Wheeee, what fun!

Wheeee, what fun!

Another day, another 10 points closer to 2,100 on the S&P and, during yesterday's Live Trading Webinar (replays available at our YouTube channel) we shorted the Nikkei (/NKD) Futures at the 17,000 line and that trade alone was good for $1,000 per contract as we hit our 16,800 goal overnight. We didn't wait for the overnights, however as we had a live $525 gain on /NKD along with another $580 on our Natural Gas (/NG) Futures longs and making over $1,000 in a 2-hour webinar (plus another $110 on the Dow shorts) was plenty to lock in at the time.

Not being able to trade the futures is like not having a hammer in your toolbox. Sure, you can get by using your other tools to hammer things in when the need arises but isn't it better to learn how to use a hammer so that, any time something needs to be nailed – you have the proper tool. As I said two weeks ago, when we made $683.50 in 10 minutes while teaching Members how to trade the Futures:

If you want to get an idea of the techniques we teach our Members at Philstockworld, you can check out the replay here – unless, of course, you already make more than a $4,000 hourly rate – then we have nothing to teach you.

Today we are shorting oil (/CL) IFF (if and only if) it crosses back below the $50 line and we will have tight stops over the line. $50 is a good point of resistance and the main reason oil is high is because the Dollar is down 0.3% this morning and, of course, because it's a holiday weekend and they are trying to screw you at the pump. In fact, we're also playing gasoline (/RB) over the $1.65 line, also with very tight stops.

The key to Futures trading is finding a good support/resistance line where you can set tight stops where the risk significantly outweighs the reward. Gasoline contracts pay $420 per penny and we were over $1.67 on Tuesday so we expect to test it today for an $840 per contract gain and, if not, we'll be out by $1.649 with a $42 loss so the potential reward far outweighs the risk.

That's pretty much how we try to structure all our trades using our Be the House – NOT the Gambler system. Let other people PAY YOU to take risks while you sit back and make money collecting the risk premiums on every trade – it's the only sure thing in the markets, so why not take advantage of it?

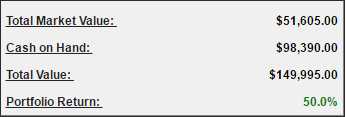

It's the system we teach in our Option Opportunities Portfolio, which you can follow, live, over at Seeking Alpha. Yesterday we shared our Nasdaq Ultra-Short (SQQQ) hedge in the morning post, which is a fine example of our strategy and, yesterday, I'm happy to say the OOP finished the day up just under 50%, doing better than our 5% monthly average goal that we set for ourselves back on August 8th last year, when we initiated the new portfolio.

It's the system we teach in our Option Opportunities Portfolio, which you can follow, live, over at Seeking Alpha. Yesterday we shared our Nasdaq Ultra-Short (SQQQ) hedge in the morning post, which is a fine example of our strategy and, yesterday, I'm happy to say the OOP finished the day up just under 50%, doing better than our 5% monthly average goal that we set for ourselves back on August 8th last year, when we initiated the new portfolio.

The reason we have so much cash in the portfolio is because we SELL risk to others. For instance, in yesterday's Nasdaq hedge, we sold 4 Target (TGT) 2018 $60 puts for $5.10 ($2,400) to help pay for the hedge. TGT is currently at $69.28 and what we've done is collect $2,400 in exchange for our promise to buy 400 shares of TGT for $60 between now and Jan, 2018. Our worst case is having 400 shares of TGT assigned to us for $24,000 (and we have 10% of that in our pocket for the contracts), which is a 13.4% discount to the current price already, so the contracts give you net 23.4% off the current price (cash + the lower strike).

That's another one of our Educational Videos: "How to Buy a Stock for a 15-20% Discount" and imagine how much better off your portfolio would be if you had bought every single stock in it for a discount over the years. It always amazes me that the same people who brag about sending their kids off to get $200,000 college educations don't invest $10,000 learning how to trade properly. A person trading a $100,000 portfolio can save that much every year with this basic technique alone!

Meanwhile, let's look for the next great trade idea. We have a Durable Goods report this morning and the headline was a healthy 3.4%, miles better than 0.7% expected but, if you strip out volatile Transportation, it's just an anemic 0.4% and, if you take out Defense, now we're -0.8% – that's NOT GOOD. No change in our stance though – we know the economy is still weak and we know the rally is BS so we continue to wait it out.

Meanwhile, let's look for the next great trade idea. We have a Durable Goods report this morning and the headline was a healthy 3.4%, miles better than 0.7% expected but, if you strip out volatile Transportation, it's just an anemic 0.4% and, if you take out Defense, now we're -0.8% – that's NOT GOOD. No change in our stance though – we know the economy is still weak and we know the rally is BS so we continue to wait it out.

As a new trade, I like an old trade from our OOP and that's Williams-Sonoma (WSM), who just beat by 0.03 with 6.5% better sales in Q1 than last year, bucking the negative retail trend. Though WSM is down at $52, we sold the Jan $60 puts in the OOP for $10.91, netting us in for $49.09. It's an aggressive play we've added to on the way down but we're happy with our target and you can still sell the Jan $50 puts for $5 to net in at $45, which is 13.5% below the current price – most likely, you'll just end up keeping the $5 as WSM goes higher and the short puts expire worthless. Our worst-case scenario is owning WSM back at the 4-year lows, from before the analysts found out they were wrong!