What a scam!

What a scam!

As soon as the market drops, Yellen drops a bombshell, saying last night that: "The Federal Reserve might be able to help the U.S. economy in a future downturn if it could buy stocks and corporate bonds. It could be useful to be able to intervene directly in assets where the prices have a more direct link to spending decisions," she said, adding that buying equities and corporate bonds could have costs and benefits. Currently, the Fed does not have the power to buy equities directly – but they want it!

And if that wasn't enough Fed manipulation for one day, now Fed Gov Kaplan will be unleashed at 1pm and he was not scheduled when we looked on Monday. Kaplan is from Dallas, which is still depressed, and he's a big dove AND he's a former Goldman Sachs (GS) executive, so guess what's going to happen at 1pm? Kaplan is the guy who replaced the hawkish Fisher and had a lot to do with knocking back Fed rate expectations this year. Fisher was was very against QE3 and also was the only guy on the Fed who saw the housing crisis coming. He was "retired" last year at 64 and replaced by a Goldman stooge.

And why shouldn't the Fed buy stocks? The Bank of Japan is already the largest shareholder of 70% of the listed companies and look how well that's working for Japan. After all, when your Central Bank buys stocks at ridiculous multiples near their all-time highs – how can they lose? Even if the stock goes down, they write off the loss and it becomes part of the National Debt and the Bottom 99% pay it off – either way the Top 1% people and corporations get another massive transfer of wealth. Go Top 1%.

And why shouldn't the Fed buy stocks? The Bank of Japan is already the largest shareholder of 70% of the listed companies and look how well that's working for Japan. After all, when your Central Bank buys stocks at ridiculous multiples near their all-time highs – how can they lose? Even if the stock goes down, they write off the loss and it becomes part of the National Debt and the Bottom 99% pay it off – either way the Top 1% people and corporations get another massive transfer of wealth. Go Top 1%.

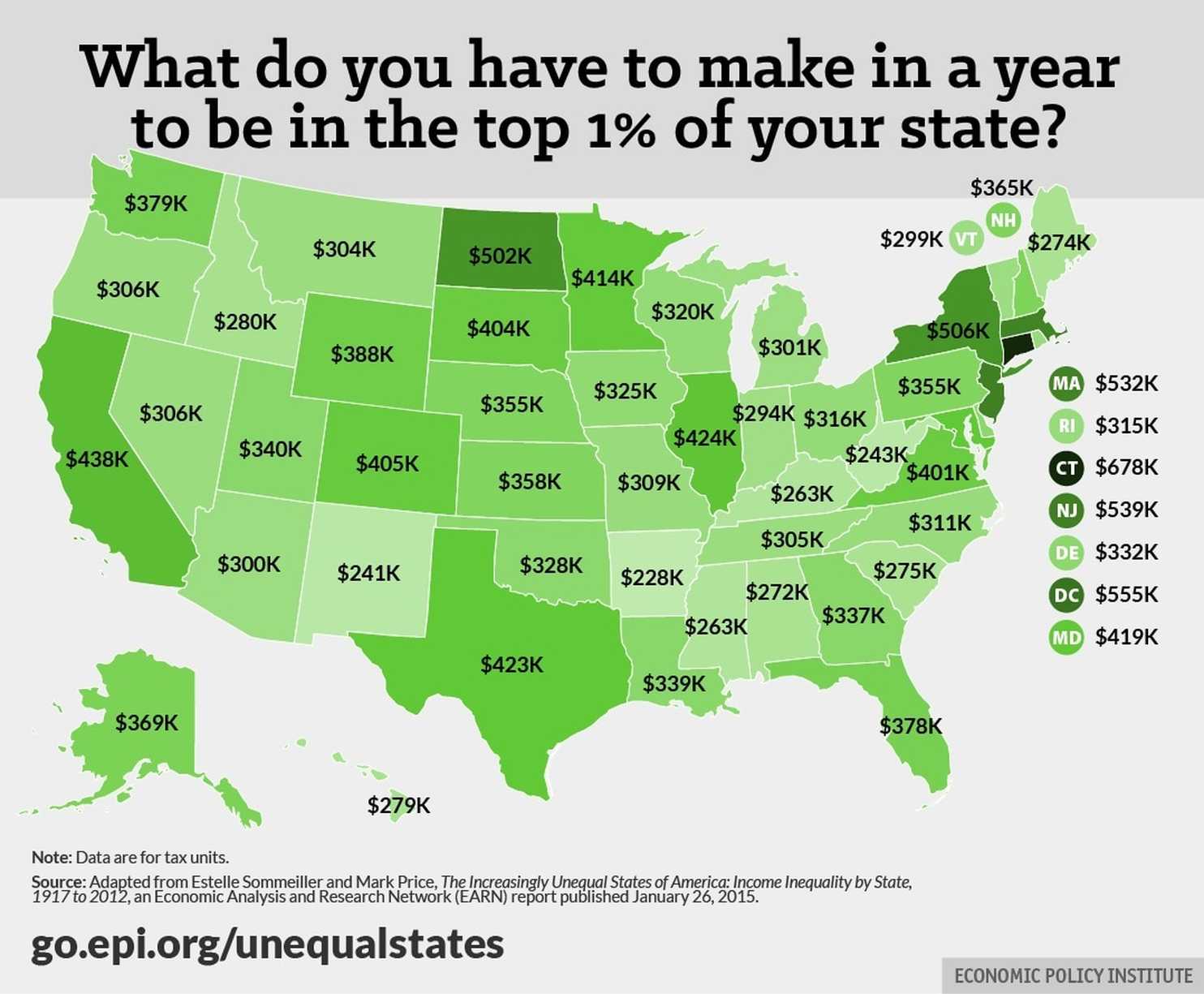

That chart, by the way, shows the MINIMUM amount you need to be in the club so, next time you are at an event, watch out for posers… It turns out that most of the Top 10% THINK they are in the Top 1% and vote like they are in the Top 1% – even while the Top 1% funnels more and more of their money away – amazing, isn't it? So clearly, being rich doesn't make you smart and the Fed is very, very rich and they are going to keep giving money to their Top 1% friends and you are going to keep believing that that money will trickle down on you, right?

Here's a handy chart to show just how wrong not just the Top 10-1% are but how wrong the Top 10-0.1% are:

Where do you think the Top 0.1% are getting their money? Do you think the $500M Trump says he made last year came from getting $5 from 100M people? No, that takes a lot of work. What Trump does is sell ridiculously overpriced apartments to aspirational Millionaires who buy it because he plates them in gold and puts his name on the building. The same goes for his overpriced hotels (OMG – check out his hotel in Vegas – AWFUL!).

As a member of the Top 10%, it's YOUR job to skim money from the Bottom 90%. YOU are the guy who charges $5 for popcorn at the movies and $600 for an EpiPen – the REALLY rich people then turn around and sell you an overpriced home or handle your money for ridiculous fees or help you with your legal problems, which multiply along with your wealth.

As a member of the Top 10%, it's YOUR job to skim money from the Bottom 90%. YOU are the guy who charges $5 for popcorn at the movies and $600 for an EpiPen – the REALLY rich people then turn around and sell you an overpriced home or handle your money for ridiculous fees or help you with your legal problems, which multiply along with your wealth.

Money trickles up, not down. Rich people know how to hold onto their money – poor people spend it and even go into debt because they spend more than they actually have and they sell more and more of their future services (via promise to pay off debt) until they are, finally, indebted for life and can officially be classified as wage slaves – entered into the ledgers of Corporate America as a long-term asset (account receivable) with a recurring income stream (interest payments).

There's the big difference between rich and poor people, the Rich are able to save 15% of their income in retirement accounts and, even better, since they have a much bigger cushion – they can afford to take bigger risks which often lead to bigger returns, giving them even more money as time goes on. When a rich person has the opportunity to be a partner in a business for $50,000 – he can say "sure, why not?" – not so much for a "middle class" worker, who have to risk their entire retirement on a single business venture.

That makes them far less likely to take that sort of risk which keeps them out of the club – that's how we can discriminate against the bottom 90% without making it too obvious. We also keep them out of the hotels and restaurants we like and out of our cabins on airlines and out of our section at concerts – there are all kinds of ways we can discriminate through pricing and no one complains because we call it Capitalism!

Capitalism, sadly, has become the religion of America (and most of the World) and the Capitalists have embraced Trickle Down Economics – even though it has never actually worked. In fact, the International Monetary Fund just did a study that PROVES trickle-down economics is a complete disaster illustrating how Non-rich people tend to spend 100 percent of their income, or close to it while rich people do not.

Very rich people spend, say, 30 percent of their income and save the rest. This difference is called the "marginal propensity to consume," and it seems like it might be a problem if income inequality is rising. The problem is that as rich people get a larger share of total income, total consumption goes down. Here's a simple example.

Very rich people spend, say, 30 percent of their income and save the rest. This difference is called the "marginal propensity to consume," and it seems like it might be a problem if income inequality is rising. The problem is that as rich people get a larger share of total income, total consumption goes down. Here's a simple example.

The IMF paper suggests MPC has a big impact. The authors look at two effects. First, as middle-income families fall into lower income groups, they spend less. Second, as a larger share of income goes to the rich, average MPC goes down. Both of these effects reduce total consumption, which in turn acts as a drag on the economy. Here's the relevant chart:

The Fed (and other Central Banks)'s actions are intensifying this problem and selling the Bottom 99% into wage slavery while creating levels of income disparity that now dwarf even the conditions we had before the Great Depression. Rather than celebrating the Fed's manipulation of the markets – we should be rebelling because, even if you are in the Top 1%, chances are you are not in the Top 0.1% and that means, as soon as rest of the Top 10% run out of money – they are coming for you next!

The Fed (and other Central Banks)'s actions are intensifying this problem and selling the Bottom 99% into wage slavery while creating levels of income disparity that now dwarf even the conditions we had before the Great Depression. Rather than celebrating the Fed's manipulation of the markets – we should be rebelling because, even if you are in the Top 1%, chances are you are not in the Top 0.1% and that means, as soon as rest of the Top 10% run out of money – they are coming for you next!

Have a great weekend,

– Phil