This is getting tedious.

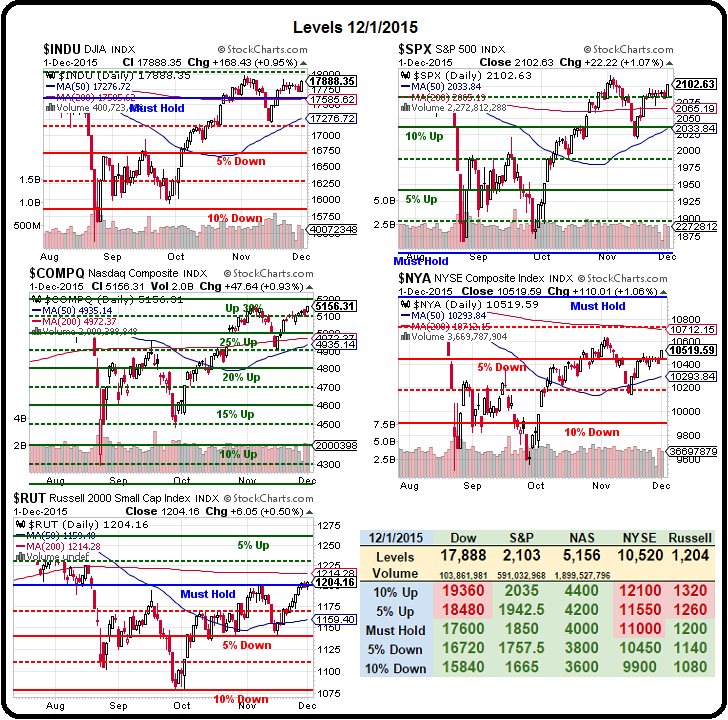

The S&P gets to 2,100 and we short /ES Futures at 2,100 (with tight stops above the line) and Russell (/TF) Futures below the 1,200 line and Nikkei (/NKD) Futures below the 20,000 line and then, tomorrow or Friday, I'll tell you how much money we made shorting and you'll say "why do I never catch these great trade ideas" and I'll say it's because you're not patient enough to wait for the pattern to reset itself and just make the obvious play.

This is the 11th time the S&P has been over 2,100 since May and, so far, it's been like a little money machine for us all year long on the short side. I know this time may be different and the last 10 times may have been different too, which is why we stop out if we don't get confirmation from the other indexes that things are toppy but, when it works – it's good for $250, $500, $1,000+ PER CONTRACT in the Futures at $50 per point to the downside.

As usual, the Dow is at 17,850 (/YM) so that's a confirming line we like to watch but the Nasdaq is now leading us higher at 5,156 but that's still, unfortunately, shy of our November high of 5,163 so let's not call this time different until we see that beat and THEN we'll look for the July high at 5,231. That's right, we've done all this before and nothing is different this time at all! As noted by Dave Fry:

As usual, the Dow is at 17,850 (/YM) so that's a confirming line we like to watch but the Nasdaq is now leading us higher at 5,156 but that's still, unfortunately, shy of our November high of 5,163 so let's not call this time different until we see that beat and THEN we'll look for the July high at 5,231. That's right, we've done all this before and nothing is different this time at all! As noted by Dave Fry:

Markets move higher given belief the ECB will cut interest rates Thursday. This belief trumps a host of bad economic data so far this week. Tuesday bulls ignored a substantial drop in manufacturing activity as manufacturing reports showed substantial declines. The PMI Mfg Index declined to 52.8 vs prior 54.1 and the ISM Mfg Index imploded to only 48.6 vs prior 50.1. Construction Spending did improve modestly to 1% vs prior 0.6%. But at the same time retail store sales slumped 10% year over year on the wacky Black Friday holiday shopping.

Other problems are front and center as Puerto Rico makes a last minute payment to creditors averting a default but it’s only a temporary solution. Next up is what’s taking place in South America’s most important economy—Brazil. It will release data tomorrow showing the economy there is entering arecession depression. So yeah, there’s trouble we can’t ignore, or can we?

Can we? Yes we can – especially in December, where the volume is low and the Bulls are scared. That's why we love our Futures bets – good for the quick in and out because it's very hard to have commitments in this market – especially bearish ones! We are bullish on oil at $41.35 this morning (/CL in the Futures) as we expect some OPEC minister to say something bullish-sounding heading into Friday's OPEC meeting in Vienna.

Again, these are patterns we teach our Members to PATIENTLY wait for so we have set-ups that have high probabilities of success. That doesn't mean they always work but, if we keep making high-percentage trades and manage our positions appropriately – just being right 60% of the time can have a huge impact on our portfolios.

Again, these are patterns we teach our Members to PATIENTLY wait for so we have set-ups that have high probabilities of success. That doesn't mean they always work but, if we keep making high-percentage trades and manage our positions appropriately – just being right 60% of the time can have a huge impact on our portfolios.

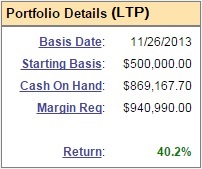

As you can see, our Long-Term Portfolio is back over +40%, which is exactly our 2-year goal for gains, so it's not like we don't benefit from all this market manipulation but, as you can also see, we are keeping a huge amount of cash on the sidelines with most of our long positions in the form of short puts (and we just added another yesterday on TGT), which give us a substantial discount on our net entries (see "How to Buy a Stock for a 15-20% Discount").

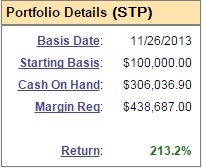

Once again I have to fight the temptation to cash out the entire portfolio as 40% is a very nice gain and there's no sense risking it. In fact, the LTP is up $19,146 (3.8%) since our pre-Thanksgiving review on 11/23 – who says we're not bullish? Well, I do. As I've said, we are "Cashy and Cautious" and you can see our cash percentage in the LTP but our STP (Short-Term Portfolio) is where we keep our bearish hedges and that portfolio has LOST $9,.354 over the same 10 days.

So we're still making money in a bull move – just not as much as we've mitigated 50% of our potential gains with our bearish hedges. As we touch the top yet again into Christmas – it will be the bearish hedges we will be putting our gains into as clearly the bullish positions don't need much improvement if they are capable of making over $2,000 per day, right?

So we're still making money in a bull move – just not as much as we've mitigated 50% of our potential gains with our bearish hedges. As we touch the top yet again into Christmas – it will be the bearish hedges we will be putting our gains into as clearly the bullish positions don't need much improvement if they are capable of making over $2,000 per day, right?

The Short-Term Portfolio has very much benefited from this strategy this year in the previous 10 times we went short at the top (and no, this does not track our Futures trading – that's just for fun). Maybe this time we'll be wrong but, if so, then our STP will lose but our LTP will win – that's the nature of the Balanced Portfolio Strategy that is the core principle we teach to our Members at Philstockworld.

This is one of the hardest things we try to teach our traders – that sometimes you are making TOO MUCH MONEY and you need to stop. While it's really great to say the LTP popped $19,000 in 10 days, that would be over $700,000 a year – almost doubling the size of the portfolio in 12 months. CLEARLY that's not realistic so CLEARLY we need to hedge our gains so we don't end up giving them right back on the next market correction.

So we take a percentage of our ill-gotten gains (thank you manipulators!) and we put it into downside hedges like the S&P Ultra-Short (SDS), which is all the way down to $19.05, down from $25 in August, when we had the flash-crash on the 24th. $19 is where SDS bottomed out before in early November and it quickly popped back to $20.70, which is almost a 10% gain in a couple of weeks.

While 10% is nice, at PSW we teach our Members how to use options to leverage a position like this and, for example, you can put your foot down and say SDS is not likely to go below $18, which is down 5% and implies a 2.5% gain in the S&P, to 2,152. So, if we want a hedge into the Holiday, we can sell the SDS March $19 puts for $1.25 and use that money to pay for the January $18 calls at $1.30 and sell the Jan $20 calls for 0.48 for net 0.82 on the $2 spread.

- Sell 20 SDS March $19 puts for $1.25 ($2,500 credit)

- Buy 20 SDS Jan $18 calls for $1.20 ($2,400 debit)

- Sell 20 SDS Jan $20 calls for $0.48 ($960 credit)

Combined with the short puts, the net on the whole spread is a 0.43 credit or $1,060 using 20 contracts. If SDS goes over $20 and stays there through January options expiration (15th), then you will collect $4,000 for the spread and, if SDS stays over $19 through March, you will keep the $1,060 credit as well for a total profit of $5,060 from a position you got a $1,060 credit to begin with.

That's how we like to hedge! The best thing about this position is you can only lose if the S&P rises from here and that would mean the long positions you are protecting would be making money to offset any losses you may have on your SDS longs. Also, it's not an all or nothing position – you can stop out the spread before it falls below net 0.52 and then you have your $1 net credit and the S&P can't hurt you unless it's over 2,150 by March and, if you are managing your longs correctly – that should make you happy, not sad!

So there's hedging for dummies and I hope you enjoyed it. Futures are far more fun but also far more dangerous and not the sort of thing we do in a single lesson but we do give weekly Live Trading Webinars to our Members where we often demonstrate our techniques and, if you are too cheap to join us – you can wait for the occasional free one.

As usual, the broad-based NYSE is keeping us from being gung-ho bullish as it's still 500 points below it's Must Hold line and the Dow and Russell are barely over theirs but the S&P and the Nasdaq are up in the stratosphere and that's why we key on them for shorts at the moment. This stuff isn't complicated folks, just good old-fashioned trading logic…