This is the end

My only friend, the endOf our elaborate plans, the end

Of everything that stands, the end

No safety or surprise, the end

Well, we couldn't be happier.

I'm sorry if you're reading this and you are losing money in this downturn – clearly you're not one of our Members as we had a very happy Friday in our Live Member Chat Room talking about all those juicy opportunities as we watched the herd of market gazells panic into the canyon, where we have them completely surrounded.

We cashed out the last of our risk on June 7th and I discussed it in our morning post on June 8th, while the Dow was hitting 18,000 and everyting still seemed awesome. My comment at the time was:

That's right, the Dow hit 18,000 and we took the money and ran, closing out over half of our uncovered Long-Term Portfolio positions, pretty much everything that was up 40% or more, getting our CASH!!! off the table just in time to take a 2-week trading vacation ahead of the June 23rd Brexit vote. It's so much easier to take your money off the table while things are still going up – you get much better prices from all the suckers who are still buying (they are called "bagholders" by market professionals).

If you are one of those bagholders, I am truly sorry but not for my lack of warning you as we had been talking about Brexit and the potential repercussions for a good month before that yet the market kept on rallying but we expected a market correction regardless for solid, FUNDAMENTAL reasons and, as I said at the time:

SOMETHING is going to hit the fan this summer. After the Brexit vote, even if the UK remains, then we will turn our attention to Brazil with 6 weeks to the Olympics (Aug 5th) that country and their disastrous economy (World's 5th largest) will be in the news constantly – as will fears of the Zika virus, which is bad enough that 150 experts petitioned the World Health Organization to postpone or move the Olympics to avoid a possible global pandemic as people from all over the World converge on Rio, get bitten by infected mosquitoes and then go home in the summer to have their local mosquitoes in turn feed on them.

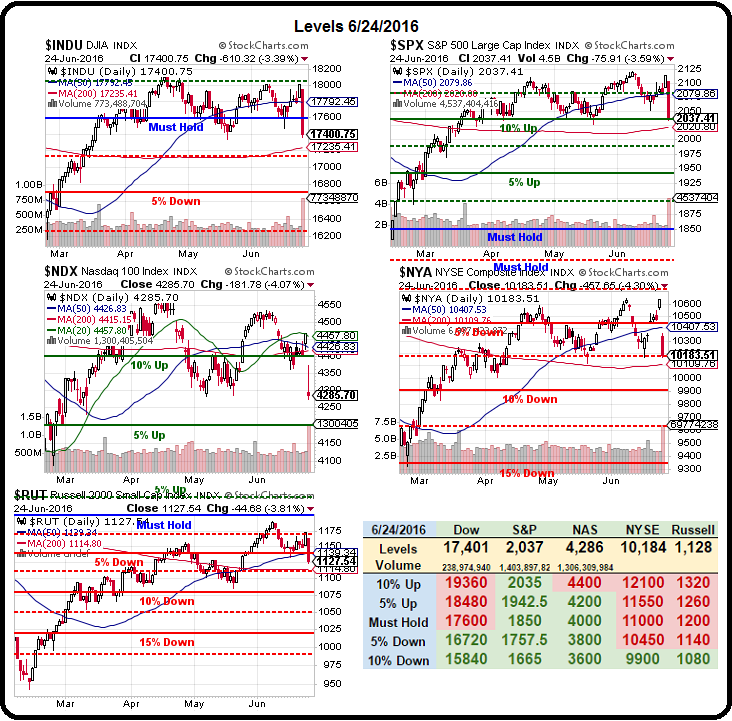

As you can see from Dave Fry's chart, the S&P volume on Friday was MASSIVE – especially compared to the very weak up volume, which was yet another reason we didn't take the rally seriously. Macro trading is not really that hard – we pay attention to the news and the market action, spot the trends and position our portfolios accordingly – perhaps you should give it a try?

As you can see from Dave Fry's chart, the S&P volume on Friday was MASSIVE – especially compared to the very weak up volume, which was yet another reason we didn't take the rally seriously. Macro trading is not really that hard – we pay attention to the news and the market action, spot the trends and position our portfolios accordingly – perhaps you should give it a try?

Hedging your portfolio is another thing you should give a try and we had an in-depth discussion about that this morning in our Member Chat Room. Hedges aren't perfect, of course. Last week, our Options Opportunity Portfolio had gained $13,626 for the week (13%) and I warned it would be easy come, easy go and this morning we're down $7,000 but keeping half of a gain we didn't expect is just fine for the monent – especially in such a negative market.

We discussed our TZA hedge in Wednesday's post and that spread (July $40/45) is just coming into the money this morning as the market falls another 1% and, as we were discussing in chat this morning, it was a trade that was meant to pay a $12,450 profit on a $2,550 outlay (488%) if the Russell fell about 7%.

We discussed our TZA hedge in Wednesday's post and that spread (July $40/45) is just coming into the money this morning as the market falls another 1% and, as we were discussing in chat this morning, it was a trade that was meant to pay a $12,450 profit on a $2,550 outlay (488%) if the Russell fell about 7%.

That hasn't happened yet and, if it doesn't – then like any insurance you buy, you lose the money you spend but at least the disaster you were worried about ddn't happen. As of Friday's close, our spread was $1, up just 0.15 (17.6%) from our 0.85 entry. The real fun starts to happen on the next leg down – if there is one.

My biggest job now, which is very difficult, is trying to be the bad cop as our Members are anxious to deploy their sidelined cash and grab opportunities. I hate to say "not yet" over and over again but we still have plenty of long positions (well-protected) aand we have no idea where this thing will bottom out. The biggest mistake people made in 2008 was buying on the initial dips – something they had been well-conditioned to do by the 6-year rally that led up to that crash.

For example, Barclays (BCS) and the Royal Bank of Scotland (RBS) are down 20% this morning – shades of 2008 indeed! That's about a 50% drop since Thursday and I'd love to tell you it's time to buy but when people lose faith in Financial Institutions – no one is safe. Another 25% drop from here ($5.50) and I'd have to take a poke, just for fun. A lot of this panic is likely overdone fears of the unknown but you don't stop a stampede by telling the gazelles there's nothing to worry about.

One thing we can do is play for bounces off significant support lines in the Futures. As you can see on our Big Chart, The S&P still has the farthest to fall to catch up to it's peers, that's why it's our primary hedge (SDS longs) and 2,035 is weak support as it's 10% over the Must Hold line but, along the way, there's no reason we shouldn't bounce at 2,000 on the S&P Futures (/ES), which is a strong psychological support line.

Since we've fallen from 2,100 (higher really but that's our shorting line) and that's 100 points so our 5% Rule™ tells us to expect a weak bounce of 20% of the drop or 20 points, back to 2,020 or a strong bounce to 2,040. We need at least a weak bounce today or we can expect more downside ahead.

As you can see, we already had a couple of moves that have confirmed the lines from Friday but it only counts when we CLOSE above a line – not the intra-day highs. /ES failing the weak bounce today (2,020) would be a signal that we're consolidating for a move lower, not a move back up.

On the Russell (/TF) we have support at the 1,100 line and the -10% line (from 1,200) is 1,080 and that really must hold or the whole thing is likely to collapse and then it will be time to add more hedges as we're guarding against a 10% drop but not as well against a 20% drop.

Our favorite long plays at the moment are Oil (/CLQ6), which is testing $46.50 this morning and Gasoline (/RBQ6), which is at the $1.51 line (very tight stops below on each!). There's nothing happening in the UK or Europe that is going to stop peole in the US from taking their July 4th trips, so we have a mismatch with price and probable demand. That's how simple it is to decide to make a trade.

Other than that, we're very much in watch and wait mode this morning – especially with the Euro Banks in melt-down mode. Friday is the end of quarter so we do expect some effort to be made to prop up the markets to save fund managers' portfolios – whether it's successful or not is what we'll be interested in seeing.

Be careful out there!