"There's nothing to hold on to when gravity betrays you

When after all the urges some kind of truth emerges

We felt the deadly surges

Discovering Japan" – Graham Parker

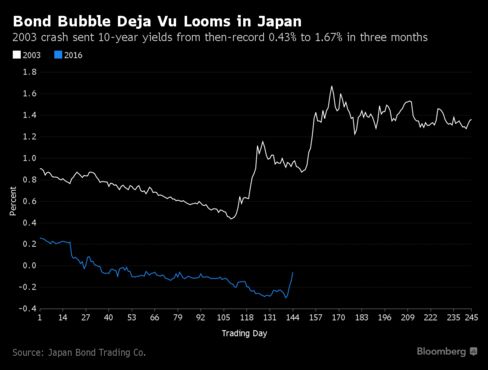

Despite the best efforts of the BOJ, Japanese 10-year note rates are rising at an alarming, er, rate.

A four-day rout pushed 10-year yields to within three basis points of turning positive on Tuesday for the first time since March, after Bank of Japan policy makers disappointed investors last week by leaving bond buying and their negative deposit rate unchanged even as they increased exchange-traded-fund purchases. Pacific Investment Management Co. and former Ministry of Finance official Eisuke Sakakibara both say central bank Governor Haruhiko Kuroda is running out of room to expand stimulus.

“The selling is insane,” Satoshi Shimamura, head of rates and markets for the investment strategy department of MassMutual Life Insurance in Tokyo, said Tuesday. “The market is picturing an end to Kuroda easing. There’s no telling how far this will go.”

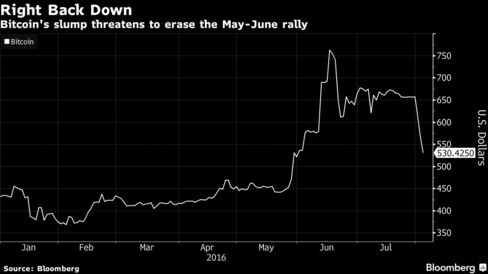

How fast can Japan fall apart? Well, let's look at another BS currency that got overinflated as money flowed into risky assets searching yield: Bitcoin plunged 30% since June and 20% of that is this week as $65M "worth" of BitCoins (119,756) were "stolen" from Hong Kong's Bitfinex, who have now halted all trading, deposits and withdrawals.

How fast can Japan fall apart? Well, let's look at another BS currency that got overinflated as money flowed into risky assets searching yield: Bitcoin plunged 30% since June and 20% of that is this week as $65M "worth" of BitCoins (119,756) were "stolen" from Hong Kong's Bitfinex, who have now halted all trading, deposits and withdrawals.

It will be fun to see how this one plays out, hopefully not another Mt Gox incident. That one involved 850,000 Bitcoins "valued" at $450M back in Feb of 2014 – Mt. Gox ended up liquidating in April 2014 and, since then, Bitfinex has become the World's largest exchange – supposedly with better security.

Where oh where can we safely put our money these days? Even the banks are looking dubious – perhaps we should invest in safe companies and then invest in someone who makes burglary tools for good measure! Speaking of banks, yesterday FAZ trade got off to a great start and our WFC hedge held $47 for the day, so a good-looking trade all around.

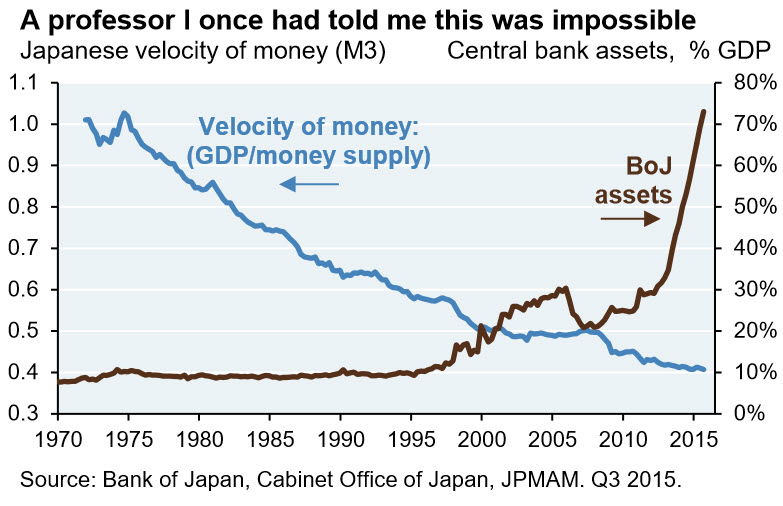

Meanwhile, today we're going to be watching the Nikkei, which slammed into the 16,000 line this morning and, so far, is holding it together but it's all an illusion courtesy of the Bank of Japan. The BOJ now one of the top 10 owners of 200 of the Nikkei's 225 companies, owning things like 10% of Uniqlo Clothing (Fast Retailing) and 5% of Kikkoman Soy Sauce, etc. Since 2013, the BOJ has doubled their holdings in the ETF market and now owns an incredible 55% of all Japanese ETFs.

It's Raining Yen! Hallelujah! – It's Raining Yen! Amen!

I'm gonna go out to run and let myself get

Absolutely soaking wet!

That's right, this is completely ridiculous so we have to make fun of it (or we'd cry). Let's think about what's going on. Since mid 2013, Abe and Kuroda have spent TRILLIONS of Dollars – hundreds of Trillions of Yen, buying up equities in order to preserve the illusion that their economy is not in crisis. To to this, they have printed more and more currency and they have borrowed Trillions of Dollars while dropping the rates they pay to NEGATIVE – yet people are still giving them money!

Well, they were, until this week and now people are not willing to give Japan money to hold for 10 years at negative rates. The Central Bank can set a target rate, but they can't make people buy bonds at those prices. This is how we reach the end game of Central Bankster manipulation in the Global Economy, when people finally wise up and stop giving their money to Governments that are riskier than mattresses.

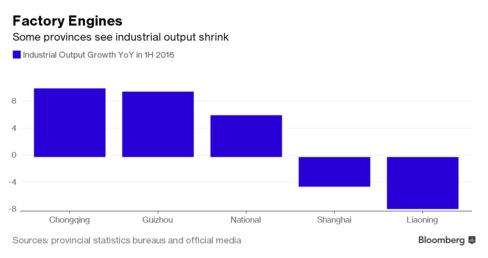

This is what we expected to happen and this is when we expected it to happen (Aug) and China is falling apart as well as Liaoning Province just reported a 1% CONTRACTION in GDP for the first half of 2016. Liaoning is a coal and steel area, so they are suffering worse than most but NEGATIVE is BAD and only 15 of China's 31 provinces showed any improvement from last year's disappointing GDP report and it was this same report last August that sent the Nikkei off a cliff. Have I mentioned how much I like CASH!!! recently?

This is what we expected to happen and this is when we expected it to happen (Aug) and China is falling apart as well as Liaoning Province just reported a 1% CONTRACTION in GDP for the first half of 2016. Liaoning is a coal and steel area, so they are suffering worse than most but NEGATIVE is BAD and only 15 of China's 31 provinces showed any improvement from last year's disappointing GDP report and it was this same report last August that sent the Nikkei off a cliff. Have I mentioned how much I like CASH!!! recently?

China, like Japan, has been pulling out all of the stops to prop up the economy so it's very scary when it's no longer working. What will these economies look like when the paint fades away? What would our own economy look like without constant Fed intervention? Europe without the ECB? Sadly, we may be close to finding out…

Our own GDP was revised drastically lower last week (see "Friday Fizzle – BOJ and GDP Disappoint Investors, Again") but, so far, we're only getting a very small pullback as traders are well-conditioned to believe that the Central Banksters will fix everything forever and ever. It's kind of like the Tooth Fairy – sure it's fun for the first 9 or 10 teeth that fall out but, after a while, you kind of suspect the money is coming from your parents and they get tired of trying to sneak into your room and, before you know it – you lose a tooth and you're on your own.

Our own GDP was revised drastically lower last week (see "Friday Fizzle – BOJ and GDP Disappoint Investors, Again") but, so far, we're only getting a very small pullback as traders are well-conditioned to believe that the Central Banksters will fix everything forever and ever. It's kind of like the Tooth Fairy – sure it's fun for the first 9 or 10 teeth that fall out but, after a while, you kind of suspect the money is coming from your parents and they get tired of trying to sneak into your room and, before you know it – you lose a tooth and you're on your own.

Our man Trump was interviewed on Fox Business yesterday and advised viewers to get out of the market. He warned of "very scary scenarios" ahead for investors (like him becoming President!).

"The only reason the stock market is where it is, is because you get free money," Trump said. "Interest rates are artificially low. If interest rates ever seek a natural level, which obviously they would be much higher than they are right now — you have some very scary scenarios out there.”

OK, I just said that too – scary is right!

Be careful out there.