Oh come on media!

Oh come on media!

Seriously we're all going to pretend that China once again hitting all of their targets dead center for another quarter (and claiming 6.7% growth) isn't complete and utter BS? First of all, 6.7% is A LOT. If your kid was 50 inches and grew 6.7% they'd be 53.5 inches – that's not the kind of thing you don't notice, right? Well, real economies don't grow on paper, they grow on the streets and by the sea and in the air – a country the size of China ($11Tn GDP – also BS) growing at 6.7% ($737Bn) is adding more than Saudi Arabia ($637Bn) or Turkey ($735Bn) every year. Hell Mexico is "only" $1Tn!

As noted by Delboy in our Live Member Chat Room this morning: "Within 0.1% every single figure was identical to the ones we were presented with for the last quarter. So they’re telling us that the trajectory is absolutely linear? The last time we all fell for that kind of consistency was when Bernie Madoff sent out the performance numbers on his funds. Can any economy, China’s included, really perform like that?" to which I replied:

Their GDP is a total joke. What companies in China are reflecting this growth? What's really crazy is that no one in the MSM ever takes a serious look at this stuff.

Think about what 7% growth looks like – you could see growth like that on a satellite – cities would be spreading like viruses around the country, truck, rail and shipping traffic would get bigger and bigger, ports would be bursting with cargo and people to load and offload day and night and they too would have to expand to meet demand.

Energy consumption would rise despite all attempts at conservation and an ever-rising flow of materials into their warehouses would not be enough to maintain inventories. In other words – they are obviously completely full of crap!

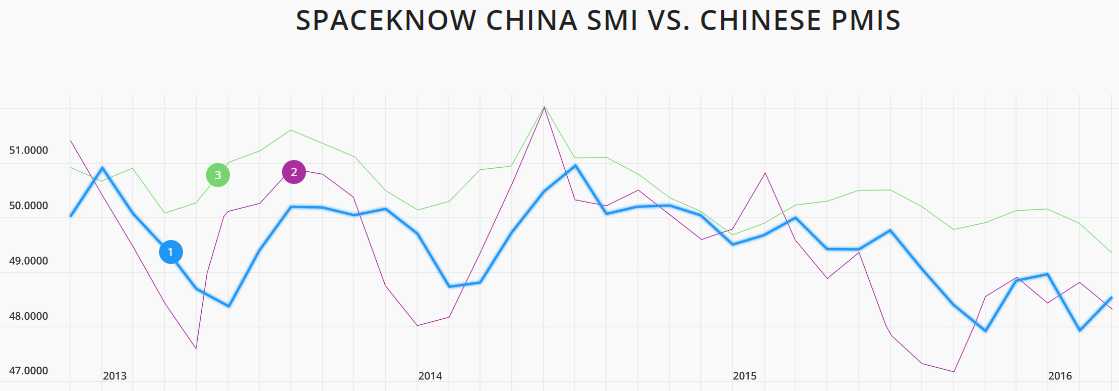

Satellites are, in fact, great ways to verify China's growth claims. Orbital Insight has a China Economic Index and SpaceKnow tracks their own China Manufacturing Index based on actual, observed activity (blue line) and it's 2-3% lower than China's "official" numbers (green):

This stuff isn't hard to check folks but, sadly, no one checks anything anymore. Our Billionaire-controlled MSM does very little actual investigation these days and generally just regurgitates whatever crap they dig up by sitting at a computer all day and reading other people's stories. Just yesterday, CNBC ran a report that Tesla (TSLA) had delayed delivery of the Model 3 from 6-9 months and The Street put up a whole article about the effect this would have on TSLA stock – all within the 10 minutes it took to find out it was a false rumor with no basis in reality – just someone manipulating the stock – and oh boy, did it work great (just after 1pm):

Of course no one will be arrested and no one will even be fired – that's just the way it is in the stock market – you can write "news" without checking the facts and without it being even remotely true and investors can lose millions but no one is ever held accountable. So of course there are going to be stock manipulation scams that use the media – there's no downside, is there?

Tesla itself is a scam of a company, so it's easy to cast dispersions yet China, somehow, is bullet-proof. The table on the left shows the MASSIVE amount of debt financing in September, an aggregate 1.72Tn Yuan or about $250Bn so they are borrowing at a rate of $3Tn per year in an $11Tn (supposedly) economy which means 27% of their 7% growth is being debt-financed. Can you hear me now?

Tesla itself is a scam of a company, so it's easy to cast dispersions yet China, somehow, is bullet-proof. The table on the left shows the MASSIVE amount of debt financing in September, an aggregate 1.72Tn Yuan or about $250Bn so they are borrowing at a rate of $3Tn per year in an $11Tn (supposedly) economy which means 27% of their 7% growth is being debt-financed. Can you hear me now?

China's M2 Money Supply is also up 11% in a massive printing effort and again, 11% more money leads to 6.7% more growth – who do they thing they are, the Fed? "Beijing talks about controlling credit but allows the banks to increase loans," said Andrew Collier, an independent analyst in Hong Kong and former president of Bank of China International USA. "The official message is not the same as the reality. Pressure from the banks for profits, from corporates for loans, and from local governments for revenue from the property sector is driving the Chinese economic bus more than the policy makers in Beijing."

So, what we have here is credit expanding at about twice the rate of real GDP growth with a Government that is determined to fake their GDP growth at any cost:

"The interconnectedness between the corporate sector and the banks points to systemic risks in the economy, especially as the economy is forecast to slow further. Such perceived “implicit guarantees” by the state have resulted in excessive risk-taking across asset classes (equity, bond and property), across economic agents (corporate, local governments and households), and across financial intermediaries. With rising central government’s contingent liability, the sovereign risks are increasing. Moody’s downgraded its outlook on Chinese government debt to negative from stable in March 2016, questioning China’s surging debt burden and the government’s ability to enact reforms."

As noted by Zero Hedge: So far the only "reform" the government has enacted has been to mask debt with even more debt, roughly 300% of GDP. However, as banks, rating agencies, the IMF and even the G-20 admit, the days of kicking the can for China are coming to an end. What waits on the other side of that particular journey is not pleasant: either massive social revolt by China's middle class, as the government renormalizes its economy in the process hiring tens of million of (soon to be angry) workers, or it unleashes the biggest banking crisis the world has every seen: at $35 trillion in total financial assets, China's banking system is more than double the size of the US. We wish Beijing (and Janet Yellen) the best of luck with their hopes that it will somehow be contained…

Speaking of scams, Saudi Oil Minister Khalid Al-Falih is at a conference in London this morning saying "many non-OPEC countries (Russia?) may join in the cartel's deal to limit output." The countries, he says, are willing to not just freeze, but implement healthy cuts. Many MAY join – man, how many times have you been suckered in with that line? That's fine with us as we took the money and ran off yesterday's oil sell-off (down to $50.25, thank you!) and now we get to short Oil Futures (/CL) at $50.40 – though very dangerous into inventories (10:30):

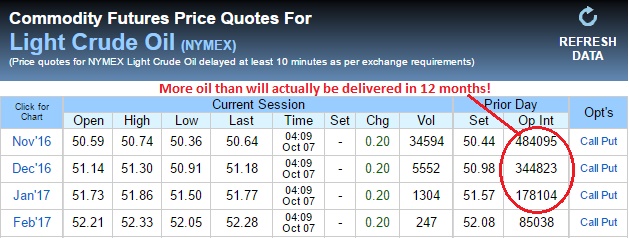

By the way, those FAKE contracts we've been tracking on the NYMEX are now down to 57,000 with 2 trading days to go. On the 7th, I told you that more than 90% of the 484,000 FAKE 1,000-barrel contracts scheduled for November delivery would be cancelled by the 20th, robbing US consumers of 460M barrels of oil that had prices locked in at $50.44 or lower in order to FAKE demand in December and other long months.

Here's what the strip looked like then:

And here's what we have now:

Back on the 7th, the 4 forward months had 1,092,000 FAKE orders and now, not counting the 57,000 orders left in the last 2 days of November, the 4 forward months have 1,020,000 FAKE orders, over 90% of which will also be cancelled or rolled prior to delivery. THIS IS A TOTAL SCAM, folks. The only purpose of all this trading is to drive up the price you pay at the pumps. We have had builds in oil in 3 out of every 4 weeks in 2016 so supply is CLEARLY higher than demand – yet prices keep going up and no one gets arrested, no one even investigates – even though we can tell you exactly what is going to happen weeks in advance EVERY SINGLE MONTH!

The only satisfaction we can get is taking their money. They have to fake demand and try to drive oil to $51.50 so we say "sure, we'll sell you 1,000 barrels of oil for $51.50" by selling a Futures contract and, when oil drops to $51.25 or $51, we buy a contract and the difference is our profit. If the difference is 0.25, we make $250 per contract. It's fun, and we get to do it over and over and over again (not always at the same lines).

Short oil has been paying off like a broken slot machine since we bought it to your attention on the 7th but, once the contracts roll over, we will take a week or two off trading Oil Futures (/CL), though we still have our shorts on the ETF (USO).

We have a Live Trading Webinar at 1pm (EST) this afternoon and you can join us HERE.