Financial Markets and Economy

Wrong-Way Bets Rule U.S. Stock Market's $3 Trillion Recovery (Bloomberg)

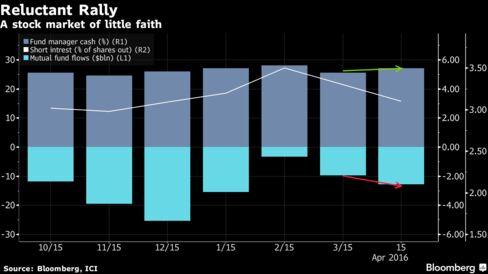

Here’s what happened during the rebound in equities that added nearly $3 trillion to U.S. share values in 10 weeks: mutual funds hoarded cash, short sellers tightened their grip on bearish bets and individuals bailed out of the market.

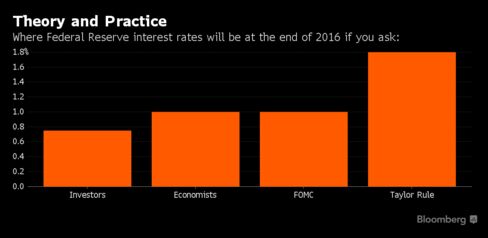

Fed Ponders Catchup With Economic Theory Signaling Rates Too Low (Bloomberg)

When does treading carefully lead to falling behind?

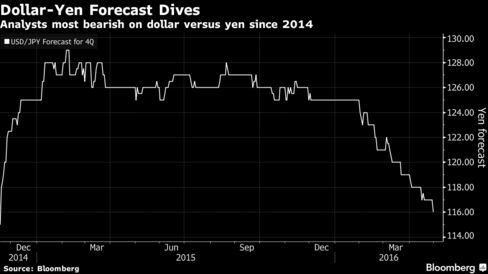

Dollar Forecasts Versus Yen Tumble to Lowest in 17 Months (Bloomberg)

With the U.S. economic outlook faltering, forecasters are the least bullish on the dollar against the yen in 17 months after the Bank of Japan held off on carrying out more stimulus.

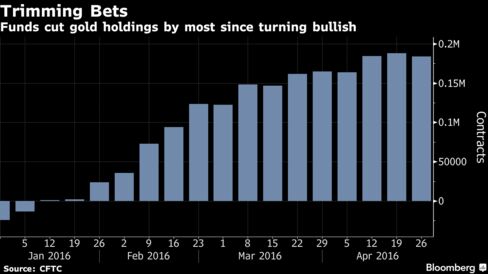

Gold Keeps Shining as Funds Miss Out on Best Rally in Two Months (Bloomberg)

Nothing seems to be slowing down the gold market, even when speculators take a step back.

Goldman targets 'mass affluent' borrowers with unusual lending plan? (Reuters)

Goldman Sachs Group Inc, the banking gold standard for the world's elite, sees a future in less prosperous investors.

G-7 Pledges to Support Energy Investments Amid Oil Downturn (Bloomberg)

The Group of Seven countries will promote investing in energy projects through the oil price crash to ensure a steady stream of supply, ministers from the member countries said Monday.

Dollar May Drop to 103 Yen Before Bouncing Back, GCI Says (Bloomberg)

The dollar’s tumble against the yen is driving it down so fast as to make it ripe for a sudden pullback, according to Tatsuhiro Iwashige, the chief foreign-exchange strategist of the investment solutions group at Tokyo-based hedge fund GCI Asset Management.

China April official factory activity expands but at slower pace (Reuters)

Activity in China's manufacturing sector expanded for the second month in a row in April but only marginally, an official survey showed on Sunday, raising doubts about the sustainability of a recent pick-up in the world's second-largest economy.

Big bargains entice Warren Buffett fans on Berkshire weekend (Reuters)

Warren Buffett, the CEO of Berkshire Hathaway Inc, is known for his keen eye for a bargain.

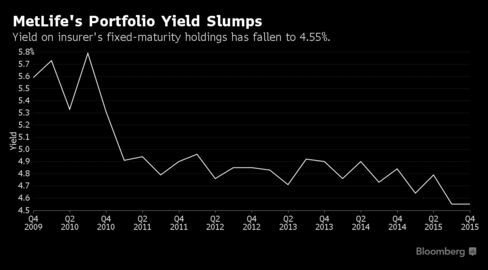

Slow Bleed From Low Bond Yields Drains Returns for Life Insurers (Bloomberg)

MetLife Inc. Chief Executive Officer Steve Kandarian has a $350 billion problem.

The Most Powerful Principle In Trading Psychology (Trader Feed)

The Most Powerful Principle In Trading Psychology (Trader Feed)

Is there a change you would like to make in your trading? In your trading psychology? In your personal life?

If you're looking to improve yourself, to continually develop as a person, change will become your norm. But how do we make changes, and why do so many of the changes we attempt never stick?

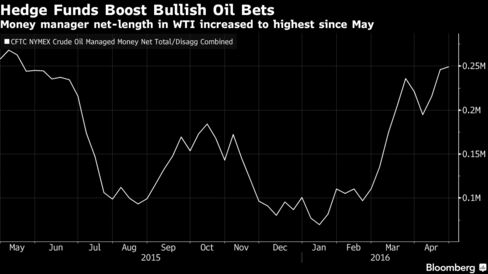

Oil Bulls Bet the Waning U.S. Shale Boom Will Curb Global Glut (Bloomberg)

Hedge funds are rooting for a quick collapse of the U.S. shale boom.

Exxon's Worrying Lack of Worry (Bloomberg Gadfly)

Three out of four ain't bad. But in dealing with the downturn, Big Oil is still drawing heavily on its reserves of oil and gas, credit — and reputation.

As oil plows through $45 a barrel, U.S. producers rush to lock in prices (Reuters)

U.S. oil producers pounced on this month's 20 percent rally in crude futures to the highest level since November, locking in better prices for their oil by selling future output and securing an additional lifeline for the years-long downturn.

The flurry of dealing kicked off when prices pierced $45 per barrel earlier in April. It picked up in recent weeks, allowing producers to continue to pump crude even if prices crash anew.

The Big Spenders on R&D (Bloomberg View)

Amazon.com and Facebook had great earnings reports this week. They also reported spending a lot of money on the future. Capital spending was up 35 percent at Amazon and 125 percent at Facebook in the first quarter compared with the same quarter last year. Research and development spending was up 28 percent at Amazon and 26 percent at Facebook.

Tokyo slide keeps mood downbeat (Reuteres)

A 3-percent drop in Japanese shares and weakness in the banking sector kept financial markets on edge on Monday, although stock markets in both Europe and the United States were on track for some minimal gains.

With trading thinned by holidays in London and a number of Asian countries, a solid showing for manufacturing sentiment in Germany drove the Frankfurt stock exchange up about 1 percent.

Puerto Rico Will Default on Government Development Bank Debt (Bloomberg)

Puerto Rico will default on a $422 million bond payment for its Government Development Bank, escalating what is turning into the biggest crisis ever in the $3.7 trillion market that U.S. state and local entities use to access financing.

Gold in Asia Trades Near Highest in 15 Months as Dollar Declines (Bloomberg)

Gold held near its highest in about 15 months in Asian trading as the dollar reached the lowest level in almost a year. Palladium touched the highest since November.

Japan final April manufacturing PMI hits lowest since Jan 2013 after Kumamoto earthquake (Reuters)

Japanese manufacturing activity contracted in April at the fastest pace in more than three years and output fell the most in two years, a final survey showed on Monday, after earthquakes halted production in the southern manufacturing hub of Kumamoto.

This Tech Bubble Is Bursting (Wall Street Journal)

When the dot-com bubble burst in early 2000, the fallout for publicly traded stocks was quick and severe. The Nasdaq Composite Index fell 37% in the 10 weeks following its peak on March 10, 2000.

Incoming Delta Chief Plans to Hold Off on Oil Hedging for Now (Bloomberg)

Delta Air Lines Inc.’s Ed Bastian, the incoming chief executive officer, said he has seen too many bad bets on the price of fuel for the carrier to start hedging again soon.

U.S. Stocks Advance as Commodities Slide, Emerging Assets Drop (Bloomberg)

U.S. shares rebounded from the worst week since February, while emerging-market assets retreated as investors pared back higher-risk holdings with many markets across the world closed for holidays. Gold reached the highest in 15 months.

European Stocks Climb After Weekly Drop as Fiat Leads Auto Gains (Bloomberg)

European stocks eked out gains in thin trading as automakers advanced, after the Stoxx Europe 600 Index ended last week at its lowest level in more than two weeks.

Virgin Australia Sees Lower-Than-Expected Profit as Demand Falls (Bloomberg)

Virgin Australia Holdings Ltd.’s full-year profit may be less than half that expected by analysts amid capacity cuts and weak travel demand.

Valeant’s CEO Was Key Force on Pricing (Wall Street Journal)

Valeant’s CEO Was Key Force on Pricing (Wall Street Journal)

In early 2015, when Valeant Pharmaceuticals International Inc.’s top brass met to set prices on a soon-to-be-acquired cardiac drug, some executives suggested slow, staggered price increases. Chief Executive Michael Pearson disagreed.

To reach Valeant’s internal profit targets, Mr. Pearson lobbied for a single, sharp increase. Hospitals could still make a profit at the higher price, he argued, which meant patients would still have access to the drug. The team deferred.

Japan's 20-Year Bond Yields Slide to Record Amid Yen Strength (Bloomberg)

The yield on 20-year Japanese government bonds slid to a record as the yen’s surge to an 18-month high drove a slump in the nation’s equities.

When Sentiment Conflicts With Investing Reality (Bloomberg View)

It is never wise to ignore market, economic or voter sentiment. Discount it, yes. Put it into broader context, for sure. But ignore it at your peril. As too many retailers, fund managers and politicians have discovered, the public is often a good barometer of what is occurring in the broader economy.

Halliburton-Baker Hughes Deal Collapses Amid Global Opposition (Bloomberg)

Halliburton Co.’s “unfixable” plan to merge with Baker Hughes Inc. finally collapsed under the weight of worldwide antitrust opposition.

India’s Sensex Extends Last Week’s Retreat as ICICI Bank Tumbles (Bloomberg)

Indian stocks declined, extending last week’s retreat, as a selloff in Asian stocks sapped demand for riskier assets.

Politics

Clinton's Battle Plan (The Atlantic)

Clinton's Battle Plan (The Atlantic)

As they look ahead to the general election, some commentators envision a campaign in which Donald Trump attacks viciously and Hillary Clinton makes a virtue of her refusal to stoop to his level. “I think Trump’s method will be to turn on the insult comedy against Hillary Clinton,” declared GOP consultant Mike Murphy earlier this week. “Her big judo move is playing the victim.” Vox’s Ezra Klein speculated earlier this year that “Trump sets up Clinton for a much softer and unifying message than she’d be able to get away with against a candidate like [Marco] Rubio.”

Sanders Vows Contested Convention, Makes Case for Superdelegate Flips (Bloomberg)

Sanders Vows Contested Convention, Makes Case for Superdelegate Flips (Bloomberg)

Bernie Sanders on Sunday marked the one-year anniversary of his bid for the White House by vowing that the Democratic convention will be "contested," despite Hillary Clinton's wide lead in pledged and overall delegates.

Indiana to test Donald Trump’s staying power with evangelicals (Reuters)

Donald Trump's success in the race for the White House may well ride on the support of Republican evangelicals made wary as the front-runner reveals a more liberal side to his social views.

A case in point is Tuesday's nominating contest in Indiana, a conservative Midwestern U.S. state that has voted Republican in nine of the last 10 presidential elections.

Spanish Politics Enters Uncharted Waters as Election Looms (Bloomberg)

The first phase of Spain’s second political transition draws to a close on Monday with four different parties sharpening their attacks for a renewed assault on government.

The deadline for patching together a majority from the most fragmented parliament in Spanish history falls at midnight on May 2, triggering a repeat election for late June.

Technology

Solar Impulse heads for Phoenix (BBC)

Solar Impulse heads for Phoenix (BBC)

The zero-fuel aeroplane has left Mountain View, California, bound for Phoenix, Arizona, on what is the 10th leg of its round the world quest.

Health and Life Sciences

Could The Most Effective Birth Control Soon Become The Cheapest? (Forbes)

The most effective reversible forms of birth control are mostly priced out of reach for millions of women who need it most—until now. An unusual partnership between a nonprofit pharmaceutical company and a traditional pharmaceutical distributor aims to increase access to IUDs (intrauterine devices) for U.S. servicewomen and in public clinics.

The Science of Fat: After ‘The Biggest Loser,’ Their Bodies Fought to Regain Weight (NY Times)

Danny Cahill stood, slightly dazed, in a blizzard of confetti as the audience screamed and his family ran on stage. He had won Season 8 of NBC’s reality television show “The Biggest Loser,” shedding more weight than anyone ever had on the program — an astonishing 239 pounds in seven months.

Here’s how low testosterone raises diabetes risk (Futurity)

Doctors have long known that men with low testosterone are more likely to develop type 2 diabetes.

Now, for the first time, they have identified how the hormone helps men regulate blood sugar by triggering key signaling mechanisms in islets, clusters of cells within the pancreas that produce insulin.

Life on the Home Planet

Recycled coffee grounds could make roads smoother and greener (New Scientist)

Recycled coffee grounds could make roads smoother and greener (New Scientist)

Your morning pick-me-up could make your drive smoother. Engineers have turned coffee grounds into building materials for roads.

British-born man breaks world record for freediving (The Telegraph)

British-born man breaks world record for freediving (The Telegraph)

A British-born New Zealander has set the freediving world record with a 400-foot plunge in the Bahamas which lasted four minutes and 24 seconds.

Describing it as a “tough dive”, William Trubridge broke his own free immersion diving record of 397 feet from 2011 but said he struggled during the ascent and feared he would lose consciousness.