Watch Germany's DAX closely:

That 10,000 line is hyper-critical – it's their Must Hold Line and, as you can see on the daily chart – it's barely been holding and just failed again this morning as Germany's ZEW Economic Sentiment survey showed a horriffic post-Brexit (July 4-18) drop to -6.8 from +19.2 in June and miles below the forecast of leading economorons, who expected +9 as the DAX rallied 800 points during the period in question.

Even worse was the assessment of Eurozone Sentiment, which fell from 20.2 in June to -14.7 in July. This indicates that Europe is not out of the woods just yet and we, at PSW, certainly got that impression from the way the Euro Stoxx Index failed to get back over 3,000 last week but, so far, we are still alone in our bearish veiw of the market.

Volume on the S&P ETF (SPY) yesterday was 54M, a new record low for the year and about half the average volume for 2016, which is less than 2/3 of 2015s average volume so, if you are buying stocks – you're pretty much alone these days. I gave a little lecture on why low volumes lead to stock rallies in our Live Trading Webinar and it's things like this that keep us in CASH!!! and on the sidelines – because this whole move up (8.5%) since the Brexit downturn has come on extremely low volume.

As you can see from Dave Fry's note on Friday's S&P chart, volumes have been going down and down and the only "people" buying are the Central Banksters, who are desperately propping up the markets lest people begin to panic and start causing liquidity crises which the CBs are in no condition to deal with at the moment.

As you can see from Dave Fry's note on Friday's S&P chart, volumes have been going down and down and the only "people" buying are the Central Banksters, who are desperately propping up the markets lest people begin to panic and start causing liquidity crises which the CBs are in no condition to deal with at the moment.

Unfortunately, while it's easy enough to push the market to record highs when Central Banks step in and begin buying up equities – sustaining them there is quite another story and here's why:

Let's say you have a car lot with 100 VW Beetle Convertibles and you bought them for $20,000 and you hope to sell them for $25,000 and make a $5,000 profit on each car. Your expectation is to make $500,000 and the "value" of your car business is 10x $500,000 or $5M and you borrowed $2M for your inventory.

You sell 10 cars for $25,000 as planned and there's $250,000 and all is going well. Then, there's a "crisis" and sales slow down but the Fed steps in and bails you out and begins buying cars for $30,000 and now you collect $300,000 on your next 10 cars and your profits jump to $100,000 on 10 cars.

Immediately, analysts upgrade your projections and your rapid growth leads them to raise their long-term expectations that you will soon be selling your $20,000 cars for $40,000 and will make $2M in profits on 100 cars and now your p/e (since you are growing) rises to 15 and now you are "worth" $30M, up from $5M.

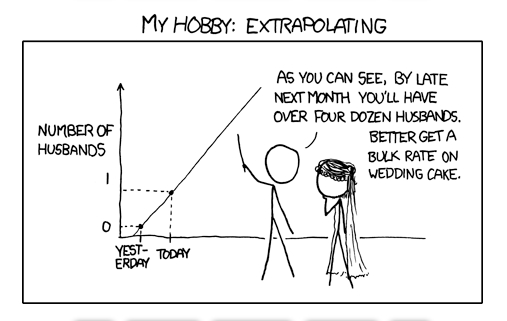

This is all nonsense, based on extrapolating artificial stimulus as if it will never end and it's completely unsustainable because the fact of the matter is that no actual consumers will buy $25,000 VW's for $30,0000, let alone $40,000 – there simply isn't enough money in the World to sustain your "business model" – especially since it's not just your business but the entire market is being priced up due to the stimulus.

This is all nonsense, based on extrapolating artificial stimulus as if it will never end and it's completely unsustainable because the fact of the matter is that no actual consumers will buy $25,000 VW's for $30,0000, let alone $40,000 – there simply isn't enough money in the World to sustain your "business model" – especially since it's not just your business but the entire market is being priced up due to the stimulus.

Netflix (NFLX) is a case in point. Yesterday, the company announced "just" 1.68M new subscribers, well below guidance for 2.5M new subscribers and miles below the 3.6M new subscribers they added last year for Q2. The company had been trading at 350 TIMES earnings (and you thought the VW example was extreme?) because clueless analysts, most of whom have never actually worked for a real company or run any sort of business, EXTRAPOLATED early success into infinite growth – despte the very, very hard fact that we live on a finite planet with a finite population which has a finite amount of money to spend.

I warned our Members out of NFLX last fall, saying:

NFLX/StJ – You are right, total bargain with a 330 p/e compared to AMZN but, compared to reality – still ridiculous. TWX has some good shows, CBS has some good shows, FOX has some good shows – none of those shows boost their company's values by $5Bn (10%), do they? All that news and reaction proves is that people who invest in NFLX have no concept of how to value a media company – that we already knew….

NFLX: 6.78Bn in sales, 0.20/share in earnings for 2015, 0.26/share projected in 2016

TWX: $28.6Bn in sales, $4.67/share in earnings, $5.29 projected next year.

It will take NFLX 3 years to earn the INCREASE in TWX's earnings next year! I'm not betting against NFLX – I'm betting on reality existing somewhere…

Netflix was up over $120 at the time and, as you can see, it's made some wild swings since but even $85 is generous for this stock over the long term. We're also short Tesla (TSLA) at $250 and Amazon (AMZN) at $750 – two other certain victims of reality – eventually.

Getting back to the broader market, up 8.5% in three weeks would lead one to imagine people somehow became 8.5% richer during those 3 weeks or that the World's GDP grew 8.5% to justify the market growth otherwise – where the Hell will all this money be coming from to justify these share prices?

You can fool some of the people all of the time – Elon Musk proves that on a weekly basis, but you can't fool all of the people all of the time and this earnings season we'll see that adage proven on a daily basis so please – don't be a fool and be careful out there!