Things are turning ugly again.

We are now officially short on the market and just in time, it seems as the EuroStoxx index is down 0.666% for the day and 3.33% from the top and it's another 145-point drop to our next support at 2,850 but call it the 5% Rule™ from 3,000, of course.

Speaking of the 5% Rule™, we nailed it with our oil prediction yesterday as Oil Futures (/CL) topped out right at $51.67 and, as I said in yesterday's morning post: "Our plan is to short 1x here ($51.15) and go to 2x at $52.25 to average $51.70, then half out at $51.70 and we'll see how far it falls." We didn't go quite as high as we'd hoped but our oil shorts already paid off nicely this morning as we fell back to $50.80 and we stopped out at $50.85 and now we're back short again below the $50.80 line, hopefully for a ride back to $50 but a tight stop still at $50.85, which risks a $50 per contract loss against possible $800 per contract gains, again:

.jpg)

We knew it would be something – that's why we called for CASH!!! on Tuesday, while everyone else was in a greed-buying frenzy. Today we can blame Mario Draghi, who spoke at the ECB's Economic Forum this morning and sent the markets into a dive (down 1%ish in Europe) by saying the truth – that monetary policy alone could not fix Europe's problems and that "if other policies are not aligned with monetary policy, inflation risks returning to our objective at a slower pace."

This marks a big shift from Draghi subtly hinting that the ECB needs to provide its own stimulus programs (preferably infrastructure spending) to outright begging as it's becoming clear that QE is losing it's effectiveness in the stalling economies of Europe and, as Draghi notes, it's not enough:

Bank balance sheets have not yet been fully repaired, as illustrated by the high stock of non-performing loans in some parts of the euro area. So more work-out of these non-performing assets will have to take place, and the conditions for that will have to be put in place by the right policies and authorities.

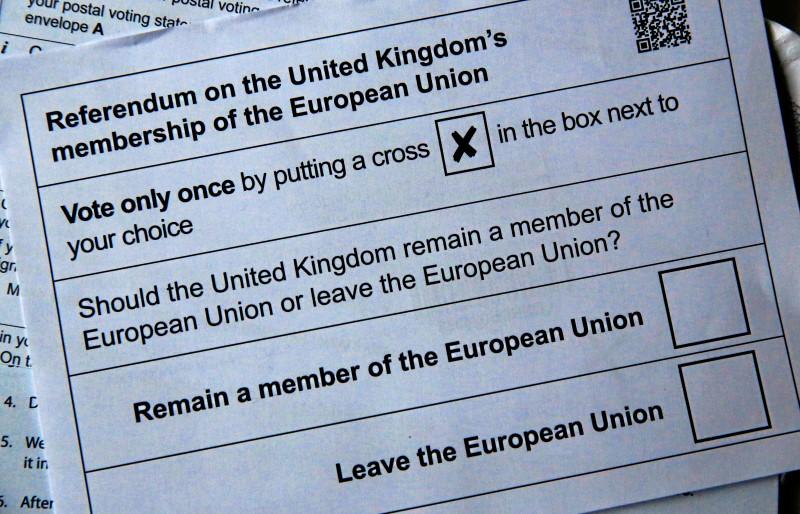

That's right, the European Central Bank is not the right authority to fix bank balance sheets – get it? I'll tell you who gets it, the 52% of the UK population who are voting to leave this madhouse in two weeks! And that, of course, is Draghi's current excuse for why the ECB's idiotic policies are failing:

That's right, the European Central Bank is not the right authority to fix bank balance sheets – get it? I'll tell you who gets it, the 52% of the UK population who are voting to leave this madhouse in two weeks! And that, of course, is Draghi's current excuse for why the ECB's idiotic policies are failing:

And that sort of uncertainty not only impacts on firms that borrow to finance real investment. It can also affect the saving rate of firms and households, as the perception of higher risk can call for higher precautionary savings. This would obviously run against the efforts of monetary policy to stimulate higher investment and consumption.

So I will only note once more the critical need to restore clarity and confidence on the institutional setup of the euro area. We know that the current setup is incomplete. There is a large degree of agreement on what its shortcomings are, and many proposals have been put forward on how to overcome them. Progress in this field is necessary for the long-term, but it is also relevant for the short-term because of its effect on investment.

Isn't it nice of Draghi to sum up our short case for us? Even if the UK remains in the EU, Draghi is telling you that the current setup is "incomplete" with shortcomings that still, 23 years after the EU was formed (1993), haven't been fixed. If the UK stays nothing will change and, if the UK leaves then their ancient enemy, France is already planning to punish the UK to dissuade other countries from following them out the door.

“If we say you are outside the EU but can keep all of the advantages, access to the single market without any solidarity, it’s a terrible message for the rest of the EU,” said a senior EU diplomat who asked not to be named due to the non-public nature of discussions. “[A painless Brexit] is impossible if we want to keep the rest of the EU present.”

Wow, it sounds like my daughters and their friends talking about boys in High School! It's an empty threat though, meant to scare the Leave voters ahead of the referendum (23rd), because the UK has 2 years to unwind it's business ties with the EU and the time-frame can only be accelerated if BOTH parties (UK and EU) agree to terms and, for France, it would be economic suicide to hamper relations with the UK, who are their 2nd biggest trading partner after Germany.

Wow, it sounds like my daughters and their friends talking about boys in High School! It's an empty threat though, meant to scare the Leave voters ahead of the referendum (23rd), because the UK has 2 years to unwind it's business ties with the EU and the time-frame can only be accelerated if BOTH parties (UK and EU) agree to terms and, for France, it would be economic suicide to hamper relations with the UK, who are their 2nd biggest trading partner after Germany.

In reality, France needs to take action to stop their own people from voting on a Frexit as 61% of their population have an unfavorable view of the EU vs "just" 48% in the UK. I'm not sure if you can believe the poll though, as they think 27% of the Greek people have a favorable view of the EU and I challenge you to go to Greece and find 27 people in the whole country who share that opinion!

In reality, France needs to take action to stop their own people from voting on a Frexit as 61% of their population have an unfavorable view of the EU vs "just" 48% in the UK. I'm not sure if you can believe the poll though, as they think 27% of the Greek people have a favorable view of the EU and I challenge you to go to Greece and find 27 people in the whole country who share that opinion!

As it has been proven by the complete failure of Conservative austerity and tax cuts in Brownback's failed state of Kansas, the Central Banksters are reaching the ends of their abilities to prop up the economy and they have failed to get the economy moving again. The EU is as gridlocked as Washington – full of wrong-headed Conservatives who still believe trickle-down economics will somehow save us – despite the fact that it hasn't worked for the first 40 years since Reagan sold the World that bill of goods.

At the time, George Bush the 1st called it "Voodoo Economics" yet Voodoo has somehow become our Global religion and, surprise, surprise – our prayers are going unanswered. Conservatives like Brownback and our beloved Central Banksters are calling for more entrails and another round of blood sacrifices to appease the economic Gods but I think it's time to let the Keynesians out of their cage and push forward some real stimulus programs – before the economic stagnation becomes permanent.