"And, has thou slain the Jabberwock?

Come to my arms, my beamish boy!

O frabjous day! Callooh! Callay!'

He chortled in his joy.

`Twas brillig, and the slithy toves did gyre and gimble in the wabe. All mimsy were the borogoves, and the mome raths outgrabe.

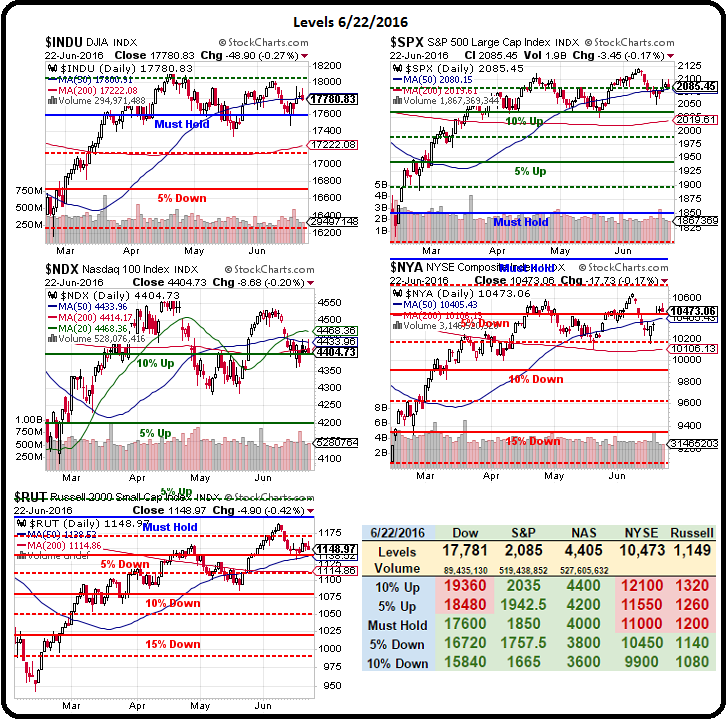

Yep, that's about how much sense the morning run makes as the UK heads to the polls on Brexit day. Early exit polls show the Remain camp with a slight lead and our indexes have rocketed back to their highs, where we've taken the opportunity to short them this morning. My note to our Members in our Live Chat Room was:

Nice test of 2,100 on /ES, which is a good shorting line along with 17,8000 on /YM, 4,450 on /NQ and 1,160 on /TF and 16,600 on /NKD is ridiculous since the Dollar is down half a point (93.23) but safer to short the US indexes since the Dollar coming back would be good for /NKD.

For our Futures, we're shorting at the 1% lines and expecting at least a small pullback off the EU's 2.5% lines to pull us back a bit. /NKD is happy because it's the Euro and Pound driving down the Yen, not the Dollar..

It's very easy to play the Futures. We had a Live Trading Webinar yesterday and we made $475 in 30 minutes just demonstrating it (we were long Oil (/CL) and Gasoline (/RB) Futures at the time, now short oil at $50 with tight stops above).

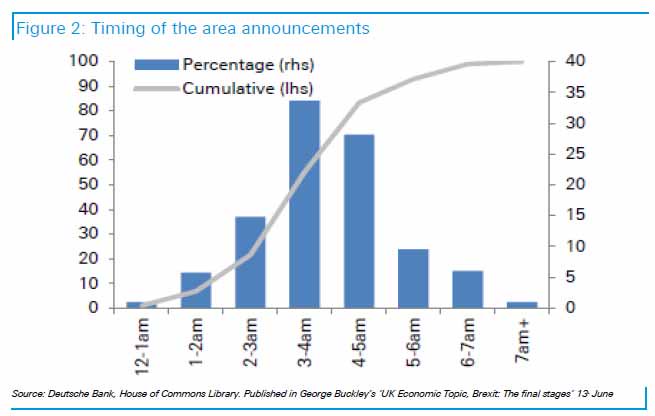

Why are we shorting? Aside from the obvious technical reason, the initial reaction is often an over-reaction and there is NO WAY that they can be certain of the vote since they haven't even begun to count yet. In fact, per this chart of the UK announcements, we won't hear the first official count until 5pm EST, as the polls don't even close until 10pm in the UK and it won't be until 5am UK (midnight EST) that 75% of the votes are counted in a close election. So, much like our Presidential elections – anyone who calls a winner this early in the day is a moron.

Why are we shorting? Aside from the obvious technical reason, the initial reaction is often an over-reaction and there is NO WAY that they can be certain of the vote since they haven't even begun to count yet. In fact, per this chart of the UK announcements, we won't hear the first official count until 5pm EST, as the polls don't even close until 10pm in the UK and it won't be until 5am UK (midnight EST) that 75% of the votes are counted in a close election. So, much like our Presidential elections – anyone who calls a winner this early in the day is a moron.

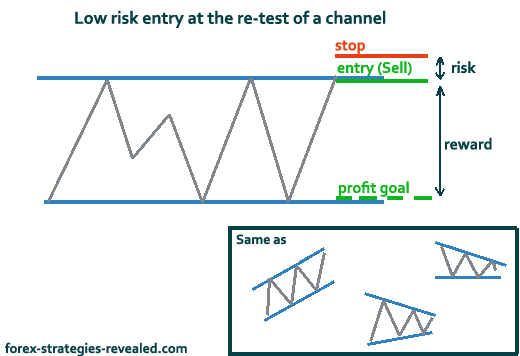

Betting against morons is how we get rich at PSW! We don't just knee-jerk bet against the trend but this is not a trend, this is a relief rally on low volume based on a rumor that doesn't justify the move – even if it is true and, as a huge bonus to us, if it's not true the markets may be "shocked" and go the opposite way and the 25-point pop in the S&P fully reverses and we make $2,500 per contract at 2,050. Take that potential win vs the potential $50 loss we'd take at 2,101 and it's a pretty good risk/reward bet at the line, right?

As I was saying in yesterday's post and in yesterday's Webinar, it's all about making steady, consistent, positive reward/risk bets over time and you would be surprised to know how often these opportunities come up every week – especially if you have access to the Futures markets.

As I was saying in yesterday's post and in yesterday's Webinar, it's all about making steady, consistent, positive reward/risk bets over time and you would be surprised to know how often these opportunities come up every week – especially if you have access to the Futures markets.

Our 5% Rule™ tells us that the 2.5% move in the EU indexes, even if justified, is ripe for a 0.5% pullback and the US indexes hit the 1% liine at the same time and generally follow Europe's lead, especially in pre-market trading so we can expect a proportional 0.2% (weak) or 0.4% pullback (strong) on the US indexes – even if they are just pausing for another move up. So, once we're below 2,095 on /ES, that becomes our stop line and our next goal is 2,090 where we certainly expect some resistance but that would already be a $500 per contract gain, which is more than enough to pay for our Egg McMuffins – so we're happy to take a profit there and move on to whatever index is lagging for the next set down (if any).

There, you are now a Futures trader – the rest is just practice. Try to make more when you win than when you lose by setting tight stops and try to win a little more often than you use by taking profits off the table and not being greedy and you will do very well. The same techniques can be applied to day-trading but we (at PSW) don't day trade stocks or options because it's nowhere near as efficient as day-trading the Futures.

If the UK votes to stay in Europe – how are we in better shape than we were a month ago, before people were worried about Brexit at all? What will have changed to justify a move over 2,100 on the S&P because the UK, tomorrow morning, will be part of the EU? Actually, once we're done obsessing over Brexit, we move on to obsessing over earnings and we've already had worrisome reports from CarMax (KMX), Barnes & Noble (BKS) and Bed Bath and Beyond (BBBY) and this afternoon we hear from Sonic (SONC) and we'll see if consumers are at least still eating hamburgers – but they are not, according to Nomura, who say "burger sales have decelerated meaningfully."

SONC is just under the $30 line but they aren't a great short since they already announced on May 18th that same-store sales are trending below guidance and that's why they fell to $30 in the first place. More likely than not, there will be a relief rally that pops them back over $30 tomorrow but it's a tough call so we're not interested – we prefer to make our bets on things we're sure about…

Only betting on things we're sure about is really the key to our success. Even when we're sure, we get it wrong often enough but not making trades when we're not sure saves us from being wrong so often that we actually seem like we know what we're doing. It's probably the single most effective adjustments you can make to your trading habits – one which falls under the category of PATIENCE, which is, by far, the hardest thing we try to teach our Members.

Next week we have earnings from Carnival (CCL), Nike (NKE), Monsanto (MON), Apollo (APOL), Pier 1 (PIR), Darden (DRI), Schnitzer Steel (SCHN) and Micron (MU) and things don't really get serious until July 11th, when Alcoa (AA) officially kicks off the earnings season.

If you want a fun play today, SCHN should benefit from yesterday's ITC ruling that the US may put duties of 500% on imports of certain Chinese steel products in anti-dumping retribution. This is also fantastic for Cliffs Natural (CLF) – a big holding of ours at PSW.

SCHN pays a 4.25% dividend, which makes them an OK stock to own but we never pay retail at PSW and 4.25% is only 0.75 a year and we can collect $1.50 right now for selling the Feb $13 puts, which is 2x a year's dividend collected for just 8 months and we don't even have to bother owning the stock. Our worst case is being assigned SCHN at net $11.50, which is 29% off the current price – nothing wrong with that! So we can commit to owning 2,000 shares by selling 20 contracts for $3,000 and the net ordinary margin requirement is $2,635 so very margin-efficient as well. Let's add 20 shorts to our Long-Term Portfolio.

See, that's how we come up with a trade idea at PSW. We read the news, think of companies that might be affected, find ones that are trading below value and then construct a sensible options play to take even further advantage of the situation. Once you get used to our system, you will never pay retail for a stock again!

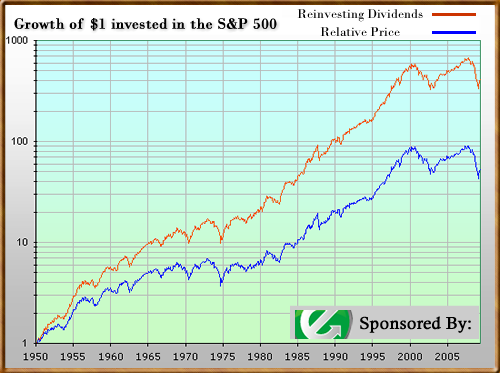

Investing should not be hard. People make it hard because they confuse trading with investing and trading is very, very hard. If you had put all your money in the S&P 500 (SPY) in May of 2006 and reinvested the dividends, you'd be up 98% today – not terrible for 10 years (7% annualized). You can do the calculations yourself here but 20 years is 351% at 7.8% average and 30 year is 1,596% at 9.9% average (1986 was a good year to start!) and if you old folks had put $100,000 in SPY in May of 1976, you'd have $6,312,757 today from your 6,312% gain averaging 10.9% per year.

Investing should not be hard. People make it hard because they confuse trading with investing and trading is very, very hard. If you had put all your money in the S&P 500 (SPY) in May of 2006 and reinvested the dividends, you'd be up 98% today – not terrible for 10 years (7% annualized). You can do the calculations yourself here but 20 years is 351% at 7.8% average and 30 year is 1,596% at 9.9% average (1986 was a good year to start!) and if you old folks had put $100,000 in SPY in May of 1976, you'd have $6,312,757 today from your 6,312% gain averaging 10.9% per year.

That's why we are THRILLED to find nice, conservative plays like SCHN which puts $3,000 in our pocket against a $2,635 margin requirement in exchange for our promise to buy 2,000 shares of a $16.25 stock if it falls below $13 ($26,000). Even if we assume the whole net $23,000 is "at risk" – it's still a 13% return in 8 months – well ahead of the S&P average in a position we expect to have no reason to touch until it expires in February, releasing our obligation and leaving us with $3,000 cash in our pocket.

If SCHN isn't too much higher, we might just sell more puts or, if it's taken off on us – we will read the news and find our next bargain. That's it, that's all there is to our system. They keep asking me to write a book but this is the only chapter!

Plenty of craziness ahead with the Brexit. We're very well-hedged and, frankly, don't care – the Futures trades are just for fun while we wait for the decision.