Financial Markets and Economy

Goldman Sachs Says It May Be Forced to Fundamentally Question How Capitalism Is Working (Bloomberg)

The profit margins debate could lead to an unsettling conclusion.

Ford Europe cuts jobs to achieve $200 million cost savings (Business Insider)

Ford Europe cuts jobs to achieve $200 million cost savings (Business Insider)

Ford plans to shed hundreds of white-collar jobs in Europe to cut costs by $200 million annually and is taking additional steps to revamp its lineup as it targets durable profitability in the region, the carmaker said on Wednesday.

How there’s just a 2% chance of a U.S. recession this year, in one chart (Market Watch)

Warnings about a potential U.S. recession have come into style in 2016 — but a Société Générale economist is still sounding cheery.

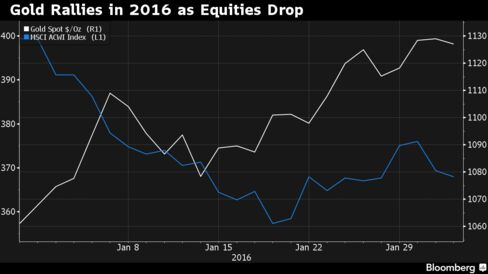

Gold Resilient as This Year's Best Commodity as Stocks, Oil Wilt (Bloomberg)

Gold held its ground near a three-month high as losses in global equities and oil fanned haven demand and investors reduced expectations of further U.S. rates rises.

For Alphabet, the Path to Becoming the Most Valuable Company in the World (NY Times)

With the close of Tuesday’s trading, it was official: Alphabet, the newly formed holding company for Google, is the most highly valued company.

The European economy will take at a €100 billion hit if it re-establishes permanent border controls (Business Insider)

The European economy is set to lose around €100 billion (£76 billion, $109 billion) if officials decide to re-establish border controls within the Schengen Area.

That's according to the French government’s economic planning agency France Strategie, which released its warning this morning in a note entitled "Policy Brief – The Economic Cost of Rolling Back Schengen."

It’s the earnings, stupid (and they’re going down) (Market Watch)

Analysts and pundits have been trying to understand why stocks have had such a bad start to 2016.

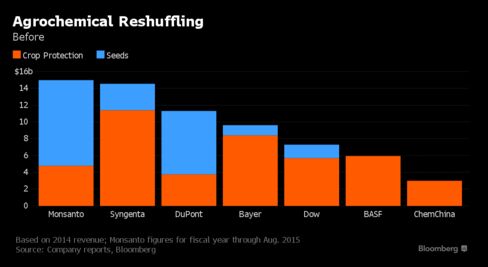

ChemChina Offers Over $43 Billion for Syngenta (Bloomberg)

China National Chemical Corp. offered to buy Swiss pesticide-and-seeds-maker Syngenta AG for more than $43 billion as the state-backed company extends its shopping spree with what would be the biggest acquisition by a Chinese firm.

China is about to announce the biggest monthly drop in FX reserves on record (Business Insider)

China is about to announce the biggest monthly drop in FX reserves on record (Business Insider)

China's central bank will announce its foreign exchange reserves figures later this week, and analysts at Barclays think they may have a shock in store for investors.

Barclays analysts, led by David Fernandez in Singapore, estimate China is burning through its reserves faster than ever to pump liquidity into its financial system and prop up its currency.

Futures Movers: Oil prices advance ahead of U.S. inventory data (Market Watch)

Oil prices rose on Wednesday in volatile trade ahead of key U.S. supply data but the global oversupply of crude continued to weigh on the market.

The American Petroleum Institute, an industry group, said late Tuesday that the U.S. crude stockpiles grew by 3.8 million barrels last week, which is less than the gains in the previous week. The official data will be released by the Energy Information Administration later on Wednesday and analysts surveyed by The Wall Street Journal survey predict an increase of 3.5 million barrels.

Dollar Bears Awaken Before Jobs Report as BOJ-Stoked Rally Fades (Bloomberg)

The dollar is having a rough ride this week, based on the outlook for the world’s largest economy.

Treasury Yields Rise From 10-Month Low as Oil Halts Two-Day Drop (Bloomberg)

U.S. Treasuries fell, with the 10-year yield rising from the lowest level since April, as oil prices halted their two-day decline, diminishing the appeal of fixed-income assets.

Bank of Japan’s Kuroda says ‘ample room’ to stimulate inflation (Market Watch)

Bank of Japan’s Kuroda says ‘ample room’ to stimulate inflation (Market Watch)

Bank of Japan Governor Haruhiko Kuroda said Wednesday that the central bank has “ample room” to ramp up its easing measures, rejecting views that it is short of ammunition to stimulate lackluster inflation.

Kuroda stunned global markets last week by deciding to set a key interest rate below zero, in a desperate attempt to save his embattled campaign to defeat deflation and generate 2% inflation. The move helped send Tokyo shares sharply higher, but it also added to speculation that the bank’s main policy of flooding the economy with cash through asset purchases has reached its limit.

Swatch Sales Growth Forecast Draws Skepticism Amid Asia Slowdown (Bloomberg)

Swatch Group AG reported annual profit that missed estimates and analysts questioned whether the Swiss watchmaker can meet 2016’s sales forecast amid vanishing stock market wealth and a slowdown in China.

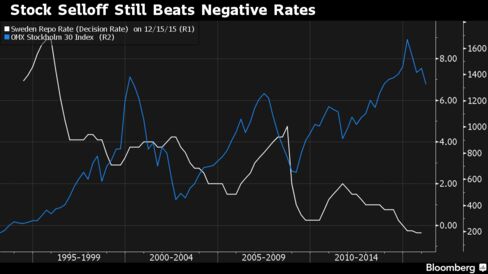

Money Has Only One Place to Hide for This Swedish Online Broker (Bloomberg)

Even after starting 2016 with a selloff, the stock market remains the best option for investors deciding where to put their money in an age of negative interest rates.

Nikkei falls 3.2%, leading sharp drop in Asian stocks (Market Watch)

Shares in Japan led most markets across Asia sharply lower Wednesday, amid ongoing volatility in the oil market and concerns that global growth is slowing.

Losses in the Nikkei Stock Average deepened to 3.2% by the close. Investors rushed to safe havens like the Japanese yen, while sending some other currencies in the region to fresh lows.

GM beats on earnings as SUV boom continues in the US (Business Insider)

GM beats on earnings as SUV boom continues in the US (Business Insider)

General Motors reported fourth-quarter and full-year 2015 earnings on Wednesday, and they were a beat.

Analysts had expected $1.24 per share, but GM delivered $1.39, on $39.6 billion of revenue for the quarter.

Disney Prices Shanghai Park Tickets Cheaper Than Hong Kong's (Bloomberg)

Disney Prices Shanghai Park Tickets Cheaper Than Hong Kong's (Bloomberg)

Tickets for Walt Disney Co.’s $5.5 billion Shanghai park will be priced at about 20 percent cheaper than for Hong Kong, as the company aims to draw families across income levels to its first theme park in mainland China.

Daily regular tickets go on sale from March 28 and will be priced at 370 yuan ($56), compared with HK$539 ($69) for a one-day adult ticket to Hong Kong Disneyland, while those for children and the elderly will cost 280 yuan. It’ll also charge higher prices during peak periods such as weekends and public holidays, Disney said in a statement.

BBVA Fourth-Quarter Profit Rises 36%, Beating Analyst Estimates (Bloomberg)

Banco Bilbao Vizcaya Argentaria SA’s fourth-quarter profit jumped 36 percent, beating analyst estimates, as the bank slashed provisions for bad loans and benefited from growth in its businesses in Mexico and Turkey.

Seven $1 billion-plus drugs seen reaching market in 2016 (Yahoo! Finance)

Seven $1 billion-plus drugs seen reaching market in 2016 (Yahoo! Finance)

Drug companies are likely to launch seven "blockbuster" drugs in 2016, each with $1 billion-plus annual sales potential, led by new treatments for liver disease and HIV, according to a Thomson Reuters analysis. The assessment means the pharmaceuticals industry is on track for another productive year, although not as good as 2015, which saw the arrival of 11 new blockbusters. The two top hits of 2016 are tipped to be Intercept Pharmaceuticals' (ICPT.O) chronic liver disease drug obeticholic acid, with a consensus sales forecast of $2.6 billion in 2020, and Gilead Sciences' (GILD.O) new fixed dose HIV drug emtricitabine plus tenofovir alafenamide, on $2.0 billion.

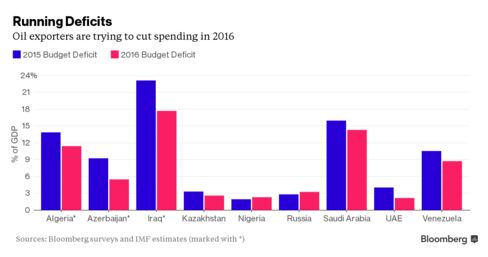

A Guide to Oil Producers' Scramble for Money as Crude Tumbles (Bloomberg)

Nigerias bid for concessionary loans from the World Bank and African Development Bank is just the latest example of the havoc wreaked on oil-producing nations by the slump in crude prices.

The company that sells Sharpies and coolers doesn't think we're anywhere near a recession (Business Insider)

The company that sells Sharpies and coolers doesn't think we're anywhere near a recession (Business Insider)

Consumer spending is either one of the last shoes to drop before a recession or the saving grace of the US economy.

And according to the CEO of Newell-Rubbermaid it sure doesn't look like the "last shoe" scenario is playing out yet.

Politics

This Is Reagan's Party (The Atlantic)

This Is Reagan's Party (The Atlantic)

When the Iowa results came in Monday night, it was clear that anti-establishment Republicans were on top. The onetime inevitable front-runner, Jeb Bush, barely registered. The bombastic and acerbic Ted Cruz, who has spent much of his career and campaign blasting Washington, came out on top. Donald Trump, certainly furious he did not win, still came in second. These are two Republicans who have spent as much time fighting their own party as they have the Democrats. Even Marco Rubio, who also put on a strong performance, was the darling of the Tea Party when he came to Washington, and he has continued to echo many of their arguments.

Donald Trump says despite loss, he’d still have skipped that debate (Market Watch)

Donald Trump says despite loss, he’d still have skipped that debate (Market Watch)

Donald Trump said skipping the final Republican debate before the Iowa caucuses may have led to his second-place finish there.

“That could’ve been with the debate,” Trump acknowledged to reporters in Milford, N.H., on Tuesday. According to CNN, Trump said: “I think some people were disappointed that I didn’t go into the debate.” Trump skipped a debate last week after protesting what he said was unfair treatment by Fox News host Megyn Kelly. Yet Trump said he would make the same decision again, pointing to the $6 million he raised for veterans’ charities.

Technology

How to use the robot AI that is becoming the bane of telemarketers (Mashable)

How to use the robot AI that is becoming the bane of telemarketers (Mashable)

Instead of just hanging up every time “Sharon, your local Google specialist” calls, one person decided to create an artificial intelligence that is as effective at wasting telemarketers’ time as telemarketers are at annoying you.

Belkin’s Smart Switch Lets You Use Your Phone to Control Dumb Appliances (Wired)

Belkin's wemo switch is a simple product: any device you plug into it can be turned on or off from your Android or iOS device, no matter where you are. In your home, outside on the lawn, across town, or across the world.

Health and Life Sciences

Seafood Might Protect Brain in People at Genetic Risk for Alzheimer's (Medicine Net Daily)

Seafood Might Protect Brain in People at Genetic Risk for Alzheimer's (Medicine Net Daily)

Seafood lovers, a new study delivers good news on two fronts: Mercury found in fish doesn't lead to mental decline, and for certain people, a diet rich in fish might stave off Alzheimer's disease.

Researchers who examined human brains confirmed that people who eat more seafood have more mercury in their brains. But, they found no link between higher brain levels of that neurotoxin and the kind of brain damage that is typical of Alzheimer's disease and dementia.

A Diet and Exercise Plan to Lose Weight and Gain Muscle (NY Times)

A Diet and Exercise Plan to Lose Weight and Gain Muscle (NY Times)

If there is a holy grail of weight loss, it would be a program that allows someone to shed fat rapidly while hanging on to or even augmenting muscle. Ideally, it would also be easy.

A new study describes a workout and diet regimen that accomplishes two of those goals remarkably well. But it may not be so easy.

Life on the Home Planet

Japan military on alert over North Korea's planned rocket launch (Reuters)

Japan put its military on alert on Wednesday to shoot down any North Korean rocket that threatens it, while South Korea warned the North it would pay a "severe price" if it goes ahead with a satellite launch that South Korea considers a missile test.

North notified U.N. agencies on Tuesday of its plan to launch what it called an "earth observation satellite" some time between Feb. 8 and 25.