Back in black

Forget the hearse 'cause I never die

Look at me now

I'm just makin' my play

Don't try to push your luck, just get out of my way – AC/DC

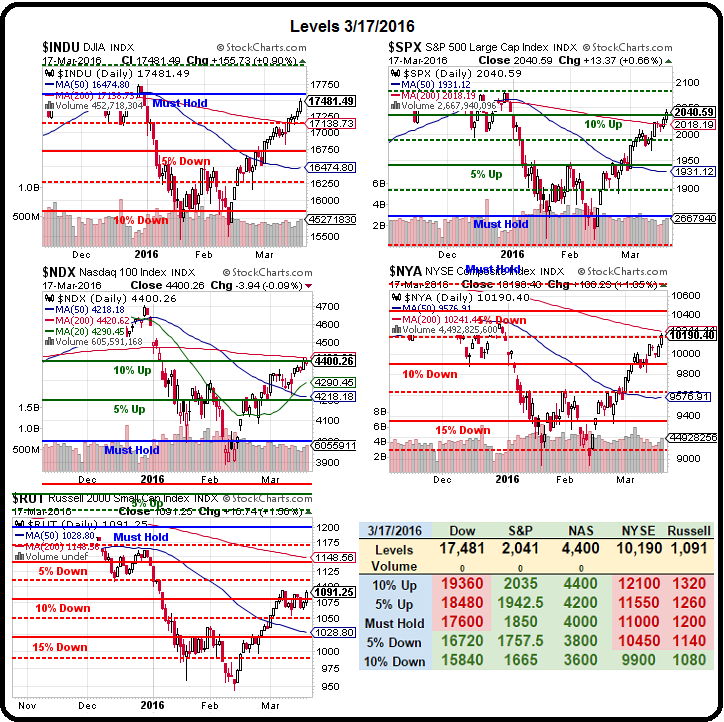

Wow, what a month we are having! 15,500 to 17,500 is 2,000 Dow points and lucky 13% off the bottom as of yesterday's close. Of course we mark 15,840 as the -10% line on our Big Chart and the Must Hold Line is 17,600, which is where the Dow needs to go just to get back to the middle of our predicted trading range for 2016 so let's not get too exhausted congratulating ourselves on mediocrity just yet.

At the same time, the Nasdaq has blased up 10% from it's Must Hold Line (4,000) and is already well over 4,400 led, of course, by a 15% pop in Apple (AAPL), who have their event day on Monday. We're already long on AAPL which means we can't be too short on the Nasdaq but 4,400 is the top of the range and, if AAPL disappoints even a little – things can come crashing down very quickly.

S&P 1,850 was our Must Hold line and we hit our +10% target of 2,035 yesterday and popped through that though the S&P June Futures (/ESM6) are right on the 2,035 line, and we care a lot more about them than we do about the index. The Russell (/TF) is the huge underperformer, only just getting back over the -10% line at 1,080. If we want to play a long – the Russell is absolutely the way to go.

A nice upside hedge would be to use the ultra-long Russell ETF (TNA):

- Buy 40 TNA April $59 calls at $1.15 ($4,600)

- Sell 40 TNA April $61 calls at 0.70 ($2,800)

- Sell 10 CLF 2018 $2 puts for $1.25 ($1,250)

That's net $550 on the $8,000 spread and, as you can see from the chart, last time the other indexes were this high in the range, TNA was in the $70s, so $61 is not much of a stretch from here – if the rally is real. The downside risk to this play is, of course, losing the $550 cash and possibly having to own 1,000 shares of Cleveland Cliffs at $2 ($2,000) for net $2,550, which would be $2.55 per share and it's currently at $2.85 so a nice discount on a stock we are heavily long in.

If all goes well, you make $7,450 back on your cash in 28 days and that's 1,354% and much more than enough to pay for the CLF down the road! So that's a fun, upside hedge for those of you who were caught flat-footed by the rally but are too nervous to jump on the bandwagon after this 10% pop, which is wise as it's very likely we pull back here – just look how overbought we are!

If all goes well, you make $7,450 back on your cash in 28 days and that's 1,354% and much more than enough to pay for the CLF down the road! So that's a fun, upside hedge for those of you who were caught flat-footed by the rally but are too nervous to jump on the bandwagon after this 10% pop, which is wise as it's very likely we pull back here – just look how overbought we are!

While I've been sour on this week's action, we did take full advantage of the dip to go bullish last month and, in our Live Trading Webinar on Wednesday (when we picked the Russell as our long in the Futures), we went over our too bullish portfolios and yesterday we took some of our ill-gotten gains and added another 50 S&P Ultra-Short (SDS) June $20 calls for 0.95 ($4,750) to our Short-Term Portfolio. SDS topped out at $25 when the market fell so we can call that $25,000 worth of additional protection (we had 50 already, plus $85,000 of other hedges) while maintaining our otherwise bullish stances in our 4 Member Portfolios. Dave Fry summed it all up very nicely this morning:

There is no economic data or earnings to suggest happy days are here again. The only policy the Fed knows is one is to keep printing more money giving corporations the ability to borrow on the cheap and buy shares back in the open market. That creates a lower amount of float stimulating share prices to rise to the betterment of shareholders.

While all shareholders benefit in the short-term, those with lucrative stock options benefit the most. This, in many ways, has created the wealth inequality we here so much about. However, at the same time, this buyback activity robs investors of long term growth as corporate investing for the long-term growth disappears.

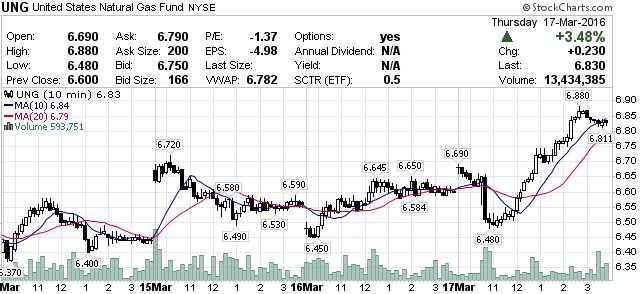

Abacab – It's an illusion, it's a game and baby, there's a hole in there somewhere but, as long as we're fooling some of the people all of the time, we are happy to go along in the Fed's wild ride! And speaking of wild rides, I'm going to be following up this morning at 10:30 with Voice of America regarding last week's live pick to go long on UNG and UCO, both of which have had fantastic weeks (you're welcome America!).

Of course, UCO was the similar trade idea to the one we featured in our Forbes Interview way back on Jan 20th. Back then, our options trade idea was:

As to oil, it never should have been at $100 in the first place. After water, oil is the 2nd most abundant liquid on the planet and there was no possible way demand could justify the supply that was on-line over the long haul so we began shorting oil at $100 and shorted more at $110 and we had (obviously) fantastic success on the way down. Yesterday we took a long on oil as it tested $29 – while we think it may go a bit lower, we think by July we’ll see $40 again and that’s +33% from here – though the options strategy we’re using will make 376% on cash if all goes well.

Those are the kind of trades we like to make at PSW!

- Buy 10 UCO July $5 calls for $3.70 ($3,750)

- Sell 10 UCO July $10 calls for $1.55 ($1,550)

- Sell 10 USO July $8.50 puts for $1.10 ($1,100)

That’s net $1,050 on a spread that will pay back $5,000 if UCO is over 10 at July options expiration day (15th). The potential downside to the trade is USO finishing below $8.50 (currently $8.79), where 1,000 shares would be assigned to you for $8,500 plus the $1,050 you already spent would effectively be $9.55 per share or, roughly $30 oil. So our worst case is being long on oil in July at $30 and our best case is making a 376% return ($3,950) on our $1,050 cash outlay. That’s not bad for 6 months’ “work”!

Well, the worst case seems to be off the table with oil already at $40 and UCO at $10.57 and the trade isn't done cooking yet but, after less than two months, the July spread is already netting out at $2,660 for a gain of $1,610 on cash (153%) already and safely on it's way to the full $3,950 profit. Technically, it's still a good trade as $2,660 will return $3,950 (148%) in just 119 days but it sounds kind of dull compared to our 376% return, doesn't it?

You can always catch these trade ideas late by waiting for someone to interview me or following me on Twitter and there's nothing wrong with making a 48% profit in just over 3 months picking up our scraps and you can do that FOR FREE, there's no need for you to SUBSCRIBE HERE!

Have a great weekend,

– Phil