Well, it's been a rotten month.

Well, it's been a rotten month.

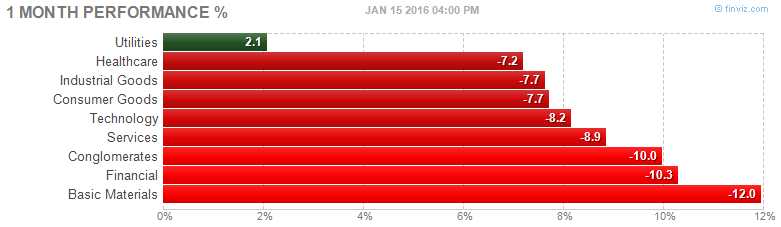

All of our sectors are down, other than Utilites, and they are still down 3.4% over the last 6 months so that's only a strong bounce (40% of the drop) in that sector anyway. Still, it's the only ray of sunshine we have so far though now, in the pre-market, at least, we are having weak bounces (20% of the drops) in all of our indexes. I went over our bounce lines in the Morning Alert to our Members, so I won't waste space here – it was also tweeted out for the masses. As I summarized there:

Still plenty of stuff to worry about but, in general, it's the same stuff we've been happily ignoring for two years and that's why I flipped bullish on Thursday – there's no new news here – just people finally taking the negatives into account, which moved the S&P (and the rest) back to a line (1,850) I consider a fair value. I don't think this is way too cheap and I'm not expecting a big recovery – I think 10% +/- 1,850 (1,665 to 2,035) is a fair range for the S&P BUT, since we know how to buy stocks for a 20% discount – there's no reason for us to fear the bottom of the range from here.

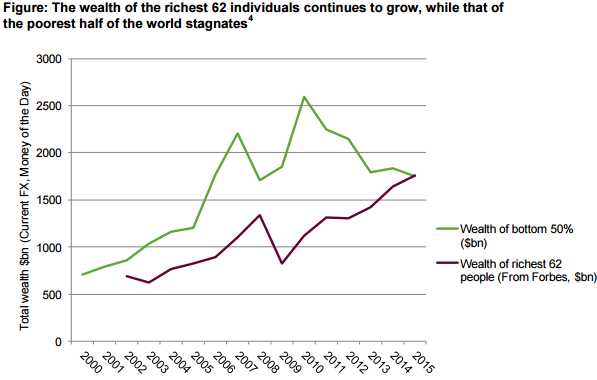

The World's movers and shakers are over at Davos this week (see our weekend notes) and the people who matter will determine your fate – so nothing for you to worry about. 8) Most likely, they will come up with a plan to boost their fortunes, which means saving the markets by robbing the people through the Central Banks yet again and, hopefully, transferring another $1,000,000,000,000 ($1Tn) from the poorest 3.5Bn people on this planet ($300 each) to the richest 100 – which is exactly what happened between 2010 and 2015.

That's right, in order for the World's richest 100 people to double their wealth in the last 5 years, the World's poorest 3,500,000,000 people had to lose half their total net worth. Now they only have $500 left to give and the wheels are still grinding them into what Oxfam calls a humanitarian crisis or what Donald Trump calls "Making America Great Again."

That's right, in order for the World's richest 100 people to double their wealth in the last 5 years, the World's poorest 3,500,000,000 people had to lose half their total net worth. Now they only have $500 left to give and the wheels are still grinding them into what Oxfam calls a humanitarian crisis or what Donald Trump calls "Making America Great Again."

That's quite a milestone we passed this month, the wealth of the richest 62 people on this planet is now more than the combined wealth of the bottom 50%. Of course, it hasn't occurred to the average person in the top 49-99.999% that, once there are no more poor people to exploit – they are going to be coming for your money too! This is something I predicted 8 years ago when I wrote: "The Dooh Nibor Economy (that's “Robin Hood” backwards!)." Interestingly enough, Mr. Trump was my prime example at the time!

Hopefully it will be a calm year and the 3.5Bn impoverished people won't realize that all they have to do is slit the throats of 62 people to double up their lifestyle (see our "2010 Outlook – A Tale of Two Economies" for more on that prediction) or that the Middle Class can keep fooling themselves into thinking that they won't be next. Well, next is a funny word as the Middle Class is obviously dying as the other 69,999,938 people in the Top 1% need more and More and MORE of their money to keep growing what they have:

That's right, the more you break it down, the more obvious it is that we are ALL being screwed by the excess of the Top 0.01% unless you are one of those people, in which case please sign up for a Premium Membership HERE! Actually, all kidding aside, if we don't put a stop to this soon – things are going to turn ugly pretty fast because it takes more and more of your money for the top 0.0001% to get their next 20%, which is about how fast their pile is growing every year!

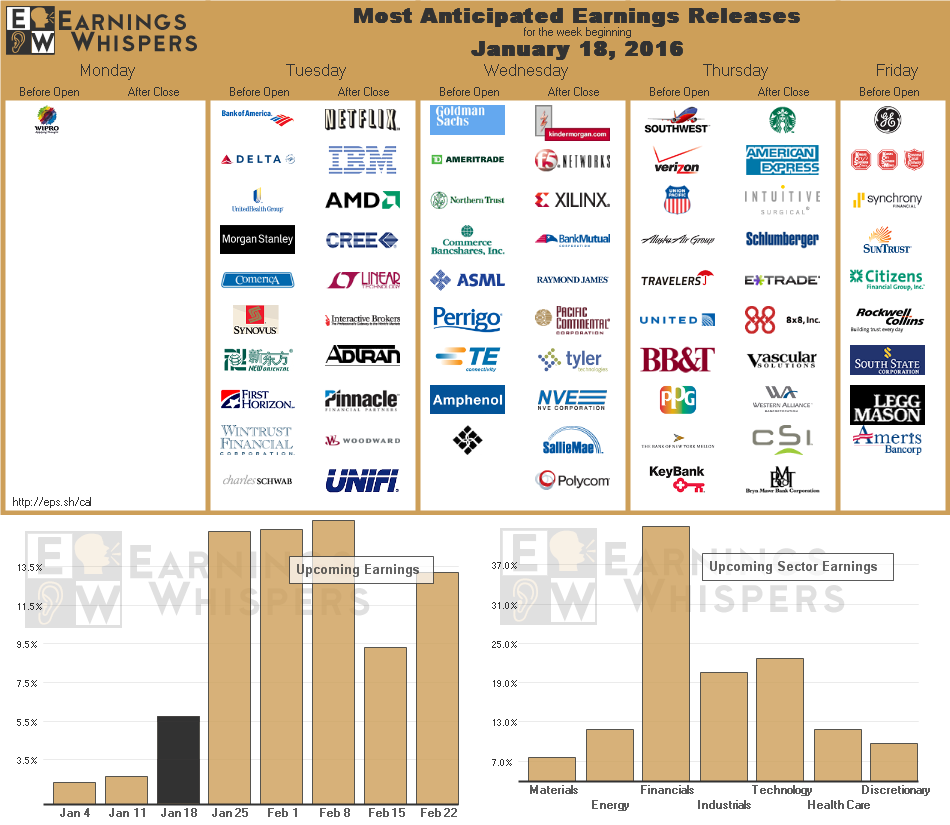

We flipped bullish (not very) last week, playing for the bounces and, this week, we'll simply have to see how much bounce there actually is in these markets. Mainly, that's going to be up to earings, but those have been so distorted through manipulative buy-backs and book-cooking that it's very hard to get a real handle on what's happening:

There's not too much market-moving data this week. We have CPI and Housing Starts tomorrow and the Philly Fed on Thursday and Leading Economic Indicators on Friday leading up to next Wednesday's Fed Rate Decision – THAT will move the markets! Until then, it's all about the earnings and we're getting busy fast on that front. Starting next week, we have our 3 huge earnings weeks for the season but plenty to keep us busy until then:

Time to have some fun!