Nothing!

That's what we got from our Fed yesterday in a statement that held no new action and not indication of when there would be action and nothing is no longer good enough to sustain record high market levels – especially with the very mediocre earnings that are being delivered in the broad markets.

As you can see from the Fear and Greed Index, the greed is still fairly extreme and the complacency is extreme too with the VIX down under 15 this morning and Treasuries (TLT), which we're short on, are still up at the $140 line post-Fed – as if they still might turn around and loosen further than they already have.

Arguing for the loose camp, the Atlanta Fed released their GDP Now Forecast for the end of July and Q2 has been downgraded 40% from 3% to now 1.8% over the course of the month so now we understand why the Fed didn't raise rates yesterday – the economy is much worse off than people have been supposing!

Since the BS upgrades began (which we said were BS all the way up) in May, the Dow has gained 1,000 points, from 17,500 to 18,500 and the S&P is up from 2,050 to 2,165 and those are both ridiculous in a flat economy and it was these RIDICULOUS upgrades to GDP outlook that acted as the catalyst to turn us around in the first place! Here's my commentary on the subject from May 27th (GDP Friday – Yellen Spins Us Into the Holiday Weekend):

…now we have the Atlanta Fed providing supporting data as they have raised their GDP Now forecast by 100% this month.

Forget the fact that the core Durable Goods were terrible or that Auto Sales are falling off or that Consumer Comfort is at year lows or that yesterday's Richmond Fed Report showed continued contraction – the Fed doesn't measure those things. The Fed measures whatever their Bankster owners want them to measure to come to the conclusion that makes the Banksters the most money. See how simple it is?

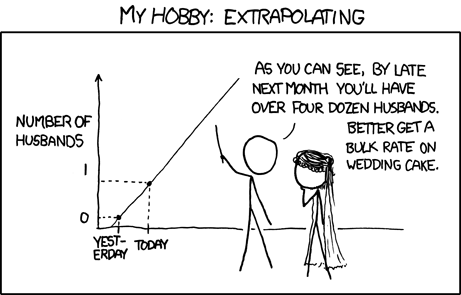

We'll see of they are right on the GDP forecast but, if they are – then a June rate hike is a lot more likely than people are thinking because, at this pace, our GDP will be over a Bazillion Dollars in a year or two if we double our growth each month.

Call me a cynic but, to me, if you can change your forecast from 1.6% to 2.9% in 22 days – then your forecast isn't worth crap and people should stop listening to you!

Wow, sometimes I read my own stuff and want to subscribe to my own site – that guy is good! Remember, it's not a conspiracy "theory" when all the facts prove the conspiracy is real – then it's just a conspiracy...

Speaking of things I was right about at the time (same post):

Speaking of things people shouldn't listen to: On Wednesday, we talked about the back and forth on the Brexit issue and, just yesterday, Project Fear put out yet another release from the UK Treasury – this time aimed at seniors with claims that a Brexit would hit pensions by $440Bn. "Pensioners rely on economic growth for their security and stability, whereas leaving the EU would mean huge uncertainty," Pensions Minister Ros Altman said in an interview with BBC Radio 4 on Friday. "All serious economic forecasters agree" that "leaving will damage our economy," she said.

The Treasury has been criticized by Brexit campaigners and some analysts for overstating the consequences of Britain leaving the EU amid accusations the government is playing on voters’ fears to keep the U.K. in the bloc. The referendum, now less than four weeks away, has split the ruling Conservative Party in two in a debate that’s become increasingly acrimonious, with accusations of smear tactics from both sides.

“This is an utterly outrageous attempt by the government to do down people’s pensions,” former Work and Pensions Secretary Iain Duncan Smith said in a statement e-mailed by the Vote Leave campaign. He said retirement savings face threats from EU plans to harmonize pension regulations and proposals for a financial-transaction tax.

Here's a good case for leaving from the Telegraph and I agree with the Brexiteers, the entire fear campaign is based on the assumption that the UK will lose out on trade agreements but, as I've said from day one, the UK used to own this whole planet – they certainly know how to negotiate trade deals on their own and the EU takes so long to get 26 nations to ratify their deals that it's been stuck in the mud for 5 years anyway.

Like our GDP forecasts – the whole thing is simply a farce and, if the UK doesn't take this opportunity to escape – this is the Bankster trap they will find themselves in:

The ESM is nothing less than a Government takeover by the Banks, who will be able to squeeze the entire EU the way they have squeezed Greece. This is what is being shoved down the throats of 500M EU citizens (and maybe 50M British citizens) and this is why tens of Billions of Dollars are being spent by Remain lobbyists on Project Fear, to cower the people of the UK into voting to stay in the alliance – by raising fears that worse things will happen if they leave (hard to imagine worse than the ESM though).

That vote is on June 23rd and it's a lot closer than you are being led to believe. Whether it's ultimately good or bad for the UK, a Brexit would certainly be catastrophic for the EU and may lead to a complete collapse of the Euro, so there's a good reason to have CASH!!! going into the weekend. We have the next Fed Decision on the 15th and OPEC meets next Thursday (2nd), so all kinds of crazy, market-moving events coming up in the next two weeks.

I know I come across as a cynic but I'm really a very optimistic person – I just happen to be reporting on a bullshit, manipulated scam of a market run by some of the most evil people who have ever walked the face of this Earth and, since I am not beholden to advertisers or other commercial interests (and you can thank our subscribers for that – become one today, please), I can tell you exactly what is going on AND how to make money playing it.

Now, let's go out there and have some fun with earnings!