Is it Tuesday already?

While we were out enjoying our last weekend of summer, our Global leaders got together in China this weekend, met for 3 days and accomplished – NOTHING! Well, not nothing – China and the US did ratify the Paris Climate accords and that's huge (more on that later) but it also wasn't actually G20 business, the G20 released their communique with 48 bullet-points that essentially reiterated their last meeting, after which nothing happened.

China's markets popped because, as Xinhau News put it: "The world has been hoping for Chinese wisdom and prescription to cope with common challenges after the country took over the G20 presidency." "We will continue to reinforce macro-policy dialogue and coordination, work in the spirit of partnership to promote mutual help and win-win cooperation, and focus our minds and energy to pursue strong, sustainable, balanced and inclusive growth," Xi said.

- A mix of effective tools, including fiscal, monetary and structural ones, must be implemented to buffer against short-term risks and unleash medium- to long-term potential, Xi said.

- "This will send a strong signal of G20's commitment to promoting global growth, and help shore up market confidence and ensure stability of global financial markets," Xi said.

- "We are determined to break a new path for growth to inject new dynamism into the world economy," Xi said.

- Past realities teach us that merely relying on fiscal and monetary policies does not work for the world economy, Xi said, adding that the world should pursue innovation-driven economy and create a new round of growth and prosperity.

Hey, hey – someone needs to tell this Xi guy that he's all worried about nothing. Stock markets are trading at record highs, what could possibly be so bad?

Hey, hey – someone needs to tell this Xi guy that he's all worried about nothing. Stock markets are trading at record highs, what could possibly be so bad?

What? No, pay no attention to that chart! Just because GDP growth (worldwide) is falling into the crapper DESPITE tens of Trillions of Dollars in stimulus by our mighty Central Banksters, the markets are trading at their all-time highs – especially in the US, where everything is AWESOME.

In fact, the Central Banksters now hold 40% of the planet's GDP on their balance sheets – what could possibly go wrong?

In fact, the Central Banksters now hold 40% of the planet's GDP on their balance sheets – what could possibly go wrong?

The PBOC has pushed in the same amount of chips as our own Fed yet their GDP is half (at best) of the US's so double our stimulus in proportion so Xi, is in fact, not leading anything but crying for help as he, like many other countries around the World, has reached the end of his policy rope.

As noted by Zero Hedge, while everyone was delighted in the early days of Fed (and then global QE) when central banks were the buyer of first and last resort, helping push asset prices up, if doing little for the actual economy, the only real question asked in the dark, tinfoil-covered corners of the "smart money" universe is whether the cost of QE has now outweighed the benefits

Both the BOJ and the ECB are making major policy decisions this week with the ECB's $1.9Tn asset-purchase program ending in 6 months (March) while Eurozone inflation remains weak and the Brexit is still a work in progress. Currently, the ECB can only buy debt with a higher yield than the deposit rate – which cuts out a lot of what they can buy in Member countries (see chart below), lowering or scrapping that rate would triple the debt eligible to be purchased by the ECB.

Both the BOJ and the ECB are making major policy decisions this week with the ECB's $1.9Tn asset-purchase program ending in 6 months (March) while Eurozone inflation remains weak and the Brexit is still a work in progress. Currently, the ECB can only buy debt with a higher yield than the deposit rate – which cuts out a lot of what they can buy in Member countries (see chart below), lowering or scrapping that rate would triple the debt eligible to be purchased by the ECB.

Other technical changes we could see from the ECB could be increasing the issuer limits (now 33%), changing the capital key (which allocates purchases relative to the GDP of the issuing country) or expanding the program to include additional asset classes. None of these moves need to be made at the current meeting but they do need to be made within the next 4 and, if nothing dramatic happens this week after the G20, the bulls will begin to lose steam.

Eurozone GDP came in at an anemic 0.3% in Q2, down from a sad 0.5% in Q1 and, oddly enough, the UK was the best performer out of the majors:

There's no indication that GDP will pick up in Q3 and, in fact, German PMI hit a 15-month low this morning (53.3). Keep in mind, this is how we are performing WITH MASSIVE STIMULUS, what will happen when we attempt to take the patient off life-support?

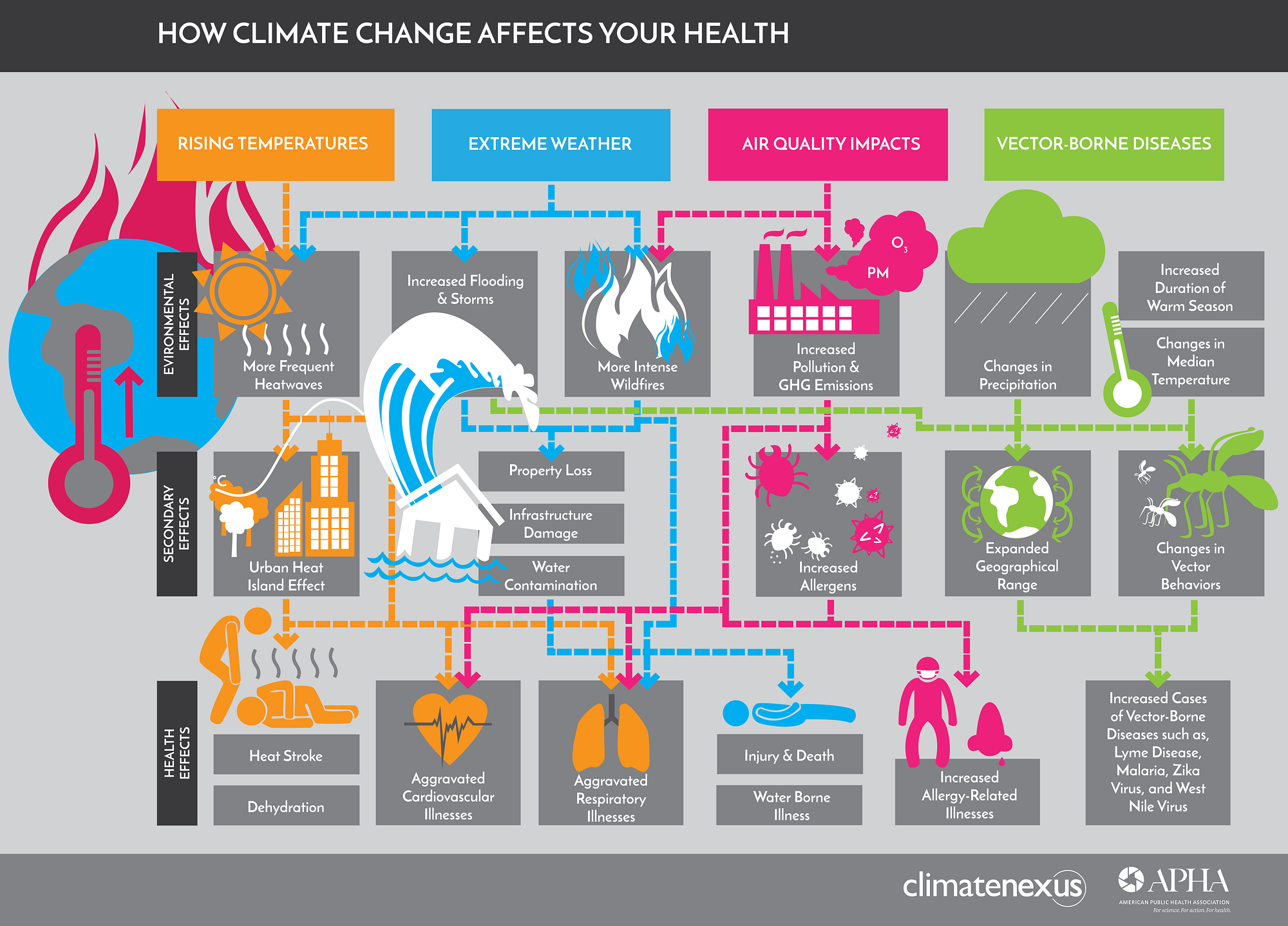

And don't forget, our patient/planet is also running a high fever which only looks to get higher for many years to come. In fact, as I mentioned above, China and the US finally ratified the 2015 Paris Climate Accord, where the intent is to raise (ie tax) carbon emission prices until emissions are down to an acceptable level.

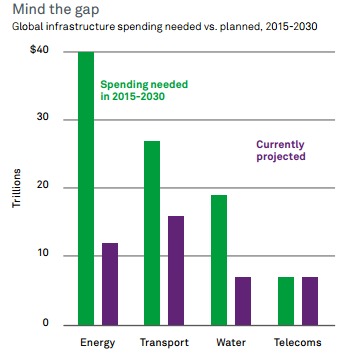

Our friends at BlackRock put out a lovely 16-page report on the subject, so no need to get into it here but it's very important to note things like an additional $30Tn worth of energy infrastructure spending is now required over the next 15 years – that's $2Tn a year that's got to be spent (and borrowed) somewhere! Transport and water systems require another $10Tn each so we're talking about something like $3Tn PER YEAR of money that begins moving…. NOW. Figuring out where it's going can make us very, very rich!

Our friends at BlackRock put out a lovely 16-page report on the subject, so no need to get into it here but it's very important to note things like an additional $30Tn worth of energy infrastructure spending is now required over the next 15 years – that's $2Tn a year that's got to be spent (and borrowed) somewhere! Transport and water systems require another $10Tn each so we're talking about something like $3Tn PER YEAR of money that begins moving…. NOW. Figuring out where it's going can make us very, very rich!

Of course, President Trump vows he will tear up the Paris accord his first day in office, saving the US their $600Bn annual share of the clean-up costs and dooming this planet to a hot and watery grave. It's currently costing us $150Bn a year in climate-related disaster relief and that's up from $25Bn in the 20 years prior to 2000 so, at this pace – it is going to be cheaper to fix the planet than to keep letting it go to Hell.

At our current rate of warming, this planet will be 4.5 degrees Celsius warmer by 2,100, that's 2 degrees over where some scientists believe we will face an extinction-level event. The best we can hope for is dropping down to a 2 degree rise by acting now and that's why EVERY country on the planet has agreed to adopt these measures. Even that is not likely to save 800,000 species (half) from going extinct between now and 2050 – hopefully, we're not one of them (50/50 chance!).

Now, I'm sure you were at a barbecue this weekend where someone in your family (maybe it was you) was telling everyone how climate change was all a big, liberal hoax and the fact that August was the hottest month every recorded was just a coincidence during the hottest year ever recorded (beating last year's record) and that 97% of the World's scientists and ALL of the World's leaders (except The Donald) are wrong and we shouldn't do anything about this immediate threat to the entire human race.

Now, I'm sure you were at a barbecue this weekend where someone in your family (maybe it was you) was telling everyone how climate change was all a big, liberal hoax and the fact that August was the hottest month every recorded was just a coincidence during the hottest year ever recorded (beating last year's record) and that 97% of the World's scientists and ALL of the World's leaders (except The Donald) are wrong and we shouldn't do anything about this immediate threat to the entire human race.

Really? That's how you want to be remembered in history (assuming there are any survivors) – as the guy who did nothing or, even worse, stopped others from doing something to save the planet. Really?

Really?

Feel free to send this to your idiot relatives and Congresspeople.