Are we there yet?

Are we there yet?

2,127.50 was our weak bounce goal on the S&P 500 (SPY) and we finished the day yesterday at 2,125.77, so not quite and, unfortunately, today we must raise the bar, and our expectations, to the strong bounce line at 2,140 and we're not going to really be impressed until 2,150 is taken back but let's not get ahead of ourselves because, as noted in the title, we're looking down, not up.

We believe we're at the early stage of what will ultimately be a 10% correction, back to the +5% line on our Big Chart at 1,942.50. The next significant milestone along the way for the S&P will be our 10% line, at 2,035, assuming we do fail support at 2,100. For the last two days, Apple (AAPL) has been propping up the markets as the index heavyweight has been responsible for essentially ALL of the market gains (see yesterday's Live Trading Webinar Replay for details).

This morning, the BOE has crimped the Dollar rally by leaving rates on hold (0.25%) but that move (or non-move) was, after all, expected and EU markets are flat in their afternoon so far. Of course unchanged still means a $435Bn QE program continues for the UK markets. In a country with a $2.6Tn GDP, that's right up there with our own Fed's $4Tn (so far). This has led John Mauldin to note:

“You shall not crucify mankind upon a cross of gold.”

– William Jennings Bryan, July 9, 1896

“You shall not crucify the retiree and saver on a cross of negative rates.”

– John Mauldin, September 14, 2016

Sadly, this reminds me of the time I quoted Bryan, back in March of 2007 when I asked the question: "Are We Heading for an Economic Tornado?" I was 16 months too early with my market warning at the time but I did call the top and, so far, my market top call at 2,100 on the S&P has been pretty close to the mark and, just as miraculously as we did in 2008 – the market continues to ignore the obvious warning sign for much longer than a rational person would think is possible, though this may be explained by a recent article in the New Yorker:

Sadly, this reminds me of the time I quoted Bryan, back in March of 2007 when I asked the question: "Are We Heading for an Economic Tornado?" I was 16 months too early with my market warning at the time but I did call the top and, so far, my market top call at 2,100 on the S&P has been pretty close to the mark and, just as miraculously as we did in 2008 – the market continues to ignore the obvious warning sign for much longer than a rational person would think is possible, though this may be explained by a recent article in the New Yorker:

Scientists: Earth Endangered by New Strain of Fact-Resistant Humans

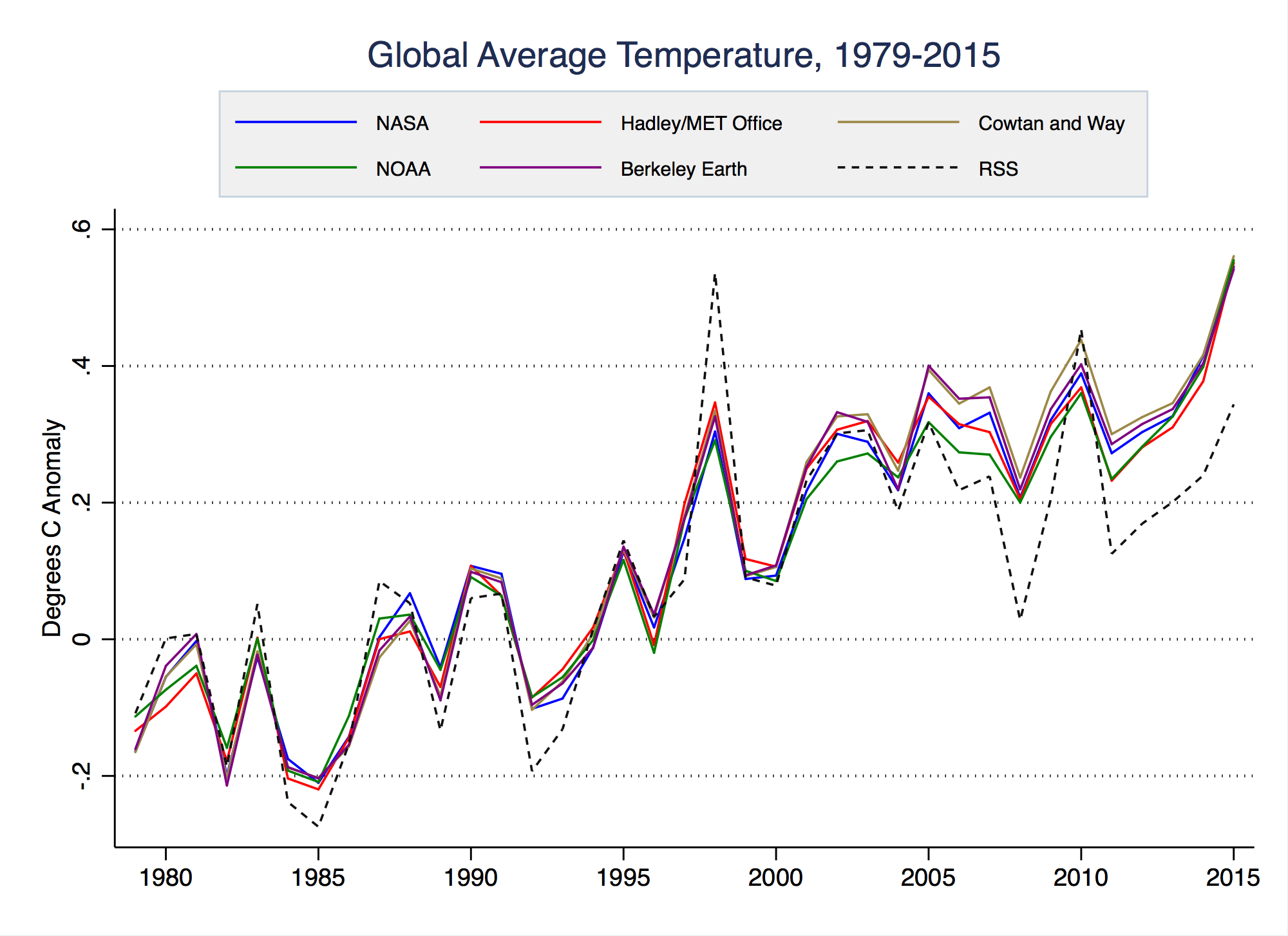

This actually explains so many things and, if you think the author of that article is joking, very sadly this article demonstrates it's no joke at all "The House Science Committee’s Anti-Science Rampage" as the fate of our planet hangs in the balance:

From climate change and evolution to sex education and vaccination, there has always been tension between scientists and Congress. But Smith, who has been in Congress since 1987 and assumed the chairmanship of the Science Committee in 2013, has escalated that tension into outright war. Smith has a background in American studies and law, not science. He has, however, received more than six hundred thousand dollars in campaign contributions from the oil-and-gas industry during his time in Congress—more than from any other single industry. With a focus that is unprecedented, he’s now using his position to attack scientists and activists who work on climate change.

Some of his interventions seem to misunderstand the very nature of science. Last year, for example, Smith introduced legislation requiring that all scientists applying for federal grants guarantee, in a special section of their grant applications, that their work is in “the national interest.” It’s hard to know exactly what Smith means by this, but whatever it means it sets a dangerous precedent, because fundamental research should be driven by curiosity—by the simple desire to generate new knowledge—rather than by anyone’s political agenda. The real national interest is always served by the generation of new knowledge; Smith seems to think that only some knowledge is appropriate. The House passed his bill in February.

Anyway, back to the markets (the political stuff is just too depressing for words). We had a bunch of data this morning and none of it was good. August Retail Sales were down 0.3% in August, 200% worse than the -0.1% expected by leading economorons. Ex-Auto was even worse, down 0.1% vs up 0.3% expected. Our Producer Price index was flat, Core CPI is up just 0.1% and Empire State Manufacturing was down 2.

Anyway, back to the markets (the political stuff is just too depressing for words). We had a bunch of data this morning and none of it was good. August Retail Sales were down 0.3% in August, 200% worse than the -0.1% expected by leading economorons. Ex-Auto was even worse, down 0.1% vs up 0.3% expected. Our Producer Price index was flat, Core CPI is up just 0.1% and Empire State Manufacturing was down 2.

The Philly Fed was up 12.8 – so one good note but not enough to cheer up the markets, which are turning down again from our shorting lines at Dow (/YM) 18,000, S&P (/ES) 2,120, Nasdaq (/NQ) 4,750 and Russell (/TF) 1,210. We discussed these as well in yesterday's Live Trading Webinar and even made a bit of money while demonstrating it!

Watch out for the Retail Spider (XRT) as it's resting on the critical 200-day moving average at $43 and news like this can push it under and Retail has been a strong spot in the market this summer, though $43 represents half of those 15% gains evaporating already. We will get our Industrial Production Numbers at 9:15 and those are expected to be down 0.3% but what's really sad is Cap Utilization, which is hovering at around 76% – we're not using 25% of our Manufacturing Capacity folks – that's what usually only happens in Recessions!

Watch out for the Retail Spider (XRT) as it's resting on the critical 200-day moving average at $43 and news like this can push it under and Retail has been a strong spot in the market this summer, though $43 represents half of those 15% gains evaporating already. We will get our Industrial Production Numbers at 9:15 and those are expected to be down 0.3% but what's really sad is Cap Utilization, which is hovering at around 76% – we're not using 25% of our Manufacturing Capacity folks – that's what usually only happens in Recessions!

On XRT, I like a bear put spread, buying 10 October $45 puts for $2.08 ($2,080) and selling 10 October $43 puts for $1.08 ($1,080) for net $1,000 on the $2,000 spread. There's no margin requirement to that and you make 100% if XRT is below $43 in 36 days and XRT has to get over $44 before you are losing money. If you want to be more aggressive, XRT hasn't been over $46.50 all year and you can sell 10 Jan $46 calls for 0.95 ($950) and then you have cut your cash outlay to $50 on the $2,000 spread and hopefully you won't have to give it back in January.

We'll get Business Inventories at 10 and, if they are climbing, that will be another nail in the coffin for the Retail Outlook.

JP Morgan has joined us in the bear camp, with Dubravko Lakos-Bujas, the head of U.S. equity strategy, saying:

JPMorgan expects the S&P 500 to end the year at 2,000, representing a roughly 6 percent decline from its current level, making it the most bearish of its peers on the Street. In this scenario, the market leaders are poised for the biggest fall, while some sector laggards will do relatively better.

Following a two-month period of very low volatility, investors have been lulled into a sense of complacency, and any pickup in volatility could spark a "deleveraging event," in which investors dump stocks, he said.

That selling will not necessarily happen immediately, he said, but an initial wave of selling could snowball by breeding negative sentiment and aversion to risk. Already, investors are feeling cautious as stocks sit at lofty valuations.

"Positioning is pretty stretched. Technicals are exhausted. So if anything, I would probably be waiting for some further correction, and then take advantage of that to turn slightly more constructive,"

"If yields continue to spike up, that could pressurize the market," he said, adding that the Bank of Japan's monetary policy decision later this month will be critical.

In short – let's be careful out there, folks!