That's how many of your fellow Americans have "a great deal" or "quite a lot" of confidence in banks. Only 18% of the people have confidence in Big Business and just 9% have confidence in Congress. 9% – that's not even the whole top 10% that Congress works for!

This is supposed to be a Democracy, folks – in a real Democracy, half of us should be happy with the people we voted for – certainly not 9%. Something is very, very wrong with this country if we are seeing these kinds of numbers but at least it's encouraging to see that the public is finally waking up to the idea that TV News and Newspapers are not to be trusted.

This is what I mean when we are having discussions in chat and I point out to our Members (who are almost certainly in the Top 10%) that we live in a bubble and that the rest of the country is deeply unhappy with the way things are – about 10% more unhappy than they were 10 years ago at this pace. That's an important number because we're down to our last 10% and we can't afford another 10 years of eroding trust or soon it will be just us rich folks defending our institutions from the 90% that are mad as Hell and not going to take it anymore.

Do we even have it in us anymore to be angry about what our nation is becoming? Only 30% of us have faith in the schools we send our own children to where they are supposed to be prepared for their lives ahead and, if not, they may have to deal with a criminal justice system that not even 1/4 of us believe in. That's kind of ridiculous, isn't it?

That's why the Brexit vote next Thursday is such a big deal – one country, one Democracy on this planet – our closest cousins, in fact, is putting their foot down and saying "we don't know if things will be better or worse but we do know that what we have sucks – so we're voting to change." Obama was elected on the "Change" platform but, as evidenced by the poll above, nothing has changed – we need something more drastic than a new President.

That's why the Brexit vote next Thursday is such a big deal – one country, one Democracy on this planet – our closest cousins, in fact, is putting their foot down and saying "we don't know if things will be better or worse but we do know that what we have sucks – so we're voting to change." Obama was elected on the "Change" platform but, as evidenced by the poll above, nothing has changed – we need something more drastic than a new President.

Later today, we hear from the Fed President but, of course, nothing will change. There's no way they will raise rates with all this uncertainty (told you so!) so it's all about the 6 words they will change in their statement and how those tea leaves are interpreted by the Corporate Media, who need to whip up a buying frenzy before this market completely sours so we can expect sunshine and lollipops after the Fed but none of that BS matters if we don't make our strong bounce levels (see yesterday's post).

We will be on LIVE for the Fed announcement, which comes at 2pm, an hour into our weekly Live Trading Webinar, so join us there and hopefully we can have some fun trading the Futures around the event. Oil is hitting our $47.50 target today and that's up over $3,500 per contract from where we called it a short during last week's Webinar (right at the open, in fact) and, in last week's FREE morning post (you're welcome). Who else tells you EXACTLY how to make $3,500 in a week on a single trade?

Today we're right at the $47.50 target we predicted last Wednesday so we're now playing LONG off that line on oil Futures (/CL) but with VERY TIGHT STOPS BELOW as there's still 190M fake, Fake, FAKE orders over at the NYMEX and only 6 days left to dump them. Figure they will actually use 15Mb and that's 175M they have to dump but it's less than 40Mb/day to roll they started the month with so there should be a bit less selling pressure, coupled with our technical support so we expect at least a $1 bounce to $48.50 and that WILL PAY $1,000 per contract. So this is me, telling you how to make $1,000 per contract trading oil – not bad for a $1,000/year newletter, right?

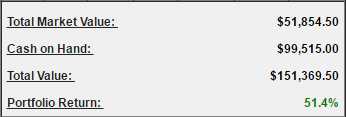

Despite our very cautious outlook into the Brexit vote, we reviewed our Options Opportunity Portfolio yesterday (see: "Options Opportunity Portfolio June Review – Up $6,818 In 5 Weeks!") and we couldn't find a single position to get rid of. Unlike our Long-Term Portfolio, which was 100% bullish and we cashed out about 1/3 of it – the OOP is self-hedging and well balanced and, as noted in the title of the review – it's doing very well in a choppy market, now up 51% since our 8/8/15 open and we're 2/3 in CASH!!!

Despite our very cautious outlook into the Brexit vote, we reviewed our Options Opportunity Portfolio yesterday (see: "Options Opportunity Portfolio June Review – Up $6,818 In 5 Weeks!") and we couldn't find a single position to get rid of. Unlike our Long-Term Portfolio, which was 100% bullish and we cashed out about 1/3 of it – the OOP is self-hedging and well balanced and, as noted in the title of the review – it's doing very well in a choppy market, now up 51% since our 8/8/15 open and we're 2/3 in CASH!!!

We'll see what kind of bounce the markets can give us today but it's all about the Fed this afternoon, after which it will be all about the Brexit vote next week – fun times ahead!