Come on kids, let me tell you a story!

Come on kids, let me tell you a story!

It's the same story we tell you every time the market goes dark and you are worried about the economic monsters in your closet but it sure works to calm the investors down – EVERY TIME! Yesterday the kids were really scared so they brought out all 4 of the Fed's master story-tellers to literally speak to kids at the New York Economic Club and boy, did that do the trick!

NEW YORK—Federal Reserve Chairwoman Janet Yellen and three former Fed leaders sought to dispel worries the U.S. is heading back toward recession despite concerns about slow global growth and the expansion’s advancing age.

Ms. Yellen, joined Thursday in an unusual gathering in New York by former Fed Chairmen Ben Bernanke, Alan Greenspan and Paul Volcker, described an economy that is progressing without breeding obvious new financial bubbles that could derail growth.

“This is an economy on a solid course, not a bubble economy,” Ms. Yellen said. It has made “tremendous progress” from the damage of the 2007-2009 financial crisis.

See, everything is great – no monsters under your bed or in the closet, now go back to the store or the market and BUYBUYBUY! And BUYBUYBUY investors did, reversing half of yesterday's losses overnight – EXACTLY what we predicted would happen yesterday morning and, how did we know? Because we've heard this story 100 times at this point! As I said to our Members:

See, everything is great – no monsters under your bed or in the closet, now go back to the store or the market and BUYBUYBUY! And BUYBUYBUY investors did, reversing half of yesterday's losses overnight – EXACTLY what we predicted would happen yesterday morning and, how did we know? Because we've heard this story 100 times at this point! As I said to our Members:

I am simply in awe of the effort that is being put in by the G20 to manipulate the markets. This morning Italy is up 3% on yet another bailout from the EU. The fact that we need these bailouts (despite all the "oversight" and stress tests) doesn't bother anyone – as long as the FREE MONEY keeps coming.

And, of course, our own Fed heads talked up the economy and, more importantly, their ability to wisely steer it, last night. The main message was well-delivered, using the history of the 4 speakers, they reminded people of how many crises they had steered us through in the past and how worried we all were at the time and how crazy they seemed at the time but how, in the end, they were right and wise and fair and just and it all works out so BUYBUYBUY because all shall be well.

And all is, indeed, well this morning and we're back to Friday's open (2,045 on the S&P) but far below Friday's close (2,075) but this too is what we predicted on Monday and, needless to say, we've had a fantastic week – though we could have just as well taken it off as net nothing happened in the bigger picture. In fact, my Monday comments about Trump's Recession have now been scientifically verified by Money Pulse, who say "more than 25% of Americans indicate they've become more cautious with their money as a result of this presidential campaign."

Remember, I can only tell you what is going to happen and how to make money playing it – the rest is up to you! 8)

Speaking of which, yesterday, in our Morning Post (which you can have delivered to you pre-market every day by signing joining us HERE) I said to you: "Of course, we don't really care about technical voodoo – the reason we're long on /NKD at 15,600 is because it puts pressure on Abe and the BOJ to take action to further weaken the Yen, which is now up 10% since February." As we expected, we got this announcement from the Finance Minister:

Japan's Finance Minister has described the dollar's recent falls vs. the yen as "one-sided movements" and vowed to intervene if necessary to continue the country's fight against deflation.

"We are watching moves with a sense of tension," Taro Aso told a press conference after the greenback sank to a 17-month low of 107.67 yen on Thursday. "We will take necessary steps in accordance with circumstances."

Of course, that sent the Nikkei flying higher, now over 16,000 and, at $5 per point per contract – we're already up $2,000 per contract off our 15,600 bullish entry – what a nice way to end the week! And, I will remind you – this is the same chart, with the same lines that I drew for you when describing this trade idea in yesterday's post – only it hadn't happened yet – our goal was just 15,900, the rest was gravy (or soy sauce)!

Needless to say, we're still running cautious into the weekend and we even got a bit more bearish yesterday, cashing in some of the longs from our Options Opportunity Portfolio to tilt it more bearish into the weekend. If we're wrong, and the markets turn higher – then we have cash on the side and plenty of hedges and we can aggressively add more longs but I super-duper doubt that's going to be necessary.

Needless to say, we're still running cautious into the weekend and we even got a bit more bearish yesterday, cashing in some of the longs from our Options Opportunity Portfolio to tilt it more bearish into the weekend. If we're wrong, and the markets turn higher – then we have cash on the side and plenty of hedges and we can aggressively add more longs but I super-duper doubt that's going to be necessary.

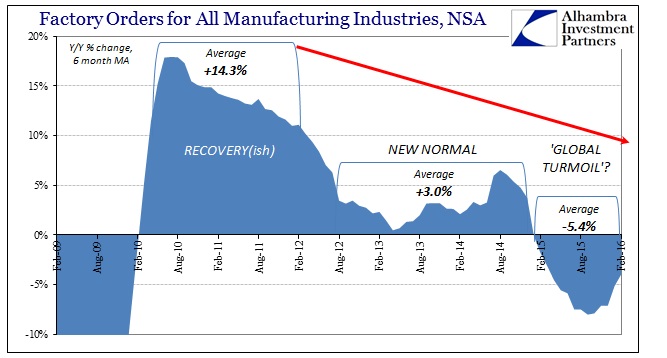

Even as I write this (8:25) William Dudley (NY Fed Head) is making a doveish speech in Hartford, saying the Fed will take a very cautious approach to rate hikes while at the same time telling us how the economy is improving. Those two things don't really go together but it's the story the Fed wants us to accept despite all those suspicious noises coming from the closet. For example, here's what we see when we actually look under the bed at the Manufacturing numbers Uncle Dudley says are "improving":

I don't know if milk and cookies are going to make this one all better, folks. Not to end the weekend on a down note but I know there are people there who think the magic pixie who runs the Fed these days can fix anything but she can't and you're going to be very upset when you find out it's just a nice old lady who puts a quarter under your pillow when you lose a tooth and, no matter how hard you wish for a comfortable retirement – she's not going to be able to make it happen – you'll have to learn to do the work and get there yourself! Here's a short list of this weekend's potential monsters – please hedge wisely!

- The end of short covering and 'Fed put' spells market trouble

- Fed’s George says commercial real estate a potential asset bubble

- ALBERT EDWARDS: A 'tidal wave' is coming that will throw the US into recession

- DoubleLine's Gundlach says negative interest rates backfiring

- Consumer Credit Rises $17.2 Billion; Holding Of Federal Debt Hit New All Time High

- KKR has a 'chilling' message about the end of the credit cycle

- "Deeply negative outlook for earnings now set in stone" – Nomura

- China’s Stocks Head for Longest Losing Streak Since January

- China Junk Spread at Record Low

- Santander seen failing U.S. stress test again

- Fast Retailing Plunges After Profit Outlook Cut to 5-Year Low

- Gap(GPS) Tumbles After Its March Sales Miss Already-Low Expectations

- Copper Heading for Worst Week Since January on Demand Outlook

- Spending in Canada's energy sector suffers record drop

- AK Steel, U.S. Steel downgraded to Sell at UBS

- It's Probably Nothing": Truck Orders Plunge 37% As Unsold Inventories Soar Most Since 2007

- Is This Why Car Sales Are Soaring

Hopefully, everything will be fine but, as I often remind our Members: "Hope is not a valid trading strategy."

Have a great weekend,

– Phil