Aren't you glad we're back?

What a great week to start doing free picks again as we started off with Monday's Toll Brothers (TOL) trade idea, which has already gone from a $300 credit to $1,250 for a $1,550 gain (516%) in 3 days, so you're welcome for that one and it's only "on track" to our full 1,433% expectation so, if you want, you could still play it for $1,550 and look to get the full $4,300 in Jan 2018, which is up another $2,750 (177%) from here – but those are just our table scraps at this point!

Even if you don't subscribe to PhilStockWorld (PSW), where you get these articles EMailed to you pre-market every morning, you can follow us on Twitter or read us on Seeking Alpha, where they had Monday's post ready by 10am – not too bad of a delay for free picks, right? On Tuesday our 8:38 article was ready on SA at 9:55, just a little behind the Huffington Post (9:36), where we picked up a short play on GameStop (GME) and I called for shorting the indexes:

Still, with the Dollar (/DX) down at 94.30, it should be bouncy here and there's no particular reason for the markets to go higher so I like shorting the Futures, with VERY tight stops, at the following levels:

Dow (/YM) 18,550, S&P (/ES) 2,185, Nasdaq (/NQ) 4,825 and Russell (/TF) 1,242.50. We can't short the Nikkei (/NKD, now 16,550) because the Nikkei likes a strong Dollar, so it's too risky but a bounce in the Dollar back over 95 will drive Oil (/CL) and Gold (/YG) lower and knock down two big sectors of the S&P.

This morning, we're at Dow 18,434 (up $580 per contract), S&P 2,170 (up $750 per contract), Nasdaq 4,775 (up $1,000 per contract) and Russell 1,233.50 (up $900 per contract) in 48 hours – nice work if you can get it, right? We also gave you a short trade idea for USO, which was:

As I noted, we're playing it with the Oil ETF (USO) Sept $11.50 puts at 0.52 from Friday's post and they are now 0.70 but we lost 0.32 on the Aug puts so we need 0.84 to get even. We're playing the options contracts because it's far too dangerous to play the Futures in the middle of the range and the put contracts limit our losses should oil blast off – like it did earlier in the month.

Those are back to 0.82 now, up $30 (57%) per contract in two days – aren't options fun? Read the article because we have other trade ideas we shared with you that haven't taken off yet! In yesterday's post, we reiterated the short trade idea on Russell Futures (/TF) at 1,250 and they were kind enough to open at 1,249 so the one-day drop down to 1,234 paid a whopping $1,500 per contract during just the one session!

Those are back to 0.82 now, up $30 (57%) per contract in two days – aren't options fun? Read the article because we have other trade ideas we shared with you that haven't taken off yet! In yesterday's post, we reiterated the short trade idea on Russell Futures (/TF) at 1,250 and they were kind enough to open at 1,249 so the one-day drop down to 1,234 paid a whopping $1,500 per contract during just the one session!

Remember: I can only tell you what is going to happen in the markets and how you can make money trading it – the rest is up to you!

I don't have any new trade ideas today (GME is still in play), because it's too dangerous ahead of Yellen speaking tomorrow at 11 though knowing when not to trade is as valuable as finding good trades to make – all part of the service! So, to close this morning, let's get back on the topic of oil (see yesterday's post) and talk about the MASSIVE GLUT of inventory and the RIGGED PRICING we're paying despite record amounts of both crude and refined products in the US.

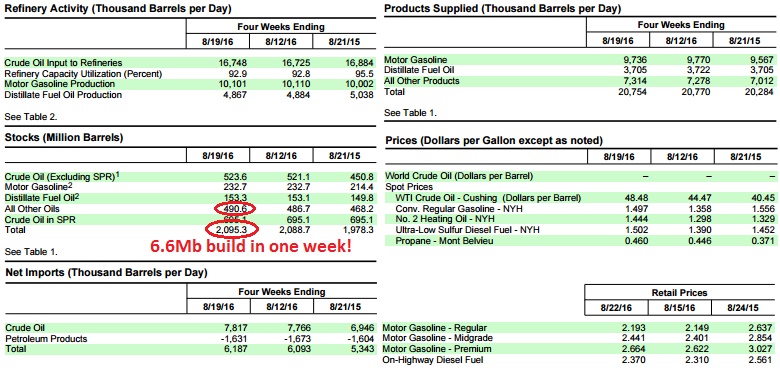

Yesterday's headline from the EIA report was a surprising (to economorons and lazy or deceitful analysts) 2.5Mb build in crude inventories but that was only the tip of the iceberg as a closer look at the inventory shows there was actually a 6.6Mb build in petroleum stocks. How is it possible that all these "professional analysts" miss this information? Well, of course they do it on purpose because most of them are not so much analysts as lobbyists for the Energy Cartel and, of course, most journalists and real analysts are lazy and simply copy other people's work – so you can feed them any kind of BS and they'll print it.

What the US Cartel has been doing is stuffing their unused petroleum into the "All Other Oils" category, which isn't reported on because it's more of an afterthought to Oil, Gasoline and Distillates that grab all the headlines but, as you can see, they tried to hide 3.9Mb or oil in that category in a single week. The total build of 6.6Mb of oil is almost 1Mb/day and, as I noted yesterday, the US doesn't actually consume 20.7Mb of product because we ship 1.6Mb/d out of the country (negative exports) so really we're using 19Mb/d and 1Mb/d of that is being added to the storage pile – that's a 5.26% SURPLUS GLUT of oil!

So, as I said at the beginning of the week, we expect oil to dip back to $45 or lower and we see any move up over $47.50 as a shorting opportunity but you do have to be very careful as OPEC rumors can spike oil up very quickly, which is why we're favoring our USO puts over the Futures contracts for now, though we did short oil (/CL) and gasoline (/RB) futures ahead of yesterday's inventories (10:30) in our Live Member Chat Room.

Remember though, as I said in yesterday's Live Trading Webinar – trading futures is GAMBLING – it's something we do for fun and we can afford to do that because the vast bulk of our market money is invested in conservative, well-hedged, long-term positions that have a very good chance of returning a steady 15-20% per year. The Futures are a fun way to pass the time while we wait for our larger trades to mature.