I told you so!

Aside from saying CASH!!! 9 times in the morning post (and 3 more in our Live Member Chat Room during the day), we laid out a perfect hedge on the Nasdaq using the Ultra-Short (SQQQ) that will now be over $8,000 in the money off our $1,100 outlay with another $8,000 to gain if the Nasdaq gets any worse – not bad for a day's work, right? Actually, the real money was made in the evening, as my last trade idea for our Members in Live Chat (3:19 pm) was:

Into the close I kind of like shorting Nikkei Futures (/NKD) at 17,530 as long as it stays below 17,550. If we go down – they'll go down but if we go up, they are already up and I doubt the pop so fast as you can't stop out. Obviously, if AAPL earnings are good – get out.

As you can see on the /NKD chart, we nailed the move and caught a 230-point drop to the 17,300 line for a $1,150 per contract gain. We'll be doing one of our World famous Live Trading Webinars this afternoon (1pm, EST) where, among other things, we teach the fine points of Futures trading.

As you can see on the /NKD chart, we nailed the move and caught a 230-point drop to the 17,300 line for a $1,150 per contract gain. We'll be doing one of our World famous Live Trading Webinars this afternoon (1pm, EST) where, among other things, we teach the fine points of Futures trading.

In last week's Webinar (replay available here), we left off with 11 short oil contracts (/CL) at $43.54 and 3 short S&P (/ES) contracts at 2,101 and the S&P fell to 2,080 the next day (21st) for a $3,150 gain and oil hit our goal at $43 for a $5,940 gain. This morning, we shorted oil again at the $45 line, but with tight stops above as we're wary of the inventory report at 10:30.

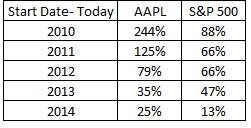

Futures trading is how we amuse ourselves at Philstockworld, as we're not day traders and long-term trades – if done properly – are BORING! Our Long-Term Portfolio, however, is not boring at all – closing out yesterday up 94%, though we'll take a little hit on Apple (AAPL) this morning. Speaking of AAPL, the details are on our main page but the gist of my Live Chat comment to our Members was:

$50.6Bn in revenues and $10.5Bn ($1.90/share) profits does not suck – especially since this is an average quarter so $9/share for the year(ish) is a p/e of 13.3 at $120. Name a bigger, safer stock than that?

Also, $175Bn share buyback will decrease the float by 30% on this dip (if they stay low). That will raise earnings to $12 a share and a p/e of 10 – and that's assuming no growth! I was praying they'd miss so we can get bigger on AAPL and I am THRILLED to hear it when "weak hands" bail over what, for any other company, would be the greatest earnings report in their history.

So we will be buyers of AAPL on the dip but not right away – we'll give them time to settle but the closer we get to $90, the harder it will be to resist and, below that, the volume spike you see will be us jumping in and BUYBUYBUYing! As an early entry, we like the same puts we sold yesterday – now we'll get more money for them. Meanwhile, AAPL is very heavily owned by hedge funds and, if they start heading to the exits en mass – $90 will not be the bottom!

So we will be buyers of AAPL on the dip but not right away – we'll give them time to settle but the closer we get to $90, the harder it will be to resist and, below that, the volume spike you see will be us jumping in and BUYBUYBUYing! As an early entry, we like the same puts we sold yesterday – now we'll get more money for them. Meanwhile, AAPL is very heavily owned by hedge funds and, if they start heading to the exits en mass – $90 will not be the bottom!

Don't forget we have the Fed statement today at 2pm (during our Live Webinar) but, as noted by BlackRock's Larry Fink, we MUST have infrastructure investing to kick-start the economy at this point. "While some countries, like Spain or France, don’t have room to increase spending, the U.S. and the U.K. are going to see an emphasis on fiscal measures, without those measures, the outlook would be grim.” Grim is not a word we like to hear from the head of a $4.7 TRILLION fund, is it?

We get our Q1 GDP Report tomorrow morning (8:30) and it's going to be somewhere around 0.3-0.7% (Atlanta Fed measured 0.4% yesterday), which is really, REALLY sad. We'll be watching out for Consumer Spending, which has been weak and Business Investment, which is way down due to cutbacks in the Energy Sector but weak all around. Home sales have showed signs of slowing too – reacting very badly to even tiny rises in rates.

We get our Q1 GDP Report tomorrow morning (8:30) and it's going to be somewhere around 0.3-0.7% (Atlanta Fed measured 0.4% yesterday), which is really, REALLY sad. We'll be watching out for Consumer Spending, which has been weak and Business Investment, which is way down due to cutbacks in the Energy Sector but weak all around. Home sales have showed signs of slowing too – reacting very badly to even tiny rises in rates.

The first quarter is generally slow but don't let the MSM cheerleaders fool you with that line as Q4 is usually good and our Q4 SUCKED at 1.4% vs 2.6% in Q4 2014 and 2.4% in Q4 2013. One obvious culprit is our reliance on the rest of the World to buy our stuff (see Apple earnings!) and the rest of the World is not spending money – as evidenced by this chart of net exports:

Now, that's net of imports and our main import is oil and that is down 60% from 2014 so our Net Export picture is MUCH WORSE than it looks because the 9M barrels of oil we import each day for $50 less than we paid in 2014 are cutting the Import side of the equation by $164Bn therefore, the net, net exports are actually down more like $700Bn and that's $700Bn less revenue to be spread among our earnings reports.

Apple has certainly done their share with an $8Bn revenue drop from last year (13%) – let's see how it's going for the rest of the S&P this week and next!