I told you so.

I told you so.

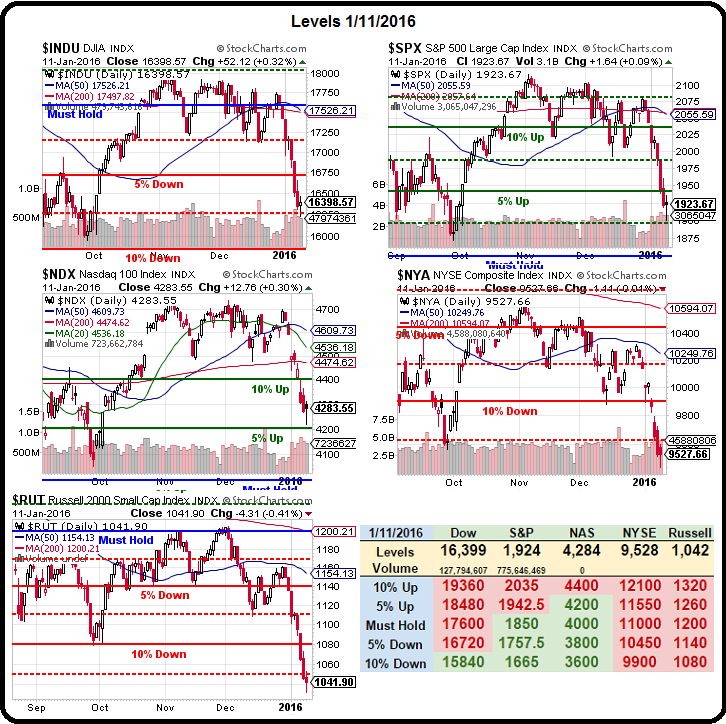

I titled yesterday's post "Meaningless Monday Market Movement" and, despite the gyrations, it certainly was. Now the real action begins and we'll see if we can hit those bounce lines (see yesterday's post). There was apparently a suicide bomber in Instanbul this morning and many people were killed at a market but, as is often the case these days, the markets are shrugging it off and moving higher – up about 1% at 8am in the Futures.

We did lose the 1,050 line on the Rustle and, if we don't get it back today we are DOOMED!!!, but I think "THEY" have other plans. Still, that line will be critical to watch this morning – weakness there (or NYSE 9,600) will mean it's another one of those narrow, manipulated rallies where the headline stocks are run up to get the suckers (that's you) to think it's time to buy the f'ing dip again.

However, I don't want to confuse the issue – I think we're oversold and I think we should get a nice bounce here. I think a lot of stocks have over-corrected and I think there are plenty of good things to buy out there – that's why we published a Watch List for our Members on Thursday with 24 stocks we like. The idea of a Watch List is that, when the market does turn back up, we can pick up the lagging stocks on our list. No need to jump in early – usually 4 or 5 of 24 value stocks at least will be slow to regroup – even in a huge rally.

American Express (AXP) is on our list. We like them at $64 but, as you know, we teach our Members never to pay retail prices for a stock. As I mentioned yesterday, when the VIX is high it's a great time to sell puts and you can sell the AXP 2018 $55 puts for $5, which would net you in at $50 (23% off the current price) if AXP is below $55 (15% below the current price) come Jan 2018. If AXP does not fall 15%, you keep the $5 without ever having to own the stock.

As long as we REALLY want to own AXP for $55 (the put strike), then we can consider the $5 free money and we can use it to buy the 2018 $55 calls for $13.50 and we can sell the 2018 $70 calls for $5.50 for net $8 less the $5 we collected for the puts is net $3 on the $15 spread. So, if AXP is $70 (up 7.6%) or more by Jan 2018, we have a 400% gain on cash. The trade is also margin-efficient as it only ties up about $5.50 per contract and that will diminish as AXP move higher.

Trades like these, which leverage our cash for 4x returns in two years, allows us to keep our portfolio mainly in cash and just use the excess margin that would otherwise go to waste. The risk is, of course, owning American Express at net $55 but that's still 15% below the current price ($64) and, if we bought it for $64, we'd need it to hit $76 to make the same $12 we'll make at $70 and, meanwhile, rather than tying up $64 in cash – we use $3 in cash and $5.50 in margin to make the same $12. That's all there is to it.

Trades like these, which leverage our cash for 4x returns in two years, allows us to keep our portfolio mainly in cash and just use the excess margin that would otherwise go to waste. The risk is, of course, owning American Express at net $55 but that's still 15% below the current price ($64) and, if we bought it for $64, we'd need it to hit $76 to make the same $12 we'll make at $70 and, meanwhile, rather than tying up $64 in cash – we use $3 in cash and $5.50 in margin to make the same $12. That's all there is to it.

Another stock on the list we don't mind owning is IBM, which was our runner-up for Stock of the Year in 2016 (it lost out to UNG as it hit $7 back in December) and now it's back at $133 but I can't tell you how we're playing that one, as it's going out as a Top Trade Alert to our Members this morning. Another I-stock on our list is IMAX at $32 and that one will be added to our Options Opportunity Portfolio today because it's going to pop very soon.

Remember we're still watching Apple (AAPL) from yesterday and they are plowing back over $100 this morning and that's all we really need to get our rally caps on. Why is AAPL going higher this morning? Who cares? Why was is going lower is the question. AAPL was our Stock of the Year in 2013, 2014 and 2015 and was in the running again as it fell towards our buy target at $97.50, where we executed the sale of the 2018 $95 puts for $15 each – as we planned in Last Tuesday's post.

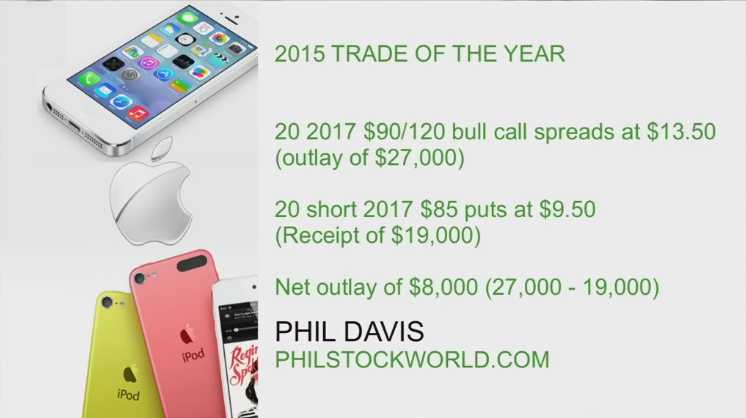

This is another one you could add a bull call spread to. As I noted, AAPL was our 2014 trade of the year and, at the time, our call was to:

- Buy 10 2016 $450/600 bull call spreads at $65

- Sell 10 2016 $450 puts for $41

AAPL did a 7/1 split since then so we have to divide by 7 and that's the $64.28/85.71 bull call spread and the short $64.28 puts so, even with the big dip – it's going to be 100% in the money when it expires on Friday, paying back $150,000 in the net $24,000 investment for a 525% return on cash – not bad for 2 year's "work", right?

Last year (2015), AAPL was again our trade of the year but we cashed it out early as it hit $130 and gave us about 60% of our projected profits in just 8 months – WAY ahead of schedule. Now, however, with AAPL back at $100, those $85 puts are back to $6.50 and the $90/120 bull call spread is just $12, so net $5.50 ($11,000 for 20 spreads) on the $30 ($60,000) that is $10 in the money – not too terrible if it makes the full $49,000, which would be 445% back on your cash outlay.

Also on that Trade of the Year video link, we discussed the Baker Hughes (BHI)/Haliburton (HAL) merger which, at the time, was in much better shape. There we went for the following set-up:

Unfortunately, it's been an epically bad year in the energy patch and BHI is now trading at $41.51 and that has pushed the 2017 $55 puts up to $15.75 ($15,750) while the net of the spread is $3.20 ($3,200) for a net of $12,550, which would be the cost to close it out. Since the initial spread was a $7,000 credit, the net loss is $5,550 – not too bad, considering.

However, we do not advocate closing this spread as we think the deal will likely still go through and we think oil will come back a bit ($45-50) in the summer. The terms of the deal is that BHI gets 1.12 shares of HAL (now $31.55) + $19 in cash. At today's prices, that would be net $54.36, which would get us out of trouble on the short puts – so why on Earth would we pay $15,750 to cancel them?

What we can do, however, is roll them out a year, to the 2018 $52.50 puts at $15.50. That would cost us $250 but gives us a bit more breathing room and another year for BHI to recover (if the deal doesn't close). On the long side, the 2017 $50 calls are $4.20 and the $40 calls are $8.70 and I think it's well worth spending $4.50 to roll the calls down $10 in strike because our calculation say that we're well in the money so we're buying $10 for $4.50 – that's always a good idea!

I also like that set-up as a new trade but I'd sell the 2018 $57.50 calls for $5 instead of the 2017 $65 calls because it's still a nice $17.50 spread that you can enter for a net $11.80 credit ($11,800) on 10 spreads that pays up to $17,500 more if all goes well ($29,300 total potential gain). The reason we can get away with selling the 2018 $57.50 calls covered by the 2017 $40s is that we expect the deal to close in 2017 and all options will terminate at the same time. If not, then the deal went sour and those calls should lose most of their value anyway.

So, lots of exciting ways to make money in 2016 as we make use of all that CASH!!! we've been keeping on the sidelines. Watch AAPL $100 – that needs to hold, as does Russell 1,050 and NYSE 9,600. Over in Europe, DAX 10,000 is a good sign (and 2% better than yesterday's close) but the Nikkei needs to come back to 18,000 before we can take it seriously (now 17,500). So long /NKD above that line if our indexes are making their levels is the Futures play of the day.