If at first we don't succeed…

If at first we don't succeed…

We're still using yesterday's shorting lines but we moved the Russell (/TF) up to 1,261.50 this morning in our Live Member Chat Room, after we gave up on 1,255 in yesterday's Live Trading Webinar (replays on our YouTube channel) – getting out even before it began to run up in the afternoon. Other than that, we're shorting the same levels, favoring the /TF short for the simple reason that the Russell is up and the others are not – so it has farther to fall!

As we expected and, as usual, Draghi and the ECB were all talk and no action this morning but we're still waiting for Draghi's press conference, where he will once again promise to take all necessary actions to prop up the markets, while actually taking no action at all.

I think the Central Banksters have become a bit complacent over the summer as the Junior Banksters manning the machines at the trading houses have given them a low-volume rally but now the Big Banksters are coming home from vacation and all the puts are in place (bought cheaply with a low VIX) and it's time to take down the markets.

In a desperate attempt to prop up oil prices, the MSM is harping on the 12.1M barrel draw in inventories shown in the API report, which is the biggest draw-down since 1985 and represents about 10% of a week's worth of oil usage. Can the US have had such a demand spike over the holiday weekend? No, of course not – that would be silly.

In a desperate attempt to prop up oil prices, the MSM is harping on the 12.1M barrel draw in inventories shown in the API report, which is the biggest draw-down since 1985 and represents about 10% of a week's worth of oil usage. Can the US have had such a demand spike over the holiday weekend? No, of course not – that would be silly.

What actually happened and what none of these "expert" analysts or corrupt media talking heads will tell you is that the hurricane disrupted imports last week and we imported 1.7M barrels per day LESS oil. 1.7 x 7 = 11.9M barrels, which accounts for all but 200,000 barrels of the drawdown – which is actually a crap demand number for a holiday weekend.

The EIA report (11 am) should confirm the draw in oil and, currently, oil (/CL) is at $46.20 and we can't wait for the beautiful sheeple to pile in and drive prices higher on the headline as they are herded into the trade by the corrupt media – who clearly understand that the lack of imports negate the drawdown but won't tell you because oil companies pay them more money than you do.

It's Capitalism baby – lying to you is more profitable than not lying to you so – they lie to you!

Our plan is to short oil into the spike and we'll use the ETF again (USO), which made us 150% last month on our put play (you're welcome) and of course we'll use the Futures, hopefully at $47.50 or better because all those ships that got held up in the storm are still out there and, as they come in, they will cause a "surprise" build in the next two reports.

Our plan is to short oil into the spike and we'll use the ETF again (USO), which made us 150% last month on our put play (you're welcome) and of course we'll use the Futures, hopefully at $47.50 or better because all those ships that got held up in the storm are still out there and, as they come in, they will cause a "surprise" build in the next two reports.

Speaking of surprises – Draghi is speaking now (8:30) and our indexes are dead flat to yesterday's close so we'll see what he has to say. Yesterday's Beige Book (also discussed in the Webinar) was blah and the Apple iPhone event was blah and, as you well know, I don't see how any of this is supportive of record market highs.

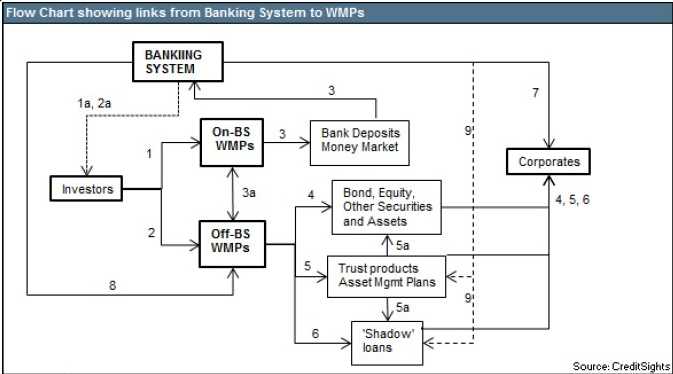

Also ignored by most media (because it's complicated and you readers are considered a bit on the dumb side by the MSM) are the new rules being proposed by China that could rock their already shaky banking system. The regulations would require Chinese banks to set aside loan loss provisions against their outstanding $3.6 TRILLION of Wealth Management Products, which have been used to move money from retail investors into stocks, bonds and real estate.

WMPs are the centerpiece of China's "shadow banking" system that has been the cornerstone of their market recovery since last summer. Chinese investors are told WMPs are "safe" investments while the banks play the markets with their money – this can get amazingly ugly if things do turn sour.

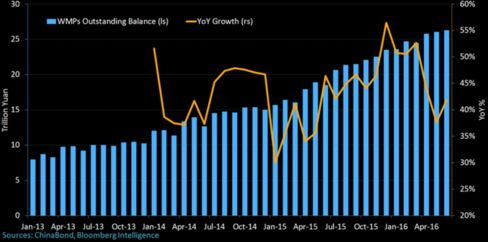

WMPs are up 55% since last summer and the growth has been accelerating to the point where the Chinese Government is now officially scared of what's going on. While they had a "nod and wink" relationship with the Shadow Banksters while the money has been pouring in, it's finally occurring to the Government that they really have no control on this process and the risks have gone parabolic while bubbles are blowing all over the place on the right side of that flow-chart above.

WMPs are up 55% since last summer and the growth has been accelerating to the point where the Chinese Government is now officially scared of what's going on. While they had a "nod and wink" relationship with the Shadow Banksters while the money has been pouring in, it's finally occurring to the Government that they really have no control on this process and the risks have gone parabolic while bubbles are blowing all over the place on the right side of that flow-chart above.

Meanwhile, banks are under pressure to find better profits and that forces them to go after riskier and riskier bonds in search of returns – ugly, Ugly, UGLY!

Draghi has said nothing useful so it's still game on for our index shorts – I had a brief moment of doubt yesterday but this China thing has me right back on my bearish track…