Oil can!

That's right, once again tumbling oil prices are taking down the global markets as yesterday's little meeting between OPEC and the American Oil Cartel (the one they pretend doesn't exist) in Houston broke up without an agreement to even cap production, let alone cut it back. Aside from telling CNBC only Allah sets oil prices, Ali Al-Naimi said to his North American counterparts:

“If other producers want to limit or agree to a freeze in terms of additional production, that may have an impact on the market, but Saudi Arabia is not prepared to cut production."

Venezuela was hoping for a lifeline and got none and that country may end up cutting a huge amount of oil production as its economy collapses, giving Al-Naimi exactly what he wants – involuntary cutbacks by bankrupt oil companies. Brazil is also in a lot of trouble as are many individual producers in Canada, the US and Mexico and now so are many hedge funds and foolishly bullish oil traders, who ramped up the price of oil from $29 to $34 (17%) into this meeting, only to see their hopes and dreams smashed into ashes at yesterday's meeting.

It's sad because, just last Wednesday, I told Canada that oil prices (and the industry) were NOT going to make a strong comeback and that they needed to move on and put their money to better use in other industries (see my Business News Network interview here). I further detailed my veiws on Oil, Gasoline and Natural Gas in yesterday's Live Member Chat Room.

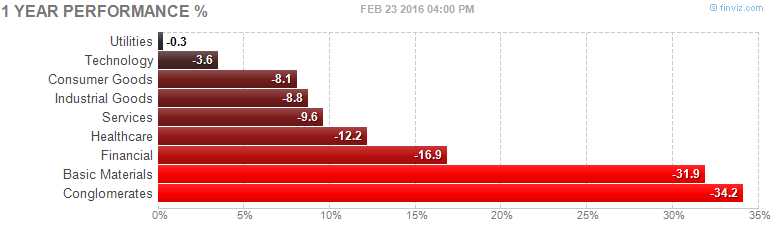

I also said that what were seeing in the markets is an overall rotation out of the Energy Sector (and the Financial who foolishly lent them money) and that continues to be what we're seeing dragging the markets down all year:

Conglomerates are down there too but that's a funny category that includes "diversified" business that often include Financial and Material components (like GE, SI, DD). The problem these sectors have is that the Central Banksters' 8-year experiment with Trickle Down Economics has been a complete failure because giving money to rich people does not create jobs and it does not create demand and it does not put money back into the economy.

That means the banks don't have a lot of transactions they can rake money off of. Rich people are more sophisticated and negotiate better rates with banks, squeezing their margins and we're seeing that in the earnings reports and the cartoon on the left is one I used back in 2007 when I first predicted this would happen as they sacrificed the consumer on the altar of profits.

That means the banks don't have a lot of transactions they can rake money off of. Rich people are more sophisticated and negotiate better rates with banks, squeezing their margins and we're seeing that in the earnings reports and the cartoon on the left is one I used back in 2007 when I first predicted this would happen as they sacrificed the consumer on the altar of profits.

It also means that there aren't enough people buying materials or building homes. Yes, the sale of $100M homes is through the roof, as are luxury yachts but what uses more materials – one $100M home or 250 $400,000 homes? Which puts more people to work and which provides a benefit for the Bottom 99% (who could have 2.5 homes each) vs the 1 home bought by a Top 1%'er? Most importantly, which creates more jobs? And don't forget the 250 realtors and mortgage brokers who make money, along with the 250 couch sales people and washer and dryer sales guys and painters and plumbers, etc.

That's right, a $100M home DESTROYS the economy because it makes it that much harder for the bottom 99% to afford homes as all the land gets more expensive and it also erodes the tax base where those homes use a lot of land and then it destroys the communities as one Top 1% family goes to the local pizza place once a week vs 250 times for the Bottom 99%. This is why our economy is broken folks and this is why materials and financials are suffering.

When 0.1% of the US families (300,000) have more money than 90% (284,000,000) – something is wrong with the country – and it's not going to be fixed by giving MORE money to the Top 1%.

When 0.1% of the US families (300,000) have more money than 90% (284,000,000) – something is wrong with the country – and it's not going to be fixed by giving MORE money to the Top 1%.

Now, this may sound like a political statement to you but it's not – it's an economic one. Our economy is not going to improve unless this changes and we make sure the bottom 99% and especially the bottom 90% are able to get their heads above water and participate in our consumer-driven economy. Since that's not going to happen with a wave of Adam Smith's invisible hand – the solution HAS TO BE a political one!

As John F. Kennedy warned: "Those who make peaceful revolution impossible will make violent revolution inevitable" – and then they shot him. But he did make a good point and, as I noted yesterday, the US will hold an election this year that will give them the choice of voting to have the country actually run by it's 120th richest person or, possibly, and advocate of Socialism. It's going to be interesting indeed though we'll probably cop out and choose the middle ground (Hillary), who "only" has $30M.

We are seeing the beginning of small concessions to the bottom 99% in the form of minimum wage increases and that will eventually lead to wage increases up the ladder as well but it is, unfortunately, a slow drip that has little immediate impact. In face, just yesterday, Consumer Confidence came in at just 92.2, the lowest reading since 2012 and, as you can see from this chart – it's falling in-line with declining Median Incomes – of course!

We are seeing the beginning of small concessions to the bottom 99% in the form of minimum wage increases and that will eventually lead to wage increases up the ladder as well but it is, unfortunately, a slow drip that has little immediate impact. In face, just yesterday, Consumer Confidence came in at just 92.2, the lowest reading since 2012 and, as you can see from this chart – it's falling in-line with declining Median Incomes – of course!

Not only that but, on the campaign trail, you have Trump, Cruz and Rubio telling you what a complete and utter disaster America is under Obama and Bernie Sanders is no help telling people what a complete and utter disaster America is under the Trump, Cruz and Rubios of the World, who don't have to be President to ruin your life anyway. No wonder the consumers aren't feeling confident – where is the positive message?

Of course, saying you're not FEELING confident in a survey is not the same thing as ACTING confident and we are seeing signs of rising confidence in the form of improved housing numbers and, hopefully tomorrow, improving sales of Durable Goods, which were down 1% (ex Aircraft) in the last reading. We'll get an update on Personal Income and Spending on Friday, which should be improving (rising wages) but also a revised Q4 GDP report, which will likely be a bit lower in light of recent data.

Of course, saying you're not FEELING confident in a survey is not the same thing as ACTING confident and we are seeing signs of rising confidence in the form of improved housing numbers and, hopefully tomorrow, improving sales of Durable Goods, which were down 1% (ex Aircraft) in the last reading. We'll get an update on Personal Income and Spending on Friday, which should be improving (rising wages) but also a revised Q4 GDP report, which will likely be a bit lower in light of recent data.

We're hoping the indexes hold up at S&P (/ES) 1,900 and Russell (/TF) 1,000, where we're playing the Futures long for a bounce with tight stops below. DAX 9,200 needs to hold up in Germany and we're already surprised that 15,700 isn't bouncing on the Nikkei (/NKD) as people have panicked into the Dollar, driving it back to test 98 this morning. The Nikkei loves a weak Yen.

If not, we still have the hedges on SDS and SQQQ we talked about in last Friday's post, which have done a wonderful job of protecting us so far and have plenty of room to run if things do get worse.

Be careful out there!