Financial Markets and Economy

These Are the World's Most Miserable Economies (Bloomberg)

These Are the World's Most Miserable Economies (Bloomberg)

Thanks to off-the-charts inflation, Venezuela will probably retain the dubious honor of being the most miserable economy for a second year.

Galloping inflation at an annual average of 98.3 percent last year alongside 6.8 percent unemployment earned the South American country the runaway top spot on the 2015 misery index. With no end in sight for Venezuela's economic woes — estimates in Bloomberg surveys predict consumer price growth of 152 percent and joblessness averaging 7.7 percent — economists polled for the 2016 index see it remaining the unhappiest country.

It's 'Super Thursday' — here's what to expect from the Bank of England (Business Insider)

It's 'Super Thursday' — here's what to expect from the Bank of England (Business Insider)

It's "Super Thursday."

This is the day when the Bank of England releases both the minutes of its Monetary Policy Committee and its inflation report.

The Bank will have one key question on its mind when it publishes at midday today – just where has all the inflation gone?

Global Stocks Rise Led by Resources Companies (Wall Street Journal)

Global stocks gained on Thursday as rising commodities prices boosted energy and mining shares.

U.S. stock futures point to further gains as oil rallies (Market Watch)

U.S. stock futures point to further gains as oil rallies (Market Watch)

Wall Street stocks were set for another day in positive territory on Thursday, with a continued rally in oil prices and a slumping dollar helping to fuel an upbeat investment mood.

Later in the day, weekly jobless claims and factory orders, among other data releases, will be closely watched ahead of the highly anticipated U.S. nonfarm-payrolls report on Friday.

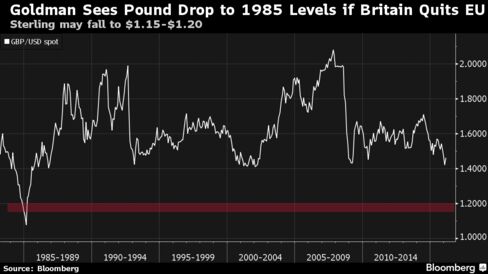

Goldman Sees Pound Tumbling by as Much as 20% on `Brexit' (Bloomberg)

The pound could fall as much as 20 percent if Britain quits the European Union, according to Goldman Sachs Group Inc.

Wall Street eyes oil, dollar (Yahoo! Finance)

U.S. stock index futures indicated a higher open on Thursday as traders watched oil and the dollar, which could be key to trading after they sent markets on a wild ride on Wednesday.

Falling crude prices and the rising dollar have been poison to the stock market with both sapping corporate profits.

Carney is being 'too aggressive' on interest rate hike threats and is 'confusing the markets' (Business Insider)

The Bank of England Governor Mark Carney has increasingly warned the markets that Britain's main interest rate will rise from its record low of 0.5% soon.

The interest rate has been at that level since 2009.

Here’s why the ‘doomsday scenario’ for one beaten-up sector isn’t happening (Market Watch)

Here’s why the ‘doomsday scenario’ for one beaten-up sector isn’t happening (Market Watch)

History was made in a few corners Wednesday, with the S&P 500 up 0.5%, the Dow up 1.1% and the Nasdaq-100 falling 0.5%. “This has happened only once in the last five years and 22 times since 1985. Twelve of those times were between 1999 and 2002,” said Michael Batnick of Irrelevant Investor.

Mining Stock Rebound Helps U.K.'s FTSE 100 Snap Three-Day Slump (Bloomberg)

Commodities rebounded for a second day, lifting mining shares and helping U.K. stocks rally from their worst three-day losing streak this year.

Europe is on a charge (Business Insider)

Stocks across Europe popped at the open on Thursday morning after a positive day in Asian markets, driven by a rally in the price of oil on Wednesday and overnight.

Investors Cast Wary Eye on Fed Rate Increases (Wall Street Journal)

Investors are rethinking their expectations for interest-rate increases this year, converging on a view that the Federal Reserve is unlikely to raise rates in March and possibly not even for the rest of the year.

10 dividend stocks that probably will give you a raise this year (Market Watch)

10 dividend stocks that probably will give you a raise this year (Market Watch)

Even though the U.S. stock market is weak this year, there are plenty of companies with enough cash to raise their dividends.

And that’s reassuring because, despite the fact that the S&P 500 Index was essentially flat last year and has fallen in 2016, you can sleep better at night knowing you are being paid to wait for better times. It is important, however, to avoid companies that might lower their payouts to preserve cash.

Fingerprint Cards Revenue Rises on Biometric Demand From China (Bloomberg)

Fingerprint Cards AB, the Swedish maker of biometric technology whose stock rose 1,600 percent last year, reported a 12-fold surge in fourth-quarter sales fueled by demand from mobile-phone makers in China.

Shell posts lowest income in at least 13 years as oil price takes toll (Business Insider)

Shell posts lowest income in at least 13 years as oil price takes toll (Business Insider)

Royal Dutch Shell, Europe's largest oil company, reported its lowest annual income in at least 13 years on Thursday as slumping oil prices hit profits.

Shell, whose shareholders last week approved its takeover of rival BG Group, said 2015 income fell 87 percent year on year to $1.94 billion, in line with analysts' estimates.

Beer, Cars and Mortgages? Super Bowl Ads Go Financial This Year (Bloomberg)

Digital wallets and mortgage apps will vie with beer and cars for Super Bowl viewers as financial-services companies step up their advertising to cater to the changing preferences of millennials.

Six OPEC states ready for emergency meeting with non-OPEC members — Venezuela's minister (Tass)

Six OPEC states ready for emergency meeting with non-OPEC members — Venezuela's minister (Tass)

Representatives of 6 member-states of the Organization of the Petroleum Exporting Countries (OPEC) are ready to participate in an emergency meeting on coordinated reduction of oil production with non-OPEC members, Venezuela’s Oil Minister Eulogio del Pino said during his visit to Tehran on Thursday.

How to make money trading both sides of the market (Market Watch)

For the past two years, the anonymous editors at investing website Zero Hedge have mocked me for a 2014 satirical article I wrote for MarketWatch.

Sharp Reports Fifth Straight Loss as Bailout Talks Continue (Bloomberg)

Sharp Corp. reported its fifth straight loss as the embattled maker of Aquos flat-screen televisions decides between two competing bailout offers.

U.S. oil prices extend gains on slide in dollar, talk of oil producer meeting (Business Insider)

U.S. oil prices extend gains on slide in dollar, talk of oil producer meeting (Business Insider)

U.S. crude oil prices extended gains from the previous session on Thursday, as a weaker dollar and ongoing yet unconfirmed talk of producers potentially meeting to discuss output cuts lifted the market despite record U.S. stocks.

U.S. West Texas Intermediate (WTI) crude futures were trading at $32.39 per barrel at 0031 GMT on Thursday, up 11 cents from the previous session's close when they rallied 8 percent from below $30 per barrel.

Australian Foreign Investment Board Needs Overhaul, Report Finds (Bloomberg)

Australian lawmakers said the nation’s foreign investment regulations need to be bolstered after the U.S., its main ally, queried a decision to sell a port in the northern city of Darwin to a Chinese company.

Asia stocks gain as dollar slide boosts oil (Business Insider)

Asia stocks gain as dollar slide boosts oil (Business Insider)

Asian shares rebounded on Thursday as speculation the U.S. Federal Reserve might opt to not raise interest rates at all this year hammered the dollar and sparked a huge rally in oil prices.

By some measures the U.S. currency suffered its largest one-day percentage drop outside of the crises of 1998 and 2008, symptomatic of just how crowded bullish positions had been.

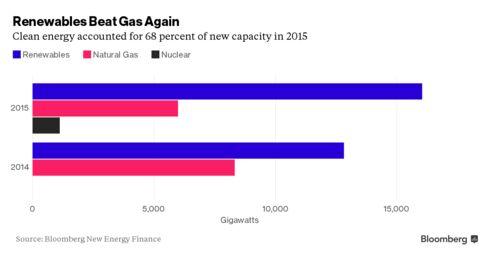

Renewables Top Fossil Fuels as Biggest Source of New U.S. Power (Bloomberg)

Renewable energy was the biggest source of new power added to U.S. electrical grids last year as falling prices and government incentives made wind and solar increasingly viable alternatives to fossil fuels.

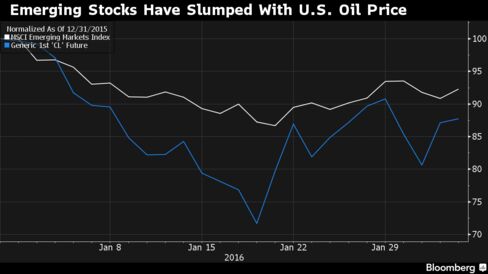

Emerging Stocks Climb on Oil Rally as Won Rises Most Since 2011 (Bloomberg)

Emerging-market stocks rose for the first time in three days as oil prices boosted commodity producers and disappointing U.S. data spurred speculation the Federal Reserve will delay raising interest rates. South Korea’s won jumped the most since October.

Noble Group Short Selling Surges to Record After Rally: Chart (Bloomberg)

Short-selling in Noble Group Ltd., which lost about two-thirds of its market value last year amid criticism of its accounting, rose to a record on Feb. 1, Markit Group Ltd. data show. That was after shares rallied 15 percent on Jan. 29, the most in three months. The commodity trader is raising $750 million cash from the sale of the remaining stake in its agricultural unit in an attempt to bolster liquidity.

Zinc Leads Metals Rally as Mining Shares Extend Gains in Asia (Bloomberg)

Anglo American Plc led a rally in mining stocks as industrial metals benefited from a drop in the U.S. currency that makes dollar-denominated commodities cheaper for investors.

The Global Economy’s New Abnormal (Project Syndicate)

Since the beginning of the year, the world economy has faced a new bout of severe financial market volatility, marked by sharply falling prices for equities and other risky assets. A variety of factors are at work – and will remain so throughout 2016 and beyond.

Bond Markets Are Underestimating the Fed, Goldman and Pimco Warn (Bloomberg)

Goldman Sachs Group Inc. and Pacific Investment Management Co. say bonds are poised to fall and traders aren’t prepared for how far the Federal Reserve will raise interest rates.

Politics

Clinton’s Security Clearance Is Under Scrutiny (Bloomberg View)

Clinton’s Security Clearance Is Under Scrutiny (Bloomberg View)

Now that several e-mails on Hillary Clinton's private server have been classified, there is a more immediate question than the outcome of the investigation: Should the former secretary of state retain her security clearance during the inquiry? Congressional Republicans and Democrats offer predictably different answers.

Rubio’s Call for No Capital Gains Tax Is a Break With the G.O.P. (NY Times)

When Steve Forbes ran for president in 1996 on a plan that called for no taxes on dividends and capital gains, Mitt Romney, then a private citizen, took out a full-page ad in The Boston Globe attacking his proposal as plutocratic.

“The Forbes tax isn’t a flat tax at all — it’s a tax cut for fat cats!” Mr. Romney’s ad declared, noting that “Kennedys, Rockefellers and Forbes” could end up with a tax rate of zero, while ordinary people would be left paying 17 percent on their wage and salary income under Mr. Forbes’s plan.

Technology

AI Is Transforming Google Search. The Rest of the Web Is Next (Scientific American)

Yesterday, the 46-year-old Google veteran who oversees its search engine, Amit Singhal, announced his retirement. And in short order, Google revealed that Singhal’s rather enormous shoes would be filled by a man named John Giannandrea. On one level, these are just two guys doing something new with their lives. But you can also view the pair as the ideal metaphor for a momentous shift in the way things work inside Google—and across the tech world as a whole.

Health and Life Sciences

Sitting for Hours May Raise Your Type 2 Diabetes Risk (Medicine Net Daily)

Sitting for Hours May Raise Your Type 2 Diabetes Risk (Medicine Net Daily)

Sitting for long stretches might boost your risk for type 2 diabetes, even if youexercise, researchers report.

Each extra hour in a sedentary position — whether working on the computer or lounging in the recliner — seems to increase your odds of type 2 diabetes by 22 percent, the study authors said.

Living With Cancer: A Woman Like Me (NY Times)

We commonly assume that cancer afflicts the aging or aged, but approximately 16 percent of breast cancer deaths involve women under the age of 50. How can or should an alarming death sentence be confronted in midlife? The personal challenges posed by incurable disease unfold in an absorbing documentary about movie-making, “A Woman Like Me,” which opened in New York in October and became available on Netflix this January.

Life on the Home Planet

What Syria's Refugees Need (Bloomberg View)

What Syria's Refugees Need (Bloomberg View)

Two big international efforts to end the suffering in Syria are taking place this week. The first, in Geneva, aims to produce a political settlement and is highly unlikely to succeed, so reluctant and cynical are many of the parties involved. The other, in London, aims to raise money to help the war's victims — and here the outlook is more promising.

All eyes will be on North Korean satellite launch (Market Watch)

All eyes will be on North Korean satellite launch (Market Watch)

North Korea’s plan to launch a satellite will give the outside world one useful outcome: a fresh opportunity to assess the secretive state’s potential missile threat.

Pyongyang surprised many when it put a satellite into orbit in 2012 from a long-range rocket after years of failure. The success elevated concerns that North Korea was making progress in developing missiles capable of carrying nuclear warheads as far away as the continental U.S.