Do you have cash?

If so and if that cash is in Dollars, your cash lost 1.5% of it's value since Friday – unless, of course, you used those Dollars to buy stocks, which only gained 1/10th of 1% since Friday's open, so you can still trade your declining Dollars for US stocks at the same prices they were Friday. The question is which one, if any, will hold their value better going forward.

Hammering the Dollar today is an unusual call for radical policy action from the San Fran Fed's John Williams (who also composed the theme for Star Wars) who is warning that our Empire is being threatened by factors beyond the Fed's control like an aging population and sluggish productivity gains which are braking growth.

That, in turn, is keeping interest rates from rising as far or as fast as in the past; Williams on Monday estimated U.S. short-term rates would likely rise only to 3% or 3.5%, even after the economy regains full health, and perhaps not even that.

That, in turn, is keeping interest rates from rising as far or as fast as in the past; Williams on Monday estimated U.S. short-term rates would likely rise only to 3% or 3.5%, even after the economy regains full health, and perhaps not even that.

Williams floated two monetary policy changes to cope with lower rates: raising the Fed's current 2% inflation goal, or replacing its current inflation-targeting regime with some form of nominal GDP targeting. Both approaches, he said, would give the Fed more scope to lower interest rates in response to downturns.

In other words, policy changes that will keep us in this QE cycle for A LOT longer than is currently expected.

That's why yesterday, on the day we set an all-time high on the S&P 500, the volume was the lowest level of the year, coming in at just 48.6M on the ETF (SPY), 20% below the previous day and barely more than 1/10th of the volume we dropped on in late June. That's right, the entirety of yesterday's SPY volume wouldn't even cover a single hour of selling on a down day – house of cards, indeed!

During this whole rally, the volume has been heading lower and lower, even as the index has headed higher and higher and the last time volume was this low was last Christmas, right before the S&P fell from 2,075 back to 1,850, down 11% in less than 3 weeks! Perhaps we'll pop right over 2,200 and go up from there but, until that happens, I'd rather stick with my devaluing CASH!!! for now.

George Soros has 40,000 SPY puts, twice as many as he had last quarter and so far, so wrong for George but it's hard to get the timing right on these major sentiment shifts. Carl Icahn, David Tepper and Jeff Gundlach are other Billionaire Fund Managers making short calls on the broad market.

George Soros has 40,000 SPY puts, twice as many as he had last quarter and so far, so wrong for George but it's hard to get the timing right on these major sentiment shifts. Carl Icahn, David Tepper and Jeff Gundlach are other Billionaire Fund Managers making short calls on the broad market.

Overall, however, short interest on the S&P 500 is at 3-year lows but it's possibly because, with $128Bn of stock outlows already this year – there's simply nothing left for fund managers to protect. We are at 80% cash in our own portfolios so our short hedges are more of a bet than insurance but our forecast was for a drop in August and August is fading fast.

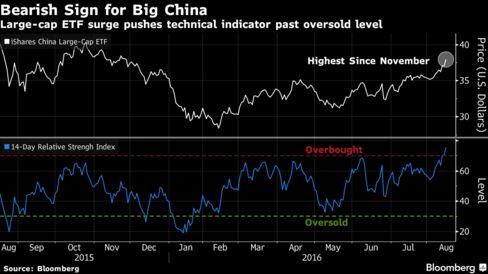

Over in China, where we expected the damage to begin, their Large-Cap ETF is as overbought as it was before last year's crash but went even higher this week on news that Hong Kong and mainland Shenzhen exchanges were hooking up to allow even more suckers citizens to participate in the market.

Our favorite short at the moment, however, is oil (/CL) at $46 and you can, of course, play the Futures but you can also take advanatage of the low VIX and buy the USO Aug (expires Friday) $11 puts for 0.32 which, with USO at $10.80 is 0.12 in premium with 4 days until expiration. Our theory is the overhang of FAKE orders at the NYMEX will have to be rolled over by Monday and that will put a lot of pressure on sellers some time this week.

We gave you a lot of winning Futures trade ideas last week and just yesterday, at 12:26 in our Live Member Chat Room, I said to our Members:

Dollar found a floor (good old 95.50), maybe it is a good time to poke short at 18,600, 2,190, 4,830, 1,240 and 16,900. I think 16,900 on /NKD and 1,240 should be the most fun. /RB fun to play for a rejection at $1.40 but all tight stops if they push on over.

As we mentioned above, /NKD dove back to 16,600 for a $1,500 per contract gain but /RB (Gasoline) moved up to $1.41 and those lose $420 per penny, per contract – which is why we use TIGHT stops!

Be careful out there.