Financial Markets and Economy

Let’s Talk About the US Government’s Interest Burden (Pragcap)

Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem.

For instance, Ip says that “higher federal borrowing puts upward pressure on interest rates”. This is classic “crowding out”,an argument that has been thoroughly debunked in the last 20 years as interest rates have fallen despite soaring government debts around the globe.

(Higher interest rates are correlated to higher government debt?)

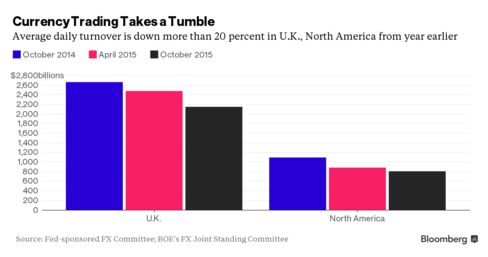

A Dying Breed: Currency Traders Are Left Out of New Wall Street (Bloomberg)

Charlie Stenger, a currency-broker-turned-recruiter, has seen it all. One fired trader wept in his office. Another admitted he hadn’t told his wife he was unemployed, and left the house every day in a suit to sneak off to a coffee shop. Then there are the delusional guys, who carefully explain how they’re not interested in jobs that don’t pay as well as those they just lost.

Tesla can't catch a break (Business Insider)

Tesla Motors fell as much as 10% on Monday, adding to a slide that's brought the shares to their lowest level in two years.

They are now trading below $150 apiece, down about $90 from where they ended 2015.

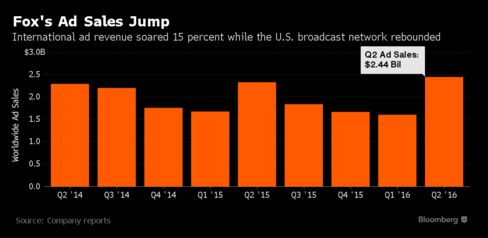

Fox Earnings Meet Estimates as Ad Gains Counter Film Drop (Bloomberg)

21st Century Fox Inc., Rupert Murdochs film and TV company, posted fiscal second-quarter profit that met analysts estimates, as growth in the cable and broadcast television businesses mostly countered lower revenue from filmed entertainment.

SEC Raises Concerns About Bond ETFs (Wall Street Journal)

SEC Raises Concerns About Bond ETFs (Wall Street Journal)

Most investors in mutual funds and exchange-traded funds probably don’t worry much about liquidity. After all, fund shares can be bought and sold easily anytime online, and trades are completed in one to three business days.

But there is another layer of trading—the trading the funds themselves do when a wave of selling by investors requires the funds to sell some of their assets—that has the Securities and Exchange Commission worried about liquidity. And the commission wants investors to be more aware of the risks it sees.

The second-largest US natural gas producer is having some serious trouble (Quartz)

Shares for Chesapeake Energy, the second-largest natural gas producer in the US, plunged as much as 50% Monday morning (Feb. 8) on news that the company has reportedly hired restructuring lawyers from the firm Kirkland & Ellis. Shares are now down about 34%.

Cisco's quarterly report to offer gauge of technology demand (Business Insider)

Cisco's quarterly report to offer gauge of technology demand (Business Insider)

Investors spooked by a steep sell-off in enterprise tech stocks will get a fresh glimpse of the health of technology spending on Wednesday when bellwether Cisco Systems Inc posts its quarterly results.

The networking equipment maker is the largest of several companies reporting this week that have benefited from the trend toward information technology (IT) delivered over the Internet, widely known as cloud computing.

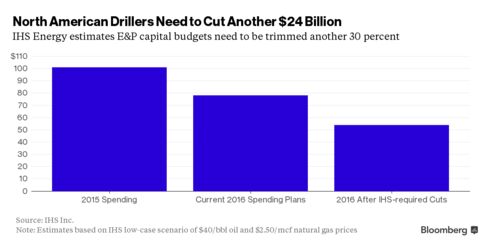

Oil Drillers Must Slash Another $24 Billion This Year, IHS Says (Bloomberg)

North American oil and natural gas drillers will need to cut an additional 30 percent from their capital budgets to balance their spending with the cash coming in their doors even if crude rises to $40 a barrel, according to an analysis by IHS Inc.

What the ‘Chart of Doom’ is saying about a global recession (Market Watch)

“Three down, two to go.”

Demand For Safe-Haven Bonds Surged Last Week (Capital Spectator)

The crowd piled into investment-grade bonds last week as economic worries triggered an exodus out of risky assets. Reviewing the major asset classes for the week just passed through an ETF lens reveals sharply divided results. The safe-haven trade generated handsome gains for several ETFs representing broad measures of the global fixed-income realm for the five trading days through Feb. 5.

U.S. bank stocks and bonds clobbered by recession worry (Business Insider)

U.S. bank stocks and bonds took a pounding on Monday as recession fears compounded concern about their exposure to the energy sector and expectations that global interest rates are unlikely to rise quickly.

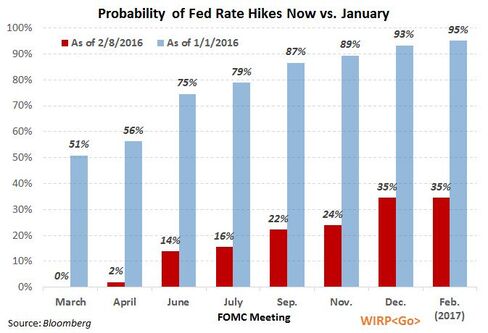

One Chart That Shows the Dramatic Repricing of Fed Expectations So Far This Year (Bloomberg)

What a start to the year.

Why Wall Street isn’t panicking about the stock-market tumble (Market Watch)

Sharp swings in stocks are the new normal.

Moves of 1% or greater—instead of being occasions for panic—have a become a new paradigm for investors that, lately, has been met with relative calm.

Of profits and prophesies (Economist)

Of profits and prophesies (Economist)

A googly is a ball bowled in cricket with unexpected spin. For years, Google was similarly hard to read, sharing only basic figures about its business. Alphabet, Google’s newly formed parent company, is bowling a bit straighter. When it reported earnings on February 1st, Alphabet disclosed for the first time how much it was spending on its “moonshot” projects, including self-driving cars, fibre internet and space exploration. In 2015 Alphabet lost around $3.6 billion on these ambitious initiatives—a large sum, but less than some had feared. Meanwhile Google, its core business, saw revenues and profits rise.

One major oil CEO thinks the industry is in a 'severe and prolonged down cycle' (Business Insider)

One major oil CEO thinks the industry is in a 'severe and prolonged down cycle' (Business Insider)

The oil industry has taken it on the chin over the last few months.

Prices have fallen along with revenues, and the renaissance in US oil production has turned into a nightmare.

The Special Few Who Are Getting Raises in This Economy (The Atlantic)

The big-picture numbers that people rely on to describe how the economy is doing currently look pretty good: Unemployment is around 5 percent (which is considered very healthy by economists, because there will always be some people changing jobs in a good economy), and hundreds of thousands of jobs are being added every month.

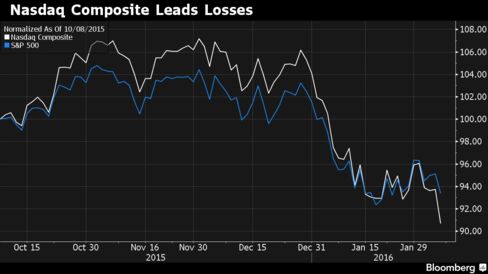

U.S. Index Futures Drop; Nasdaq Composite at Lowest Since 2014 (Bloomberg)

U.S. stocks tumbled, with the Standard & Poor’s 500 Index falling to a 22-month low, as a second straight selloff pushed bank shares to the lowest since 2013 and left the Nasdaq Composite Index approaching a bear market.

Hedge Funds Bet on Risks in U.S. Blue-Chip Debt (Wall Street Journal)

Hedge funds are betting the next bond sector to crack will be the $4.5 trillion market for the safest U.S. corporate debt.

How Tech's Undisruptables Got That Way (Bloomberg View)

How Tech's Undisruptables Got That Way (Bloomberg View)

We live in an age of rapid technological change and disruption. Launching revolutionary startups is cheaper and easier than ever. No established company is safe. Except for, you know, Apple, Amazon, Facebook and Google (Alphabet, if you prefer). Oh, and maybe Microsoft.

Economic expansions don't die of old age: Fed study (Business Insider)

Just because the U.S. economic recovery is nearly seven years along is no reason to think that the nation is due for a recession, according to a study published Monday by the San Francisco Federal Reserve Bank.

Unlike humans, economic expansions "do not become progressively more fragile with age," San Francisco Fed chief researcher Glenn Rudebusch wrote in the latest edition of the regional bank's Economic Letter. "(B)ased only on age, an 80-month-old expansion has effectively the same chance of ending as a 40-month-old expansion."

Global stocks have already lost over $6 trillion in 2016 (Business Insider)

It's ugly in global markets right now. Really ugly.

Gold is ripping higher (Business Insider)

There goes gold.

What’s Holding Back the World Economy? (Project Syndicate)

The dominant policies pursued by developed countries during the post-crisis period – fiscal retrenchment and quantitative easing – have offered little support for household consumption, investment, and growth. On the contrary, they have tended to make matters worse.

Politics

Rubio's British Doppelganger: Ed Miliband (The Atlantic)

Marco Rubio’s “robotic” performance during Saturday night’s Republican debate was bad, yes. But it wasn’t unprecedented.

To recap, when Chris Christie accused Rubio of just repeating talking points, Rubio quickly repeated a talking point. And then again. And again. A gleeful Chris Christie offered color commentary: “There it is, the memorized 25-second speech.”

Sanders Is Late to the Wall Street Revolution (Bloomberg View)

Sanders Is Late to the Wall Street Revolution (Bloomberg View)

If there is one presidential candidate who embodies the nation’s lingering post-2008 rage at Wall Street, that surely has to be Bernie Sanders. No other candidate has argued as strenuously for financial reform, or used rhetoric that so forcefully paints a struggle between the financial industry and the rest of the economy. Whether that narrative is accurate, Sanders’ concrete proposals give the impression that he hasn't carefully evaluated the policy landscape.

Technology

This Chip Will Give Your Phone AI Modeled On The Human Brain (Fast Company)

This Chip Will Give Your Phone AI Modeled On The Human Brain (Fast Company)

MIT's "Eyeriss" chip would allow for neural networks to run locally on your phone without an Internet connection.

In computing, a neural network is a collection of processors that mimic the way the human brain works. Simply put, a neural network analyzes data, learns about it, and then decides how to act upon that data. It is because of neural networks, which don't rely on standard rule-based programing, that we have software that can recognize and distinguish between different human voices or that can recognize individual objects. Both Google Now andApple's Siri are examples of consumer neural networks.

This robot cockroach could eventually help search-and-rescue teams (The Verge)

This robot cockroach could eventually help search-and-rescue teams (The Verge)

The sight of a cockroach on the run may strike fear into your heart, but what if it were running to save you? That's what researchers at UC Berkeley had in mind when they designed CRAM, a robot prototype that looks just like a cockroach. CRAM ("compressible robot with articulated mechanisms") has a jointed exoskeleton and a soft shell that allow it to shape shift and move through small spaces. The researchers think CRAM, whose existence was partially funded by the US Army, could be the first step in creating an incredibly effective search-and-rescue robot.

Health and Life Sciences

Can medical marijuana calm kids’ seizures? (Futurity)

Can medical marijuana calm kids’ seizures? (Futurity)

Desperate for relief, parents are taking unusual steps to help children plagued with seizures. The relief, however, comes in a most unlikely form: marijuana.

As many as 30 percent of people with epilepsy—or about one million Americans—still have seizures while on Food and Drug Administration (FDA)-approved treatments. It’s left many who suffer from uncontrollable seizures—or their parents, since many are children—turning to medical marijuana and its derivatives in an attempt to take back control of a disease with no cure.

New Study Shows That Fish Really Is Brain Food (Forbes)

New Study Shows That Fish Really Is Brain Food (Forbes)

A century ago, the evidence that fish is brain food was virtually nonexistent. Researchers have been looking at this question ever since, and the evidence has been mixed. Even if fish is good for the brain, the mercury content in some fish might have the opposite effect.

A new study that appeared last week in JAMA answers this question: fish is indeed good for the brain.

Well: Opening Up About Depression (NY Times)

I have slogged through a number of difficult situations in recent months, among them the ongoing crises of my elderly parents’ illnesses and the suicide of a friend. I never lost my appetite nor burst into tears, and I didn’t suffer from any of the other typical symptoms of depression. Maybe I was more irritable than usual, a bit more prone to snap. And yes, I buried myself in my work. But I didn’t think I’d tripped down into the rabbit hole of depression.

Life on the Home Planet

Chipotle is giving out free burritos — here's how to get one (Business Insider)

Yep. Click on the link and follow the instructions.

Surrounded by Diamonds, Villagers Go Hungry in Drought-Hit Zimbabwe (Scientific American)

Surrounded by Diamonds, Villagers Go Hungry in Drought-Hit Zimbabwe (Scientific American)

S hylet Mutsago, a 63-year-old who lives near the diamond fields of Marange, cannot hide her anger over how mining in this gem-rich part of eastern Zimbabwe has failed to improve the lives of local people.