"Whatever it takes."

"Whatever it takes."

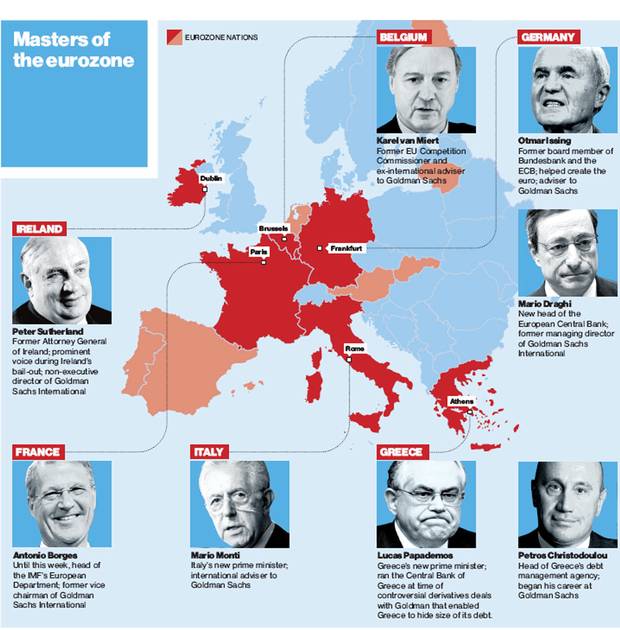

That's what Goldman Stooge (yes, it's an official position, so we capitalize) Mark Carney says he is willing to do to get investors to ignore the fact that the Bank of England had to severely reduce their outlook for 2017 GDP, from 2.3% to 0.8% while, at the same time stating that: "recent surveys of business activity, confidence and optimism suggest that the United (for now) Kingdom is likely to see little growth in GDP in the second half of this year."

Today's move drops the UK's benchmark rate to 0.25%, half of what it's been for the last 7 years and Carney left the door open for even more easing – though not too much, apparently:

“I’m not a fan of negative interest rates,” says Carney. “We have other options to provide more stimulus if needed.”

“We see the effective lower bound as a positive number, close to zero, but a positive number.”

A positive number – but clearly not a positive whole number – that ship has sailed long ago! The FSTE jumped 1.5% on news that their economy will be right on the edge of recession next year but, of course, that's because the BOE is now pumping $50Bn PER MONTH into the $2.6Tn economy, which would be like our Fed tossing $380Bn/month onto the fire. That is a staggering amount of QE funneled through the banks by Goldman Sach's former Executive Director – just a coincidence, I'm sure.

Speaking of Goldman Sachs getting caught using their connections to manipulate the market – the firm was ordered to pay $36.3M to settle a case after they hired a Fed employee and used confidential information he provided to bring in clients to access their access. This went on for 2 years and involved Billions of Dollars worth of transactions and, in response to the $36M penalty, a GS spokesman said "Ow, my wrist!"

Lloyd Blankfein reportedly only had $34M cash on him and embarrassingly had to have employees take the other $2.3M out of this week's office party jar, meaning lower-level employees will not be able to use the helicopter to go to the Hamptons this weekend. and will have to travel on the much slower company yacht. This will really teach them a lesson, right?

Lloyd Blankfein reportedly only had $34M cash on him and embarrassingly had to have employees take the other $2.3M out of this week's office party jar, meaning lower-level employees will not be able to use the helicopter to go to the Hamptons this weekend. and will have to travel on the much slower company yacht. This will really teach them a lesson, right?

Actually, GS makes $6Bn a year and that's about $60,000 per working minute so two 8-hour days until the weekend is 960 minutes = $57.6M – that's $20M more than they need to cover the fine – party at Lloyd's house! This is the problem with Financial law enforcement – how can the punishment fit the crime when the penalties are a joke to the criminals? Imagine if the entire penalty for speeding was $1,000 and no points and, at most, you got pulled over once a month. How fast would you drive? How fast would you drive if you were a Billionaire?

Not only would I drive much faster but I'd buy a nice sports car so I could go even faster, passing the ordinary suckers at 100 mph on the highways (you've seen those a-holes) and "winning" all the time because, unlike common folks, I get places twice as fast and spend half as much time in a car – so I have a huge competitive advantage and can make even more money, which then let's me further lever my advantage and then I can go on TV and tell you how great I am because I did it all on my own….

See how unfair that is? That's what the system is like for the super-rich, be they Top 0.1% Corporations or Individuals. Ordinary laws apply to them but the penalty for disobeying them is a comparative joke – so, in reality, the rules simply don't apply. They can buy votes (thanks SCOTUS), they can buy politicians and lobbyist who rewrite the laws to give them a competitive advantage at every turn and you and I and everyone in this World who doesn't have at least $100M in the bank is a victim of this corrupt system that is meant to keep them rich and us, relatively, poor.

We'll see how much of a bounce $79Bn buys us but I'm predicting it will be weak and short-lived and we're looking to short the Russell (/TF) Futures below 1,210 confirmed by Dow (/YM) 18,300, S&P (/ES) 2,160, Nasdaq (/NQ) 4,725 and Nikkei (/NKD) 16,200. Tomorrow is Non-Farm Payrolls at 8:30 and there's no indication that will be strong but economic weakness is often rewarded by the bulls, as it means the free money train rides another day.

This is a global economy on life-support and the bulls are betting it's going to win the marathon when it hasn't actually been able to get out of bed for 8 years.

I'll close this post with music for Mark:

"He said he heard about a couple living in the USA

He said they traded in their baby for a Chevrolet

Let's talk about the future now we've put the past awayThey think that I've got no respect, but

Everything means less than zero"