Thank you Mr. Wilson!

Thank you Mr. Wilson!

That's right, we can blame Woody for this mess that has devalued our fine currency by 5% (so far) this year. Yesterday, we got a peek behind the curtain at the Fed through the minutes of their July meeting which, frankly, were barely distinguishable from their Jan, March, April or June Meetings and will not likely vary much in Sept, Nov or December either but that doesn't stop the Financial Media from treating these monthly meetings and the minutes of the monthly meetings (16 times a year!) like they are some kind of Earth-shaking revelations – EVERY SINGLE TIME!

Of course, the Fed would never say "we're going to raise rates 0.25% in September" even though it is August 18th and you would think they would know by now but where's the fun in telling people your plans? It's so much more fun to watch them run around in circles trying to interpret all the hints you drop along the way. That's why, in addtion to 16 meetings and minutes, we have had over 200 Fed speeches this year – AND STILL WE KNOW NOTHING!

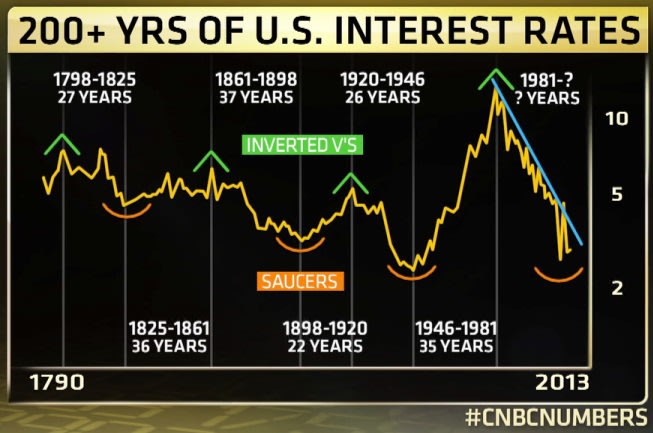

When you think about it, though, what difference will it make in your life if the rate is 0.25% or 0.5% next month? What difference would it make to IBM or AAPL or WMT? What difference would it make to the UK or China or Japan or Canada or Switzerland? While 0.5% may bed twice as much as 0.25%, it's only 1/10th of the "normal" rate of 5.18% that has been the average for our nation's history.

When you think about it, though, what difference will it make in your life if the rate is 0.25% or 0.5% next month? What difference would it make to IBM or AAPL or WMT? What difference would it make to the UK or China or Japan or Canada or Switzerland? While 0.5% may bed twice as much as 0.25%, it's only 1/10th of the "normal" rate of 5.18% that has been the average for our nation's history.

There's certainly nothing "normal" about 0.25% interest rates, let alone negative interest rates. A negative 1% interest rate means that, if you work hard and save $100,000 by the time you are 25, by the time you are 75 you'll get $50,000 back. Clearly this is not a good plan yet that's what the Fed would have you believe is "appropriate" for the health of the economy – certainly they don't mean your personal economy.

Similarly, if you have $2M saved up for retirement and you planned on getting 5% interest and living off $100,000/yr – instead the Fed says you should be penalized $10,000 a year for having $2M and, if you spend $100,000 a year, you'll be broke in 18 years. This is the "new normal" for the past few years and the Fed has given no clear indication of when they plan to stop torturing savers and retirees, who NEED clarity so they can plan their lives.

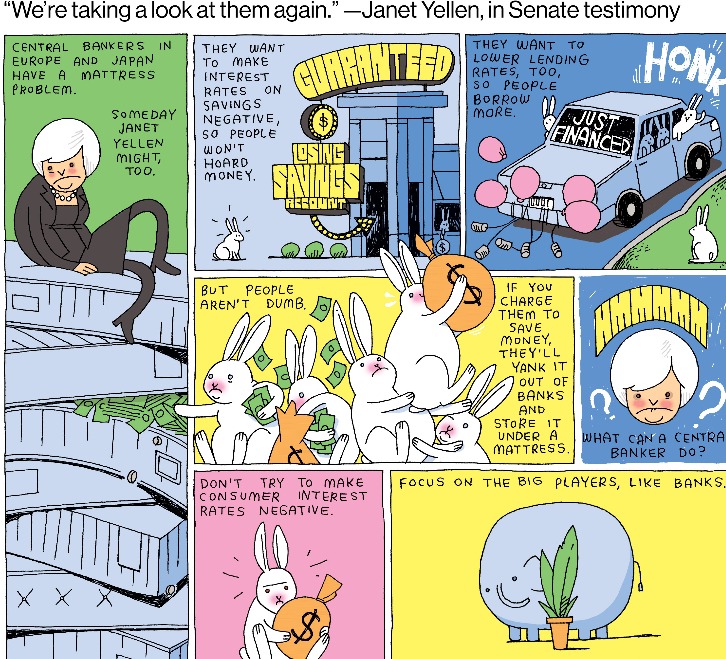

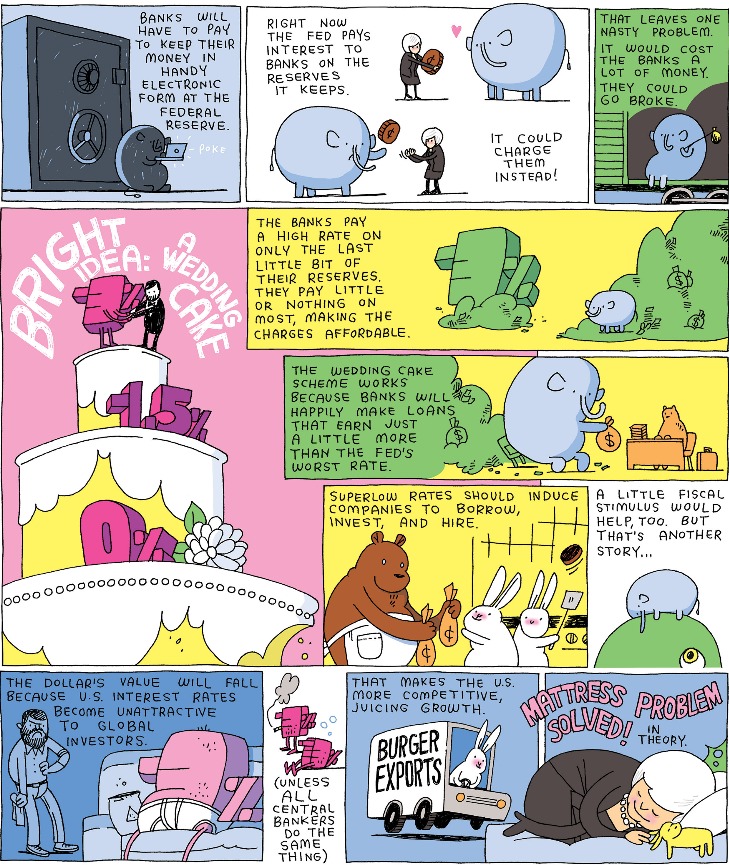

Certainly there are better ways to stimulate the economy than threatening negative rates but, of course, the GOP-controlled Congress hasn't passed a stimulus bill since the Bush administration and it's not too likely they'll do it anytime soon, so this is the only tool in the Fed's toolbox and they'll keep using it – no matter how ineffective, or even damaging, it is:

It would be nice if this cartoon model actually worked but Japan is the nation with the lowest overall rates (-0.3%) and their export numbers are getting worse and worse, down 14% from last July in the most recent reading:

In a double whammy to the Global economy, Japan also imported 24.7% less than last year yet leading Economorons continue to insist that the Global Economy has turned a corner. I went over chart technicals with our Members this morning in our Live Chat Room but it's Japan and China (who led Japan's drop in exports to) that still concern me on the Fundamental side yet still I bet you can watch CNBC, Fox or Bloomberg all day today and not hear a word about Japanese trade data. Ignoring bad news doesn't make it go away…

Japan proves (to a rational person) that the current Fed policies do not work and WILL NOT WORK if they keep at them for another decade – as Japan has been doing.

Carl Icahn sums it up nicely: "I have hedges on, I'm more hedged than I ever was. I will tell you there's certainly good companies. [The market] is way overvalued at 20 times the S&P and I'll tell you why: a lot of it is a result of zero interest rates. It's just what I said. You have zero interest and a lot of buybacks. Money is not going into capital.

"Think of it as a rich family that just decides "we're just going to have a lot of fun, we're going to sit around in the pool, and we'll keep printing up IOUs to the town, we've got a good name." You keep doing it until you go broke. And this is what's happening in our economy. Zero interest rates are building huge bubbles. You have retirees that saved a million bucks, half a million bucks.

"I think the market is at literally very high levels because of zero interest rates, and if you really look at it, the dollar is pretty strong right now, which is going to hurt international earnings. The S&P, they live on international earnings. That's going to be hurt. There's going to be a day of reckoning here. I've seen it many times in my life. When things look good, they look great. You go into the sky. But that's when you have to really pull down and really stop buying. That being said, I'm not going to tell you it's going to happen tomorrow, next week, even next month, even next year possibly. But it's going to happen, and you have to change the direction of our economy. I can't say it plainer than that."

In other words, please, be careful out there!