F is for Failure.

It's also for Finance Ministers and F is also the grade they got at this weekend's G7 meeting after failing to accomplish anything to calm the markets. As you can see from the Nikkei chart, Japan's markets opened down a quick 2% before recovering half as it gyrated wildly into the close after testing 16,666, which is how the Banksters signal their minions that the fix is in and they have control.

For those of us not looking for Satanic messages from the trading floor, 16,500 is a strong (40% of the run) retrace from the bottom we called at 15,900 back on May 4th (good for a $5,000 per contract gain) to the top we called at 16,900 on May 11th (good for a $2,000 per contract gain) so you're welcome for those! Remember – I can only tell you what the markets are going to do and how to make money trading them – the rest is up to you…

16,700 is the 20% (weak) retrace and, per our 5% Rule™, so upside resistance there is a bad sign and, if we bounce between there and 16,500, we're likely consolidating for a move down, which is likely if Japan fails to get permission to further devalue the Yen by the end of the G7 Bosses Meeting on Friday. So we can look forward to another week of rumors and innuendo but the fun won't end there as OPEC then has their meeting on June 2nd. Have I mentioned how much I like CASH!!! lately?

The lack of consensus over which policy levers to pull comes as Japanese Prime Minister Shinzo Abe prepares his heavily indebted nation for what may be another dose of spending to help the struggling economy. Ideally, he’d like the blessing of his G7 peers before doing so, but expectations are low that national leaders can go one step further on any economic accord when they meet in Japan later this week.

"Globally coordinated stimulus and cooperative exchange-rate management look a distant prospect amid deep G-7 divisions," said Frederic Neumann, co-head of Asian economic research at HSBC Holdings Plc in Hong Kong. "Japan’s desire to attain acquiescence for intervention to prevent Yen strength is running into resistance from trading partners worried about their own competitiveness amid sluggish growth."

As a group, the G7 agreed not to target currencies to stoke growth and warned of the negative consequences from disorderly moves in exchange rates. The currency rift also undermines a theory that policy makers used a Shanghai gathering of the larger Group of 20 economies in February to agree on a secret pact to weaken the dollar, similar to the 1985 Plaza Accord.

This is far from the end of it as, just this morning, Japan's April Trade Data showed exports falling a shocking 10.1%, accelerating March's 6.8% decline as the Yen gained 4% over that two-month period. On a year/year basis, Japan's exports are now down 23% and they are buying 10% less as well – this is the World's 3rd largest economy falling apart right in front of us, folks. Have I mentioned how much I like CASH!!! lately?

This is far from the end of it as, just this morning, Japan's April Trade Data showed exports falling a shocking 10.1%, accelerating March's 6.8% decline as the Yen gained 4% over that two-month period. On a year/year basis, Japan's exports are now down 23% and they are buying 10% less as well – this is the World's 3rd largest economy falling apart right in front of us, folks. Have I mentioned how much I like CASH!!! lately?

As nicely explained by Harvard's Martin Fedlstein (one of the few Economists who isn't a moron), Japan's rising level of National Debt absorbs funds that would otherwise be available to finance productivity-enhancing business investment. Businesses now fear that the increasing deficits will lead to higher taxes, further discouraging investment. When interest rates rise, as surely they must, the cost of servicing the debt will require higher taxes, hurting economic incentives and weakening economic activity and the persistence of large deficits reduces the room that governments have to increase spending when there is an economic downturn.

Japan is already past saving with almost 250% of their GDP in debt and 40% of their annual tax receipts now going to debt service and they are STILL running a 10% annual deficit (here's me discussing it on TV earlier this month). Imagine what happens to them if interest rates double! Of course, interest rates are currently negative so, if Japan can move fast enough and refinance that debt into negative rates – their debt will ADD money to their economy for a few years (until the notes mature) and THEN it will all explode in their faces. Either way, they are f**ked – and I don't mean that they are going to stop using chop sticks and switch to European eating utensils!

Japan is already past saving with almost 250% of their GDP in debt and 40% of their annual tax receipts now going to debt service and they are STILL running a 10% annual deficit (here's me discussing it on TV earlier this month). Imagine what happens to them if interest rates double! Of course, interest rates are currently negative so, if Japan can move fast enough and refinance that debt into negative rates – their debt will ADD money to their economy for a few years (until the notes mature) and THEN it will all explode in their faces. Either way, they are f**ked – and I don't mean that they are going to stop using chop sticks and switch to European eating utensils!

You KNOW this is unsustainable, you KNOW this is going to end badly so please do not act surprised when there's a tipping point at which the broad market finally becomes aware of this and the whole global ball of debt begins to unravel, let by the Japanese Government and Chinese businesses – who are in even worse shape than Japan is.

We talked about China last week and, according to the Financial Times this weekend, the Chinese Government has been bailout out businesses at an alarming rate and doing it in an even more alarming way – by forcing banks to forgive debts in exchange for company stock. In just two months of this program, $220Bn of debt has been converted to stock – in companies that couldn't afford to pay their debts! – and now that stock is carried on the balance sheets of the banks as if they had any real value.

This accomplishes several things: It takes the bad debts off the banks books, it takes the debt obligation off the companies' books, it makes it look like banks actually WANT to own shares of Chinese companies because, 3 months from now, when you are looking at the list of major shareholders of Chinese companies, you'll be impressed to see that several banks are major shareholders. Admit it, that's what will happen as you'll have forgotten this article by then.

This accomplishes several things: It takes the bad debts off the banks books, it takes the debt obligation off the companies' books, it makes it look like banks actually WANT to own shares of Chinese companies because, 3 months from now, when you are looking at the list of major shareholders of Chinese companies, you'll be impressed to see that several banks are major shareholders. Admit it, that's what will happen as you'll have forgotten this article by then.

This years Debt to Equity program is replacing last year's $612Bn Debt to Bond program because companies haven't been able to pay the interest on the bonds either – this should fix everything! As noted by Zero Hedge: "Coercing banks to become stakeholders in companies that could not pay back loans will further weigh down profits this year. Instead of underpinning stability at banks, the efforts undermine it." The good news for China is that by swapping one bad asset into another, it may have confused the market long enough to buy a few quarters of time.

As I noted on Friday, maybe we'll muddle through and the markets won't correct over the summer but I see no reason for them to rally back over 2,100 on the S&P, up less than 2.5% from here, while there is just as much chance of a 10% of worse correction for these and many other reason so, unless you are very, very comfortable with your hedging strategies – I would strongly suggest having a lot of CASH!!! in your portfolio – just in case things do hit the fan harder than we think they will.

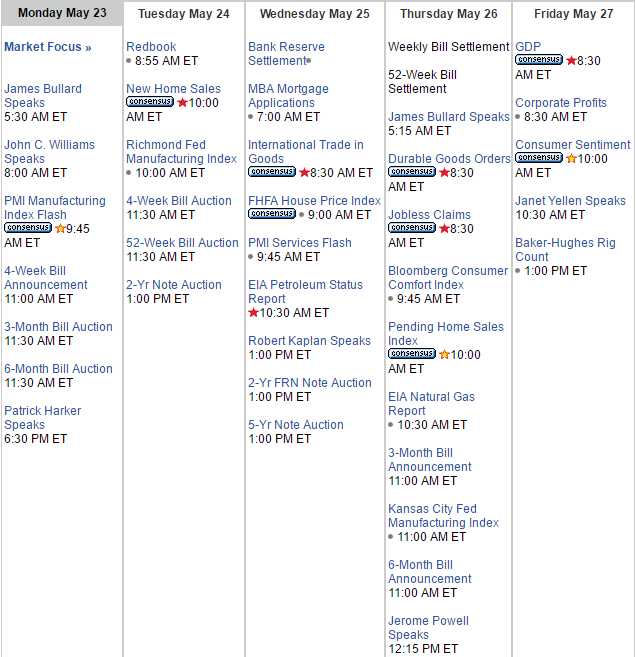

I know it's a holiday weekend but watch out for Friday as we get our Q1 GDP (0.7% expected) and then Yellen speaks at 10:30 so don't plan on leaving too early if you have a lot at risk! Yellen with be the 7th Fed speaker of the week as they attempt to clean up the mixed message that traders took from last week's minutes so we'll see how they do propping up the markets but so far, so lame as we had Bullard and Williams go already and nothing but gyrations around the flat-line into the morning open and ahead of our PMI Report.