Financial Markets and Economy

The Buy-Bunds/Sell-Treasurys Trade Is Pulling Back Again (Wall Street Journal)

Here is one factor that may reduce the risk of a sharp rise in U.S. government bond yields: The unwinding of the relative-value trade between U.S. and Germany government bonds.

U.S. economy seen growing 0.4 percent in first quarter: Atlanta Fed (Reuters)

The U.S. economy is growing at a 0.4 percent pace in the first quarter following the latest data on home resales and durable goods orders, the Atlanta Federal Reserve's GDPNow forecast model showed on Tuesday.

Durable Goods Orders Increase, Led By Defense; Autos Decline 3%, Shipments Down 0.5% (Talk Markets)

Durable goods orders for March rose 0.8% following a downward revision in February from -2.8% to -3.1%.

S&P Strips Exxon of Triple-A Credit Rating (Wall Street Journal)

Exxon Mobil Corp. was stripped Tuesday of the perfect triple-A credit rating it has held for more than six decades by Standard & Poor’s Ratings Services, a sign that the oil bust is hurting even the strongest players in the energy industry.

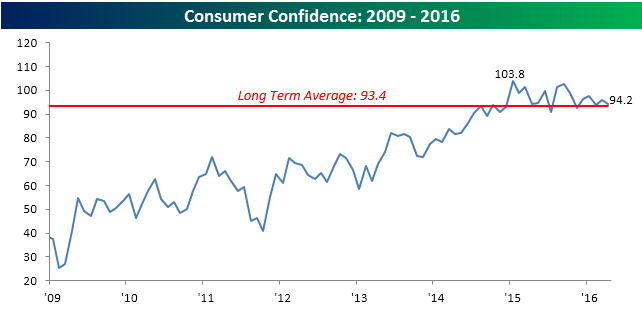

Consumer Confidence Weaker Than Expected (BeSpoke)

Consumer Confidence saw a larger than expected decline in April falling from last month’s reading of 96.1 down to 94.2 versus expectations of 95.8. As shown in the chart below, Consumer Confidence is hanging in there above its long-term average of 93.4, but the trend of lower highs is concerning.

Guess How Much Cubans Earn Per Month (Forbes)

Sorry investors, outside of the tourism business, Cuba’s economy isn’t that interesting and the purchasing power of the locals is a paltry $25 per person, per month. Unless Apple can make a MciPhone and General Motors can price its Chevrolet Cruze model at about two thousand bucks, then the largest Caribbean island is still just a booming business for Carnival Cruise and other love boats looking for mambo kings and a good cigar.

Apple Shares Are on Track to Be the Dow's Biggest Losers (Bloomberg)

For the fourth time in five quarters, shares of Apple Inc. are poised for a post-earnings drop.

The Mirage of a Return to Manufacturing Greatness (NY Times)

Half a century ago, harvesting California’s 2.2 million tons of tomatoes for ketchup required as many as 45,000 workers. In the 1960s, though, scientists and engineers at the University of California, Davis, developed an oblong tomato that lent itself to being machine-picked and an efficient mechanical harvester to do the job in one pass through a field.

As Wages Keep Rising, So Does Employee Turnover (Fortune)

Want proof that the job market just keeps getting better (for employees and job seekers, anyway)? Full-time employees ages 25 to 34 got an average 10% pay hike if they changed jobs in the first quarter of this year, up from 8.3% in the last three months of 2015, according to the latest quarterly Workforce Vitality Report from ADP Research Institute and Moody’s Analytics. Older job switchers didn’t do too badly, either. People ages 35 to 54 who moved to a different job saw an average pay increase of almost 5%, versus just over 3% in last year’s fourth quarter.

Slower Growth Projected For US Q1 GDP (Capital Spectator)

What a difference a month makes for anticipating Thursday’s “advance” GDP report for the first quarter. In late-March economists were projecting US growth at 1.5%-plus, perhaps even in the low-2% range by some accounts (seasonally adjusted annual rate). But expectations have fallen on hard times in recent weeks and the government’s preliminary estimate of economic output in Q1 has been cut to as low as 0.1% by one firm’s reckoning. Econoday.com’s consensus forecast of 0.7% is firmer, but this estimate still represents a sharp deceleration from the already sluggish 1.4% pace in last year’s Q4.

I Hate This Market, I Love This Market (Wall Street Journal)

In markets, as in life, a sudden fright can quickly be replaced by embarrassed laughter. The fear evident earlier this year has already been superceded by nervous giggling in Western equity markets, while in some areas of commodities, where the shock was deepest, it seems to have turned into full-on hysterics.

Treasury Sells $34 Billion In 5 Year Paper In Another Mediocre, Tailing Auction (Zero Hedge)

Yesterday's 2 Year auction was surprisingly poor because, among other things, it was the first tailing auction since 2014. Moments ago the US Treasury sold $34 billion in another lackluster auction which saw the high yield print at 1.41%, tailing 0.2 bps through the When Issued.

Iconic Hedge Fund Brevan Howard Slammed With $1.4 Billion In Redemption Requests (Zero Hedge)

It had already been a very bad several years for hedge funds with 2016 starting off especially brutally, as Goldman's own Hedge Fund VIP basket demonstrates…

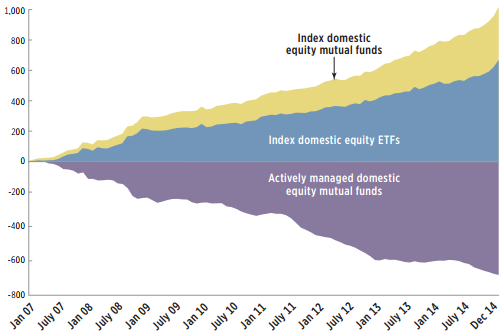

The Rise of the Most Powerful Idea in Investing (Bloomberg View)

The biggest story in the finance industry during the past decade might not be the 2008 crisis, or new regulation, or even record-low interest rates. Maybe it's the shift from active to passive-investment management. In the realm of mutual funds, the change is stunning. Here is a picture of fund flows in billions of dollars since 2007.

As Worries Grow About a Tech Bubble, Know The Realities of Every Investment Platform (Inc.)

As Worries Grow About a Tech Bubble, Know The Realities of Every Investment Platform (Inc.)

On May 16th 2016, the SEC will, after a huge delay in even publishing the rules, make the JOBS act final, allowing businesses to use crowdfunding to raise a funding round. This is a great scenario for many entrepreneurs; it's the chance to solicit and raise capital in addition to or instead of difficult-to-access investors who are becoming increasingly scared of taking risks.

How Have Stocks Fared the Past 50 Years? You'll Be Surprised. (Motley Fool)

With stock market prices fluctuating wildly during the first quarter, it's important to consider the longer-term movements of equity prices when trying to decide what to do with your money. As I've said many times, making investing decisions based on short-term price movements can be dangerous. Here, I'd like to examine the long term a little bit closer to see if it can tell us anything about the future.

U.S. Service Sector Growth Remains Subdued, “Fragile” (Mish)

The Markit Services PMI diffusion index is hovering just above 50, the boundary between expansion and contraction.

Big Banks Might Have To Hold a Year's Worth of Cash In Reserve (Fortune)

On the heels of a proposal to curb Wall Street pay, U.S. regulators are reportedly set to present another ruleTuesday that could force 30 of the nation’s biggest banks to hold enough cash to prop themselves up through a year of economic turmoil.

P&G profit beats estimates on cost cuts, price hikes (Reuters)

Procter & Gamble Co, the maker of Tide detergent and Gillette shaving products, reported a better-than-expected quarterly profit, boosted by cost-cutting and higher selling prices.

Why do we pay so much for lousy investment advice? (LA Times)

The unspoken subtext of the Obama administration's recent initiative on brokers' responsibilities to their clients was that individual investors are vulnerable to being ripped off by the financial services industry. (I wrote about the new broker rules here.)

Politics

“Late Night” host Seth Meyers took a “Closer Look” at Donald Trump’s recent rebranding strategy, led by controversial lobbyist Paul Manafort.

“Manafort was brought into the campaign in part to help Trump run a more traditional operation,” Meyers explained, “and also to ensure GOP officials that Trump, despite his public rhetoric, isn’t going to war with the party.”

Trump and Hillary refuse to explain why they both share the address in Delaware (Black Listed News)

This brick-and-mortar, nondescript two-story building in Wilmington, Delaware would be awfully crowded if its registered occupants — 285,000 companies — actually resided there. What’s come to be known as the “Delaware loophole” — the unassuming building at 1209 North Orange Street — has become, as the Guardian described,“famous for helping tens of thousands of companies avoid hundreds of millions of dollars in tax.”

What to Look For in Tuesday’s East Coast Primaries (Wall Street Journal)

Opinion polls indicate Tuesday’s slate of Democratic and Republican primaries are likely to reaffirm the leads of the two front-runners, Hillary Clinton and Donald Trump. But the results Tuesday night will be about more than simple momentum; they will tell us a lot about the state of races that have been in flux for months.

Technology

Automakers entrenched in fuel cell hydrogen are succumbing to physics and going electric (Electrek)

Automakers entrenched in fuel cell hydrogen are succumbing to physics and going electric (Electrek)

I think we are witnessing the start of a new (but long overdue) trend this year. The few established automakers still pushing fuel cell hydrogen vehicles appear to be warming up to battery-powered electric vehicles instead. Honda, Toyota and Hyundai, arguably the automakers most stuck on hydrogen, all announced new electric vehicle programs in the past few weeks.

Someone invented a drone that will follow you around and take selfies (Business Insider)

Someone invented a drone that will follow you around and take selfies (Business Insider)

Is this the future of selfies?

Instead of a selfie stick, a startup called Zero Zero is working on an autonomous drone called the Hover Camera that follows you around everywhere, snapping photos and shooting video.

Health and Life Sciences

Musical rhythm helps babies find patterns in speech (Futurity)

Musical rhythm helps babies find patterns in speech (Futurity)

A series of play sessions with music not only improved 9-month-old babies’ brain processing of music, but also speech sounds, report researchers.

“Our study is the first in young babies to suggest that experiencing a rhythmic pattern in music can also improve the ability to detect and make predictions about rhythmic patterns in speech,” says lead author Christina Zhao, a postdoctoral researcher at the University of Washington’s Institute for Learning & Brain Sciences (I-LABS). “This means that early, engaging musical experiences can have a more global effect on cognitive skills.”

This Gin Is Supposed To Make Its Drinkers Look Younger (Popular Science)

This Gin Is Supposed To Make Its Drinkers Look Younger (Popular Science)

Drinking to youth may have gotten a little too literal this year thanks to a new spirit.

Anti-aGin is a new collagen-infused gin, and its creators think it will make drinkers look younger. They've selected botanicals (the key flavoring ingredients that a clear distilled alcohol is "steeped" in to make flavorful gin) that promote youth, revitalization, and all the things people want to hear an anti-aging product does.

Life on the Home Planet

An Earth made verdant by greenhouse gases brings its own dangers (New Scientist)

An Earth made verdant by greenhouse gases brings its own dangers (New Scientist)

Half our planet’s vegetated surface has become significantly greener in the past three decades. Plants in many regions – from stocky shrubs of the Arctic to towering trees of the rainforest canopy – are growing more and bigger leaves, according to the latest evidence. Leaf for leaf, it’s as though 4.4 billion giant Sequoia trees have been added to the Earth.

'Human swan' to join Russia migration (BBC)

'Human swan' to join Russia migration (BBC)

A conservationist plans to take flight this autumn alongside thousands of swans as they make a 4,500-mile journey from the Russian arctic to the UK.

Sacha Dench will fly by paramotor – paragliding with a propeller strapped to her back – to get as close as possible to flying as the swans do.