You are welcome!

You are welcome!

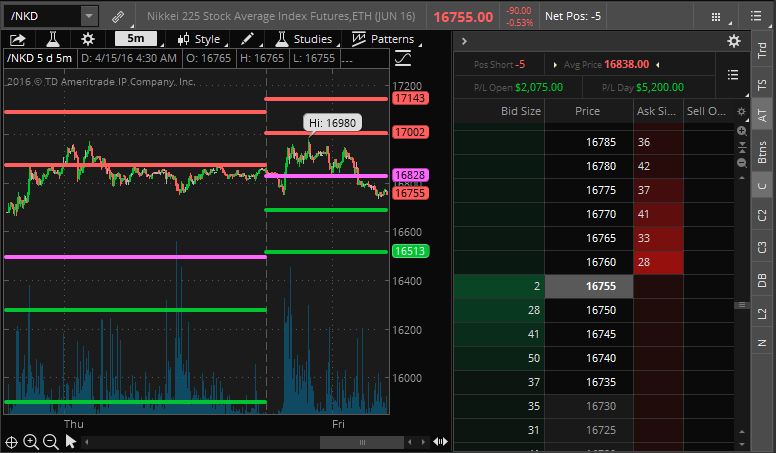

That's right, yesterday we told you that the Nikkei was facing the Kobayashi Maru and we picked a short on the Futures (/NKD) at 16,830 and m-m-m-my Kuroda literally went to war with us, calling the Yen's recent strength "excessive" and warning speculators (us) not to get on the wrong side (our side) of his trade. Rather than getting out, we decided to press our bet as the Nikkei tested the 17,000 line (down $850 per contract) as I said to our Members in Live Chat at 11:43 pm (yes, we work that long and hard):

What complete and utter BS!

I'm still in and would like to add some more to bring the average up to 16,800 if possible – no change in premise – just more talk and no actual action. Hopefully, we'll be back to 16,800 by 3am (EU open).

As I write this (8:05) we're now down to 16,700 so 16,750 is now our stop to lock in a $2,000 gain on 5 contracts and each 100 points now is good for another $2,500 and our target is that 16,000 line but each 100 we drop, we lower the bar on 1 more contract to the last 100 line we pass. For the Futures challenged, in our Webinar, we discussed playing the Nikkei short using the EWJ May $12 puts at 0.35, which closed yesterday at 0.34 – so don't complain you didn't have time to get that one. If we're right about the Nikkei dropping 700 points (4%) that would drop EWJ ($11.89) to $11.41 so 0.59 on the puts and let's say we look for 0.50 and a 0.15 (42%) profit by Tuesday – that's almost as much fun as playing the Futures!

We're not just shorting Japan, of course. In our Live Member Chat Room yesterday, we added $8,500 to our ultra-short S&P ETF (SDS) in our Short-Term Portfolio – exactly as we planned to do, using a portion of the unrealized profits we made in our Long-Term Portfolio this week to lock in some of the gains (the same way we lock in Futures gains by setting stops along the way).

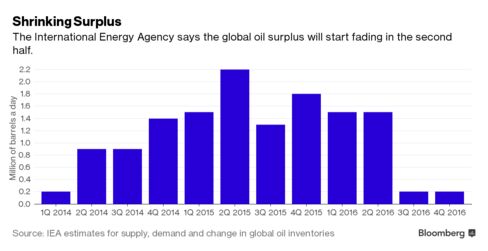

We shorted oil futures (/CL) at the bell yesterday as it tested $42 based on the ridiculous amount of fake, Fake, FAKE!!! open front-month orders at the NYMEX and the FACT that the storage facilities at Cushing, OK (where the NYMEX oil is delivered), as well as everywhere else in the country are full, Full, FULL!!! It's a simple investing premise and one we make money on on a regular basis at PSW – simply because we pay attention to basic fundamentals like these.

We shorted oil futures (/CL) at the bell yesterday as it tested $42 based on the ridiculous amount of fake, Fake, FAKE!!! open front-month orders at the NYMEX and the FACT that the storage facilities at Cushing, OK (where the NYMEX oil is delivered), as well as everywhere else in the country are full, Full, FULL!!! It's a simple investing premise and one we make money on on a regular basis at PSW – simply because we pay attention to basic fundamentals like these.

Yes, there's a big OPEC meeting this Sunday (again, see yesterday's post) but they are talking about a production FREEZE, not cuts and a freeze won't do anything to burn of the massive global glut of oil that is sloshing around out there and oil had already run up from $32.50 to $42 (29%) in anticipation of this and we considered 30% a bridge too far and $42.25 is right about where we spiked to a halt, which was also $45 on Brent Crude (/BZ) – so a perfect spot to go short.

This is the kind of stuff we teach our Members to look for at Philstockworld, SIGN UP HERE – end of commercial.

Even with the anticipated OPEC production freeze (I don't even think they'll accomplish that – hence our S&P shorts) and even with a presumed involuntary reduction in US production (due to lack of E&P spending for the past year, bankruptcies, etc), which was the Saudi goal in the first place, the EIA still projects a 200,000 barrel/day SURPLUS though the end of the year.

Even with the anticipated OPEC production freeze (I don't even think they'll accomplish that – hence our S&P shorts) and even with a presumed involuntary reduction in US production (due to lack of E&P spending for the past year, bankruptcies, etc), which was the Saudi goal in the first place, the EIA still projects a 200,000 barrel/day SURPLUS though the end of the year.

Surplus means too much, not too little, and our storage facilities are bursting at the seems and there is NO indication that demand is picking up (global economy still languishing) so WHAT THE HELL ARE PEOPLE BULLISH ABOUT? The 30% pop in oil is a sentiment change that has NOTHING to do with the underlying fundamentals of supply and demand and, though we were bullish on oil at $32.50, our target was and remains $45 in July as the high of the year. $42 in April is simply too far ahead of the curve, so we're looking for a correction and then we'll go long again.

Meanwhile, speaking of our crappy economy, this chart of Retail Sales should sober you up but, when viewed in conjunction with Consumer Credit – it should scare the crap out of you!

We recently saw the “retail sales figures” for March which were, to say the least, disappointing. I say this because these numbers expose the flawed economic theories of the mainstream proletariat that the abnormally warm winter and exceptionally low energy prices should boost spending due to the relative savings.

Despite ongoing prognostications of a “recession nowhere in sight,” it should be remembered that consumption drives roughly 2/3rds of the economy. Of that, retail sales comprise about 40%. Therefore, the ongoing deterioration in retail sales should not be readily dismissed.

More troubling is the rise in consumer credit relative to the decline in retail sales as shown below.

What this suggests is that consumers are struggling just to maintain their current living standard and have resorted to credit to make ends meet. Since the amount of credit extended to any one individual is finite, it should not surprise anyone that such a surge in credit as retail sales decline has been a precursor to previous recessions.

CASH!!! is your friend. Hedges are your friend – be very careful out there as the earnings season roller coaster is just rolling out of the gate (103 S&P companies report next week) and it's going to be a very wild ride!

Have a great weekend,

– Phil