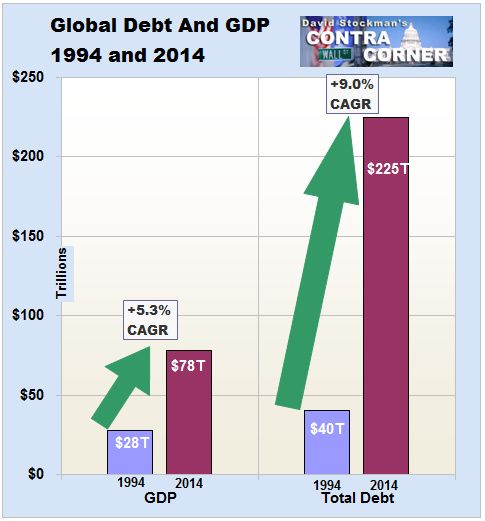

Global Debt is up $147Tn in 20 years. That's $7Tn a year or about 10% of our Global Economy has been debt-driven. Meanwhile, the Global GDP grew $50Tn over the same 20 years, which is $2.5Tn per year or 5% so, in simple terms, our debt is growing twice as fast as our economy.

This is why there is a global push for 0% interest rates – 1% of $225Tn is $2.5Tn – that's 100% of our growth getting sucked up by interest payments. 2% would chop $2.5Tn off the growth, 3% rates would pull $5Tn out of the Global Economy, 4% $7.5Tn (10%), 5% $10Tn, 6% $12.5Tn… I know you can do the math but have you really thought about these numbers?

How can we ever go back to "normal" interest rates when just 3% would devastate the Global Economy? Just take a look at the energy patch, where the EIA is showing that US onshore oil producers' debt service is already taking up 85% of the cash flow – even at these incredibly low rates:

This is much worse than last December (70%) and December is the month in which lenders are to reassess E&P companies’ loans conditions based on their assets value in relation to the incurred debt. Also, oil was $100 a barrel in mid-2014, so the oil companies WERE still swimming with cash at the end of last year – not so much this year – especially for those who squandered it on buybacks or weak M&A deals.

How long will this charade continue? Actually, it can go on for quite a while as long as the Fed, the ECB, BOJ, BOE, PBOC, etc. are all willing to keep playing. The ECB meets Thursday and it's widely anticipated they will double down on even lower rates and even more Quantitative Easing, which will then open the door for another round of Global easing and rate reductions – game not over by a long shot.

As you can see, both Europe and the US are nowhere near Japan's radical stimulus levels and China is also pumping it up at an amazing pace. So it will not be wise to stand in the way of the Central Banks if they are willing to push it for another year or so. As long as they keep pumping money in – some of it will find its way to the stock market – especially given how poor the alternatives are looking by comparison.

And more stimulus is certainly needed. Just this morning, Canada showed a 0.5% CONTRACTION in GDP for September, the worst monthly decline since the Financial Crisis. Fortunately, July and August were solid so Q3 came in at a reasonable 2.3% growth rate but that's some serious weakness at the finish line.

Also at the worst levels since 2009 is the S&P's Junk Bond Distress Ratio, now at 20.1% but miles off the almost 90% rate we hit mid-crisis. Oil and gas companies were responsible for 113 of the 361 distressed issues. The ratio, along with other conditions, indicates "growing pressure" that the number of defaults might rise, S&P says, “We believe companies with distressed bond spreads are at a higher risk of default if they are unable to borrow or are only able to borrow on unfavorable terms.”

Also at multi-year lows are China's PMI readings. This morning the October PMI stood at 49.6 with the private Caixin survey showing 48.6 – both in contraction for the 4th consecutive month but don't worry – I'm sure China will be able to show another 7% GDP growth regardless. On a brighter note, the Service PMI was 53.1, driven by AliBaba's record Singles Day sales.

I will leave the last word to our President, who just gave a great press conference in Paris tackling issues of Climate Change, Syria, ISIS and Terrorism. He almost laughed when asked what would happen if a Republican was elected to replace him – clearly he doesn't believe it's going to happen: