Who are we kidding?

Who are we kidding?

Well, the American People, for one thing. We're also kidding Investors and Savers and other Nations and we're certainly kidding our children with these ruinous economic policies that do nothing but cover up the complete failure of our fiscal policies to address what is now an 8-year Global Recession.

Pretending things are better than they really are at a Federal level leads Corporations, in turn, to also pretend things are better than really are – kind of like the Emporer's New Clothes – where no one wants to be thought a fool for simply admitting what is obviously true.

Financial-management maneuvers – some reasonable and some questionable – are being pushed to extremes as executives work to keep up appearances. If you've spent any time following the markets, then you're probably familiar with some of the tactics companies are employing to boost earnings:

- From an operational standpoint, a company may lay off workers while squeezing more productivity out of its existing workforce.

- From a financial-engineering standpoint, a company may buy back shares, reducing the share count and ultimately boosting earnings per share for investors.

- From an accounting standpoint, a CFO may argue that certain costs and expenses were unusual in nature; from this you get a pro forma earnings figure that's higher than earnings defined by generally accepted accounting principles (GAAP).

Say what you want about all that stuff above. That's just how business has been done.

I have long been the fool who says the Emperor has no clothes and, finally, I'm being joined by no less a fool than Barry Eichengreen of Berkeley, who is also calling for a return to REAL Keynesianism (Government Spending) to stimulate the demand side of the equation. Like me, Eichengreen does not think things are all that complicated but like Global Warming, those in power simply refuse to see or admit the inconvenient truth:

I have long been the fool who says the Emperor has no clothes and, finally, I'm being joined by no less a fool than Barry Eichengreen of Berkeley, who is also calling for a return to REAL Keynesianism (Government Spending) to stimulate the demand side of the equation. Like me, Eichengreen does not think things are all that complicated but like Global Warming, those in power simply refuse to see or admit the inconvenient truth:

The solution is straightforward. It is to fix the problem of deficient demand not by attempting to further loosen monetary conditions, but by boosting public spending. Governments should borrow to invest in research, education, and infrastructure. Currently, such investments cost little, given low interest rates. Productive public investment would also enhance the returns on private investment, encouraging firms to undertake additional projects.

Thus, it is disturbing to see the refusal of policymakers, particularly in the US and Germany, to even contemplate such action, despite available fiscal space (as record-low treasury-bond yields and virtually every other economic indicator show).

Ideological and political prejudices deeply rooted in history will have to be overcome to end the current stagnation. If an extended period of depressed growth following a crisis isn’t the right moment to challenge them, then when is?

As I pointed out to our Members this morning, Japan has been using QE and low rates to fake their economy for 15 years longer than we have and it's done NOTHING to actually help them. What it has done is led to a population that's essentially given up and not just on their own lives but on future generations as a generation of delays in marriage and low birth rates have led to a rapidly aging population which is actually declining, with deaths outpacing births by 250,000 souls per year.

As I've been saying, Abe will likely face a no-confidence vote this summer (I also predicted Brexit will pass, so pay attention!) and now Japan's head 1%'er, Akio Toyoda has told TM employees that they can't even get 1,000-Yen raises ($9) because: "“The virtuous economic cycle that Abe has sought isn’t working well, With Japan’s economic outlook dimming, company management can’t be aggressive about wage hikes that increase fixed costs.”

Despite the revolt fermenting among the Keiretsu, the corporations who really rule Japan, BOJ's Kuroda only knows how to push one button to get his cheese and has been wistfully talking about the possibility of -0.5% interest rates. Of course a country that's 300% of it's GDP in debt would love to get -0.5% interest, that would PAY THEM 1.5% of their GDP on the money they borrowed! As I said yesterday though, it's just another form of taxation in the end as money is taken from worker/savers and given to the Government (or any rich person who wants to borrow money).

Despite the revolt fermenting among the Keiretsu, the corporations who really rule Japan, BOJ's Kuroda only knows how to push one button to get his cheese and has been wistfully talking about the possibility of -0.5% interest rates. Of course a country that's 300% of it's GDP in debt would love to get -0.5% interest, that would PAY THEM 1.5% of their GDP on the money they borrowed! As I said yesterday though, it's just another form of taxation in the end as money is taken from worker/savers and given to the Government (or any rich person who wants to borrow money).

Meanwhile, in the US, we're entering into the very dangerous STAGFLATION zone, where we have inflation despite a stagnant economy. You won't read about this in the US Corporate Media but the Telegraph has a good article highlighting our own Federal Reserve's "sticky price indicators" that show that real inflation (the kind our Government refuses to measure) is indeed picking up quickly while the obviously ridiculous "core inflation" remains stagnant.

Even The Cleveland's Fed's own "median consumer price index" jumped to 2.9%, with big rises are in medical services, housing rents, car insurance, restaurants, hotels, women's clothing, jewelry, and car hire. This is the long-feared inflection point we all forgot about in those halcyon days of deflation.

The Fed's is itching to tighten, saying: "We may well at present be seeing the first stirrings of an increase in the inflation rate.” He spelled out why the 1970s 'Phillips Curve' trade-off between unemployment and inflation is alive and well, and an implicit warning that prices could soon off take since the labor market is clearly approaching the electric fence of Milton Friedman's NAIRU (non-accelerating inflation rate of unemployment).

The economy created 242,000 jobs in February. The broad U6 unemployment rate has dropped to a cycle-low of 9.7%. The willingness of workers to switch jobs – the 'quit rate' – has surged since September and is back to 2008 levels. Higher wage demands will follow as surely as night follows day. The Fed will not raise rates this week with so much fog still in the air. Half the world is in a sulk, the ISM manufacturing gauge still below the boom-bust line of 50, and US retail sales slipped again in February.

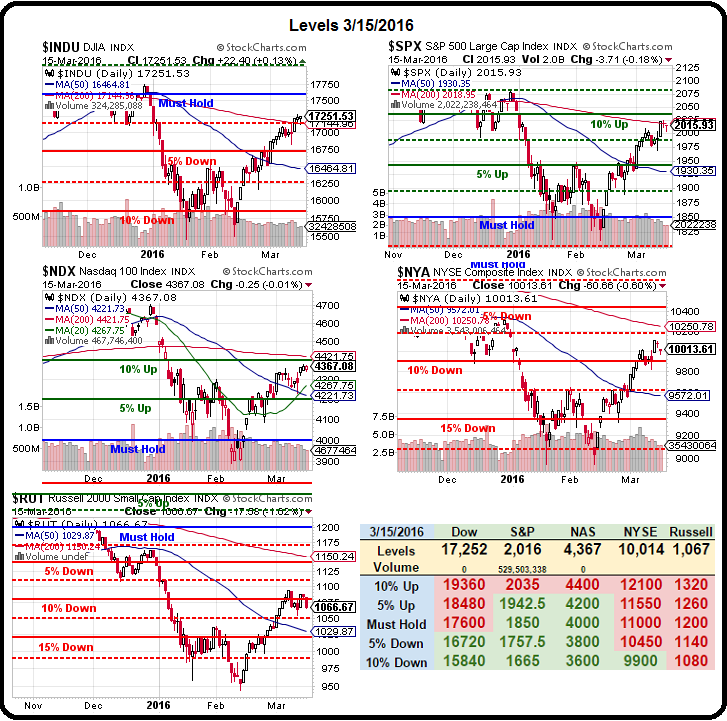

We'll stay flexible ahead of the Fed (and we have a Live Trading Webinar at 1pm, EST so we'll be watching the Fed LIVE this afternoon) but our Futures shorts are paying off already and there's still time to jump on board as we don't see what Yellen will do to shift sentiment this afternoon – but you never know so – TIGHT STOPS! The shorting lines for the week were (and are):

- Dow (/YM) 17,100 – now 17,117

- S&P (/ES) 2,000 – now 2,000

- Nasdaq (/NQ) 4,325 – now 4,347

- Russell (/TF) 1,070 – now 1,055

- Nikkei (/NKD) 17,000 – now 16,890