A big nothing.

A big nothing.

That's what came out of Obama's meeting with Yellen and company last night. The White House issued a very short, meaningless statement which seemed very odd following an "emergency meeting" with the Fed. Of course, as former Fed adviser, Andrew Levin, reminds us: "A lot of people would be stunned to know” the extent to which the Federal Reserve is privately owned… Currently, the leaders of the New York, Philadelphia, Dallas and Minneapolis Fed banks are helmed by men who formerly worked for or had close connections to investment bank Goldman Sachs." So, when the Fed has an emergency meeting with the White House – it's really our favorite Banksters making demands of the President.

Very likely the "emergency" is the horrific earnings we're expecting from the Financial sector and nothing gets bankers to take action faster than a threat to their bonuses – especially this close to the time of year when they have to come up with deposits on their Hampton beach houses. Goldman Sachs, who arguably steered the United States right into the subprime crisis with Trillions of Dollars in risky mortgages repackaged as AAA paper – finally paid a $5Bn fine yesterday (0.1%) – a very small consolation as the statute of limitations runs out on criminal prosecutions for those "shitty deals":

There's a great documentary called "The Men Who Crashed the World" that summarizes the events leading up to the crisis and the scary thing today is that NO ONE went to jail and most of the same people are in the same positions today, once again writing the same kinds of loans with new packaging – setting us up for the next financial crisis. Even worse, they have exported their expertise and now demand for World Bank loans is back at pre-crisis levels – and this isn't even a crisis – yet!

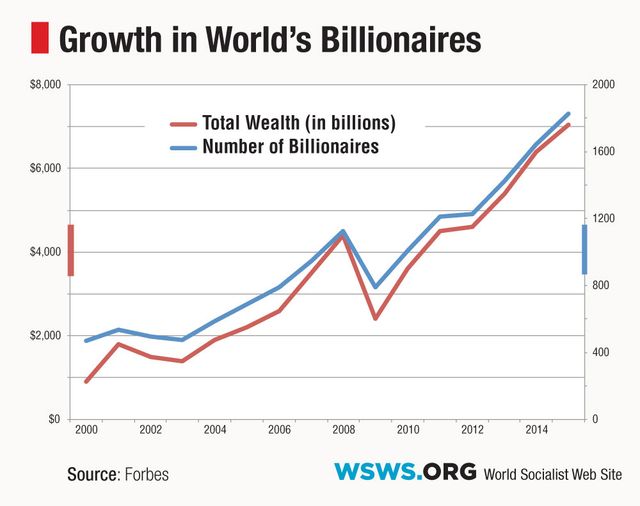

Chinese Banksters have really taken the US playbook and ran with it and China has produced 450 new Billionaires since the Financial crisis, now past the US with 568 Billionaires (1/3 of the World's total) vs. "just" 535 people with 10-figure bank accounts in the US.

Chinese Banksters have really taken the US playbook and ran with it and China has produced 450 new Billionaires since the Financial crisis, now past the US with 568 Billionaires (1/3 of the World's total) vs. "just" 535 people with 10-figure bank accounts in the US.

Imagine the affect it has on a population when 450 people scoop up $1Bn or more for themselves. Even with China's 1Bn people, it works out to about 6 month's salary of the entire population transferred to 450 people. In the US, our 568 Billionaires have $3,600,000,000,000 and if we have 320M people (close) that's "only" $11,000 for every man, woman and child that we've contributed to their piggy bank – and we have the nerve to ask them to share? We should be ashamed of ourselves – that's Commie talk, right?

Fortunately, President Trump will never let that happen or, if we elect President Cruz, he will LOWER the taxes paid by our 568 best people by 15% so that the wealth will "trickle down" to the other 319,999,232 of us. Sure, it hasn't happened yet, but it does work for Mr. Cruz, who is funded by a dozen different Billionaires who are simply too lazy to run themselves, unlike Mr. Trump. In fact, while Trump may spend $100M of his own money to become President – he says it's still cheaper than buying Ted Cruz has been for his friends.

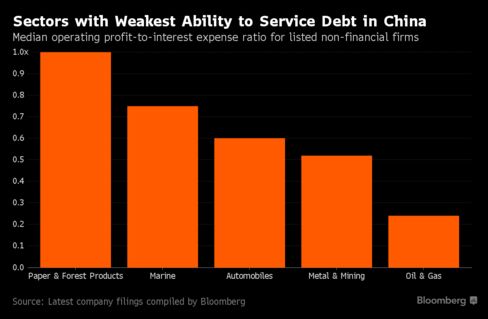

Anyway, back to China. The transfer of wealth from the poor to the rich in China has been so rapid that it's left a path of devastation in its wake. As money is sucked out of the pockets of the many and placed in the bank accounts of the few, China's economy (like ours) has stagnated as consumers can't afford to buy the goods they are producing at work and, as of last year, Chinese firms had only just enough operating profit to cover the interest expenses on their debt 2 times, down from 6 times in 2010. That means a rise in rates OR a decline in profits can quickly lead to a huge economic crisis with massive defaults.

Anyway, back to China. The transfer of wealth from the poor to the rich in China has been so rapid that it's left a path of devastation in its wake. As money is sucked out of the pockets of the many and placed in the bank accounts of the few, China's economy (like ours) has stagnated as consumers can't afford to buy the goods they are producing at work and, as of last year, Chinese firms had only just enough operating profit to cover the interest expenses on their debt 2 times, down from 6 times in 2010. That means a rise in rates OR a decline in profits can quickly lead to a huge economic crisis with massive defaults.

This hasn't come suddenly, of course, the PBOC lowered rates 6 times since 2014 in an attempt to hold off this looming disaster but, as companies rushed to refinance, debt has jumped up to 247% of GDP – worse than Japan!

"We will likely see a wave of bankruptcies and restructurings when the interest coverage ratio drops further,” said Xia Le, chief economist for Asia at Banco Bilbao Vizcaya Argentaria SA in Hong Kong. “Return on assets for Chinese companies has been declining due to rising debt. Profitability is also slowing due to overcapacity in many sectors, which has weakened the ability of companies to repay their debts."

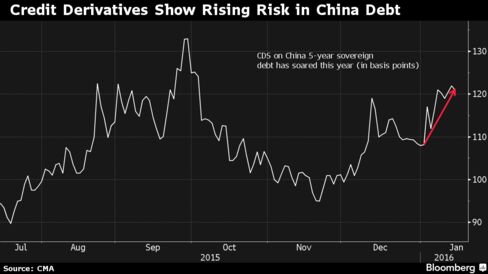

As credit stresses mount, China is drafting rules to make it easier for lenders to convert bank loans into equity stakes of debtor companies. China may also approve, as soon as this month, a plan allowing banks to convert as much as 1Tn Yuan ($150Bn) of soured debt into equity – a very bad idea. That could lead to a "vicious cycle,” said Raymond Yeung, a Hong Kong-based senior economist at Australia & New Zealand Banking Group Ltd. “More defaults will cause credit conditions to tighten so more companies will run into cash flow problems.”

Last May (in case you forgot) is when China began going off the rails – triggered by a wave of defaults that I was warning you about all spring. The problem was, I was too early with my warnings and a lot of people got complacent by May so this year I've waited before bringing it up again but the cycle will begin again soon and we need to keep our ears open for reports of Chinese loan defaults. Our own market followed China down with a 20% drop in July.

Last May (in case you forgot) is when China began going off the rails – triggered by a wave of defaults that I was warning you about all spring. The problem was, I was too early with my warnings and a lot of people got complacent by May so this year I've waited before bringing it up again but the cycle will begin again soon and we need to keep our ears open for reports of Chinese loan defaults. Our own market followed China down with a 20% drop in July.

And, of course, Japan, Brazil, Greece, Italy, Argentina, Venezuela, Puerto Rico, Jamaica, Ukraine… have I mentioned how much I like CASH!!! lately? These are just a few things to worry about before we start worrying about the still-likely Brexit and the repercussions on the Euro-zone. In fact, just this morning, the President of the EU Parliament said a Brexit vote this summer will lead to the “implosion of the EU” as many of the remaining 27 countries will also want to “escape”. When the head of the EU uses the word "escape" – perhaps his title should be Warden – because clearly most of those 27 countries are already economic prisoners who deeply regret their once-voluntary confinement in the EU.

In an interview with German newspaper Frankfurter Allgemeine Zeitung, Mr Schulz said: “We are in Europe for some time now on a downward path. The trust of many people in institutions as a whole, whether national or European, has been lost.” He added: “If the British leave the EU, there will be demands for further escape referendums."

Amid rising euroscepticism across Europe, Mr Schulz confessed there was now a widespread view that the EU is unable to deal with its mounting difficulties, such as the eurozone debt disaster, migration crisis and the threat of terrorism. He said: "The EU has been created as a tool for solving problems, but many people have the impression that it is rather part of the problem because of the solution." Already a poll revealed a majority of Dutch voters backed the country having a further in/out referendum on its EU membership.