Financial Markets and Economy

Gold Up 12%, Silver Up 11% YTD As Stocks Crash … Again (Business Insider)

Gold jumped 2 percent to a 7-1/2-month high yesterday, briefly touching the psychological level of $1,200 an ounce. Falling bank shares and stock markets and worries over global economic growth and a new financial crisis prompted investors to seek the safety of gold.

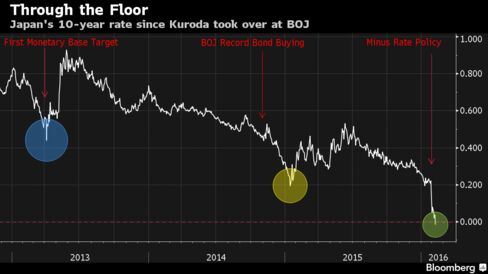

Kuroda's Three Strikes Drive 10-Year Yield Below Zero: Chart (Bloomberg)

Japan’s benchmark 10-year yields touched a record low of minus 0.01 percent Tuesday in the wake of the Bank of Japan’s surprise decision on Jan. 29 to charge some lenders on excess reserves held at the central bank. Governor Haruhiko Kuroda drove down yields to unprecedented levels after initiating a monetary base target in April 2013 and a boosting the BOJ’s bond purchases to a record in October 2014.

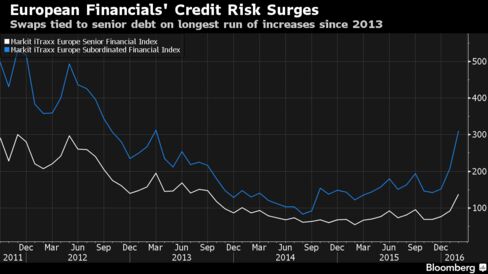

Nervousness About Global Banking Giants Intensifies (NY Times)

An unsettling trend has emerged from the heavy selling that sent global markets tumbling this year: Investors are getting nervous about the world’s biggest banks.

Now’s the time to buy stocks — the stars are aligned (Market Watch)

Can anyone “call” a stock market bottom? Nope. But by tracking the right signals, you can get close.

Three “stars” I follow to spot market turns say we’re just about there.

These four points unlock the secret to cracking China's luxury market (Business Insider)

These four points unlock the secret to cracking China's luxury market (Business Insider)

The huge anti-corruption and anti-extravagance campaign led by president Xi Jinping, has transformed China's burgeoning luxury goods sector forever.

Luxury goods have become less accessible to the growing Chinese middle class, and less acceptable for members of China's elite.

The $102 Billion of Bank Debt That's Making Investors Nervous (Bloomberg)

Last year’s sure thing in credit markets is quickly becoming this year’s nightmare for bond investors.

Convertible bonds are alluring as stocks slip (Market Watch)

Convertible bonds are alluring as stocks slip (Market Watch)

The performance of the equity and convertible bond markets diverged in the fourth quarter as U.S. stock indices registered healthy gains while the U.S. convertible market rose by less than 1%. Despite this, the asset class is still attractive.

There are several factors that contribute to the divergence between stocks and convertibles. First, within the convertible category, several issuers experienced sharp drops caused by company-specific setbacks.

We're slashing our oil price forecast by 50% (Business Insider)

We're slashing our oil price forecast by 50% (Business Insider)

Oil is one of the most traded commodities at the moment and everyone has a view.

But the prevailing opinion is now that oil won't be returning to triple digits a barrel anytime soon.

On Monday, Ian Taylor, CEO of Vitol Group and boss of the world's biggest independent oil trader, said the price of oil will stay beneath $60 for as long as 10 years.

A Free-Market Plan to Save the American West From Drought (The Atlantic)

A Free-Market Plan to Save the American West From Drought (The Atlantic)

On a brisk, cloudless day last january, Disque Deane Jr. stepped out of his SUV, kicked his cowboy boots in the dirt, and looked around. He had driven two hours from Reno on one of the loneliest stretches of interstate in the United States to visit the Diamond S Ranch, just outside the town of Winnemucca, Nevada. Before him, open fields stretched all the way to the Santa Rosa mountains, 30 miles away. But the land was barren. The fields had been chewed down to the roots by cattle, and the ranch’s equipment had been stripped for parts. A steel trestle bridge lay pitched into the Humboldt River.

Tesco Sales Drop Eases as U.K. Grocery Leader Begins Turnaround (Bloomberg)

Tesco Plcs sales decline eased further in the early weeks of 2016, adding to signs of a turnaround at the U.K.s leading grocer.

Global stocks hit the rocks after Asian markets slump (Yahoo! Finance)

Global stocks hit the rocks after Asian markets slump (Yahoo! Finance)

European shares gave up early gains as bank stocks dropped and losses in Asian markets sent investors scurrying for safe havens. STOXX Europe 600 banks (.SX7P) were down 1.6 percent, and shares in several Italian banks were suspended from trading after dropping sharply. The search for shelter pushed up the Japanese yen, long considered a safe-haven asset, and drove the yield on Japan's benchmark government bond into negative territory for the first time ever.

Cheap oil means big bargains in alternative-energy stocks (Market Watch)

Cheap oil means big bargains in alternative-energy stocks (Market Watch)

A big trend in investing has been the persistent decline in oil prices, and the cascading effect across asset classes including stocks in all industries.

Everyone knows by now about the serious pain for oil companies, as most recently evidenced by ConocoPhillips COP, +4.65% which lost $3.5 billion in the fourth quarter and just cut its dividend by two-thirds. And after some ugly headlines in the junk bond market recently, including the liquidation of the Third Avenue Focused Credit Fund, investors should be aware of how the pressures on oil may affect them.

They Broke the Silver Fix (Business Insider)

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action.

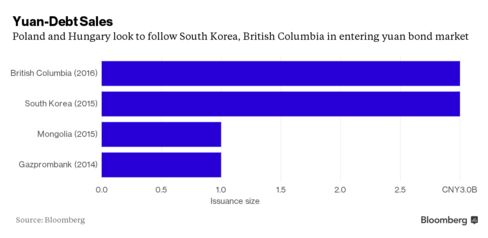

Yuan Bonds Drawing Crowds as Americans Turn Cool on Europe Debt (Bloomberg)

Governments in Europe’s developing markets are looking east to seize on a shift in investor demand.

Why a few money-making tech stocks won’t make up for the big losers (Market Watch)

Can one huge winner transform a stock portfolio into a market-beating champion?

"People In The Market For Many, Many Years Have Been Replaced By An Algorithm" (Business Insider)

Two years ago, just before Michael Lewis released Flash Boys starting a sharp if brief revulsion against parasitic, predatory High Frequency Trading frontrunners, which delayed Virtu's IPO by one year, we broke down Virtu's 2013 net trading income by product line.

Red Tape and Power Struggles: South Africa Is Losing Miners (Bloomberg)

South Africa ranks as one of the richest countries in natural resources from gold to iron ore. The problem: few companies want to deal with the headache of getting it.

FTSE 100 flops as investors search for safety (Market Watch)

U.K. stocks moved lower Tuesday, extending a selloff in the previous session that left the benchmark FTSE 100 near a three-week low.

After initially opening higher, the U.K’s FTSE 100 fell 0.3% to 5,670.16, with mining and finance shares lower. The benchmark on Monday tumbled 2.7% to 5,689.36, its lowest close since Jan. 20, hit by global growth concerns and persistent turmoil in the oil markets.

Deutsche Bank stock is rising as European markets stabilise (Business Insider)

Deutsche Bank has managed to calm the market over its ability to make coupon payments on its bonds. For now.

Emerging-Market Stocks, Currencies Drop as Investors Seek Havens (Bloomberg)

Emerging-market stocks fell for a second day and currencies weakened as renewed concern over the health of the global economy sparked a worldwide selloff in equities.

Nikkei skids 5% as global growth anxiety spreads (Market Watch)

Nikkei skids 5% as global growth anxiety spreads (Market Watch)

Japanese stocks fell more than 5% and the yield on the benchmark government bond dropped into negative territory for the first time, twin signs of a flight to safety that threatened to undermine the nation’s slow recovery under Prime Minister Shinzo Abe.

In afternoon trading, the benchmark 10-year government bond was yielding minus 0.025%, meaning investors were willing to lend the Japanese government money for 10 years and get back less than they put in.

"I Was Far Too Bullish": Jeremy Siegel Admits Things Are Really, Really Bad Out There (Business Insider)

Well, no one ever accused Jeremy Siegel of being bearish, but now he is at least less bullishafter witnessing one of the worst Januarys for stocks in history.

This Is What Central Bank Failure Looks Like (Business Insider)

From omnipotence to impotence… Peter Pan(ic) is here…

Brace Yourself, Global Stocks Are Close to a Bear Market: Chart (Bloomberg)

After claiming the European equity benchmark and Japan’s Nikkei 225 Stock Average, bears are knocking on the door of the global share gauge. MSCI’s All-Country World Index has lost more than 18 percent from an all-time high reached in May as anxiety over the world economy haunts financial markets.

Abenomics Fails Miserably As Japan's Workers "Get Nothing" In 2015 (Business Insider)

Late last month, in what amounted to a tacit admission that nothing is working when it comes to pulling Japan out of its decades’ long stint in the deflationary doldrums, the BoJ adopted negative rates.

Another Data Point To Ignore: Dividend Cuts Have Surpassed 2008 (Business Insider)

Being "paid to wait" in high-yielding stocks last year was a death by 394 cuts. As Bloomberg reports, the number of dividend reductions far surpassed 2008, almost 100 more than at the outset of the Great Recession – a time when the implosion of Lehman caused equity markets to plummet in the later stages of the third quarter.

5 Questions for Janet Yellen (Bloomberg View)

5 Questions for Janet Yellen (Bloomberg View)

Federal Reserve Chair Janet Yellen will deliver her semi-annual testimony to House and Senate committees this week. Her remarks will be closely monitored, especially in light of the recent increase in global economic insecurity — which has intensified talk of a recession threat — and global financial volatility.

IEA sees global oil glut worsening, OPEC deal unlikely (Business Insider)

IEA sees global oil glut worsening, OPEC deal unlikely (Business Insider)

The world will store unwanted oil for most of 2016 as declines in U.S. output take time and OPEC is unlikely to cut a deal with other producers to reduce ballooning output, the International Energy Agency said.

The agency, which coordinates energy policies of industrialised countries, said that while it did not believe oil prices could follow some of the most extreme forecasts and fall to as low as $10 per barrel, it was equally hard to see how they could rise significantly from current levels.

Politics

Careening to the Finish in New Hampshire (The Atlantic)

Careening to the Finish in New Hampshire (The Atlantic)

The voting is underway in New Hampshire, where voters in three hamlets—Hart’s Location, Millsfield, and Dixville Notch—cast their ballots just after midnight. Once all the registered voters have made their choices, the ballots can be counted.

Technology

Voice Control on Apple TV Is About To Get Way More Useful (Gizmodo)

When the new Apple TV was announced, the inclusion of Siri was a strong selling point—too bad it turned out to suck. Finally, though, Apple is making voice control on the set-top box rather more useful.

'Bionic spinal cord' aims to move robotic limbs with power of thought (Mashable)

'Bionic spinal cord' aims to move robotic limbs with power of thought (Mashable)

Australian scientists hope a device about the size of a matchstick will one day help people with spinal cord injuries get back on their feet.

Health and Life Sciences

No safe way to suntan, experts warn (BBC)

No safe way to suntan, experts warn (BBC)

There is no safe or healthy way to get a tan from sunlight, new guidance from the National Institute for Health and Care Excellence (NICE) has warned.

The health watchdog's latest guidance also says an existing tan provides little protection against sun exposure.

Vacation Weight Gain Can Lead to 'Creeping Obesity,' Study Finds (Medicine Net Daily)

Along with souvenirs, there's a good chance you'll return from your vacation with some extra weight, new research suggests.

The study looked at 122 American adults, aged 18 to 65, who went on vacations ranging from one to three weeks between March and August.

Life on the Home Planet

Caves reveal Australia wasteland's secret past (BBC)

Caves reveal Australia wasteland's secret past (BBC)

A network of hidden caves has helped reveal the lush rainforests that thrived in one of Australia's harshest deserts between three and five million years ago.

The iconic Nullarbor Plain is a vast expanse of desert straddling South and Western Australia, which receives less than 3cm of rain annually and is nearly entirely devoid of trees.